General Interest— Quick Takes

Oil sands investment to recover by yearend

The expected economic recovery in developing the oil sands in Alberta may start in late 2009 or early 2010, said Robert J. Mason, managing director, head of oil sands, investment banking, global energy, and power group, TD Securities Inc., Calgary.

“Some producers are thinking about restarting projects because oil price forecasts are more definite,” Mason said, speaking July 14 at PennWell Corp.’s Oil Sands & Heavy Oil Technologies Conference & Exhibition in Calgary. He added that capital cost have come down by 30% in the last 9 months.

Projects he thought might be slow in restarting are those involving upgraders. Upgrader projects are still in question with some deferred and others canceled, he said.

Mason noted that since fall of 2008, development activity has been in a “pause and evaluate” mode because of low oil prices, lack of available financing, high borrowing costs, and inability of small companies to raise capital.

One higher cost the companies will have to contend with is the cost for handling carbon emissions. He said in past years, companies had expected this cost to add 25-30¢/bbl but now additional costs of $2-3/bbl are more likely.

Labor forecasts have also come down. He noted that projections are that new projects will need 25,000-28,000 fewer workers if the pace of development is as slow as now expected.

Investor convicted in scheme targeting SOCAR

A federal jury in Manhattan convicted a US investor on July 10 of trying to bribe senior government officials in Azerbaijan in a scheme to privatize the country’s national oil company in a rigged auction, the US Department of Justice said.

Frederic A. Bourke Jr. of Greenwich, Conn., conspired with Czech investor Viktor Kozeny and members of their consortium to make a massive profit on the auction using options and vouchers to bid for shares of the State Oil Co. of the Azerbaijan Republic (SOCAR), DOJ said.

DOJ said evidence presented during the 6-week trial showed that the group flew millions of dollars in cash into the country for Oily Rock Ltd., a company which Kozeny allegedly controlled, to buy the options and vouchers.

Bourke, a neighbor of Kozeny’s in Aspen, Colo., invested about $8 million in Oily Rock for family members and friends as well as on his own behalf, DOJ said. Evidence also showed that Bourke obtained directorships, salary, and stock options with other companies Kozeny allegedly set up and funded, DOJ said.

DOJ said that starting in August 1997 through the fall of 1998, Bourke and others conspired to pay or cause to be paid millions of dollars in bribes to Azeri government officials. In return, the government officials were to ensure that the Bourke-Kozeny investment consortium would gain, in secret partnership with the Azeri officials, a controlling interest in SOCAR and its substantial oil reserves.

Bourke also arranged for two of the corrupt officials to travel to New York City on different occasions in 1998 to receive medical treatment, for which Oily Rock paid, according to DOJ. Thereafter, in interviews with the Federal Bureau of Investigation in April-May 2002, Bourke falsely stated that he was not aware that Kozeny had made the alleged payments to the Azeri officials, it said. DOJ indicted the two men in October 2005.

The jury convicted Bourke of conspiracy to violate the US Foreign Corrupt Practices Act and the Travel Act, and of lying to the FBI. It acquitted him of a money laundering charge. At sentencing, which is scheduled for Oct. 13, Bourke faces up to 5 years in prison and a $250,000 fine for each of the two charges on which he was convicted.

BLM Colorado to hold its first on line lease sale

The US Bureau of Land Management’s Colorado state office posted a proposed list of parcels on July 13 for what will be the agency’s first on line oil and gas lease sale.

Congress directed the US Department of the Interior agency to conduct an online lease sale as part of DOI’s fiscal 2008 budget as a one-time event to determine whether it is feasible, BLM said. It selected Colorado for the event, which will be held entirely on line and run from 9 a.m. on Sept. 9 to noon on Sept. 17.

The auction pilot’s web site is at www.blm.gov/leasingpilot. It lists 38 parcels totaling 28,489 acres. BLM said the parcels will be split into two groups and become available for bids on a staggered basis over 2 days, with each group being offered for 7 days.

Similar to typical on line auctions, bidders will have the option of submitting one-time set bids on parcels and proxy bids, which automatically increase to a set amount indicated by the bidder, according to BLM.

It said bidders would have to register online to actually bid and encouraged them to do so early to become familiar with the web site and the auction guidelines.

Credit card information and a sworn statement of an intention to buy are required. An on line tutorial is available at the web site, which will remain available for viewing for 30 days after the sale closes.

There will be no charge for filing protests, BLM said. Protests of parcels being offered must be in writing and delivered by hand, mail, or fax. BLM has not made any provision for filing protests on line or by e-mail.

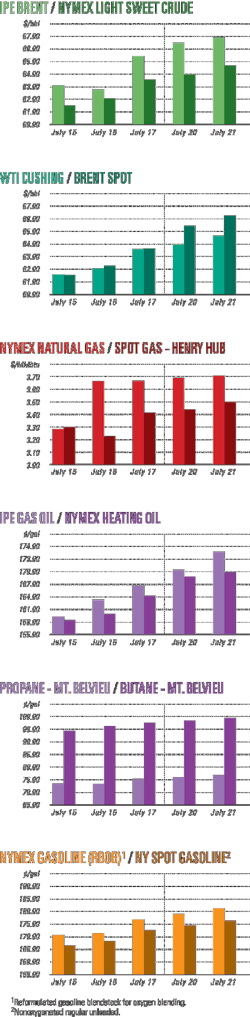

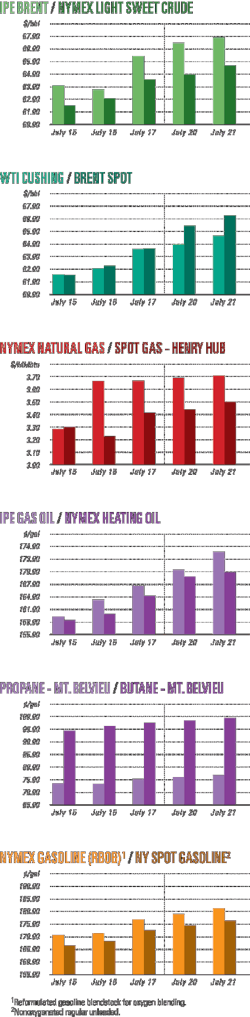

Industry Scoreboard

Exploration & Development— Quick Takes

Three Forks rates rise as drilling costs fall

Operators are climbing the learning curve in the Williston basin by drilling long lateral wells in the Bakken and Three Forks formations with as many as 24 frac stages.

One operator, Brigham Exploration Co., Austin, Tex., said it is continuing to see drilling and completion costs fall.

Initial rate at the Strobeck 27-34, in the Ross area of Mountrail County, ND, is 1,788 b/d of oil and 1.4 MMcfd of gas from a long lateral in Three Forks. Brigham Exploration completed the well with 20 frac stimulation stages, 18 of which were effective.

Strobeck 27-34, which appears to have had the basin’s second highest initial rate for a Three Forks completion, cost $3.9 million, 33% lower than company late 2008 authority for expenditures at similar wells.

“The Strobeck 27-34 results also confirm the core taken from our Anderson 28-33, which indicated that both the upper Three Forks and middle Bakken formations were heavily saturated with oil,” the company said.

Anderson is 1 mile west of Strobeck and about a mile southwest of Brigham Exploration’s Carkuff-22 1H, which went on production at 1,110 b/d of oil after 12 frac stages in a short lateral.

The company recently drilled the lateral of its Anderson 28-33 on a 1,280-acre unit in the Ross area to 19,900 ft in the Bakken and ran 24 swell packers to bottom. A 24-stage frac operation, believed to be a record number for the basin, is planned in early August.

Brigham Exploration has spud the Brad Olson-1H 9-16 well in the Rough Rider area of Williams County, ND, and plans 24 frac stages in an intended 20,000-ft Bakken lateral at an estimated cost of $6.25 million, 34% less than 2008 AFEs.

Brigham Exploration controls 35,200 net acres in the Ross area and 100,345 net acres in the Rough Rider area. It is participating in 20 Mountrail County Bakken wells operated by others in various stages, including 12 already on production.

Haynesville well results encourage operators

Forest Oil Corp., Denver, and Goodrich Petroleum Corp., Houston, reported results from recent Jurassic Haynesville horizontal well completions in Louisiana and East Texas.

Forest, meanwhile, said it operated only four rigs in this year’s second quarter and continues to defer significant investments until drilling and completion costs are reduced to acceptable levels to support a larger drilling program at current natural gas prices.

In Red River Parish, La., the Driver 13-1H well produced into a sales line at 20.3 MMcfd of gas equivalent with 6,500 psi flowing casing pressure in early July. It had 10 frac stages in a 3,500-ft horizontal leg and cost $9 million.

Forest has identified 110 potential horizontal locations on the 11,050 Haynesville prospective net acres it holds in Louisiana. It will maintain a one-rig program in the parish for the rest of 2009 and one rig in other prospective areas of the play in Texas and Louisiana.

Goodrich Petroleum said the Taylor Sealey-3H in Panola County, Tex., produced at 9.3 MMcfd with 5,200 psi on a 24⁄64-in. choke. It is in Minden field 6 miles south of the Lutheran Church-5H well that had an initial rate of 9 MMcfd. The company has 100% working interest.

The company reached total depth at two other Haynesville shale horizontal wells, T. Swiley-4H in Minden field and Beard Taylor-1H in Beckville field.

Goodrich Petroleum also held interests in three wells completed by Chesapeake Energy Corp. in Bethany-Longstreet field, Caddo and DeSoto Parishes, La.

Initial rates were 12.5 MMcfd with 7,800 psi on an 18⁄64-in. choke at Johnson 32H-1, Goodrich 31%; 15.4 MMcfd with 6,100 psi on a 22⁄64-in. choke at Wallace 36H-1, Goodrich 22%; and 14 MMcfd with 4,000 psi on a 22⁄64-in. choke at the Bryan 25H-1, Goodrich 13%.

Alberta’s Nikanassin zone has resource play

Daylight Resources Trust, Calgary, said it is working on a strategy to develop a gas resource play in the Jurassic Nikanassin zone just below Cretaceous Cadomin at Elmworth in the Alberta Deep Basin.

Two vertical wells in the first quarter found more than 100 m of sand in the Nikanassin at 2,700-3,200 m and came on production in March and April at initial rates of 2-3 MMcfd of gas.

Daylight Resources plans to drill one more vertical delineation well and a horizontal well before the end of the 2009-10 winter drilling season. It holds Nikanassin rights in more than 51,200 acres at Elmworth.

The company said it is investigating the potential for using the same advanced horizontal drilling and multistage fracturing technologies on the Nikanassin that it has applied in the Cadomin.

Due to weak natural gas prices, Daylight Resources has deferred the majority of its planned gas expenditures for the 2009 second quarter and early third quarter to late third quarter and fourth quarter.

US nets $700 million for GOM leases

The US Department of the Interior’s Minerals Management Service said it accepted high bids valued at $700 million and awarded 328 leases to the successful high bidders who participated in the Central Gulf of Mexico Oil and Gas Lease Sale 208.

MMS said funds from the total high bids will be distributed to the general fund of the US Treasury, shared with the affected states, and set aside for special uses that benefit all fifty states.

It said the leases were awarded following the completion of an extensive, two-phase bid evaluation process to ensure that the Federal government receives a fair monetary return for the public mineral resources it makes available.

Seventy companies submitted 476 bids on 348 tracts in the sale, held on Mar. 18. The total for high bids submitted on all tracts was $703,048,523. Using the bid evaluation process, MMS rejected high bids totaling $12,673,983 on 19 tracts as insufficient for fair market value.

In addition, MMS said that a successful high bidder forfeited the lease and the 1⁄5th bonus which was submitted with the bid. As a result, $52,836.40 of the $264,182 bid on the forfeited tract has been collected.

The highest bid accepted on a tract was $65,611,235 submitted by Shell Gulf of Mexico Inc. for Mississippi Canyon Block 721. This tract lies in 800-1,600 m of water and received two bids.

The top five companies with the highest number of accepted high bids for Sale 208 were Shell Gulf of Mexico Inc., 39 for $154 million; BHP Billiton Petroleum (Deepwater) Inc., 28 for $50 million; BP Exploration & Production Inc., 25 for $77 million; Ecopetrol America Inc., 22 for $19 million; and Noble Energy Inc., 22 for $54 million.

Drilling & Production— Quick Takes

Murphy starts producing Thunder Hawk field

Murphy Oil Corp. has started producing oil and associated gas from Thunder Hawk field on Mississippi Canyon Block 734 in the Gulf of Mexico. The field lies in more than 5,700 ft of water, about 145 miles southeast of New Orleans.

The facilities on the semisubmersible floating production unit have a capacity to handle 45,000 bo/d and 70 MMscfd of gas.

Initial production is from three subsea completed wells tied back with flowlines to the semisubmersible.

Operator Murphy has a 37.5% interest in Thunder Hawk. Partners are Eni Petroleum US LLC 25%, Statoil Hydro USA E&P Inc. 25%, and Marubeni Oil & Gas USA Inc. 12.5%.

Apache lets contract for Forties oil platforms

Apache North Sea Ltd. has contracted Petrofac Ltd. for the onshore engineering and offshore construction that will support the five fixed platforms in Forties oil field in the UK North Sea.

The deal is worth £25 million/year and it will last 3 years with Apache holding two optional 1-year extensions.

Forties field is producing more than 70,000 b/d of oil and Apache has spent more than $1.2 billion on the mature assets since its acquisition in 2003. Apache is confident that Forties could produce oil for another 20 years and has identified 60 targets ranging in size from less than 0.5 MMboe to 1.5 MMboe to drill; most of the prospects are less than 1 MMboe.

In June, Apache started oil production from its Forties Charlie 6-3 well with 10,500 b/d (OGJ Online, June 22, 2009). The well is the seventh development well brought on production at Forties this year. The well’s initial production rate is the field’s highest since 1994, Apache said.

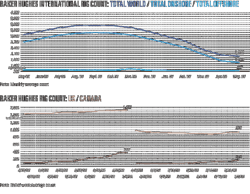

US drilling count drops

After climbing for 3 consecutive weeks for the first time since early September, US drilling is down by 12 units to 916 rotary rigs working the week ended July 10, Baker Hughes Inc. reported.

That compares with 1,922 rigs drilling in the US during the same period a year ago.

Land operations led the latest loss, down 7 rigs to 871 drilling. Offshore drilling declined by 5 rigs to 37, all in the Gulf of Mexico. Drilling in inland waters was unchanged with 8 units drilling.

Of the rigs still working, those drilling for oil increased by 5 to 234. Those drilling for natural gas declined by 16 to 672. There were 10 rigs unclassified. Horizontal drilling decreased by 6 rigs to 390. Directional drilling increased 4 to 165.

Among major producing states, Louisiana was down 4 rigs to 130 drilling. California dropped 3 to 20. Texas and New Mexico were down 2 each to 336 and 38, respectively. Wyoming was down 1 rig to 30; Alaska was down 1 to 5. States with unchanged rig counts included Oklahoma, 82; Colorado, 45; and North Dakota, 40. Arkansas’s rig count increased by 1 to 45.

In other states of interest, Pennsylvania, West Virginia, and Utah were unchanged with respective rig counts of 43, 20, and 16.

Canada’s rig count increased by 13 to 178, down sharply from 414 rigs working in the same week in 2008.

Imperial lets contract for Kearl oil sands project

Imperial Oil Ltd. awarded Fluor Corp. a $1.5 billion engineering, procurement, and construction contract for infrastructure and offlease facilities for the first phase of the Kearl oil sands project, a surface mining and bitumen extraction operation about 70 km northeast of Fort McMurray, Alta.

Imperial expects the first phase to start producing in late 2012 at an average 110,000 b/d of bitumen.

In May, Imperial Oil said it was reactivating the $8 billion (Can.) Kearl project (OGJ Online, May 29, 2009).

Processing — Quick Takes

Ukraine refinery hydrotreaters due revamp

JSC Ukrtatnafta has let contract to CRI/Criterion Catalyst Co. Ltd. and Shell Global Solutions Eastern Europe BV for a revamp of two processing units at its 360,000-b/d refinery in Kremenchug, Ukraine.

The work includes Shell reactor internals and a Criterion catalyst system for diesel hydrotreaters.

One of the revamped units will produce vacuum gas oil with less than 0.2 wt % sulfur. The other will allow the refinery to produce automotive diesel with sulfur content of less than 350 ppm and batches of diesel with sulfur content below 50 ppm.

Jubail hydrocracker, cat cracker, coker work let

Saudi Aramco Total Refining & Petrochemical Co. has let a contract to Technip for two packages, including one covering hydrocracking and catalytic cracking units, for the 400,000 b/d export refinery it will build in Jubail, Saudi Arabia.

The Aramco-Total venture let an engineering, procurement, and construction contract to Chiyoda Corp. and Samsung Engineering for a coker unit at the 400,000-b/d export refinery to be built in Jubail, Saudi Arabia.

Technip will handle engineering, procurement, and construction for the hydrocracking and catalytic cracking units and for some of the utility units and interconnecting network and process control system for the entire refinery.

The coker contract is one of 13 process packages for which the joint venture approved an awarding plan in June after a delay last year during which Aramco assessed projects in light of global economic problems (OGJ, June 22, 2009, Newsletter).

Aramco and Total formed the joint venture in third quarter 2008. Aramco holds 62.5% and Total, 37.5%. Aramco plans to offer 25% of the joint venture to the Saudi public out of its share in an initial public offering in the last quarter of 2010.

Venezuela acquires stake in Dominican refinery

The Dominican Republic, struggling to pay off oil debts to Venezuela, agreed to transfer a 49% stake in its 34,000-b/d, state-owned Refineria Dominicana de Petroleo SA (Refidomsa) to Venezuela’s state oil company Petroleos de Venezuela SA.

The Dominican Republic has owned 100% of the refinery since last December, when it bought the 50% stake formerly held by Royal Dutch Shell PLC for $110 million.

Reports say the Shell sale was part of the firm’s strategy to exit all of its businesses in the Caribbean in order to focus on other regions of the world.

The sale of the 50% stake in the refinery, which began operating in the mid-1970s, coincided with a visit to the Dominican Republic by Venezuelan officials, led by PDVSA commercial director Ramon Herrera.

The Venezuelans were in the Dominican Republic for talks on how the island nation could use goods and services to pay off $1 billion in debt to Venezuela for oil supplied under the Petrocaribe initiative.

The Dominican Republic is one of 18 Central American and Caribbean nations that participate in the PetroCaribe energy initiative under which Venezuela offers its crude and refined products to buyers on favorable terms.

The Herrera-led delegation discussed matters with Dominican Finance Minister Vicente Bengoa. The Dominican Republic currently receives 33,000 b/d of Venezuelan oil under the Petrocaribe initiative but wants an increase to 50,000 b/d.

In June of this year, Bengoa announced a plan for the repayment if its $1 billion oil debt, saying the bill would be “partially” settled with black beans and tourist packages—among other goods and services.

Bengoa said PDVSA would acquire its 49% share of the refinery by foregoing 60% of the payment it normally receives from the Dominican Republic for PetroCaribe oil over a 3-month period—about $130 million.

Venezuela’s Energy and Oil Minister Rafael Ramirez said his country’s plan is eventually to integrate the Dominican refinery into a network of eight refineries in various countries that are being upgraded or built by Venezuela as part of its PetroCaribe initiative.

Transportation — Quick Takes

Chevron Australia awards construction contract

Chevron Australia Pty. Ltd. has awarded a $500 million (Aus.) contract to Thiess Pty. Ltd. for site preparation and construction of temporary facilities for the proposed 3-train LNG and domestic gas Gordon Project on Barrow Island off Western Australia.

The project will be supplied from the Greater Gorgon gas fields, including Jansz and Io.

Theiss is in a joint venture with Decmil Group Ltd. and Kentz Corp. Ltd. that in June was awarded another $500 million (Aus.) contract to design and construct an accommodation village capable of housing 3,300 people on the island.

Project scope for the new contract includes preparation of finished earthwork levels for the LNG plant and associated storage tanks, along with production of road base material and feedstock for concrete aggregate production. It also includes reticulation of site services, a material offloading facilities causeway and breakwater plus temporary construction facilities to be used by other contractors later.

The offshore gas fields will be developed via subsea wells and two pipelines bringing gas to Barrow Island where three LNG trains will each produce 5 million tonnes/year. There will also be a 300-terajoule/day domestic gas plant feeding into a pipeline to the mainland and a carbon dioxide sequestration plant with capability of storing the high levels of carbon dioxide contained in the Gorgon field in deep formations beneath the island.

Chevron has 50% of the project while ExxonMobil Corp. and Royal Dutch Shell PLC have 25% each.

BLM schedules times to discuss Ruby Pipeline

The US Bureau of Land Management will host seven public meetings during July to discuss a proposed natural gas pipeline that would extend from southwestern Wyoming across Utah and Nevada and into Oregon.

Meetings are scheduled July 21 in Malin, Ore.; July 22 in Lakeview, Ore.; July 23 in Winnemucca, Nev.; July 27 in Brigham City, Utah; July 28 in Elko, Nev.; July 29 in Kemmerer, Wyo.; and July 30 in Hyrum, Utah. All meetings will begin at 7 p.m.

The Federal Energy Regulatory Commission published a draft environmental impact statement on June 19 for the proposed 675-mile pipeline, which would have an initial design capacity of as much as 1.5 bcfd. Ruby Pipeline LLC, an El Paso Corp. subsidiary, is the sponsor. FERC will accept comments on the draft EIS through Aug. 10.

BLM said the federal Mineral Leasing Act makes it responsible for issuing rights-of-way on public lands. It said it is working with the US Bureau of Reclamation, the US Fish and Wildlife Service, the US Forest Service, the US Conservation Service, the US Army Corps of Engineers, the Utah Public Lands Policy Coordination Office, and the Lincoln County, Wyo., Board of County Commissioners.

Cooperating agencies have jurisdiction by law or special expertise with respect to resources potentially affected by the proposed project and participate in the analysis under the National Environmental Policy Act, BLM said.