OGJ Newsletter

General Interest — Quick Takes

ConocoPhillips asks to amend propane agreement

ConocoPhillips Co. has petitioned the Federal Trade Commission for approval to amend its propane supply agreement with NGL Supply Inc., the FTC announced.

The agreement is part of the antitrust regulator’s consent order issued to resolve concerns stemming from the 2002 merger of Conoco Inc. and Phillips Petroleum Co. That order required the combined companies to divest propane business assets and supply propane to the purchaser, the FTC said on Aug. 5. ConocoPhillips sold the Phillips propane business to NGL to comply with the order.

ConocoPhillips now wants to amend the supply agreement to ensure that it has enough propane stocks at relevant times of the year, and that it is able to continuing supplying the product to its own customers and to NGL, according to the FTC. It said that the proposed amendments govern the summer supply of propane to NGL when ConocoPhillips’s supplies drop below certain levels.

The commission said it would accept public comments on the request through Sept. 8. Copies of the petition can be found at its web site at www.ftc.gov.

Texas receiving grant to plug GOM wells

The Texas General Land Office will receive a nearly $1.4 million grant to seal abandoned Gulf of Mexico oil and gas wells in state waters, US Interior Sec. Ken Salazar announced.

The funding through the US Minerals Management Service’s Coastal Impact Assistance Program will plug abandoned wells in bays and offshore waters to eliminate potential pollution threats to natural resources on the Texas Gulf Coast, he said Aug. 5.

The latest funding for Texas includes $48.6 million for each of fiscal years 2007 and 2008, and $35.6 million for 2009 and 2010, according to the US Department of the Interior. Eighteen coastal counties will share the funding of projects outlined in the state’s approved plan, it said.

CIAP was created under the 2005 Energy Policy Act, according to DOI. It said that through the program, MMS provides $250 million in grants annually to six eligible Outer Continental Shelf oil and gas producing states: Alabama, Alaska, California, Louisiana, Mississippi, and Texas.

House GOP leaders urge to end OCS delay

Ninety-eight US House Republicans urged Interior Sec. Ken Salazar to end a 6-month delay early and move ahead with a 2010-15 federal offshore oil and gas leasing plan he halted on Feb. 10.

“By offering new leasing opportunities in the Atlantic and Pacific Oceans, as well as in Alaska and the Gulf of Mexico, the proposed plan is appropriately expansive, provides maximum flexibility to properly utilize all of our nation’s domestic resources, and helps coastal communities pursue leasing and responsible development in the deep waters off their coastlines,” the House Republican members said in a July 31 letter to Salazar.

“Important offshore areas, like those in Alaska, offer tremendous natural gas and oil resources. By some estimates the Chukchi Sea, off Alaska’s coast, contains as much natural gas and oil as the country has produced in the Gulf of Mexico since 1942. The administration should not continue to stand in the way of American energy development,” the letter said.

Salazar announced the delay to obtain more public comment and to broaden the plan to include alternative and renewable energy sources. His predecessor, Dirk A. Kempthorne, launched the lease plan earlier than scheduled last summer in response to record high crude oil and gasoline prices.

The letter said that the lawmakers also hoped the US Minerals Management Service maintains the current 2007-12 Outer Continental Shelf leasing plan for all available areas, including the Gulf of Mexico, Mid-Atlantic Coast, and Alaska.

Russians sign accords in Nicaragua, Venezuela

The Nicaraguan government, following the lead of Venezuela, has signed an agreement allowing exploration by a Russian consortium.

“The concessions include the Caribbean and Pacific, both offshore and on land,” said Francisco Lopez, president of the Nicaraguan Petroleum Enterprise. He said a technical board would be installed to analyze implementation of the agreement.

Russia’s Deputy Prime Minister Igor Sechin said the proposed exploration in Nicaragua would be carried out by the Russian National Oil Consortium, created on Oct. 8, 2008, and comprising Rosneft, Gazprom, Lukoil, TNK-BP, and Surgutneftegaz.

Sechin did not say how much Russia could invest in Nicaraguan exploration, saying only, “We must first carry out in-depth studies to calculate the investments.”

Nicaragua last September became the only country to join Russia in recognizing the independence of Abkhazia and South Ossetia from the small Caucasus state of Georgia.

A month earlier, Russian military forces had invaded Georgia, a former Soviet republic, and forced the shutdown of major international oil and gas pipeline operations.

Prior to his visit to Nicaragua, Sechin also met with Venezuelan President Hugo Chavez and signed a range of economic agreements including one between OAO Gazprom and Petroleos de Venezuela on a joint venture in oil and gas services.

The Venezuelan newspaper El Universal reported the joint firm will take over some gas compression plants formerly operated by Exterran Holdings Inc.

Earlier this year, according to El Universal, PDVSA nationalized nearly 50 gas units of Exterran after a new law gave the state-run firm control over the operation of several oil services, such as gas compression and gas injection, as well as transport of oil workers and equipment in Lake Maracaibo.

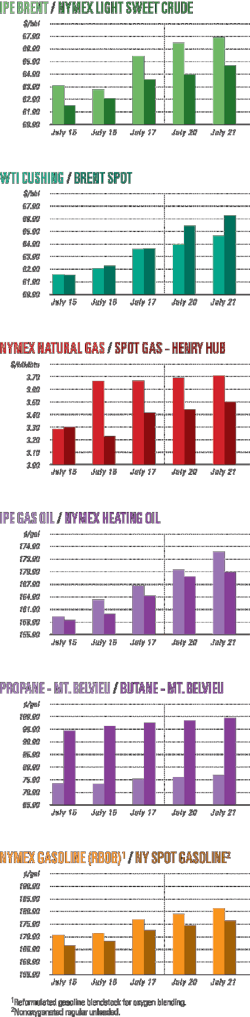

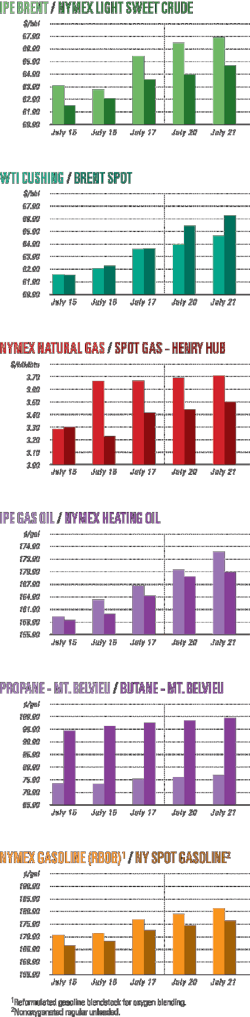

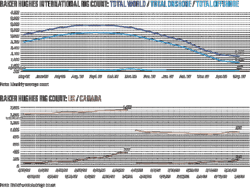

Industry Scoreboard

Exploration & Development — Quick Takes

Development advances at East Siberian field

Verkhnechonskneftegas (VCNG), an affiliate of TNK-BP, has let a contract to KBR for front-end engineering and design of a production facility at giant Verkhnechonskoye oil field in Eastern Siberia.

The contract covers a single facility to handle 140,000 b/d of crude oil to be tied into a new 85-km link to the Eastern Siberian Pacific Ocean (ESPO) pipeline.

The remote field, 4,000 km from Moscow and 1,100 km north of the regional capital of Irkutsk, holds reserves of about 1.4 million bbl, development of which will require investment of $4-5 billion, according to TNK-BP. It was discovered in 1978.

VCNG, in which TNK-BP holds a 68.5% interest, completed a pilot development phase in 2007 and began an “early oil” project last year. That work included construction of the pipeline link to ESPO and a road to neighboring Talakan field. Deliveries into the ESPO line began last October.

Target flow from the early-oil project is 20,000-30,000 b/d by the end of this year. TNK-BP hopes to achieve plateau production of 140,000 b/d by 2014.

KBR said the field will produce at the plateau level through 430 production wells and have 215 water-injection wells. It will have 75 well pads.

The reservoir is about 1,700 m deep and has initial reservoir pressure of about 2,250 psia and temperature of 12°-20° C.

Rosneft is another major shareholder in VCNG.

Chesapeake adds volume in Granite Wash

The western Oklahoma Colony and Texas Panhandle Granite Wash oil and gas-condensate plays are delivering exceptional rates of return even in the current low commodity price environment, said Chesapeake Energy Corp.

The Colony play, in Custer and Washita counties, Okla., and the Texas Panhandle play in Hemphill and Wheeler counties, Tex., are Chesapeake’s highest rate of return play due to high oil and natural gas liquids content. Pretax rates of return are 135-140% based on $7/Mcf gas and $70/bbl oil from a 4.75-5.7 bcfe horizontal well drilled and completed for $5.5-6.25 million.

Chesapeake holds 60,000 net acres in Colony and 40,000 net acres in Texas Panhandle. It is the largest leaseholder, most active driller, and largest producer in Colony.

In Colony, Chesapeake averages 90 MMcfe/d net or 165 MMcfe/d gross operated and plans to raise that to 105 MMcfe.d net or 190 MMcfe/d gross operated by the end of 2009 and 140 MMcfe/d net or 250 MMcfe/d gross operated by the end of 2010.

The company plans to average four rigs in the second half of 2009 to drill 10 net wells and seven rigs in 2010 for 40 net wells. Three recent completions in Washita County averaged initial 30-day rates of 17.1 MMcfe/d including 1,300 b/d of oil, 16 MMcfe/d including 900 b/d of oil, and 15.4 MMcfe/d including 1,100 b/d of oil.

In the Texas Panhandle play, Chesapeake produces 70 MMcfe/d net or 95 MMcfe/d gross operated and plans to reach 75 MMcfe/d or 100 MMcfe/d gross operated by the end of 2009 and 80 MMcfe/d net or 110 MMcfe/d gross operated by the end of 2010.

The company will average two rigs in the second half of 2009 and in 2010 to drill 10 and 20 net wells, respectively.

Dana Petroleum plugs Tafejjart-1 well

Dana Petroleum (E&P) Ltd. plugged the onshore Tafejjart-1 well (TAJ-1) in Morocco because it has not discovered commercial quantities of gas.

A 2,000 HP rig provided by Aladdin Middle East Ltd. drilled a TD of 3,274 m on the Bouanane license and targeted Ordovician sandstone. “However, cuttings information and wireline log data indicated poor reservoir quality with low porosity,” said Tethys Oil AB, a partner in the well.

“This wildcat came in very close to prognosis. Several of the necessary criteria for a successful exploration well were fulfilled, and with better porosity in the reservoir it would have been a success,” said Magnus Nordin, managing director of Tethys Oil.

The company will withdraw from the 2,000 sq km license to focus on projects in Oman.

Dana Petroleum has a 50% interest in the license, with its partners Moroccan state oil and mining company, ONHYM, holding 25%, Eastern Petroleum (Cyprus) Ltd. with 12.5%, and Tethys Oil AB with 12.5%. Tethys has a share of 16.66% of all expenditures on the license above $12 million.

Santos awards contract for Gladstone LNG

Santos Ltd. let a front-end engineering design contract to Foster Wheeler to determine how it should extract and transport coal-seam gas for the upstream phase of its Gladstone LNG project in Queensland, Australia. The value of the deal was not disclosed.

Foster Wheeler will focus on delivering coal-seam gas to the transmission pipeline and associated infrastructure and services, including power generation and water treatment facilities. The work is scheduled to be finished in the first quarter of 2010.

Santos will source 170-220 petajoules/year of coal-seam gas from Fairview, Roma, and Arcadia fields in Central Queensland to a planned single train onshore LNG facility. Gladstone LNG Pty. Ltd. (GLNG) will have a 3-4 million tonnes/year LNG processing train and associated infrastructure.

In June, Santos said Petronas of Malaysia was willing to buy 2 million tonnes/year of LNG starting from 2014 with an option of an additional 1 million tonnes/year under a heads of agreement. However, this was conditional only on the GLNG project’s receiving final approval to proceed (OGJ Online, June 18).

Santos is the operator with a 60% stake in the project with Petronas holding 40%. The project is expected to cost $7.7 billion (Aus).

Drilling & Production — Quick Takes

Aramco: 400 wells prepped for Khurais start

Saudi Aramco said its Southern Area Production Engineering and Production Services Departments prepared more than 400 wells for completion before supergiant Khurais oil field came on stream in June (OGJ, July 20, 2009, p. 34).

The units managed 232 oil-production, 119 water-injection, and 58 observation wells, as well as stimulation work and the installation and testing of electrical submersible pumps.

The stimulation work covered 118 power-water injectors and 14 oil producers. It included the pumping of 12 million gal of fluid.

Aramco said the use of rigless coiled-tubing technology tripled injection rates in comparison with conventional methods using drill pipe in a rig.

At Khurais, which added 1.2 million b/d to Saudi production capacity, the company made its first use of distributed temperature sensors combined with multilateral tools in a number of reservoir access wells.

Khurais development made heavy use of permanent downhole monitoring sensors, remote-control chokes, and multiphase flowmeters. Data flow through a remote terminal unit at wellsites to field control rooms and eventually to ’Udhailiyah and Abqaiq for validation and interpretation.

Bolivia’s Itau field declared commercial

France’s Total declared Bolivia’s giant Itau gas-condensate field commercial, 10 years after its discovery in Tarija Department.

Itau, discovered in 1999 in Block XX Tarija West, is scheduled to start production in mid-2010 at an initial 50 MMcfd of gas, the company said.

Gas is to be processed at Petrobras Bolivia’s 210 MMcfd plant in adjacent San Alberto field just north of the border with Argentina and less than 100 miles west of the border with Paraguay. Total operates Itau with 75% equity.

The Itau X-1A discovery well tested gas-condensate from the Devonian Huamampampa formation. TD is 18,917 ft.

San Alberto was discovered in 1998 and began producing in early 2001. Itau’s development has been delayed until its supply was needed for throughput in the Bolivia-Brazil gas pipeline.

The Total Group plans to spud an appraisal well by the end of 2009 at Incahuasi gas-condensate field found in 2004 on the Ipati block 80 miles north of Itau in Chuquisaca Department. It will drill the appraisal well on the adjacent Aquio license. Total owns 80% equity in both blocks.

Total, OAO Gazprom, and Yacimientos Petroliferos Fiscales Bolivianos in 2008 created a mixed company to explore the 4,764 sq km Azero block. Total and Gazprom will have equal stakes in the mixed company.

TAQA to operate Dutch gas field platform

TAQA Energy BV (TAQA Energy) will operate the L11b-A platform in the Dutch North Sea, which will start production from the southern part of L8-D gas field later this year.

The Abu Dhabi National Energy Co. subsidiary has acquired a 15% interest in the license, platform, and connection to the Noordgastransport (NGT) pipeline. TAQA’s partner, Cirrus Energy Nederland BV, will operate the L11b license, which is 50 km north of Den Helder.

The L11b Group, comprising Chevron Exploration & Production Netherlands BV, DSM Energie BV, and EBN, sold the assets to the L8-D Field Group for an undisclosed amount.

The L8-D Group includes TAQA Energy, Cirrus Energy Nederland, DSM Energie, Energy Investments BV, EWE AG, and EBN.

The L8-D structure holds an estimated 323 bcf of gas in place, according to a report compiled by GLJ Petroleum Consultants Ltd.

In February, the L11b-A06 appraisal well (previously called L11-13) tested gas at a maximum stabilized flow rate of 30.6 MMscfd on a 48/64 in. choke at a flowing wellhead pressure of 200 bar (OGJ Online, Apr. 1, 2009). The group used the Noble Lynda Bossler jack up to reach a TVD of 4,200 m.

“Production from the nearly depleted L11b-A field has been shut-in, and modifications to the existing process equipment are under way to allow for the tie-in of the L11b-A06 well,” said Cirrus Energy. “This is expected to be completed in the fourth calendar quarter of 2009, at which time L8-D field production is expected to commence from the L11b-A06 well.”

A second L8-D field appraisal-development well is to be drilled from the L11b-A platform later this year, which, if successful, is expected to be on production during early 2010.

TAQA also will take over DSM Energy’s share in the L8-D Group following its acquisition of the company. The deal is expected to close in the third quarter of this year, subject to regulatory approvals and notifications.

TAQA has a 15% share in the LD-8 Group. Cirrus Energy Nederland has 25.479%, DSM Energie has 2.88%, EBN holds 41.9%, Energy06 Investments BV has 1.341%, and EWE AG has 13.4%.

Processing — Quick Takes

Contract let for German refinery integration

Shell Deutschland Oil GMBH has let an engineering, procurement, and construction management contract to Technip for integration of the 327,000-b/d Rheinland refinery near Cologne, Germany.

Until 2005, Royal Dutch Shell units operated the facility as separate refineries, with 140,000 b/d of crude capacity at Wesseling and 162,000 b/d of capacity at Godorf (OGJ, Dec. 19, 2005, p. 60).

Technip’s initial work will be at Wesseling. It includes modification of desulfurization and hydrogen units and construction of new facilities. Wesseling will desulfurize gas oil from Godorf.

Technip handled basic design for the first phase of the integration project, called Connect, and is working on basic design packages for later phases.

Uganda to study feasibility of refinery

Uganda is considering construction of a 50,000-b/d refinery to produce fuel for local and regional markets, according to the Ministry of Energy and Minerals Development.

Feasibility studies are to be launched before yearend for a refinery with capacity that might be doubled in 6-7 years. The ministry says production from recent discoveries might reach 100,000 b/d.

Heritage Oil Ltd., Tower Resources PLC, and Dominium Uganda Ltd. are exploring in the country.

The announcement of the refinery plan follows reports that Tower Resources has commissioned a reevaluation of the West Nile where the first well drilled, Iti-1, was dry).

Transportation — Quick Takes

Midcontinent Express begins full operation

Natural gas service on the roughly 500-mile Midcontinent Express Pipeline (MEP) began Aug. 1 between Delhi, La., and Transcontinental Pipe Line’s Station 85 in Butler, Ala. Interim service from Bennington, Okla., to Delhi began in April.

Completion of the final segment of MEP connects production from the Barnett shale, Bossier sands, and other plays in the region to the eastern US.

MEP has multiple receipt and delivery points along its length, crossing northeastern Texas, northern Louisiana, and central Mississippi between Oklahoma and Alabama.

Capacity is currently 1.25 bcfd in Zone 1, which interconnects with the Columbia Gulf Transmission system in Delhi and up to 0.84 bcfd in Zone 2, which interconnects with the Transcontinental Gas Pipe Line system in Butler. An expected 2010 expansion of the pipeline will further increase MEP’s capacity to about 1.8 bcfd in Zone 1 and 1.2 bcfd in Zone 2. The pipeline’s capacity, including the expansion capacity, is fully subscribed by long-term binding commitments.

Construction of two additional compression stations, one in Cass County, Tex., and a second in Hinds County, Miss., will start in fall 2009 to meet this expansion timeline.

MEP is a joint venture of Kinder Morgan Energy Partners LP and Energy Transfer Partners LP. Kinder Morgan constructed and will operate the pipeline.

Dolphin Energy announces financing

The Dolphin Energy consortium raised $4.1 billion to refinance debt, help fund construction of a gas pipeline, and pay for the refinancing fees.

Dolphin said the $4.1 billion will be used to repay a $3.45 billion loan secured in 2005, to provide 70% of the construction costs of the 244-km, 48-in. Taweelah-Fujairah pipeline, and to pay for fees related to the refinancing.

Dolphin’s majority shareholder, the Abu Dhabi government’s investment firm Mubadala Development Co. (51%), reportedly played a key role in raising the financing, while partners Total SA and Occidental Petroleum (24.5% each) are lending the project $1.2 billion.

Last month, Australia’s export credit agency EFIC said it was guaranteeing Gasco’s $6.5 million contract to supply and supervise installation of two heaters for the pipeline.

Gasco’s client is Russia’s Stroytransgaz, which was awarded a $418 million engineering, procurement, and construction contract for the pipeline in June 2008.

The Taweelah-Fujairah gas pipeline will link Dolphin Energy’s gas-receiving facilities at Taweelah, on the coast of Abu Dhabi, with the ADWEA Power and Water Desalination Plant at Qidfa, in Fujairah.

TAQA Bratani operates Brent pipeline system

TAQA Bratani Ltd. assumed operatorship from Shell UK Exploration & Production for the Brent System pipeline in the UK North Sea, marking a change in management for the first time in almost 30 years.

The pipeline delivers 100,000 b/d of oil from 20 North Sea fields and constitutes around 8% of offshore oil production. It accounts for almost 60% of the input at the Sullom Voe terminal in the Shetland Islands, in which the company has a 24% stake.

TAQA will have a 16% interest in the system and has invested in experienced staff and first class IT and systems infrastructure to work with its other Brent partners, such as ExxonMobil Exploration & Production Norway AS and Lundin Thistle Ltd.

TAQA will focus on its operated Cormorant Alpha platform as well as the 150 km pipeline connecting Cormorant Alpha to the BP PLC operated Sullom Voe terminal.

Leo Koot, TAQA Bratani’s managing director, said: “This is the latest step in our North Sea activity program, which this year already has seen TAQA increase production from our operated assets, initiate drilling, and near-field exploration.”

In December, TAQA completed the $631 million purchase of assets in the UK North Sea from Shell UK Ltd. and ExxonMobil Corp. (OGJ Online, Dec. 7, 2008) TAQA operates Tjern, Kestrel, Eider, Pelican, Cormorant North, and Cormorant South fields and related assets. They lie in 150-167 m of water northeast of Lerwick in Shetland.

TAQA is the UK arm of the Abu Dhabi National Energy Co.

| Correction A credit line for the photo of the Bw Cidade de Sao Vicente floating production, storage, and offloading vessel on the cover of the Aug. 3 edition of OGJ inadvertently was left out of the coverbox text on the table of contents. That photo was supplied by the Petrobras News Agency. |