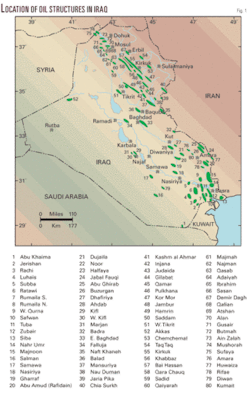

Iraq’s proved reserves of 115 billion bbl are housed in some 80 oil fields (Fig. 1). Of these, seven oil fields have been fully developed and another 15 partly developed.

The remaining 58 fields rank between appraised or discovered but not yet delineated or appraised.

It should be noted, however, that there is a concentration of reserves in few fields. The seven largest fields, for example, Rumaila South and North, Kirkuk, East Baghdad, Majnoon, West Qurna, and Zubair, contain two-thirds of total reserves.

Iraq may prove to have the greatest endowed oil reserve base in the world, whose true extent has not as yet been fully explored or developed. Its proved reserves are 145.5 billion bbl of oil and its potential reserves are in excess of 215 billion bbl.

Its historically sustained optimum oil production level was 3.5 million b/d, while its production today is 2.5 million b/d. As such, Iraq’s production capacity has always lagged its potential.

Finding cost

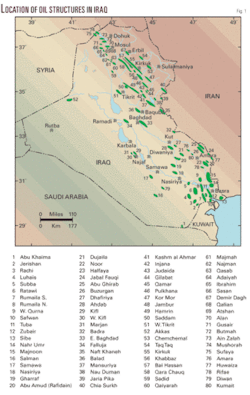

Until recently, 157 exploration wells were drilled in Iraq to investigate 116 structures, of which 122 wells were successful in finding oil or gas, proving reserves of some 145 billion bbl housed in the 80 fields.

Almost every oil field has multiple reservoirs. As a result, the drilling success rate is almost eight for 10, and the discovery rate is seven out of 10 (Fig. 2).

It is no surprise, therefore, that the finding cost has been less than 0.5¢/bbl in 1997 dollars. Allowing for inflation and as the search progresses into more difficult and deeper horizons and smaller oil fields, the finding cost would be higher, but it would still be a fraction of a dollar for a long time.

Development cost

According to the author’s experience and based on the findings of the Petrolog & Associates 1997 study, average Iraq development cost at the field’s boundary was of the order of $1,000/daily bbl; to erect facilities to produce a rate of 1 b/d for the foreseen future requires a capital investment of $1,000.

The cost runs from as low as $750 rising to $3,150/daily bbl, reflecting very high economy of scales though varying well productivity in the range of 4,000 b/d to 20,000 b/d in fields situated in rather plain unrugged land areas.

New development until a few years ago would have had a similar wide, though higher, cost range of up to $3,000/daily bbl for expansion and $5,000-6,000/daily bbl for grassroots oil field development. This higher cost would account for lower well productivity (500 b/d to 5,000 b/d), deeper and more difficult drilling conditions, shallow water in the marsh areas, and early application of water injection. However, the high inflationary trend over the last 2-3 years could have doubled this cost to $6,000 for expansion and $10,000-12,000 for grassroots oil field development. Oil field development cost still remains among the lowest worldwide.

In terms of cost per barrel, the finding and development costs in Iraq should be $1.50-2.25/bbl, the least expensive worldwide.

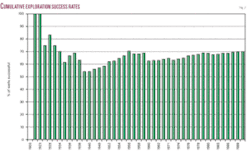

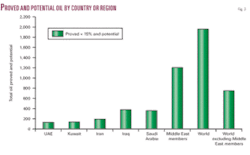

Table 1 summarizes Iraq’s oil statistics in comparison with the other Middle East major producers and the contribution of each to the global energy market at the year beginning 2007.

Iraq’s oil resource is on par with Saudi Arabia, but its resource base is the least depleted. Its resource provides the most oil reserves (174 billion bbl) prior to peak oil setting in post-midpoint reserves depletion.

It is, therefore, worthwhile to diagnose the impediments that have limited Iraq oil production to date to 2.5 million b/d while Saudi Arabia has managed, decades away, around 10 million b/d under a system of state monopoly.

Iraq, as the table shows, has thus far produced only 8% of its oil source base while it has over 19% of the world reserves and over 31% of the total production of the Middle East major producers. Iraq’s reserves shall provide the global energy market with the most reserves (174 billion bbl of oil) that defers the setting in of peak oil when world oil production starts declining. Such contribution to the global energy market is imminent.

The table aims to provide a conceptual conclusion. It is based on: Published proved reserves for January 2007, oil recovery upgraded from world average of 35% to 50% which is within easy reach of today’s technology, potential discovery in each country is assumed 20% of published proved reserves except Iraq, which is given Petrolog & Associates’ researched estimate of 215 billion bbl.

Vital concepts

Iraq’s cumulative oil production is 30.5 billion bbl, only 8% of its oil resource base of 330-380 billion bbl (based on enhanced recovery).

Iraq’s proved reserves are 115 billion bbl, and its potential exceeds 215 billion bbl. These figures put it on par with Saudi Arabia. It would take Iraq 300 years to deplete its reserves at the production rate of 3 million b/d, 180 years at 5 million b/d, and 90 years at 10 million b/d.

Fast-track development is required but has not been achieved yet.

Iraq’s present production is 2-2.5 million b/d, and its historical high is 3.5 million. Due to past and present impediments, Iraq’s developed production rates have always lagged its proved reserve capacity.

Iraq’s priority, therefore, should be to rehabilitate its infrastructure, build capacity, and monetize reserves.

With ample proved reserves and the present low production rate, Iraq can develop a production plateau of 10 million b/d, which can be maintained for a decade without the need for additional new reserves. To start, it would take Iraq 1.5-2 decades to reach 10 million b/d.

Further exploration for reserves equates to additional frozen investment, generating no return. Exploration should be conducted to improve geological prospecting and enhanced development planning.

The policy of granting wholesale exploration contracts of the latest amended draft petroleum law, based on controversial long-term contracts, is unnecessary and divisive. Announced at this time, when the country is in desperate need for peace within its factions, is most unwise.

Iraq’s recovery factor has averaged 25-31%, while technology elsewhere has achieved 50-60% and 70% is the target. The Iraq of today lacks state-of-the-art technology and management know-how, due to years of war, sanctions, and lately, occupation, terror, and failing infrastructure and institutions.

Clearly, Iraq requires international oil company support. The question is, on what contract model basis, whether production-sharing agreement or service contracts for know-how, with or without investment?

Iraq is a founding member of OPEC and rightly adopts a policy of crude oil price stabilization and conservation. An open exploration and production policy under contracts employing IOCs’ technical support as well as their capital investment would create the problem of having to cap exports while investing. IOCs require unrestricted production. Service or management contracts employing IOCs latest technology and management with remuneration choice in cash or kind suggests itself as an appropriate model.

Iraq’s present proved reserves could support a production rate in excess of 12 million b/d as potential reserves are discovered and developed to sustain the plateau. Today, however, Iraq’s production facilities are dilapidated, looted, sabotaged, or war-torn, to the extent that in September 2003, its production rate sank to around 1 million b/d from a prewar rate in March 2003 of 2.8 million b/d.

Rehabilitation of infrastructure and monetizing reserves should, therefore, be the priority.

Iraq’s enormous proved reserves and potential make it the only major Middle East member with relatively untapped and inexpensive oil resources. At the same time, it raises an alarm amongst Iraqis, fearing continuing occupation and interference in the country’s political and economic future.

Iraqis have lived and seen all the major Middle East member producers for 4 decades of state control of oil exploration and development with pivotal if not total role given to their national oil companies.

No doubt privatization rubs against the skin of Iraqis.

Next: Impediments to progress in exploiting Iraq’s world-class oil resource.