Analysis foresees decline in US gasoline imports

The many uncertainties surrounding forecasts of US gasoline demand for the most part relate to predicting economic activity and industry fundamentals. Further complicating the forecasting exercise are the initiatives of the administration of US President Barack Obama. Generally designed to reduce greenhouse gas emissions, these initiatives result in reduced motor-fuel demand and a greater reliance on biofuels.

Exacerbating these demand-side pressures will be completion in the next few years of several refinery expansions developed in response to expected shortfalls in US gasoline supply. These developments lead to a growing likelihood that petroleum-based gasoline demand may have peaked in the US at the same time that domestic and offshore supply increases—adding pressure on margins and prices and seriously challenging US refiners.

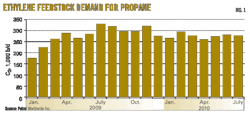

To quantify these challenges, Turner, Mason & Co., Dallas, developed five cases with varying assumptions related to implementation of the biofuels mandate and corporate average fuel economy standard changes as they affect gasoline demand and import levels (Fig. 1).

All cases show long-haul imports will continue to be required to meet US gasoline demand for the next 4 years. By 2014, however, these imports begin to fall, and by 2017 all cases but one show long-haul imports no longer necessary to meet projected US demand.

As gasoline demand continues to lag projected US production (including short-haul imports), capacity rationalization will be required among refineries making up the US domestic and short-haul systems.

CAFE; RFS2

Spurred by rising energy prices, the US Congress in 2007 passed the Energy Security and Independence Act that raised the automotive fleet target for CAFE to 35 mpg in 2020. Recent new-car production has been around 25 mpg, according to calculations by Turner, Mason.

In May 2009, President Obama increased the target to 35.5 mpg and advanced the target date 4 years to 2016. In the same month, he reaffirmed support for renewable fuels and the US Environmental Protection Agency offered clarifying language to the previous but less-defined 2007 program (renewable fuel standard; RFS1).

The current program mandates a total of 36 billion gal of renewable fuels in 2022 with graduated targets for each preceding year. Of this total, 1 billion gal is to be biodiesel, 15 billion gal will be conventional ethanol (from corn or other renewable sources), 16 billion gal are to be cellulosic biofuels (presumably cellulosic ethanol), with the remaining 4 billion gal being from other advanced biofuels (anything other than ethanol from corn).

Gasoline supply

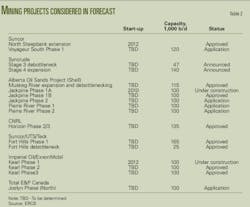

While changes in the regulatory environment are resulting in lower gasoline demand, refinery expansions will add 341,000 b/d of new gasoline production capacity by 2015. The two largest, Motiva in Port Arthur and Marathon in Garyville, will add 195,000 b/d (OGJ Online, Mar. 8, 2009; June 22, 2009).

In addition, as the dieselization of transportation fuels in Europe continues and export-oriented refineries in India, the Middle East, and other parts of the world are constructed, significant offshore supply will have to be absorbed worldwide.

Model basis

To estimate the effects of the new initiatives, Turner, Mason recently ran its gasoline demand forecasting model to assist in preparation of its biennial Outlook and other industry analyses. While the components of the ramp-up of the RFS2 ethanol mandate and the new refinery unit additions were easy to model, the CAFE increases proved more difficult.

There are two primary relevant variables in measuring the effects of the CAFE changes:

- The vehicle-miles traveled by the automotive fleet.

- The changes of the efficiency of the fleet in miles-per-gallon.

Fig. 2 shows the historical VMT. The factors influencing VMT include overall economic activity, absolute price levels of gasoline, and population/vehicle growth. Over the entire 17-year period, VMT rose at 1.7%/year. High gasoline prices 2005-08 reduced VMT growth to less than 1.0% in each of 2005, 2006, and 2007 and, along with the recession, caused the steep drop of 3.4% in 2008.

With the inclusion of these low-growth years, the average VMT growth for the past 10-year period (1998-2008) is less than 1.1%/year.

While the annual CAFE increases are known, they only represent new-vehicle sales. Calculating the annual improvements for the entire automotive fleet required developing a historical correlation that included the ever-changing age of the fleet. The best historical information available proved to be the annual R.L. Polk survey that reports the median age for cars and light trucks (Fig. 3).

The median ages have generally risen over the last 7 years and are currently at 9.4 years for cars and 7.5 years for light trucks. Using these parameters, Turner, Mason constructed a model that gradually incorporated the new CAFE standards into the existing automotive fleet under various aging patterns.

Adjusting each of these variables—VMT, CAFE implementation, change in age of the automotive fleet, and various cases for implementation of the RFS2 program—allows the model to compute "neat" gasoline demand (no ethanol) under a wide range of scenarios. Neat gasoline is first computed because it is the fuel used for CAFE purposes.

Once neat gasoline demand is determined (the result of increases in the VMT and CAFE), the ethanol volumes adjusted to their neat gasoline equivalents (66% based on btu value) are subtracted to yield the remaining fuel demand from petroleum.

The model assumes the refining contribution base is the 2008 volume that is computed from the Energy Information Administration and then adjusted for new refinery production capabilities. Remaining demand is met through imports.

The purpose of the model was to calculate quickly the effects of multiple scenarios. Table 1 details the assumptions of the five cases and Table 2 their results. All of the cases assume full implementation of CAFE; and:

- Case I: Full implementation of RFS2, VMT growth rate at the average of the last 10 years, and constant median age of the auto fleet.

- Case II: Case I with higher VMT basis by excluding 2008 and shifting the 10-year average to 1998-2007.

- Case III: Case I with no cellulosic volume (16 billion gal) in RFS2.

- Case IV: Case I with higher median age of auto fleet to reflect customer resistance to higher mileage but smaller vehicles.

- Case V: Case II (higher VMT basis) with no cellulosic volume.

The critical component in the results is the level of US gasoline production and the required imports necessary to balance.

Gasoline imports averaged 1,091,000 b/d in 2008, according to EIA. These imports fall into two distinct classifications: short haul and long haul.

Short-haul imports are produced close to the US (Virgin Islands, Caribbean, Canada, etc.) and can be viewed as an extension of the US domestic refining system. They comprise about 33% (358,000 b/d) of the total.

Long-haul imports are generally from Europe and presumably must be supported by a necessary location differential to justify their movement. If long-haul imports (733,000 b/d) are eliminated and do not figure the incremental price for gasoline, refining margins would likely narrow.

Model results

All the cases result in declining petroleum-based gasoline demand during the phase-in periods for CAFE and biofuels (through at least 2022). This is a result of a decline in consumer demand brought on either by CAFE increases more than offsetting VMT gains or by the substitution of ethanol for neat gasoline.

In the first four cases, imports (both long haul and short haul) are eliminated and surplus gasoline capacity is created by 2017 at the latest. Only in Case V, which assumes more bullish growth in VMT along with no production of cellulosic ethanol, does demand continue to exceed total domestic production (including short-haul imports).

If RFS2 and CAFE are fully implemented and VMT matches the last 10 years (Case I), long-haul imports will be eliminated by 2014 and 943,000 b/d of surplus gasoline capacity will exist by 2020.

A more robust VMT growth assumption (Case II) eliminates long-haul imports by 2017, and 330,000 b/d of surplus gasoline capacity will exist by 2020. Cases III (elimination of cellulosic ethanol) and IV (slower auto fleet turnover) both result in the need for long-haul imports going away by 2015, although Case IV results in a much higher level of surplus gasoline in 2020 (891,000 b/d vs. 491,000 b/d).

The effects of reducing US gasoline demand are multifaceted. As demand declines, long-haul imports are the first to be reduced. This occurs when the over supply of gasoline depresses prices and margins to a level that will no longer justify their movement.

This level may be deceptively low in that European refiners may prefer to sell gasoline at a loss in the US (large gasoline market) than to distress-sell the product in Europe (smaller gasoline market). This forces prices steadily lower and, if unabated, to a point the European refiner must either cut runs or completely shut down.

This condition illustrates how declining gasoline demand in the US will most likely be felt first in Europe due to its refining-complexity disadvantage vs. the US.

If over-supply grows more acute and all long-haul imports have been eliminated, margins will decline even further as the US refining industry (and short-haul suppliers) must rationalize the imbalance.

To do this, new export markets can be developed, domestic throughput can be reduced, refineries can be closed, or more likely a combination of these actions will be taken to bring supply into balance with the reduced level of demand.

In any case, lower refining margins will likely result in this environment, in which the US moves from being a net importer to a net exporter of gasoline.

The authors