Pressure mounts on UK government to improve UKCS operating conditions

Exploration activity in the UK North Sea has dropped by more than 50% compared with last year, holding serious implications for the nation's energy security in 2010, according to trade association Oil & Gas UK.

The group warned in its economic report published last month that decommissioning of oil and gas facilities could start soon, signaling an early end to the industry. Companies are cancelling or delaying projects due to high costs and scarce funding amid the drying up of money markets.

Investment in the industry fell to £4.8 billion last year, down £1.2 billion from the last 2 years. The group warned that investment could dip below £3 billion in 2010. Around £5 billion/year is required to keep exploration going, it advised. Production from the UK North Sea was 2.64 million boe/d, a decline of 5% from 2007, and in 2009 production is projected at 2.5 million boe/d.

"The decline rate has slowed from the 7.5% a year seen in the period 2002-07," said the report. Total expenditure reached £13 billion on exploration, development, and operations.

Operators started production from 17 new fields in 2008, bringing 475 million boe into the market. In the next 2 years, another 20 fields are slated to come on stream, and Oil & Gas UK said that another 30 fields are competing to attract investment.

If the trend of falling activity continues, the UK continental shelf will supply only 20% of Britain's energy needs by 2020, compared with up to 50% if investment is maintained. The association's analysis may increase pressure on the government to address the exploration and investment challenge and the potential loss of 50,000 jobs. It has urged Chancellor Alistair Darling to change the tax regime to make it more favorable for companies to invest in this mature basin (OGJ Online, May 11, 2009). Particular areas that could yield substantial reserves would be the Central North Sea and the area west of the Shetland Islands.

Rescue package

Darling introduced incentives in April 2009 that focused on small and marginal fields, but Oil & Gas UK described this as a "modest step." Operators are demanding tax breaks for existing fields.

With so many UKCS operators being small and independent companies, finding a suitable rescue package for them is difficult as the government rescue needs to consider their long-term viability. Too many of the smaller players have no producing assets, and it is questionable as to whether they can emerge from the crisis considering the problems with raising finance.

Richard Cliff, partner at international law firm Eversheds LLP, said, "Rescue funds should be directed at those players which have a chance to survive and thrive once the current crisis is over. These are likely to be those companies that have a mix of producing assets as well as developmental assets. The remainder should be encouraged either to consolidate or to fade away."

DECC data

According to figures published in July by the Department for Energy and Climate Change (DECC), indigenous energy production decreased by 5% in 2008 compared with 2007.

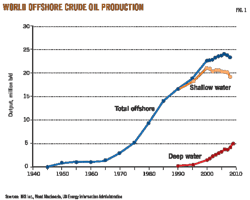

Gross natural gas production fell 3.4% in 2008, and net gas imports accounted for 28% of input into the transmission system. There was a 6.4% reduction in crude oil (including natural gas liquids) production in 2008, which stood at 72 million tonnes, and now constitutes 44% of domestic energy production.

Deloitte analysis

The bleak picture for the UK continental shelf was also recently highlighted by Deloitte LLP, which said oil and gas drilling operations have been more than halved in the past year, while activity in the equivalent sector in Norwegian waters has increased.

The Norwegian authorities offer better tax incentives, which the UK government needs to emulate, Deloitte urged. Its North West Europe Review, published in July, showed that only 15 exploration wells were drilled in the 3 months to June, 57% lower than last year. In contrast, activity in Norwegian waters leapt by 50%. In the second quarter, 18 new wells were drilled in the Norwegian North Sea, which was 29% higher than in the first quarter.

Costs, government cooperation

Oil & Gas UK has recommended that operators reduce their costs and improve efficiency in this difficult period.

"This is not an easy process; some costs will come out of the system as demand falls, but many companies are still having to make difficult choices, particularly when it comes to the size and capacity of their work forces," the group added.

Cooperation with DECC and the Treasury is crucial to reverse the pressures on the industry as 20-25 billion bbl of oil and gas equivalent could be produced, but these projects are more expensive and technically challenging.

Energy committee

The Energy and Climate Change Committee has also suggested that the Chancellor offers operators incentives to encourage exploration and production.

After listening to the evidence of operators at a hearing in June, the committee said that effective tax, regulation, and licensing policy were needed to govern the sector.

It is not confident that the field allowance tax will stimulate the predicted extra 2 billion bbl of oil because it does not address existing sites or the west of Shetland.

"Qualification criteria are too stringent and unless its scale can be extended, the allowance will provide no significant incentive for investment even in new fields. When reviewing the operation of this allowance the government must reconsider the merits of more wide-ranging and generous reforms of the fiscal regime such as a capital uplift or a reduction in the supplementary charge, calculating and setting out the predicted effects on tax revenues and on investment in the industry," the committee said.

Malcolm Webb, chief executive officer of Oil & Gas UK, welcomed the recommendations, arguing that there was urgent need for government to give the right fiscal and regulatory signals to attract more investment to the UK.

"We are encouraged by the committee's recognition that the measures announced in the last budget don't go far enough," Webb said.

Energy security policy

Although the oil industry is important, the UK will best enhance its energy security through a variety of sources including wind and other renewables, nuclear, gas, and clean coal, according to a report by former energy secretary Malcolm Wicks.

Wicks has been appointed the Prime Minister's Special Representative on International Energy. His analysis concluded that an "interventionist" approach by the government will be needed to ensure security of energy supplies, a move that was criticized by business lobby group, the Confederation of Business Industry.

"The government is already shaping the market through various low-carbon targets and incentives, and more intervention is not necessarily the answer," said Dr. Neil Bentley, the CBI's director of business environment. "The role of government should be to provide the right policy and planning frameworks to encourage the £150 billion of private sector investment needed to bolster energy security, cut emissions and keep prices affordable."

Wicks said the UK needs to foster tight relationships with gas exporters, Norway, Qatar, and Saudi Arabia, while tripling nuclear capacity and pushing for renewable energy. He also suggested strategic storage to stop companies from diverting gas supplies to other countries if there were a shortage.

Energy and Climate Change Sec. Ed Miliband said that maximizing North Sea production was a priority as well as energy diversification.

The government is to consider carefully the report's recommendations and publish a formal response.