Bill would reverse oil shale program revision

US Rep. Doug Lamborn (R-Colo.) has introduced a bill to restore the Bush administration’s oil shale programs and reverse US Interior Secretary Ken Salazar’s revision of them.

Salazar announced Feb. 25 that DOI would offer another round of oil shale research, development, and demonstration (RD&D) leases in Colorado and Utah. He withdrew a proposal for expanded offerings.

An earlier oil shale RD&D lease solicitation was withdrawn because it contained several flaws, Salazar said.

On June 5, Lamborn introduced his bill, saying Salazar’s actions bring uncertainty to future oil sands research.

“Investors will not commit millions, or potentially billions, of dollars to the research and development needed to make oil shale a viable energy source unless they have a clear picture of the financial rewards and challenges associated with such an investment,” Lamborn said.

His bill directs Salazar to issue additional RD&D leases within 180 days of enactment using bids published on Jan. 15, effectively reversing the secretary’s Feb. 25 action.

Lamborn’s bill would make commercial oil shale regulation guidelines that DOI published in November permanent and apply them to all commercial leasing of federal oil shale holdings. It also would give the Interior secretary authority to provide incentives to producers by temporarily reducing royalties and fees.

“Oil shale could result in the addition of more than 1 trillion bbl of recoverable oil from lands in the western United States. This is too vital a resource to keep under lock and key,” said Lamborn, ranking minority member of the House Natural Resources Committee’s Energy and Mineral Resources Subcommittee. “Secretary Salazar is dragging his feet with one of America’s most promising new energy sources. America needs to wean itself from foreign sources of energy once and for all.”

Chevron exits Kenyan marketing business

Chevron Africa Holdings Ltd. has sold Chevron Kenya Ltd. to Total Outre Mer.

The initial sales agreement, announced in November 2008, was part of Chevron’s strategy to streamline its downstream operations.

In April both parties also completed the sale of Chevron Uganda Ltd. Chevron Kenya and Chevron Uganda’s assets include 165 Caltex-branded service stations, one terminal, seven fuel depots, six aviation facilities, one lubricants blending plant, and a commercial and industrial fuels business.

The values of the transactions were not disclosed.

Hamm interests take Hiland Partners private

Enid oilman Harold Hamm, his affiliates, and family trusts are acquiring the interest they don’t already own in Hiland Partners LP and Hiland Holdings GP LP, Enid, Okla., which will become private entities.

Hamm proposed to take the businesses private on Jan. 15. Conflicts committees have recommended for the transactions, to be completed in the third quarter.

In the mergers, Hiland Partners unitholders will receive $7.75 for each common unit they hold, and Hiland Holdings unitholders will receive $2.40 for each common unit they hold.

Hiland Partners is a public midstream energy partnership that buys, gathers, compresses, dehydrates, treats, processes, and markets natural gas and fractionates and markets natural gas liquids. It also provides air compression and water injection services for use in oil and gas secondary recovery operations.

Highland Partners owns 15 Midcontinent and Rocky Mountain gathering systems totaling 2,138 miles of pipelines, six gas processing plants, seven treatment plants, three fractionation plants, two air compression facilities, and a water injection plant.

Hiland Holdings owns the 2% general partner interest, 2,321,471 common units and 3,060,000 subordinated units in Hiland Partners, and the incentive distribution rights of Hiland Partners.

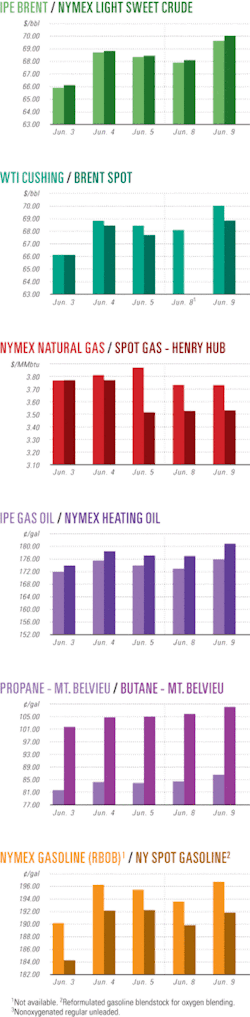

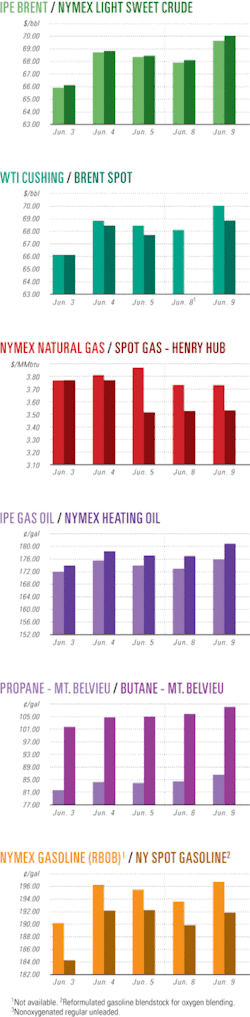

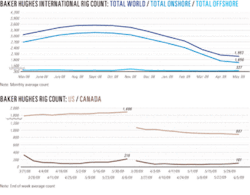

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesPioneer updates Texas, ANS drilling

Pioneer Natural Resources Co., Dallas, completed its first horizontal well in the Eagle Ford shale play.

The Friedrichs Gas Unit No. 1 well, drilled in Dewitt County, Tex., initially flowed 3.7 MMcfd of gas equivalent, including 2.7 MMcfd of natural gas and 160 b/d of condensate, after partially completing only five stages of a planned eight-stage completion.

Mechanical problems in the original lateral required a sidetrack with a modified well path that reduced the well’s exposure to the main reservoir section in the brittle shale at the base of the Eagle Ford formation. Pioneer estimates only two stages of the fracture stimulation, representing less than 500 ft of the 3,000-ft lateral, penetrated the brittle shale and are contributing to gas production.

Scott Sheffield, Pioneer’s chairman and chief executive, said, “We have drilled more than 150 wells through the Eagle Ford shale as we developed the deeper Edwards formation and recognize the potential that underlies our 310,000 gross acres in the play.” The company plans to drill a second Eagle Ford well more than 40 miles southwest of the first location in the third quarter. Additional wells are planned to high grade that acreage, including another well in the Friedrichs area.

At Pioneer’s Oooguruk project on Alaska’s North Slope, operations are under way to drill four horizontal laterals in the Nuiqsut formation during the second and third quarters. Two will be fracture-stimulated producing wells, and two will be water-injection wells.

The first water-injection well was completed and is being produced temporarily to measure the unstimulated productive capability of the Nuiqsut formation. It was tested initially at 2,500 b/d of oil and was put on production at a stabilized 1,000 b/d.

Initial production exceeded expectations, Sheffield said. Pioneer’s net production from Oooguruk was forecast to average 5,000 b/d in 2009, gradually increasing to 10,000-14,000 b/d in 2011 as development drilling continues. “Later this year, we will reevaluate our production profile to incorporate higher than expected performance from our Kuparuk wells, early waterflood results, and the performance of our planned fracture-stimulated Nuiqsut wells,” Sheffield said.

Pioneer operates the Oooguruk project with 70% working interest, and Eni Petroleum US LLC holds a 30% working interest.

Repsol YPF consortium to explore off Falklands

A consortium led by Repsol YPF SA plans oil and gas exploration in international waters off the Falkland Islands beginning in early 2010.

Repsol YPF executives disclosed no project details. In 2006, Repsol and Energia Argentina SA (Enarsa) signed two agreements to explore and develop oil and gas off Argentina.

The first is a 10-year strategic agreement covering all areas 100% owned by Repsol or Enarsa off Argentina within three zones of interest from the Uruguay border to the Falkland Islands.

The second agreement establishes a consortium specifically to explore the Colorado Marina basin. Consortium members are Enarsa, Repsol, Petrobras, and Petrouruguay.

Repsol operates the area with 35% interest while Enarsa holds 35%, Petrobras 25%, and Petrouruguay 5%.

Argentina and Britain both claim large areas of the seabed around the islands.

Britain lodged a claim for 1.2 million sq km in May. Argentina filed a claim for the same area in April with the UN Commission on the Limits of the Continental Shelf.

British company Rockhopper Exploration PLC in May reclassified a 1998 North Falkland basin exploration well as a gas discovery with a 3.4 tcf mean contingent resource.

Shell Exploration & Production Southwest Atlantic BV drilled the 14/5-1A wildcat on the Sebald prospect to 4,525 m measured depth in 464 m of water (OGJ, Nov. 9, 1998, p. 44).

Africa Oil signs farmout for blocks

Africa Oil Corp. has announced a farmout agreement with East Africa Exploration Ltd. (EAE), a unit of Black Marlin Energy Ltd., for their entry into the production-sharing contracts in Ethiopia and Kenya.

In Ethiopia, Africa Oil said it will transfer a 30% license interest to EAE in Blocks 2/6 and 7/8, which both lie in what Africa Oil calls “the highly underexplored” Ogaden basin of southern Ethiopia.

In Kenya, Africa Oil will transfer a 20% license interest to EAE in prospective Block 10A, which is in northern Kenya’s Anza basin.

In both cases, EAE will pay a disproportionate share of costs associated with the planned 2D seismic data programs to be carried out in 2009-10 as well as paying a portion of Africa Oil’s past costs and future operational costs, Africa Oil said.

Africa Oil also said it has executed a seismic contract with Upstream Petroleum Services Ltd. to undertake the seismic acquisition in both Ethiopia and Kenya. Africa Oil remains operator of all blocks associated with the transaction.

The farmout transaction also is subject to approvals of the appropriate regulatory authorities from the governments of Ethiopia and Kenya, in addition to a waiver of preemptive rights by an existing partner in the Ethiopian licenses.

Centrica to buy 45% stake in Trinidad block

Centrica PLC will increase its position in Trinidadian LNG development by acquiring a 45% interest in gas development Block 5(c), off the southeast coast of Trinidad and Tobago.

The company agreed to pay $142.5 million cash to Canadian Superior Energy Inc. and will use the estimated 650 bcf of recoverable gas to supply customers in the UK, North America, or other Atlantic Basin markets from 2014. The block is close to existing gas pipeline infrastructure and LNG export facilities. The company’s initial estimates of development capital expenditure attributable to its stake are £400 million.

Centrica will join BG Group, which operates the block with a 30% stake. “The agreement is subject to preemption rights from the existing field partners and subject to approvals from the Trinidad Government and Canadian courts,” said Centrica.

So far BG has discovered significant contingent gas reserves, and the partners hope undrilled exploration opportunities could substantially increase the potential of the block. Centrica said its share of reserves is equivalent to half its current UK gas reserves.

Centrica Chief Executive Sam Laidlaw said, “Trinidad is one of the key export areas for Atlantic Basin LNG with substantial available reserves and infrastructure in place. Gas produced from this block could help address our long-term structural hedge position by reducing our exposure to volatile wholesale gas prices, offering a potential future gas supply option for our British Gas customers in the UK and for our Direct Energy customers in North America.”

Centrica has an existing position in Trinidad and Tobago through an equity interest in Block 2(ab).

Drilling & Production Quick TakesTransCanada unit sees 6.8 tcf from Montney

The Triassic Montney tight sand formation will provide the majority of the natural gas for the proposed Groundbirch gas pipeline in British Columbia and Alberta, TransCanada Corp.’s Nova Gas Transmission Ltd. told Canada’s National Energy Board.

Of Groundbirch’s projected throughput of 7.5 tcf, about 6.8 tcf would come from the Montney out of an estimated 40 tcf of marketable gas expected to be available from the formation, Nova said.

Conventional resources in the project drainage area would contribute the other 0.7 tcf. Nova noted that conventional gas production in the project drainage area comes from the Cadomin, Doig, Gething, Baldonnel, Halfway, Bluesky, and Charlie Lake formations above Montney and the Kiskatinaw below the Montney.

Construction on the 77-km, 36-in., 1.66 bcfd Groundbirch line is to start in the third quarter of 2010, and the expected service date is Nov. 1, 2010. The line is to run from Groundbirch, BC, to Gordondale, Alta., passing north of the Dawson Creek area.

Public estimates of original gas in place in the Triassic Montney tight sand formation in Northeast British Columbia range as high as 318 tcf, said Nova.

Nova said it used a 25% recovery factor compared with published estimates of 10% to more than 60% recovery from the Montney.

Nova projects flow on Groundbirch at 255 MMcfd in 2010-11 rising to more than 1 bcfd in 2015-16 and exceeding 1.4 bcfd by 2020-21 (OGJ Online, Feb. 27, 2009).

Dong E&P orders subsea production system

Dong E&P Norge AS awarded Aker Solutions a 350 million kroner engineering, procurement, and construction contract for a subsea production system for developing Oselvar field on Blocks 1/3 and 1/2 in the North Sea.

The production system includes a four-slot template with manifold, three subsea trees, control systems, subsea wellheads, and 28 km of steel-tube umbilicals.

Oselvar, discovered in 1991, is in the southwest part of the North Sea in about 70 m of water. Appraisal wells were drilled in 1995, 2007, and 2008.

The Norwegian Petroleum Directorate indicates that the field may recover 4.4 million cu m of oil and 4.8 billion cu m of gas. It says the field contains oil with a gradual transition to gas via a condensate phase. Depth of the reservoir is at 2,900-3,250 m.

Dong E&P plans to produce Oselvar with three subsea completed horizontal wells.

The subsea production system will tie back to the BP PLC-operated Ula platform on Block 7/12, about 23 km from Oselvar. Part of the gas from Oselvar will be used for injection in a water-alternating-gas scheme for enhancing oil recovery from Ula, and oil and the remaining gas will go via Ula to Ekofisk for further transport.

The contract is subject to the Norwegian government approval of the March development and operation plan for Oselvar.

Aker will manage the contract from its Oslo headquarters and manufacture most subsea equipment in its Norwegian facilities at Tranby, Moss, and Egersund. Aker Solutions is a subsidiary of Aker Subsea AS.

Aker expects to make final equipment deliveries in first quarter 2011; planned start of production is expected in fourth quarter 2011.

Operator Dong E&P holds a 40% interest in Production License 274 on Block 1/3. Partners in the license are Bayerngas Produksjon Norge 30%, Wintershall Norge ASA 15%, and Norwegian Energy Co. ASA 15%.

Dong E&P has an agreement to acquire Wintershall’s interest in Oselvar.

Lacq field CCS project is France’s first

Following 2 years of study and preparation, Total SA has received administrative authorization to start injecting carbon dioxide in France’s first carbon capture and storage (CCS) pilot project.

Injection into the nearly depleted Rousse reservoir at Lacq gas field in southwestern France is to start in late June and last 2 years.

CO2 will be captured from exhaust gases at one of five boilers at Lacq’s steam generating plant converted to an oxyfuel combustion unit, then compressed and sent via a 27-km pipeline for injection into the Rousse at a depth of 4,500 m.

The pilot plant will produce some 40 tonnes/hr of steam, which will be used by industries in the Lacq complex. It will emit 120,000 tonnes of CO2 in 2 years.

The Rousse reservoir, a carbonate formation, will be closely monitored through detectors set throughout the surface and subsoil to measure the injection flow and the CO2 pressure, temperature, and concentration.

The €60 million pilot is being carried out in cooperation with Institut Francais du Petrole and Bureau de Recherche Geologique et Miniere (Mining and Geological Research Office).

Its purpose is threefold: to better master the oxyfuel combustion process, namely for applications in the production of extra-heavy oils; to halve the cost of carbon capture compared with existing processes; and to develop monitoring tools, techniques, and methods to establish that long-term and large-scale geological CO2 storage is viable.

Processing Quick TakesValero halts two US hydrocracker projects

Valero Energy Corp. has suspended plans to add hydrocrackers at two US refineries, citing its agreement to acquire a major refining interest in the Netherlands.

Valero Chairman and Chief Executive Officer Bill Klesse said the company is “indefinitely postponing our major new hydrocracker projects at St. Charles and Port Arthur.”

At the 250,000-b/d Port Arthur, Tex., refinery, Valero had planned to add a 50,000-b/d hydrocracker at an estimated cost of $1.7 billion. The project was expected to add as much as 75,000 b/d of distillation capacity through debottlenecking.

In a $1.25-billion project at the 310,000-b/d St. Charles, La., refinery, Valero planned a new 50,000-b/d hydrocracker.

It had earlier announced delays in both hydrocracker projects.

Klesse linked the postponements to Valero’s recent agreement to acquire Dow Chemical Co.’s 45% interest in Total Raffinaderij Nederland NV (TRN) for $752 million (OGJ Online, May 26, 2009). TRN owns a 190,000-b/d refinery in Vlissingen with 68,000 b/d of hydrocracking capacity.

“In the current environment, it makes more sense to acquire existing capacity at a substantial discount to new construction costs,” he said.

In the TRN deal, Klesse said, “we believe the purchase price is less than 50% of replacement cost for this world-class distillate hydrocracking facility.”

In March, Valero won a bid to buy five ethanol plans plus one under development from bankrupt VeraSun Energy Corp. at a price it estimated to be 30% of replacement cost. It agreed to pay $477 million for total ethanol production capacity of 780 million gal/year.

Shell sells gasoline blended with cellulosic ethanol

Royal Dutch Shell PLC on June 10 launched a month-long demonstration selling gasoline blended with 10% cellulosic ethanol at a Shell service station in Ottawa, Ont.

The cellulosic ethanol, made from wheat straw, was produced at Iogen Energy Corp.’s demonstration plant in Ottawa using advanced conversion processes. Iogen and Shell are partners in the plant, which produces 40,000 l./month of fuel.

The demonstration is part of Shell’s strategic investment and development program in sustainable biofuels.

Graeme Sweeney, Shell executive vice-president future fuels, said this demonstration is an indication of what is possible in the future.

“While it will be some time before general customers can buy this product at local service stations, we are working with governments to make large-scale production economic,” Sweeney said.

Brian Foody, Iogen Corp. chief executive officer, said, “Building a demo plant is one thing but you then need to go through the process of operating the new technology at scale, learning, modifying and lowering costs.”

Iogen, a biotechnology firm, has produced cellulosic ethanol at its Ottawa demonstration plant since 2004.

Shell also is working with German company Choren to launch a new biofuels plant that will convert biomass, such as woodchips, into synthetic fuel, which is then being marketed by Choren as SunFuel.

The fuel is being used in diesel engines and can reduce emissions. The 15,000 tonne/year plant uses waste plant material. Shell earlier signed a letter of intent with Volkswagen and Iogen to assess the economic feasibility of producing cellulose ethanol in Germany.

Texas suing BP Texas City refinery

The Texas Attorney General’s Office is suing BP Products North America Inc. for 46 pollution violations at its Texas City, Tex., refinery, the site of a 2005 explosion that killed 15 workers and injured 170 others.

On June 4, Texas Attorney General Greg Abbott said BP did not report emissions to regulators by certain deadlines. Abbott’s office filed a hearing for an injunction requiring BP to install additional air monitors.

A June 29 hearing is scheduled in state district court in Austin, where the lawsuit was filed on May 22. It claims BP improperly released volatile organic compounds, carbon monoxide, hydrogen sulfide, and nitrogen oxides.

“BP Products is charged with polluting our environment, concealing information from authorities and harming Texans,” Abbot said. “In recent years, more than 45 unlawful pollutant emissions occurred at BP’s Texas City facility. This enforcement action holds BP accountable for failing to comply with environmental, health and safety laws that are intended to protect Texans from harm.”

In response, BP said it had no comment on the lawsuit. But BP spokesmen in the past have said the company is working to reduce the number of emissions events at the Texas City refinery.

Transportation Quick TakesConocoPhillips VLCC leaves Orkneys for Chile

A very large crude carrier (VLCC), after spending 3 months as a floating storage unit, sailed from the Scapa Flow in Scotland’s Orkney Islands bound for Chile with a load of North Sea Ekofisk crude.

The Orkney Islands Council Department of Harbours said the Malaysian-registered Bunga Kasturi Dua, carrying 2 million bbl of crude oil, anchored in Scapa Flow on Feb. 14, chartered by ConocoPhillips.

The departure of the VLCC “leaves the Abqaiq and the Maersk Neptune still at anchor in Scapa Flow, storing between them just under 4 million bbl of Forties Crude,” the council said.

In May, the council said that a recent ship-to-ship transfer between the Leander and the Front Shanghai, which saw 2 million bbl of crude transferred, brought the total amount of oil transferred this year to just more than 10 million bbl.

Oil stored in Scapa Flow is part of 20 million bbl of North Sea oil currently stored in Europe on supertankers, creating a readily available source of supply that has helped keep a lid on North Sea crude benchmark prices (OGJ, Mar. 2, 2009).

Peru fertilizer plant would need gas line

A grassroots nitrogen fertilizer complex under consideration in Peru would require construction of about 100 miles of gas pipeline.

CF Industries, Deerfield, Ill., has let a lump-sum contract to Technip of Paris for front-end engineering design of the complex, proposed to be built near the coastal city of San Juan de Marcona.

The complex, Peru’s first major nitrogen fertilizer facility, would use natural gas from Camisea area fields about 300 miles northeast.

The contract covers a 2,600-ton/day ammonia unit, a 3,850-ton/day urea synthesis plant, a 3,850-ton/day urea granulation unit, and utility and offsite facilities.

Work is to be complete by yearend, after which a decision will be made whether to proceed.

The plant would require a link to a pipeline that carries Camisea gas to fractionation facilities in Pisco, south of the site of a liquefaction plant under construction by the Peru LNG consortium (OGJ Online, Jan. 30, 2009).