Special Report: Cost reductions may rekindle some oil sands investment

Cost deflation alone will not provide the necessary catalyst for companies to begin to sanction more oil sands projects. Based on a Wood Mackenzie analysis, we expect companies to stay in a low-cost safe mode until clear signs of an improvement in energy markets or the economic environment emerge.

Hit hard by industry cost inflation, Canada’s oil sands projects now have some of the highest break-even prices of upstream assets globally. As a result, many operators have opted to delay, defer, or redefine their oil sands portfolios in order to effectively manage and control project costs, time scales, and potential returns through the economic downturn.

The question on everyone’s lips now is when, and to what extent, will cost deflation filter through the sector.

With steel and labor accounting for more than 50% of a typical oil sands project’s total cost, it seems inevitable that the collapse in the value of steel and a depressed labor demand will result in lower development costs.

In contrast to an inflationary environment, however, the cost of raw materials and wages can be slow in coming down as companies renegotiate contracts and redesign project scopes,

There are initial signs that project costs now are lower, but it is too early to tell if these reductions will be across the board.

Project status

An array of large and small companies has suspended or reduced activity levels on their oil sands projects amid the toxic combination of low commodity prices and high costs. As a result, these companies have avoided constructing multibillion-dollar projects at the height of global cost inflation, instead conducting the long and painstaking process of renegotiating existing contracts and redefining project scopes.

The list of projects that companies have scaled-back, delayed, or redefined includes both future phases of some of the region’s established projects and new greenfield developments.

In addition to deferring decisions on development sanction, such as Petro-Canada at its McKay River and Fort Hills projects or Total E&P Canada Ltd. at its Joslyn development, some companies have withdrawn applications or postponed plans for upgraders in Alberta, including StatoilHydro at Kai Kos Dehseh and Total at Northern Lights.

Other operators have chosen to redefine project scopes and to place projects into a safe mode, such as Suncor Energy Inc. at its Voyageur project and Shell Canada Ltd. with the second expansion of its Athabasca oil sands project (AOSP).

The slowdown also has affected the region’s smaller operators, such as Connacher Oil and Gas Ltd. The company had deferred its second phase at Great Divide, named Algar, and temporarily constrained bitumen production in late 2008. The company, however, has reinstated production levels in light of narrowing bitumen differentials and restarted Algar construction.

Needless to say, new projects in undeveloped areas are unlikely in the short term, especially those championed by smaller companies, as they grapple with tight credit and debt markets.

One exception is the proposed 300,000-b/d Imperial Oil Ltd.-operated Kearl mining project. Although not materially redefining the project’s scope or timing, the operator has taken time to work with its suppliers to drive down costs and also has delayed ordering some of the project’s long lead items in an inflationary environment. As a result, it made a go-ahead investment decision on the first phase in May.

Cost components

With steel price down 60% from its highs in 2008 and labor markets easing as industry activity rapidly slows in Canada not only in the oils sands but also in the conventional oil and gas sector, there is no doubt that a deflationary impact will filter through to the oil sands—although to what extent remains uncertain.

To date, there have been no widespread announcements of decreased costs, although early signals are emerging.

Husky Energy Inc. has indicated that costs to develop the first phase of its Sunrise project may have come down to $2.5 billion (Can.) or $2.1 billion (US) from $4.5 billion (Can.) or $3.8 billion (US). It cited the lower costs of steel, labor, and materials compared with the costs just 1 year ago.

In addition, Petro-Canada estimates that the cost of its Fort Hills mine could come down by 30% from previous estimates, putting the project cost at about $10 billion (Can.) or $8.3 billion (US).

The table below shows the scale and timing of cost reductions across different categories of expenditures.

Large integrated projects and standalone mining developments are likely the most sensitive and correlate the best with cost reductions of raw materials, such as steel, due to their massive scale and capital-intensive nature. On the other hand, stand-alone steam-assisted gravity drainage projects tend to be modular and more controllable and therefore are less affected by a lower cost of materials. This is borne out by the typical project economics displayed by integrated and nonintegrated SAGD projects, with the latter displaying lower break-even points and higher rates of return.

Labor is a vital element in the successful execution of an oil sands project. Labor constraints, poor productivity, and reliability issues have been at the heart of many project delays and cost increases announced during the last few years.

With oil sands operators lowering their activity level during the current economic turbulence, labor demand has decreased. An added benefit of the slowdown could be increased productivity because experienced skilled personnel continue to work with operators ensuring that they retain key staff members through the downturn, so that activity can ramp-up quickly.

Furthermore, on any recovery, the development pace will be likely below the levels previously witnessed, and proportionally the percentage of short-term contract workers will decrease. In addition, vital personnel are unlikely to leave projects before first production, in order to secure a more lucrative contract at another project. This will avoid some reliability and start-up issues that have plagued projects.

Project economics

To assess the effect of regional cost deflation on oil sands’ project economics, our analysis considers the break-even points of future mining and SAGD projects. The projects included are future green field projects and future phases of existing projects except for three integrated legacy projects because of their economies of scale, long-term production experience, and infrastructure positions. These three projects are unrepresentative of the newer projects.

It also is worth noting that new integrated projects, without any existing production, generally display higher break-even economics than their nonintegrated counterparts. In light of recent project deferrals, however, there are no integrated projects in our data set that have an existing phase already in production.

We have analyzed the projects under two discount rates: 12% and 15%. It could be argued that such a long-lived and known resource be assessed with a discount rate of 10%, or below, especially when compared with, for example, a high-risk ultradeepwater development and its rapid production rate decline. We, however, see 15% as a more sensible planning assumption in the current environment, due to tight credit and debt markets.

In actuality, participants display varying appetites for risk as a result of different costs of capital and internal strategies. The drivers for selecting an appropriate discount rate are also the subject of much debate.

Without factoring in any regional cost deflation, we estimate that the average mining project break-even point is about $90/bbl and $70/bbl (West Texas Intermediate) at 15% and 12%, respectively (Fig. 1). The average SAGD project requires a $65/bbl and $55/bbl at the same discount rates.

A discount rate of 15%, in conjunction with a 25% and 50% decrease in total project capital expenditure results accordingly in average break-even points of about $55/bbl and $45/bbl for SAGD projects and about $70/bbl and $55/bbl for mining projects.

In essence, under our average SAGD results, a project is economic at less than $50/bbl WTI at a discount rate of 15%, with a 50% decrease in capital costs. Under the same metrics, a mining project would require more than a 50% decrease in costs to be economically viable at less than $50/bbl.

Another way to interpret our results is that to reduce the average break-even of our projects to $55/bbl or less, would require a cost reduction of 25% for a SAGD project but 50% for a mining project.

Long-term narrow bitumen differentials could offer much upside to our average break-even estimates for nonintegrated projects.

Our current long-term assumption is that bitumen trades at a 50% discount to WTI, which is about the historical average. Bitumen differentials, however, currently are narrow and hence some standalone projects could produce more favorable economics under a narrower assumption.

On the contrary, wide bitumen differentials favor integrated developments—a high quality product is generated from a low quality input—so that the inverse relationship holds true. Therefore, taking a short-term view on bitumen differentials for a long-life resource when making investment decisions introduces an added element of risk because bitumen differentials depend on the volume of nonupgraded bitumen sold to the market in the forthcoming years and its ability to displace extra heavy oil from Mexico and Venezuela delivered to the Gulf Coast region, which remains largely uncertain.

Future scenarios

To evaluate the potential impact of the prevailing oil price and industry cost deflation on the region’s bitumen production forecast, we have considered our base unrisked profile and assumed that production does not go ahead if project or future phase break-evens equal or fall below several defined WTI price thresholds. We evaluated our production with and without a total capex reduction of 50%, at our preferred discount rate of 15%. It is assumed that all production currently on stream ramps up as per company plans (Fig. 2).

At a prevailing $60/bbl or less WTI price, under our base-cost assumptions, about 1 million b/d of future production could be at threat in 2020. If, however, there is a 50% reduction in total capex, under threat in the same year is less than 500,000 b/d of bitumen production.

Additionally, under our reduced cost scenario, companies would not constrain any production that we currently model if its break-even WTI price is $80/bbl or more. In reality, companies will delay production that is uneconomic under the prevailing cost and commodity price until costs decrease or oil prices increase.

Resource

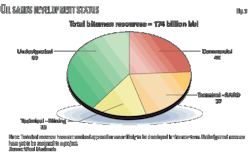

We currently model 24 commercial oil sands projects. These are projects that are onstream, have received development approval, or are likely to be developed in the near term. This represents around 42 billion bbl of recoverable bitumen reserves in total, of which 13% has been produced.

Until early 2009, our commercial reserves estimate was higher than this. As a result of recent project deferrals and delays, however, we have moved 6.8 billion bbl of commercial reserves across seven projects to a technical status because we believe that these projects are unlikely to proceed in the current environment.

Our identified technical and commercial reserves combined total about 105 billion bbl, only a proportion of the known 174 billion bbl of bitumen resource. We therefore still have about 70 billion bbl of undesignated resource not assigned to a project (Fig. 3).

There is no doubt that the long-term production potential of the oil sands region is immense and that the area remains one of the last global opportunities to acquire and develop a known long-life resource. Nonetheless, the rate at which companies will develop the resource depends on a range of factors, not least of which being the prevailing economic and commodity prices, environmental legislation, and regulatory factors.

Expectations

As would be expected, cost deflation materially improves oil sands’ project economics, but integrated and mining projects, which are larger in scale and more capital intensive, require greater cost reductions for them to become viable at current prices. Moreover, cost deflation alone will not provide the necessary catalyst for project sanctioning decisions, and we expect companies to stay in a low-cost safe mode until clear signs of an improvement in energy markets or the economic environment emerge.

With the potential expansions of existing projects and the host of new projects previously noted, companies must ensure that upon any turnaround the overheated materials and labor market that has dominated the sector in recent years does not return. Companies can only achieve this by effectively planning and staggering future projects to manage efficiently the pressures placed on the region’s infrastructure, service sector, and suppliers alike.

In turn, this would satisfy environmental groups, which have put pressure on the government to slow the pace of developing oil sands.

The author