Special Report: Global processing capacity trails advances in production

Global gas processing activity in 2008 remained flat, despite gains in global natural gas production.

Natural gas production last year advanced in every region, as climbing natural gas prices spurred global production growth of nearly 7% (OGJ, Mar. 9, 2009, p. 64).

Each major region of the world witnessed growth in gas production, with the Middle East leading the way with more than 18% (1.8 tcf) growth. Countries of the Western Hemisphere produced more than 1.6 tcf (4.8%) over 2007.

Gas processing capacity, however, lagged this growth. In the US, capacity moved ahead by nearly 2% but Canada's growth was flat (Table 1). For the entire world, OGJ's data show that capacity growth in virtually every region stagnated.

Natural gas processing capacity outside the US and Canada continued to outgrow combined capacities in the world's two largest gas processing countries, a trend that emerged in 2005. For 2008, processing capacities of the two North American nations held at slightly less than 50% of world capacity. That trend was pushed by plants' capacities in the US advancing by only 1.8%, while Canadian plants' capacities remained flat.

Highlights

The marginal advantage in gas processing capacity for regions outside the US and Canada continued in 2008, the fourth year in a row to show this imbalance.

Production of Canadian NGL barely ticked upward. Combined with US production, NGL output from the two countries' gas plants resumed a decline evident in recent years but reversed somewhat in 2007. Total NGL production for the two North American countries reached 108.3 million gpd, or 37% of global NGL production. For 2007, the countries' combined production was 130.4 million gpd, or more than 44% of global NGL production. For 2006, the figure was 38.7% of world totals; for 2005, slightly more than 33%; for 2004, more than 34%; and in 2003, more than 40%.

On Jan. 1, 2008, OGJ data show that US gas processing capacity stood at more than 72 bcfd, up from 71 bcfd for 2007; throughput in 2008 only 395 MMcfd ahead of 2007, averaging slightly less than 46 bcfd (less than 64% utilization); and NGL production, more than 75.7 million gpd, compared with 76 million gpd for 2006 (Table 1; Fig. 1).

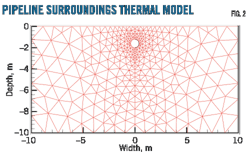

Fig. 2 shows pricing differentials in the US between LPG—the most widely traded NGL on the world market—and crude oil for the first trading day of each month in 2008. With crude oil prices escalating sharply during the first half of the year then dropping over the last half, the chart nonetheless reflects the historically normal relationship between LPG and crude oil continued throughout 2008. (An accompanying article, beginning on p. 58, discusses international trade in LPG and ethane.)

Sources

Oil & Gas Journal's exclusive, plant-by-plant, worldwide gas processing survey and its international survey of petroleum-derived sulfur recovery provide industry activity figures.

Canadian data are based on information from Alberta's Energy and Utilities Board that reflect actual figures for gas that moved through the province's plants and are reported monthly to the EUB. For 2000 for the first time, OGJ took these data for all of Alberta and compiled annual figures and thereby created a new baseline for data comparisons thenceforth.

(Effective Jan. 1, 2008, the province realigned the EUB into two separate regulatory bodies: the Energy Resources Conservation Board to regulate the oil and gas industry and the Alberta Utilities Commission to regulate the utilities industry.)

In addition to EUB figures for Alberta and to operator responses to its annual survey, OGJ has supplemented its Canadian data with information from the British Columbia Ministry of Employment & Investment's Engineering and Operations Branch and the Saskatchewan Ministry of Energy & Mines.

As 2008 began, gas processing capacity outside Canada and the US stood at more than 127 bcfd; throughput outside Canada and the US for 2008 averaged 80.5 bcfd, up from 77.8 bcfd in 2007 and 80 bcfd in 2006. NGL production in 2008 outside the US and Canada averaged 182.4 million gpd compared with 163 million gpd in 2007 and 170 million gpd in 2006 but still off of 2005 production of more than 201 million gpd.

The current state of gas plant construction in the world appears in Table 2, based on OGJ's worldwide construction surveys. Table 3 ranks the world's major natural gas reserves by country at the start of 2008; Table 4, the world's top natural gas producing countries for 2008; and Table 5, the world's leading NGL producers.

Activity

Global gas plant construction, especially in the Middle East, is responding to the increases in natural gas production that occurred last year. Following is a review of project plans and progress announced in the last 15-18 months.

Asia, Australia

China National Petroleum Corp. announced last month it will begin construction later this year on a gas processing plant in the South Sulige block currently operated by Total SA. The plant will be on line by yearend 2010.

CNPC and Total are developing the South Sulige block in what will be one of the largest investments by a foreign company in China's onshore oil and gas sector.

The report in a Chinese newspaper did not provide planned plant capacity.

Preliminary work on the 2,400-sq km South Sulige block has begun. Total plans to drill about 2,000 wells at South Sulige over the field's life of 20-25 years. Peak gas production is estimated to be about 3 billion cu m/year, a level that may be achieved 3 years after first production.

In Australia, the Chevron Australia-led Gorgon joint venture said last year it plans to build a 284-MMcfd gas plant beside its LNG plant on Barrow Island. Plans call for gas to be brought on stream for domestic use about the time the JV commissions the LNG project's last of three 5 million tonne/year LNG train (OGJ Online, May 19, 2009).

In March 2009, Houston-based Apache Corp. awarded Clough Ltd. a $45 million (Aus.) contract for engineering of the 200-MMcfd Devil Creek gas processing plant, southwest of Dampier. Apache will operate a $585 million (US) natural gas venture in Western Australia.

The plant will process gas from offshore Reindeer field, owned by Apache (55%) and Santos Ltd. (45%), to supply Citic Pacific Ltd.'s Sino Iron project at Cape Preston.

Production is slated to begin in second-half 2011.

Africa, Middle East

In Africa in May, state-owned Ghana National Petroleum Corp. announced it was looking for investors to fund a $1 billion gas processing plant. The site had yet to be selected but is likely to be about 130 km west of the western port city of Takoradi.

The plant will initially have an inlet capacity 150 MMcfd with likely expansion in 3 years to 600 MMcfd. Gas from Tullow Oil PLC's Jubilee field, off the country's west coast, will feed the plant.

Oil production is to start in 2010, with gas following in 2012.

In Egypt, Dana Gas, Sharjah, announced earlier this year it had started production from its recent Al Basant gas-condensate discovery in the West Manzala concession in the Nile Delta.

The company also began producing from its El Wastani East-2 sidetrack, Dana Gas Egypt's first highly deviated, horizontal well in Egypt.

The Al Basant discovery was developed on fast track, said the company, with two 17-km pipelines, one 6 in. OD and 12 in., to transport Al Basant production to the El Wastani integrated gas plant. The plant has design capacity of 160 MMscfd and 7,500 b/d of condensate and LPG but is currently operating at 153 MMscfd gas and 5,400 b/d.

Dana said the new gas production from Al Basant will "allow testing the plant beyond its full design capacity and identifying components that require modification, or upgrading." It will also maximize throughput, while targeting production levels of 170 MMscfd.

In Saudi Arabia, Saudi Aramco has several major multibillion dollar projects under way to boost natural gas processing capacity. The company's latest annual review, for 2008 and published in April 2009, says that, when completed, these projects will increase processing capacity for associated and nonassociated gas to 12.5 bcfd from 9.3 bcfd.

The Hawiyah NGL recovery plant started up in second-half 2008. The associated pipelines were completed in November 2007 to deliver C2+. The plant can process nearly 4 bcfd of sales gas to yield 310,000 b/d of NGL as feedstock for the country's expanding petrochemical industry.

Transport capacity on the existing East-West NGL pipeline, says the annual review, is being increased to 555,000 b/d from 425,000 b/d to meet demand on the west coast for ethane and NGL.

The Khursaniyah gas plant, with processing capacity of 1 bcfd of associated gas, was to have begun operating the middle of 2009, but published reports have put the start-up closer to October. The plant will be able to produce 560 MMscfd of sales gas and 280,000 b/d of C2+.

A company spokesman declined to provide OGJ with an update on the schedule of this or any other project summarized here.

The Hawiyah gas plant expansion to process an additional 800 MMcfd of non-associated gas is to be completed mid 2009 and will raise the plant's capacity to 2.4 bcfd.

Expansion of the Ju'aymah gas plant to fractionate additional NGL was to have come into service in first-half 2009. The project adds 260,000 b/d of C2+ capacity and 260,000 b/d of C3+ capacity for a total of 815,000 b/d and 715,000 b/d, respectively, of fractionating capacity, according to the report.

Expansion of the Yanbu' gas plant is increasing existing NGL fractionation capacity to 555,000 b/d from 370,000 b/d to meet increasing demand for ethane as a petrochemical feedstock, specifically at the Yanbu' and Rabigh petrochemical complexes. This project was to have been on line in mid-2009.

Karan gas field, discovered in 2006 east of Jubail, is Saudi Aramco's first nonassociated offshore gas field. Drilling is under way; the company ultimately plans 23 wells on five producing platforms. The program to develop the field will provide offshore platforms, pipelines, new gas treating and upgraded facilities at the Khursaniyah gas plant. Saudi Aramco projects output from Karan field at about 1.6 bcfd.

Combined with associated gas from the Manifa project, the net production increase of gas processing at the Khursaniyah plant will reach 1.8 bcfd, says the annual review. Offshore gas production is slated for early 2012.

Saudi Aramco's Master Gas System can process more than 9 bcfd and deliver more than 7 bcfd of net sales gas to industrial customers around the country. A project to expand the transmission system in the eastern region, funded in 2007, is set for completion in 2010. This project will expand the MGS with 215 km of 56-in. pipe paralleling existing lines in order to serve future demand in Jubail and Ras az-Zawr. A total of seven stations will be installed to protect critical equipment for black powder corrosion, says the 2008 review.

In January 2009, Saudi Aramco awarded a contract to the Bonatti Group to build a plant to recover and treat residual gasses produced in the Uthmaniyah and Shedgum gas plants and currently being flared. Work was to have begun immediately with a target completion of October 2010.

As part of developing its $9 billion Manifa offshore oil field project, Saudi Aramco will also build a 1-bcfd gas plant. The processing plant will receive gas from offshore fields Arabiyah and Hasbah, both near Manifa field.

The Manifa project will be Saudi Aramco's largest offshore field when fully operating and add 900,000 b/d of capacity to the country's oil production. As well as heavy crude, Manifa field will produce 120 MMcfd of sour gas, 50,000 b/d of condensate, and 950,000 b/d of produced water. Production from the field targets mid-2011.

In addition, the nearby Khursaniyah gas plant is being upgraded to handle additional gas from the project.

In April in Iran, the managing director of Oil Industries Engineering and Construction Company said the Siri NGL project will come on stream by the end of March 2010.

The Siri NGL project includes Siri-to-Qeshm pipeline, Siri-to-Kish pipeline, Siri NGL plant, and Kish booster station, all estimated to cost $450 million.

The NGL plant is to produce 841 tonnes/day of propane, 328 tonnes/day of butane, 361 b/d of pentane, and 1,250 b/d of gas condensates. Siri Island sits in the southern waters of Iran off Hormozgan Province.

In Abu Dhabi, as part of plans to develop Shah sour-gas field, Abu Dhabi National Oil Co. and ConocoPhillips will build a 1-bcfd gas plant for the field, located about 180 km southwest of Abu Dhabi city, said Adnoc. The plant will process about 570 MMcfd.

The project also involves construction of new gas and liquid pipelines, and sulfur-exporting facilities at Ruwais. Upon completion, the partners will form a new company to operate the Shah facilities with Adnoc holding a 60% interest and ConocoPhilips 40%.

Russia

Late in 2008, Sibur Group, one of Russia's leading petrochemical companies, announced plans for a gas processing expansion project in Noyabrsk, in the middle of west Siberian oil fields, about 300 km north of Surgut.

US-based Fluor Corp.'s scope of work includes the EPCM services for expansion and upgrade of the Vyngayakhinskaya compressor station, the compressor Station 3 of the Nizhnevartovsk gas processing complex, and construction of the Vyngapurovsky gas plant and associated pipelines, as well as LPG storage and loading Noyabrsk.

Americas

In April, EnCana Corp., Calgary, announced plans to build the Cabin gas processing plant 60 km northeast of Fort Nelson, BC.

Phase 1, 400-MMcfd, is due on stream in third-quarter 2011. The plant will be expanded as the Horn River basin gas-shale production grows.

In Mexico, Pemex plans a 250-MMcfd gas processing plant at the Poza Rica gas complex in Veracruz state in northern Mexico to handle new supplies from the Chicontepec basin that is currently under development, the company said earlier this year.

Chicontepec, mainly an oil field, also produces associated natural gas. Only in the early stages of developing Chicontepec, Pemex plans to produce about 1 bcfd in the area by 2016 and propane, butane, and natural gasoline at the new plant.

Contract awards and construction were due to start by mid-2009 with 2 years anticipated for construction.

In the US in April, Range Resources Corp., Fort Worth, updated its Marcellus shale activity in the Pennsylvania Appalachia, announcing completion and commissioning on a 30-MMcfd cryogenic gas processing plant in Washington County, south of Pittsburgh.

The plant is part of the second phase of infrastructure work based on a 2008 agreement with MarkWest Energy Partners LP that set plans for development of gas processing and pipelines in the area. The companies completed the first phase of those plans in October 2008.

That initial phase included a 30-MMcfd refrigeration gas plant, three compressor stations, and about 25 miles of pipelines. The second phase adds three compressor stations and 20 miles of gathering and pipelines. The new cryogenic plant will bring Range's total processing capacity in southwestern Pennsylvania to 60 MMcfd.

When the second plant starts up later this summer, Range plans to divert natural gas flowing to the first-phase plant to the second cryogenic plant. The company said it wants to fill the cryogenic plant "as soon as practical" because it can extract a larger portion of natural gas liquids from the high-btu Marcellus gas.

Once the cryogenic plant is fully loaded, Range said, it will begin flowing gas from previously drilled Marcellus wells into the expanded pipeline system. As Range adds more production, it will be processed through the first-phase refrigeration plant. Range said it will be tying in new wells and expects the refrigeration and cryogenic plants to reach full capacity in third-quarter 2009.

The company said earlier this year it had 15 Marcellus wells in various stages of completion, waiting to be turned to production.

A third phase of the project will add 20 MMcfd of refrigeration capacity by the end of September, increasing total processing capacity to 80 MMcfd.

Also in progress is construction of a 120-MMcfd cryogenic plant expected to come on line in January 2010. At the same time, Range said, it is adding more compression and pipelines as it continues to drill new Marcellus shale wells throughout the rest of the year.

The drilling program, said the company, keeps it on track to end 2009 at its Marcellus production target of 80-100 MMcfd net.

In Utah, units of Ute Energy LLC and Anadarko Petroleum Corp. formed Chipeta Processing LLC to operate a gas processing and delivery hub for the Greater Natural Buttes area of the Uinta basin of Utah.

Ute Energy is an investment of Quantum Energy Partners, Quantum Resources Management, and the Ute Indian Tribe of the Uintah and Ouray Indian Reservation, Utah.

Chipeta owns an existing 250 MMcfd refrigeration processing facility and earlier this year started up a second 250-MMcfd cryogenic processing facility.

In Colorado in March, Enterprise Products began operations at its Meeker II gas processing plant in the Piceance basin. The Meeker II expansion doubles processing capacity at the Meeker complex to 1.5 bcfd with the capability to extract up to 70,000 b/d of NGL.

Enterprise also began operating its expanded Shilling and Thompsonville plants in South Texas and started up its relocated Chaparral plant in the Permian Basin. Meeker is supported by long-term commitments from 10 of the largest producers in the Piceance, according to the company. Current inlet volume at Meeker is about 750 MMcfd with about 38,000 b/d of NGL being extracted. Natural gas volumes will eventually reach about 1.1 bcfd by yearend and produce about 60,000 b/d of NGL.

Chaparral was an idle plant acquired in the 2004 merger with GulfTerra Energy Partners LP and was relocated from southeast Texas. It can handle up to 40 MMcfd and extract more than 2,000 b/d of NGL.

Expansions were also completed at two processing plants that are part of Enterprise's South Texas system. At the Shilling plant in Webb County, capacity was increased to 110 MMcfd from 60 MMcfd

The partnership also modified existing equipment rather than build new systems to expand its Thompsonville plant in Jim Hogg County. Re-piping and other efforts designed to enhance efficiency increased capacity at the facility by 10%, to 330 MMcfd from 300 MMcfd, while maintaining ethane and propane recovery percentages.

Enterprise also completed expansion of its Gulf Coast NGL pipeline system earlier in 2009. This expansion follows the company's service at Meeker II and expansion of three natural gas processing facilities in the Piceance basin of Colorado.

Enterprise said it completed installing two 8-in. pipelines to increase NGL throughput capacity from the partnership's Norco fractionation plant west of New Orleans to refineries and petrochemical plants in southern Louisiana.

The Norco fractionation plant can separate up to 75,000 b/d of NGL and is owned 100% by an affiliate of Enterprise. The plant receives mixed NGL via pipeline from refineries and gas processing and fractionation plants in Texas, southern Louisiana, and along the Gulf Coast of Mississippi and Alabama.

The company said one of the pipelines is dedicated to a Garyville, La., refinery and will transport natural gasoline under long-term agreement. The second pipeline will allow Enterprise to increase delivery of NGL to refineries and petrochemical plants in the St Charles Parish area.

In Alaska earlier this year, Denali—The Alaska Gas Pipeline LLC announced it would build what it called the world's largest gas-treatment plant.

The plant, to be located on the North Slope, is part of Denali's overall project. It will remove carbon dioxide, water, hydrogen sulfide, and other impurities from the gas before it is shipped in the pipeline.

It will also provide initial gas chilling and compression. The GTP will be the largest plant of its type in the world, according to the announcement, and will have process modules weighing up to 9,000 tons. Denali is also planning for the construction of a pipeline to deliver 4 bcfd of gas from the North Slope of Alaska to markets in the Lower 48, Alaska, and Canada.

OGJ subscribers can download, free of charge, the 2009 Worldwide Gas Processing Survey tables at www.ogjonline.com: Click on Resource Center, Surveys, OGJ Subscriber Surveys, then Worldwide Gas Processing, and choose from the list below June 22, 2009. To purchase spreadsheets of the survey data, please go to http://www.ogj.com/resourcecenter/orc_survey.cfm or email

[email protected].