Proposition: global effort to model largest oil fields

Oil is the world’s most important commodity, and the need to understand the long-term supply is widely recognized. In some way, all energy projects—whether they involve conventional or green alternatives—will be measured against oil. Some of the most pressing questions facing the future of oil supply are:

- What is the future global delivery capacity?

- When and at what volume will oil fail to meet the need?

- How can the future price of oil be predicted, and how reliable is the price prediction?

- How can the oil price be maintained at levels sufficient to assure adequate investment to maximize exploitation of oil resources concurrent with timely and adequate investment in alternative energy sources?

A second tier of questions is tied to the best use of oil when supply cannot meet demand. The proposal made in this article will be essential to addressing those questions as well.

Answers to any of these questions are predicated upon a reliable and credible forecast of global delivery capacity. The need for answers becomes more urgent as excess productive capacity shrinks and oil remains the primary and cheapest source of energy (Fig. 1).1 Primary contributing factors to the present inadequacy of energy investment are price volatility and uncertainty of future delivery capacities, which are the byproducts of tightening supply.

The authors confirm the work of others that the energy future depends upon a handful of irreplaceable and aging fields, many of which are in unknown states of depletion. It is time for the world to better understand global oil productive capacity in order to take appropriate measures.

Modeling giants

The authors propose that the key to this understanding is the modeling of the largest fields. Should government and industry fail to understand the future supply from these fields, there is a potential for large shortfalls of productive capacity without adequate alternative replacements having been put in place. As the world has experienced on several occasions, even small shortfalls can cause large price increases. Failure to understand when and at what volume oil supply will be insufficient is not acceptable.

The key observation behind this proposal is that over time the proportionate contribution of large fields to world oil supply has been generally consistent. Fig. 2 illustrates the percent of the cumulative daily production through time from giants. For the past 3 decades, the giants have represented around 60% of the total.

The authors propose that modeling the range of productive capacity from the largest fields in the world (321 of the top fields) provides the basis to answer the questions posed at the opening of this article. The scale of the proposed undertaking is easily managed. This model would provide a high degree of reliability for 50% of the world’s production—the portion that is assumed irreplaceable and the primary driver for future deliverability. As these largest fields diminish in productivity there is little prospect that the loss of their capacity will be offset by new discoveries. The historic trend is that new discoveries do little more than keep pace with depletion of nongiant fields.

Today there is an overreliance upon historical methods to predict future production. The focus on understanding the whole of the reserves and production picture from an historical perspective, such as the Hubbert model, may be misplaced. Hook et al.2 and Robelius,3 as well as Nehring4 and Klemme,5 have shown that the world’s giant and supergiant fields, deliver over 50% of the world’s supply.

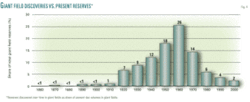

In Fig. 3, the largest 19 fields (the lowest curve) and the 321 largest fields (the middle curve) are nearly parallel in the last 20 years to the top curve, which is world total production. Compared to the period between 1940 and 1980, when 70% of the reserves of the largest fields were discovered (Fig. 4), the 3 subsequent decades have contributed only 12%, even with the advantage of greatly advanced technology and access to a large portion of the world’s prospective areas.

Giants critical

Considering the advanced depletion and large portion of global supply coming from the few giants and supergiants of the world, a sensitivity analysis will identify these fields as the critical variables in the future delivery of oil. The unanticipated decline of the largest fields poses the greatest risk to future delivery, and the loss of their production without replacement or energy alternatives would be economically catastrophic.

The contribution of the smaller fields and future additions will not have the capacity to mitigate the significant disruption of the global economy brought on at some point by the decline of the largest fields. Therefore, a widely accepted method of forecasting supply is required.

In response, this article proposes building reservoir models of the world’s largest fields to gain insight to their possible supply rates. These rates would not be unique answers but would model different scenarios of reservoir development from high investment to low or no investment while giving full consideration to the limitations of remaining oil in place within each field. Further, all producers might join in this effort because it is in everyone’s interest to do so. The reliability of the forecast will improve along with increasing cooperation from producers. While the use of a black-oil model of the largest fields does not provide an absolute prediction (one does not exist), it does offer a means of establishing more robust and explainable boundaries than before.

Others (e.g., Simmons,6 Khadduri,7 and Laherrere8) have recognized the production profile of the largest fields as a better solution than historical data, but no one has done it for a variety of reasons. Constraints include not only availability or access to data but also project funding, size of the undertaking, and a lack of an organization willing to take on the task.

Nonetheless, the role of the supergiants and giants is so compelling that it is now time to start this project.

Prior efforts

Numerous efforts by highly qualified, skilled, and adequately funded persons and groups have produced supply forecasts, but they still have a lot of uncertainty and some controversy. The uncertainty is exacerbated by a lack of transparency in the reporting of much of the world’s reserves, inconsistent reporting standards, and the lack of independent, third-party verification. Beyond the lack of transparency, the core reasons for this situation are the lack of a single repository for the primary data on fields and reliance upon historic data with their inherent limitations.

While some countries require the release of such data, others treat it as a state secret. Consequently, there has been no cooperation within industry to create such a repository. Even when reserve data are available, they are often fraught with uncertainties of reporting (they can be 1P, 2P, 3P, or simply not defined).

Beginning with reserves reports first due in the spring of 2010, the US Securities and Exchange Commission will accept reserves estimates beyond 1P, or proved reserves. Even then, reporting of less certain reserves categories will remain optional. Such a lack of international standards clearly leads to difficulties of analysis.

When considering the application of historic methods, there is an emerging view that the “peak” and “postpeak” periods will not be easy to recognize and will not follow smooth declines as modeled mathematically. Instead, the decline period will likely be slower than modeled by the Hubbert curve and a lot “bumpier” as a result of continued management and investment.

The data used by King Hubbert and the majority of subsequent investigators to forecast future oil supply is essentially historical field-size data with a touch of “growth to known.” While suffering from the usual inconsistencies of such data, the Hubbert method provided a prediction of “peak” oil in the US correct in time but somewhat off in volume.8 The extrapolation to the future using symmetry to predict decline, however, was not nearly as close in time or volume. What the Hubbert model does not accommodate well is the impact of variables such as oil price and the pace of development, which results in a wide range of uncertainty, making it inadequate as a tool to plan the transition from oil.

Complicating the picture is the necessity of dealing with a nonunique number for future production volumes rather than “snapshot” quantities related to a specific date and economic conditions existing at that time. The only time a reserves value is a unique number is when the field is abandoned and the wells are plugged. And, even then, it can return to life with advances in technology and improvements in economics.

Alternative approach

The authors’ approach is to simplify the task and improve the reliability of forecasting crude delivery capacity. This is done by modeling the largest fields in the world.

This method has the built-in flexibility to forecast deliverability with ranges of outcomes subject to the sensitivity of production to investments and timing. Additionally, the model can be used to place in context the role of new fields, potential new reservoirs, and field extensions. It is not proposed to model heavy oil deposits, but that could be included.

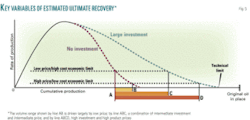

This production forecast will not provide a unique answer to “peak oil” or rate of production decline, but it is a tool that will define the upper and lower boundaries that are dependent on investment in the fields (Fig. 5). Underlying the tool will be a library of hard and soft-copy data that would be updated regularly. The library would consist of both static and dynamic reservoir models of the giant and supergiant fields using industry standard software, which would allow for scenario analysis.

Fig. 5 is a conceptual diagram of production rate versus cumulative volume. The cumulative volume is a nonunique answer and depends upon price, investment, and the applied technology. The end members of no investment and high investment are shown. This is the core output. The proposal here is to model these two production profiles for the giants and supergiants of the world.

The benefits

The benefits of a reliable forecast of future oil productive capacity are:

- Confidence and agreement by industry, government, and financial markets in the timing and scale of oil shortfalls.

- A forecast suitable for use in estimating the price of oil.

- A forecast suitable for determining the rate for deployment of oil replacements.

- Economic stabilization as a result of reduced oil price volatility and appropriate levels of energy investment.

- Defining timing and needs for energy alternatives in the public debate between industry, regulators, and proponents of oil replacements.

- Providing the core basis for formulation of energy and environmental policies, a significant input to monetary policy.

Of course many factors in addition to the amount of spare capacity influence the price of oil, including demand for specific crude types, the size of inventories, secrecy, disinformation, and the impact of trading. Recent oil pricing demonstrates that volatility is disproportionate to changes in demand and in part reflects the uncertainty of delivery capacity.9

Currently, there is a high probability that the energy sector will be short of capital in the near term. Irrational oil pricing combined with vast uncertainty regarding reserves and future deliverability have a chilling effect on lenders and investors in all energy projects, both oil and alternatives. In contrast to popular belief, most oil companies do not have large amounts of cash on hand; similarly, there is no ready pool of capital for alternative energy technology.

Future energy security depends on the level of participation of capital markets. The current murkiness of global reserves and delivery capacity makes an increase in the amount of available capital unlikely. Even companies with large cash reserves, such as Saudi Aramco and ExxonMobil, will be reluctant to deploy capital to expand capacity. This is especially applicable in today’s markets. A common understanding of reserves and future delivery capacity would help operators, lenders, and investors decide if, when, and at what amounts to invest.

Monetary policy, whether by taxation or incentives, plays a large role in investment decisions. The International Energy Agency has forecast that the energy industry will require $20 trillion over the next 20 years in order to meet current and forecast growth of demand. A reliable supply forecast would greatly assist not only government policy-makers but also bankers, fund managers, and energy companies themselves.

A forecast based upon transparency is the foundation to formulate energy policy and mobilize large scale energy investment. Mike Bray of KPMG correctly argued in his 2004 paper delivered to the World Energy Council (WEC) community at the Sydney World Energy Congress “....that a critical success factor to raising sufficient energy capital through to 2030 is the visibility and clarity of attractive and viable investment propositions, enabled by an effective business-reporting and communications (BRAC) toolkit. This toolkit allows capital providers to differentiate between competing investment propositions and allocate capital with precision based on merit.”

Bray’s comments then and subsequently at the 2007 WEC in Rome are made in the context of his and others’ concerns about raising the $20 trillion forecast by the IEA as needed to meet expected energy demand in the next 2 decades. Taking the point one step further, the effective business reporting referred to in Bray’s papers requires that all of the oil sector report in auditable numbers derived from primary data. By whatever means, it is essential to create a reliable reporting of global reserves and forecasting of delivery capacities.

Call for cooperation

The authors propose that industry and government cooperate by the formal establishment of a global body mandated to:

- Establish a library that minimally collects primary data (logs, seismic data, production histories) for the 321 largest fields.

- Acquire the necessary expertise to validate the interpretation of the data and create the static and dynamic models.

- Issue forecasts of the production of the fields in the database, and extend the forecast to total global capacity.

- Periodically update the models and issue updates to the forecast.

- Issue price expectations in coordination with other similar bodies, such as IEA and the Joint Oil Data Initiative (JODI).

This proposal requires industry and producing countries to contribute financing and data to the library. Much of the data already is available, but this is an offer of encouragement to those countries who have not released the data to do so.

To implement the proposal, potential contributors could convene to do the planning through the auspices of professional organizations that have demonstrated an interest in the subject in venues such as American Association of Petroleum Geologists Hedberg conferences and Society of Petroleum Engineers applied technology workshops. JODI, launched in May 2004 by the Organization of Petroleum Exporting Countries, IEA, Asia Pacific Energy Cooperation (APEC), Statistical Office of the European Communities (Eurostat), Latin American Energy Organization (OLADE), and United Nations Statistical Division, provides precedence for such a body.7 JODI broadly accumulates production, refining, and storage statistics from over 90 countries, and grades the statistics for their quality. JODI claims its data represents 94% of global production and 95% of global demand, but these data are not forecasts of future productive capacity.

How do the authors propose to overcome objections to the proposal?

Confidential primary data could be used to reliably model deliverability without compromise to the source. Results could be aggregated to protect the information provided by individual members and other interested parties. What is most important is that all parties have confidence in the forecasts.

There will be naysayers attacking the formation of a cooperative body to coordinate energy policy and pricing saying it lacks adequate transparency, contradicts the inherent advantages of a free market, does not accommodate the needs of the poorest of nations, and is beneficial only to a few. No method is perfect. But the lack of a coordinated policy and stable pricing puts all countries at risk, the richest and poorest.

Changing tactics

Continuing to do what has been done before will not secure future global oil deliveries or deploy alternative technology on a large scale. Continued delay makes solutions increasingly difficult. By changing tactics, it is possible to create a world body with the mandate to forecast oil deliverability.

The authors have proposed conventional modeling methods that require access to primary data that can reliably forecast future oil supply. Though the World Energy Council has taken tentative steps in this regard, a higher profile body with the capacity to cause appropriate cooperation is warranted.

In the US, the Obama administration has the opportunity to take the initiative in calling for such a world body. In addition to the US, the OPEC countries, Japan, China, India, the Euro zone, Brazil, and Russia need to cooperate.

Energy industry leaders can raise the level of awareness of the world’s energy peril and the need for a new approach. The inevitable transition from an oil-based economy is one of the greatest global challenges and deserves a similar level of attention to nuclear proliferation, global warming, and the current economic crisis. The stakes are too high to choose inaction or further delay.

References

- Bryce, R., “Let’s get real about renewable energy,” Wall Street Journal, Mar. 5, 2009, p. A17.

- Hook, M., Soderbergh, B., Jokobsson, K., Alklett, K., 2009, “The evolution of giant oil field production behavior,” Natural Resources Research, Vol. 18, No. 1, 2009, pp. 39-56.

- Robelius, F., “Giant Oil Fields—The Highway to Oil: Giant Oil Fields and Their Importance for Future oil Production,” PhD dissertation, Department of Nuclear and Particle Physics, Box 535, Uppsala University, SE-75121, Uppsala, Sweden, 2007.

- Nehring, Richard, “Giant oil fields and world resources,” The Rand Corporation Report R-2284-CIA, 1980.

- Klemme, H.S., “Giant fields contain less than 1% of world’s fields but 75% of reserves,” OGJ, Mar. 3, 1977, pp. 164-169.

- Simmons, M., “The peak oil debate as the EIA Turns 30,” US Energy Information Administration Energy Conference, Washington, DC, 2008, available from http://www.simmonsco-intl.com/research.aspx?Type=msspeeches.

- Khadduri, W., “Information and Oil Markets,” International Energy Forum, Riyadh, Saudi Arabia, Nov. 19, 2005.

- Laherrere, J., 2005, http://www.mnforsustain.org/oil_forecasting_production_using_discovery_laherrere505.htm.

- Al Husseini, S.I., “Long-term oil supply outlook: constraints on increasing production capacity,” Oil and Money Conference, London, Oct. 30, 2007.

The authors

Wayne L. Kelley ([email protected]) is managing director and chief executive officer of RSK (UK) Ltd. Before cofounding RSK in 2003, he started his career in 1974 with Pennzoil and since then has worked in exploration and production in Alaska, Brazil, Canada, Mexico, the North Sea, and much of Africa. Kelley attended Trinity University and the Colorado School of Mines.

D. Ronald (Ron) Harrell ([email protected]) is chairman emeritus and former chief executive officer of Ryder Scott Co. LP and a senior advisor to RSK (UK) Ltd. A 1957 petroleum engineering graduate of Louisiana Tech University, he serves on six boards of directors, including those of corporations, universities, and not-for-profit organizations.

Richard S. Bishop, ([email protected]) is executive director and chief geologist of RSK. He has worked in research, exploration, and production for ExxonMobil (29 years) and Unocal (2 years). A past president of the American Association of Petroleum Geologists, he received the AAPG Sproule Award and is a distinguished alumnus of the University of Missouri and an honorary member of AAPG and the Houston Geological Society. Bishop received a PhD from Stanford University, an MA from University of Missouri, and a BS from Texas Christian University.

Kirby Wells ([email protected]) is a senior petroleum engineer with RSK. He began working in the oil and gas industry in 2001 with a reserves evaluation consultancy and has since worked as a reservoir engineer supporting exploration and production in North America, East Africa, North Africa, the Middle East, and South America. Wells holds a BS in physics from Texas Tech University and an MS in petroleum engineering from the University of Houston.