Special Report: Weak energy demand to persist through 2009

Demand for oil will shrink this year—as will demand for almost all sources of energy in the US—because of economic contraction. Gas, coal, and nuclear energy demand will decline, but the use of hydroelectric power generation and all other renewable energy sources will grow from last year.

Global oil demand will decline from 2008, led by a decrease in oil consumption by the world’s advanced economies.

Production of crude and condensate in the US this year will increase, and imports will decline almost 6% from a year ago.

Volumes of crude and products in storage are abundant and are expected to remain that way even though worldwide oil production this year is forecast to shrink in excess of 2 million b/d on average.

The US will consume less natural gas this year due to weaker industrial, commercial, and residential demand, but supplies of gas will be plentiful. Inventories of gas are hefty as a result of a surge in production last year. The amount of gas produced in the US in 2009 will decline slightly as a result of much lower prices compared with those last year.

Worldwide outlook

Worldwide oil demand will average 83.8 million b/d this year, down from the 2008 average of 86.2 million b/d. This is the latest demand estimate from the International Energy Agency, which has lowered its outlook repeatedly during the lingering global economic slump.

Economic weakness will cause oil demand inside the Organization for Economic Cooperation and Development to slump by 2.4 million b/d from last year’s 47.5 million b/d, according to the latest estimates from IEA. Demand will fall in North America and in the OECD countries in Europe and Asia.

Outside the OECD, demand for oil will be unchanged from 2008, averaging 38.7 million b/d. IEA estimates that demand will decline in the former Soviet Union (FSU) but climb slightly in the Middle East and in China. In other non-OECD Asian countries, demand will move a little lower from last year.

Oil demand averaged 87.5 million b/d in the first quarter of 2008, and then slid each successive quarter to bottom out at an estimated average 83.1 million b/d in the second quarter of this year. IEA forecasts that worldwide oil demand will climb in the third quarter to average 83.6 million b/d and then will grow again during this year’s fourth quarter, averaging 83.9 million b/d.

Meanwhile, supply from producers outside the Organization of Petroleum Exporting Countries also has been in decline. In particular, countries that are members of the Organization for Economic Cooperation and Development will post a 5.1% supply decline this year vs. 2008, according to IEA.

Declining oil production in the UK and Norway will lead the slump in OECD Europe oil supply this year, but OECD Pacific and North America will log small increases in 2009 oil output.

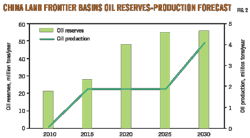

Among the non-OECD members, IEA forecasts sizable production increases this year in Brazil and China. Oil supply from FSU is expected to increase to average 13 million b/d this year, up from 12.8 million b/d last year. Russian production will be almost flat year-on-year, but IEA expects output increases in Azerbaijan and Kazakhstan.

Starting in September 2008, OPEC has agreed three times to lower crude output by a cumulative 4.2 million b/d. IEA reported that by June of this year, OPEC had reduced production by 2.9 million b/d, pegging effective spare production capacity at 5.2 million b/d.

Although the organization’s crude production has been waning since it implemented the lower output ceilings, OPEC’s NGL production has been climbing. NGL output from OPEC members this year will average 5.2 million b/d, up from 4.7 million b/d last year.

OGJ forecasts that OPEC crude output will average 28.4 million b/d this year, putting upward pressure on inventories. Combined with IEA’s outlook for demand, the global stockbuild will average 500,000 b/d.

Oil prices

The threat of delayed economic recovery is combining with large oil inventories to keep a ceiling on oil prices this year. US demand for oil will remain weak throughout this year.

OGJ forecasts that in 2009, the average US wellhead crude price will drop 34% from last year to $62/bbl. Also, US refiner acquisition costs of domestic and imported crude will average $64/bbl, down from $94.73/bbl last year.

Since the front-month futures price of oil on the New York Mercantile Exchange closed at $145.29/bbl on July 3, 2008, the price has been driven down by the global economic contraction and weakening worldwide demand for oil.

The most recent projections from the International Monetary Fund are that worldwide economic output this year will contract by 1.4% and then expand next year by 2.5%. In 2008, worldwide output grew by 3.1%.

IMF projects that GDP this year will contract by 3.8% in the world’s advanced economies but grow by 1.5% in the world’s emerging market and developing economies.

World crude prices plunged from mid-2008 to the start of 2009, and then rebounded some by the middle of this year. For example, EIA figures show that all OPEC crudes averaged $121.52/bbl on June 1, 2008, and then dropped to $35.48/bbl on Jan. 1, 2009, before rising to $65.88/bbl on June 1.

The front-month NYMEX futures price of oil closed at a recent high of $72.68/bbl on June 11. The rise was disconnected from market fundamentals; rather it was due to optimistic expectations of future demand based on early signs of economic recovery. Investors saw oil as a safe commodity and a good store of value in which to invest.

Oil prices retreated in early July due to signs of continued economic sluggishness and therefore a further delay in oil-demand recovery. Lower forecasts of 2009 oil demand sent futures prices below $60/bbl by July 10.

Product prices

Like crude prices, retail prices for all oil products will be sharply off their 2008 highs. This will be the first year since 2002 that annual average retail gasoline prices have declined.

OGJ forecasts that the pump price for all types of motor gasoline in the US will average $2.30/gal this year. Last year the pump price of regular and premium unleaded gasoline averaged $3.317/gal, according to EIA.

Heating oil prices also will retreat from their 2008 record average of $3.22/gal excluding taxes. OGJ expects heating oil will decline 29% this year.

Prices of diesel fuel, jet fuel, and propane also will post lower averages this year as compared with 2008 prices.

US economy

OGJ forecasts that gross domestic product in the US this year will decline 2%. The US economy shrunk 5.5% in this year’s first quarter, as reported by the Bureau of Economic Analysis.

As the Federal Reserve Board reported following its latest decision to leave the federal funds interest rate unchanged at ¼% or less, new data show that the pace of economic contraction is slowing. Household spending has shown further signs of stabilizing but remains constrained by ongoing job losses, lower housing wealth, and tight credit, the FRB said.

Consumer credit has been in decline since the fourth quarter of 2008, and unemployment at the end of June reached 9.5%—the highest level in 26 years.

The Bureau of Labor Statistics reported that since the start of the recession in December 2007, the number of unemployed persons has increased by 7.2 million, and the unemployment rate has risen by 4.6 percentage points.

Last year GDP grew by 1%, posting declines in the third and fourth quarters following a first half with economic growth.

US energy demand this year will contract faster than the economy. OGJ forecasts that demand for energy will shrink in 2009 such that energy efficiency improves to 8,430 btu/dollar from 8,520 btu/dollar a year ago.

Energy by source

The use of renewable energy sources will climb this year in the US, but demand for all other sources of energy will contract from a year ago. Total US energy demand will decline 3% from last year to 96.29 quadrillion btu (quads).

Oil and gas will account for 61.45% of the US energy market this year, the same share the two sources combined for last year, but coal’s share of the market will decline. Nuclear energy, hydroelectric power, and other renewable energy sources will pick up coal’s decline in market share.

OGJ forecasts that US oil demand will decline nearly 4% this year, totaling 35.837 quads. Demand for almost all of the major petroleum products will decline sharply from last year’s weak numbers.

Economic weakness also will result in a decline in gas use, which OGJ expects will drop 2% this year. Residential, commercial, and industrial demand for gas will move lower, but gas demand in electric power will be little changed from a year ago. US gas demand this year will total 23.333 quads and garner 24.2% of the energy market.

Coal demand will fall 6% this year as a result of an overall reduction in electricity demand and increases in the use of other energy sources for electric power generation. OGJ expects coal demand will total 21.07 quads, comprising 21.9% of the US energy market. This compares with coal’s 22.6% market share a year ago.

The use of nuclear power will be little changed from last year and will total 8.45 quads, a decline of only 0.1%. The number of operable nuclear units has held at 104 since 1998, and this year nuclear energy’s share of the US energy market will be 8.8%. Nuclear energy accounts for about 20% of all electric power generation in the US.

Hydropower and the use of other renewable forms of energy will climb 2% this year, totaling 7.6 quads. This includes demand for wind, solar, and biofuels, as well as geothermal electric power generation and wood and waste energy. In total these renewable energy sources will account for 7.9% of all energy consumed in the US this year, up from 7.5% last year.

US oil demand

Demand for petroleum products in the US will fall to average 18.732 million b/d, down from the 2008 average of 19.497 million b/d.

Against weak second-half 2008 demand, gasoline demand in 2009 will grow, but only by 0.2%. OGJ forecasts that gasoline demand will average 9.01 million b/d this year.

Demand for gasoline plunged last year amid economic weakness, higher retail prices, and rising unemployment. Fewer miles are being driven as fewer workers commute and vacationers have cut many discretionary road trips.

Residual fuel oil, which is used in transportation as well as in power and industrial plants, will incur the largest drop in demand among all the oil products. Fuel switching to cleaner and relatively cheaper fuels when possible will drive down 2009 resid demand to average 496,000 b/d, a 20% decline from a year ago.

Jet fuel demand will post a 7% decline from last year as a result of fewer flights and a drop in demand for passenger and cargo traffic. Demand averaged 1.4 million b/d in this year’s first half, down 11% from first-half 2008.

The Air Transport Association of America reported that the number of passengers traveling on US airlines in May fell 9.5% from the same 2008 period, as weak demand was exacerbated by the impact of the H1N1 influenza outbreak.

Dampened by a decline in demand for both diesel fuel and heating oil, the use of distillate fuel oil will drop 4.7% to average 3.76 million b/d this year. Last year, distillate demand fell 6%, plunging during the summer months when distillate prices were unusually high.

Demand for propylene, propane, and all liquified petroleum gases, which are mostly used by industrial customers, will shrink 5% to average 1.847 million b/d this year.

The use of all other petroleum products will average 2.192 million b/d this year, declining almost 11% from last year. This category of products includes those used in construction, such as asphalt and road oil, as well as waxes, petrochemical feedstocks, lubricants, pentanes plus, and petroleum coke.

US oil production

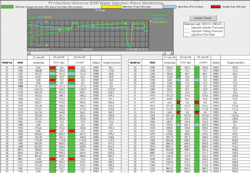

OGJ forecasts that 2009 production of crude and condensate in the US will average 5.275 million b/d, climbing from an average 4.949 million b/d last year. Output will get a boost from new fields coming on line this year, such as Murphy Oil Corp.’s Thunder Hawk field in the Gulf of Mexico (OGJ Online, July 9, 2009).

In the first half of this year, production increased almost 3% from a year earlier to average 5.282 million b/d. This increase was led by output gains in North Dakota, Louisiana, Montana, and California.

Production in Alaska climbed by an estimated 1.7% in this year’s first half to average 713,000 b/d, but production was lower from a year earlier in Texas, Oklahoma, and Colorado.

Natural gas liquids production will be down slightly, averaging 1.77 million b/d vs. 1.784 million b/d last year.

Imports, exports

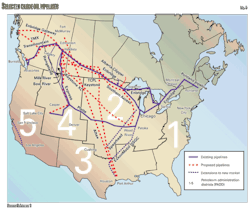

With demand down and inventories plentiful, US imports will decline this year. OGJ expects that crude imports will average 9.17 million b/d, a 5.8% decline from last year.

Product imports will decline at about the same rate, averaging 2.975 million b/d this year vs. 3.152 million b/d last year.

Sending an average 2.459 million b/d to the US, the leading source of US crude and product imports in 2008 was Canada. The second-leading source, averaging 1.532 million b/d last year, was Saudi Arabia, followed by Mexico, Venezuela, Nigeria, and Iraq.

The US will export 1.8 million b/d of crude oil and petroleum products, the same amount as last year. Almost all of the volume of oil that the US exports is in the form of products rather than crude.

Oil inventories

US inventories of crude and products at yearend will be slightly larger than at yearend 2008.

At midyear, about 350 million bbl of crude were held in commercial stocks, including 30 million bbl at Cushing, Okla. A year earlier crude stocks at Cushing totaled about 20 million bbl.

Declining imports will relieve some of the pressure on these inventories through the rest of the year. OGJ forecasts that crude stocks, excluding crude held in the Strategic Petroleum Reserve (SPR), will stand at 330 million bbl at the end of this year. Crude held in the SPR will total 726 million bbl at yearend, OGJ forecasts.

Product inventories will total 720 million bbl at the end of this year, down from 760 million bbl at midyear. Total products in storage stood at 709 million bbl at yearend 2008.

Stocks of distillate at mid-2009 were 27% higher than a year earlier, while the amount of gasoline in stocks was little changed from mid-2008. Resid in storage at the middle of 2009 was down about 10% from a year earlier.

Refining

Poor refining margins and large oil product inventories amid weak demand will weigh on refinery utilization this year, bringing the average utilization rate at US refineries to 83.6%, down from 85.3% a year ago. Operable capacity will total 17.675 million b/d.

First-half 2009 refining margins moved sharply lower from those a year ago. West Coast refiners incurred the mildest hit, with cash margins down 21% to average $12.27/bbl in the first 6 months of this year, according to Muse, Stancil & Co.

East Coast refiners’ cash margin averaged just $1.61 in this year’s first half, down 39% from a year earlier, while the margin for Gulf Coast refiners declined 59% to average $4.06/bbl over the first 6 months of this year.

Gas market

US demand for gas will decline 2% this year, keeping prices low and inventories full.

The economic recession has cut into industrial and commercial demand for gas. Industrial gas use has declined each month year-on-year starting in August 2008. Residential demand has been more resilient over this period, though, mostly due to cool winter weather.

Last year US gas demand was nearly flat, climbing 0.7% to 23.206 tcf, at the same time that production jumped 7.1% as a result of output from unconventional sources in the US, such as the Barnett shale.

The number of rigs drilling for gas has plunged over the past year—especially reduced are rigs drilling in higher-cost and conventional plays—as gas supply has outpaced demand. The number of US gas rigs operating in early July was 672, down from 1,544 a year earlier, according to Baker Hughes Inc.

OGJ forecasts that US gas production will decline 1% this year, totaling 21.228 tcf. Output from the federal Gulf of Mexico will jump to 2.55 tcf from 2.345 tcf last year. But gas production from Texas, Louisiana, and other states will move lower from a year ago.

US gas imports by pipeline will decrease from 2008 levels, but LNG imports will post a big increase. Growing global liquefaction capacity is placing an increasing surplus of LNG on the world market, and the US inevitably will absorb some of this supply.

Imports of gas from Canada this year stand to decline 10%, while imports from Mexico will shrink 77% to total just 10 bcf over the year. OGJ forecasts that the US will import 528 bcf of LNG, a 50% jump from a year ago.

The US will export 965 bcf of gas this year, 4% less than in 2008.

Since supply will far outpace demand, the amount of gas in storage will build by 260 bcf this year. First-quarter 2009 withdrawals were weak, totaling 698 bcf in January, 371 bcf in February, and only 98 bcf in March.

Natural gas prices

Gas futures prices hit a peak at $13.577/MMbtu on July 3, 2008, then began a retreat such that a year later, the closing price on the New York Mercantile Exchange was $3.615/MMbtu.

The recent lower price reflects an amount of gas in underground storage above the past 5 years’ range of such stocks. At 2,796 bcf, the amount of working gas in storage at the beginning of July was 27% higher than a year earlier. The US wellhead price of gas will average $4.20/Mcf this year, plunging from last year’s record $8.07/Mcf average. EIA estimates show that in the first quarter of 2009, gas at the wellhead averaged $4.35/Mcf.