Exploration & Development — Quick Takes

EPA dissatisfied with Texas clean-air permitting

Key aspects of the Texas clean-air permitting program do not meet US Clean Air Act requirements, the Environmental Protection Agency said in a Sept. 8 news release from its Dallas office.

EPA proposes to disapprove parts of the Texas air permitting program. The CAA requires states develop permitting plans that are approved by EPA. Previously, Houston Mayor Bill White and others have pushed for stricter air pollution regulations for refineries and petrochemical plants along the Houston Ship Channel.

The federal agency's rejections are expected to become final next year following a 60-day public comment period. Meanwhile, EPA said it will work with the Texas Commission on Environmental Quality, industry, and environmental groups to identify and adopt changes in the state program.

"Texas' air-permitting program should be transparent and understandable to the communities we serve, protective of air quality, and establish clear and consistent requirements," said Lawrence Starfield, EPA acting regional administrator. "These notices make clear our view that significant changes are necessary for compliance with the Clean Air Act."

EPA proposes to reject Texas' flexible permits, which allow air polluters to exceed emission limits in certain areas provided that those areas achieve an overall emissions average. EPA also plans to reject Texas rules that allow air polluters to make certain changes at plants without having to schedule public hearings.

EPA cites Shell for second pollution violation

The US Environmental Protection Agency cited Shell Chemical Yabucoa Inc. in Puerto Rico on Sept. 3 for violating the federal Clean Water Act for the second time in a year.

EPA's Region 2 office in New York said that the refining and petrochemical plant improperly maintained deep ocean outfall equipment it operates under an EPA permit under the National Pollutant Discharge Elimination System (NPDES) and discharged unauthorized pollutants as a result. It issued a complaint, in which it has proposed a $153,057 penalty, and a compliance order.

Specifically, EPA said that the Shell Chemical affiliate violated the permit's terms by unlawfully discharging the pollutants into navigable waters for 14 days, and by not properly operating a multiport diffuser pipeline for 105 days.

According to the complaint, Shell Yabucoa admitted that a leak from its diffuser pipeline began on or about Feb. 25 and claimed that it stopped discharging from the pipe on Mar. 2. But the company later reported that it discharged through the pipeline during 14 days from Feb. 27 to Mar. 30, EPA said.

The federal environmental regulator's latest complaint against the firm followed a $1.025 million fine that Shell Chemical Yabucoa paid in May for similar violations. EPA said that fine stemmed from a Dec. 31, 2008, report indicated that two or three of Shell Chemical Yubacoa's diffuser ports were blocked by sand.

It said it accordingly issued an administrative compliance order (ACO) in March that required Shell Yabucoa to submit a plan to repair the leak and properly operate all ports of the diffuser. Despite the ACO, Shell failed to properly operate and maintain the diffuser from at least Dec. 31, 2008, to Apr. 15, 2009. That failure, in conjunction with the unauthorized discharges in February and March, led EPA to issue the most recent complaint, the agency said.

Shell Chemical bought the installation at Yabucoa from Sunoco Inc. in January 2002 to produce chemical feedstock for its plants in Norco, La., and Deer Park, Tex., as well as refined products for customers in Puerto Rico.

Clinton, others sued over Alberta Clipper oil line

Four environmental and Native American groups sued US Secretary of State Hillary R. Clinton and other federal officials on Sept. 3 to protest US Department of State approval of the proposed Alberta Clipper oil pipeline.

The Indigenous Environmental Network, Minnesota Center for Environmental Advocacy, National Wildlife Federation, and Sierra Club filed their 37-page complaint in the US District Court for Northern California. They are represented by the nonprofit law firm Earthjustice.

The groups said they might sue after the State Department's Aug. 24 approval for the 1,000-mile, 450,000 b/d line from Hardisty, Alta., to Superior, Wis., to cross the Canadian-US border. The project's sponsor, an Enbridge Energy Inc. subsidiary, said it hopes to have the system operating by mid-2010 after it receives other Canadian and US government permits.

In their complaint, the groups said the State Department and US Army Corps of Engineers violated the National Environmental Policy Act by not adequately analyzing indirect and cumulative impacts of the proposed line.

They also said Congress has not fully relinquished its authority to regulate pipelines to the federal government's executive branch, and that an executive order issued by then-US President George W. Bush giving the secretary of state authority to issue permits to export and import oil, petroleum products, and other fuels at US borders did not include tar sands crude from Canada.

"This project will lock our nation into a dirty energy infrastructure for decades to come," said Sierra Club Executive Director Carl Pope. "Instead of increasing our reliance on oil and piping in pollution, the State Department should support clean, American energy and the jobs that come with it."

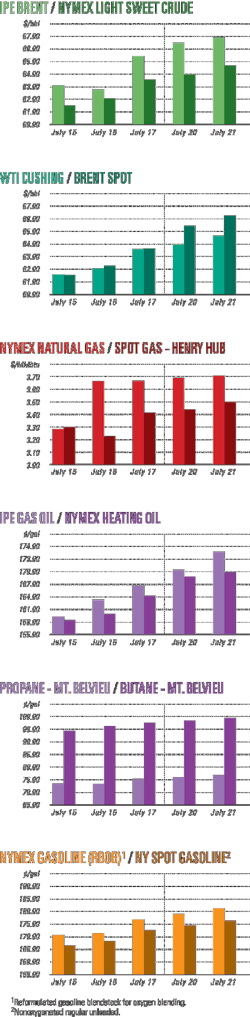

Industry Scoreboard

Exploration & Development — Quick Takes

Tests reveal high productivity of Guara presalt find

Flow tests, limited by equipment capacity, on the Guara presalt discovery well 1-SPS-55 (1-BRSA-594) drilled off Brazil produced at about 7,000 bo/d, according to Petroleo Brasileiro SA (Petrobras).

From these tests, the company estimates that the well initially could produce at about 50,000 bo/d and that the area contains about 1.1-2 billion bbl of recoverable 30° gravity oil.

The well, drilled in mid-2008, is on Block BM-S-9 in the Santos basin about 310 km off Sao Paulo state and 55 km southeast of the Tupi 1-RJS-628A (1-BRSA-369A) discovery well. Water depth is 2,141 m.

The operator Petrobras holds a 45% interest in the block. Companies holding the remaining interest in the block are BG Group 30% and Repsol YPF SA 25%.

Lundin finds Luno extension in Norwegian N. Sea

Lundin Petroleum AB found a gross 40 m oil-bearing column within a fractured basement on the Luno extension prospect in the Greater Luno Area of the Norwegian North Sea.

The complex reservoir requires further analysis to determine the resource potential and commerciality. Luno extension lies on Block 16/1, and is south of the Luno discovery made on the PL 338 license in 2007.

The company said the exploration well 16/1-12 did not encounter the same pre-Cretaceous reservoir of the Luno discovery.

"An extensive data acquisition program was carried out on this well, including coring and several mini drill-stem tests with the successful recovery of hydrocarbon samples," said Lundin Petroleum.

It used the Songa Dee semisubmersible drilling rig to reach a TVD of 2,030 m subsea in 107 m of water.

PL 338 was awarded in the Norwegian North Sea licensing round in 2004. Lundin Petroleum is the operator of PL338 with a 50% interest with partners Wintershall Norge ASA with 30% and RWE Dea Norge ASA with 20% interests.

Ashley Heppenstall, president and chief executive officer of Lundin Petroleum, said it was likely the Luno extension is not connected to the Luno field.

Drilling blocked in Colorado's San Luis area

A federal district court in Denver has blocked drilling at least temporarily in Colorado's San Luis Valley 30 miles north of Alamosa.

The court granted a motion by San Luis Valley Ecosystem Council for a preliminary injunction against the US Fish & Wildlife Service. FWS, surface owner of the Baca National Wildlife Refuge in Saguache County, had issued a finding of no significant impact for the proposed Baca gas drilling project (OGJ, Nov. 10, 2008, p. 44).

Lexam Explorations Inc., Toronto, said the decision prohibits drilling until a final ruling is reached in the litigation.

The FWS finding, which followed a 15-month review process, was the final approval needed for exploratory drilling in the nonproducing San Luis subbasin.

Lexam drilled two exploration wells in the San Luis subbasin in the 1990s when the surface was privately owned and plans to drill two more with 75% interest. ConocoPhillips has 25% (OGJ, Sept. 1, 1997, p. 78). The F&WS acquired surface ownership in 2000 and operates the refuge.

Drilling & Production — Quick Takes

ATP finds more sands, thicker pay at Mirage

ATP Oil & Gas Corp., Houston, said the No. 3 well at its Mirage field on Mississippi Canyon Block 941 in the deepwater Gulf of Mexico found thicker than expected sands and logged hydrocarbon-bearing sands that weren't present in the original wells.

Mirage, Morgus, and Telemark in the Atwater Valley and Mississippi Canyon areas are the three Telemark Hub fields that ATP plans to tie back to the ATP Titan drilling and production platform in MC 941.

ATP calls the Titan floating vessel, to be installed in October, a minimum deepwater operating concept. It has a production capacity of 25,000 b/d of oil and 50 MMcfd of gas (OGJ Online, May 12, 2009).

The MC 941-3 well, in 4,000 ft of water, logged more than 250 ft of net oil and gas pay, more than double predrill estimates. ATP set 75⁄8-in. casing at 17,089 ft measured depth through the pay intervals.

Eight previously drilled wells had encountered 16 hydrocarbon-bearing sands, ATP said. Well depths are 20,000-24,000 ft at Telemark, where no oil-water contact was found, and 14,000-18,000 ft at Morgus and Mirage.

ATP previously tallied the project's proved and probable reserves at 42 million boe, 76% oil. The additional pay sands should lead to higher production and reserve estimates greater than currently booked, the company said. Production start is set for late 2009 or early 2010.

ATP is Telemark Hub project operator with 100% interest. ATP had invested $1 billion through June, including $554 million in the Titan, and expected to incur $500-600 million in further capital outlays through yearend 2010.

ATP's vendors have agreed to absorb 45-55% of project capex in exchange for a limited net profits interest.

The Titan will feed a 20-mile, 10-in. oil pipeline to the Shell Mars oil system on MC 718 and a 62-mile, 20-in. gas pipeline to the Discovery gas system in Grand Isle 115. The pipelines have been installed.

Tombua-Landana off Angola starts oil production

Cabinda Gulf Oil Co. Ltd. started oil production from the $3.8 billion Tombua-Landana project on Block 14 about 50 miles off Angola.

The Chevron Corp. subsidiary expects the two fields will reach peak production of 100,000 bo/d in 2011. Landana, discovered in 1998, and Tombua, discovered in 2001, contain 350 million bbl of recoverable oil, the company estimates.

The 46-well project includes a 1,554-ft compliant piled tower installed in 1,200 ft of water. The facility is designed for no produced water discharge and no routine gas flaring, CABGOC says.

The Angola Liquefied Natural Gas project, under construction at Soyo, will process the Tombua-Landana gas along with associated gas from other fields on Blocks 0, 14, 17, and 18. Completion of the Angola LNG projects is expected in 2012.

Early production from the Landana North-1 well began to the Benguela-Belize-Lobito-Tomboco compliant-piled tower in November 2006.

Operator Cabgoc holds a 31% percent interest in Block 14. Other interest owners are Sonangol P&P 20%, Eni Angola Exploration BV 20%, Total E&P Angola 20%, and GALP Energia 9%.

Another Kizomba satellite development contract let

Esso Exploration Angola (Block 15) Ltd. has awarded to GE Oil & Gas a contract for subsea equipment for its Kizomba satellite project in Block 15 off Angola.

The Kizomba satellites will produce to the existing Kizomba A and B field developments.

GE will supply subsea trees, manifolds, jumpers, and connectors; controls equipment; umbilical termination assemblies; subsea distribution units; and flying leads.

Topside equipment will be installed at the Kizomba A and B floating production, storage, and offloading vessels.

Previously Esso had let a tieback contract to Saipem SPA (OGJ Online, Aug. 3, 2009).

The ExxonMobil Corp. subsidiary expects production from the Mavacola and Clochas satellite fields to peak in 2010-12 at 125,000 b/d.

Petrominerales hikes Llanos basin production

Petrominerales Ltd., Bogota, said its Boa-1 exploration well, formerly B1, on the Corcel block in the Llanos basin is making more than 6,000 b/d of 19° gravity oil, hiking the company's output in Colombia above 25,000 b/d.

Boa-1, which reached a total depth of 12,875 ft on July 25, is producing the oil with less than 1% water cut from the Lower Sand 1 formation. Logs indicated 48 ft of net oil pay in the Lower Sand 1 and 2 formations, but Lower Sand 2 tests proved noncommercial.

Petrominerales, a 67% owned subsidiary of Petrobank Energy and Resources Ltd., Calgary, is drilling the Corcel-A2 sidetrack targeting the highest point of the Corcel A structure to reach bypassed Mirador and Guadalupe pay. The well is to be producing by the end of September, after which the rig will drill two wells on the Guatiquia block Percheron and Candelilla structures.

Meanwhile, the company plans to core the entire Mirador zone at Chiguiro Oeste-1, second of the 2009 three-well heavy oil exploration program in the Llanos basin. Coring and testing are to be finished by the end of September.

After Chiguiro Oeste-1, the rig will spud Rio Ariari-1 on the Rio Ariari block by early October.

Petrominerales shot and is interpreting 423 sq km of 3D seismic on the Castor, Mapache, Casanare Este, Casimena, and Rio Ariari blocks and a further 14 line-km of 2D data on Castor.

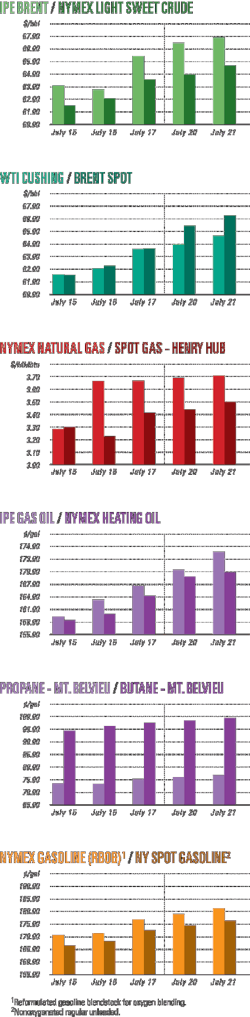

Company production averaged 20,679 b/d in August and has grown to more than 25,000 b/d including Boa-1 and excluding output of 1,300 b/d from Corcel-A4, which went offline Aug. 26 when the electric submersible pump failed. It is to be back on line within 10 days. Larger ESPs are to be run at Corcel-C1, Corcel-D2, Mapache-1, and Mirasol-1 by the end of October.

Processing — Quick Takes

Valero shuts Delaware City coker, gasifier

Valero Energy Corp. is shutting down the coker and gasifier complex at the 210,000-b/cd refinery operated at Delaware City, Del., by its Premcor Refining Group Inc. subsidiary.

The move is the company's third major curtailment of operations this year.

"Both the coker and the gasifier complex at the Delaware City refinery have been unprofitable, a situation resulting from the economic recession, declining demand for refined products, and poor coking margins due to a decreased price differential between heavy sour and light sweet crude oils," the company said in a press release.

It also cited poor reliability and low operating rates of the gasifier complex, which it attributed to the facility's design and low gas prices.

"Regulatory issues and potentially significant capital expenditures contributed to the decision to shut down the gasifer complex," the company said.

Valero said the shutdown will reduce the Delaware City workforce by at least 150 employees and 100 contract workers.

It also said it expects to release more than 700 contract workers this month at its 235,000-b/d Aruba refinery, which it shut down in July and expects to remain idle "for an extended period."

Because of its configuration as a heavy crude oil upgrading facility, the Aruba refinery was losing money because of narrowing spreads between the prices of heavy sour and light sweet crudes.

Valero also said the Aruba refinery suffered from "looming local tax burdens," including a disputed tax on revenue and the expiration in December 2010 of a 20-year tax holiday.

In June the company shut down a coker and FCCU at its 315,000-b/d Corpus Christi, Tex., refinery. It also has trimmed coker utilization at other of its refineries.

Contract let for Suriname refinery expansion

Staatsolie, the state oil company of Suriname, has let a project management consultant contract to Aker Solutions US Inc. for a doubling of crude capacity of its refinery at Tout Lui Faut to 15,000 b/d.

When online in 2013, the expanded refinery will produce diesel, gasoline, fuel oil, bitumen, and sulfuric acid.

Glyn Rodgers, president of Aker Solutions US, said the expansion is "the largest single project in the country's history."

CB&I Lummus Inc. holds the contract for the third phase of front-end design work.

Vietnam urges quick repair of Dung Quat refinery

Vietnam has asked general contractor Technip to deal swiftly with the breakdown at the country's first refinery at Dung Quat so that operations can resume as soon as possible.

Operations at the 140,000-b/d plant were suspended on Aug. 16 for about 20 days due to a "technical repair" in the refinery's residue fluid catalytic cracking unit, according to a Petrovietnam official.

"There was a problem at the RFCC unit and repairs should take about 20 days, which means the plant will resume operation by Sept. 9 or 10," said a Petrovietnam official, who declined to be identified.

At the time, Technip director S.K. Singh said the consortium was working with suppliers and technical experts to determine the causes of the problem and find solutions so the refinery could resume operations.

The Dung Quat plant produced a combined 437,000 tons of products from the start of its trial run in April 2008 through Aug. 15.

In March, Vietnam's Petrovietnam Gas Corp., keen to reduce the nation's expenditures on imports, began construction of an LPG depot and a tank truck station at the Dung Quat facility.

The project, valued at 226.6 billion dongs ($13.32 million), includes two 1,000-tonne LPG rundown tanks, a system to deliver LPG from the rundown tanks to tank trucks, a firefighting system, and an industrial pipeline system (OGJ Online, Mar. 18, 2009).

Transportation — Quick Takes

Second huge LNG train starts up in Qatar

Another megatrain of LNG production has begun service.

Earlier this week, Qatargas 2 partners Qatar Petroleum and ExxonMobil Corp. announced completion of the 7.8 million tonne/year Train 5. This follows start-up in the second quarter of Qatargas 2's other 7.8 million tpy Train 4. Each train is about 50% larger than any other liquefaction plant currently operating outside Qatar, said the announcement.

QP holds 65% of Train 5, ExxonMobil 18.3%, and Total SA 16.7%. Qatargas 2 Train 4 shareholder interest is QP 70% and ExxonMobil 30%.

Qatargas 2 links natural gas production, liquefaction, shipping, and regasification infrastructure into integrated LNG development and supply.

In addition to Trains 4 and 5, Qatargas 2 joint venture encompasses a fleet of carriers and the newly commissioned South Hook LNG terminal in Milford Haven, Wales (OGJ Online, Mar. 23, 2009; Apr. 6, 2009). The South Hook LNG Terminal Co. Ltd. is owned by QP 67.5%, ExxonMobil 24.15%, and Total 8.35%.

Qatargas 2 also has capacity to produce 0.85 million tpy of LPG and 140,000 b/d of condensate and employs three 145,000-cu m storage tanks.

Kuwait terminal receives first LNG

The Persian Gulf's first LNG regasification terminal, Kuwait's offshore Mina Al-Ahmadi GasPort, received its first cargo earlier this month.

The cargo arrived aboard the 150,900-cu m Express, a combined LNG carrier and regasification vessel owned and operated by Excelerate Energy LLC, The Woodlands, Tex.

According to an announcement from Excelerate's joint-venture partner RWE AG, the vessel regasified and delivered 130,000 cu m into the offshore port and directly into the country's gas grid. The LNG was loaded at Woodside's North West Shelf LNG plant in Australia.

The Mina Al-Ahmadi GasPort lies about 25 miles south of Kuwait City and was built by Excelerate for Kuwait National Petroleum Co. Construction started in 2008.

The terminal is intended as an interim solution to meet Kuwait's current gas needs, according to KPC, in advance of future development of domestic gas reserves to meet industrial and commercial demands.

One of Excelerate Energy's Energy Bridge regasification vessels (EBRV) will be stationed at the existing Mina Al-Ahmadi south jetty and can deliver regasified LNG at a baseload rate of up to 500 MMcfd, says KPC.

In addition, the terminal will incorporate a shuttle tanker berth that will provide for ship-to-ship LNG transfer and boil-off gas management capabilities between a conventional LNG carrier and the EBRV, according to the company.

Other sites served by Excelerate technology and vessels are the US (Texas and Massachusetts), the UK (Teesside), and Argentina (Bahia Blanca).

InterOil moves ahead with LNG project

InterOil Corp. is pushing ahead with its proposals for an LNG project in Papua New Guinea after submitting a project agreement to the Papua New Guinea government.

InterOil, along with partners Petromin PNG Holdings and Pacific LNG, submitted the agreement for the construction of the proposed plant.

Both Prime Minister Michael Somare and Minister for Petroleum and Energy William Duma have voiced their support for the $6 billion (Aus.), two-train LNG project that will have the capacity to produce 4 million tonnes/year of LNG.

InterOil says the project also is supported by other key Papua New Guinea government members.

According to InterOil, about 5,000 jobs will be created during the peak construction period at the plant site and economic returns are expected to fund public infrastructure and community services.

Although InterOil has yet to firm up sufficient reserves for the project, the company points to two separate independent resource evaluations that support the project agreement. It believes the likelihood of more successful gas and gas-condensate exploration has increased along with the potential for commercial oil discoveries.

InterOil has targeted first production from the project as end 2014 or early 2015.