First-quarter E&P earnings plummet on lower prices

Lower oil and gas prices and increased costs sharply reduced the earnings of some US and Canadian producers in the first 3 months of 2009. At the same time, some producers benefited from lower costs. Also, refiners and marketers reported stronger earnings from a year earlier as a result of healthier margins and reduced costs.

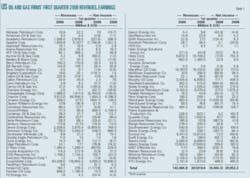

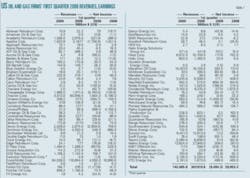

A sample of 79 producers and refiners based in the US combined for a $9.5 billion loss in the first quarter of this year. This contrasts with earnings of $30 billion for the same group of companies a year earlier. In the recent quarter, 47 of the companies posted a loss—more than twice as many as incurred a loss in first quarter 2008.

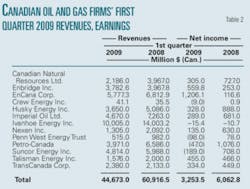

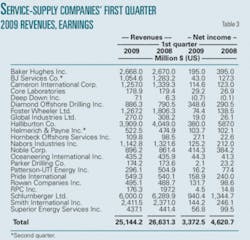

Meanwhile, a sample of Canadian producers and pipeline companies recorded a decline in earnings and revenues for the quarter. Also, a group of service and supply companies posted a collective decline in first-quarter 2009 earnings and revenues as a result of a contraction in exploration and drilling activity.

Prices, margins

Weak worldwide oil demand brought on by the global economic recession caused prices to sink from their mid-2008 highs. In the first quarter of this year, the front-month contract closing price of crude on the New York Mercantile Exchange averaged $43.31/bbl, down from $97.82/bbl a year earlier and down from $59.06/bbl in fourth quarter 2008.

Likewise, US natural gas prices plunged on weak demand by industrial and electric power customers and on rising supplies in storage. The front-month gas contract on NYMEX averaged $4.468/MMbtu in the recent quarter, down from $8.74/MMbtu in first quarter 2008.

Average US cash refining margins in the first quarter of 2009 moved sharply lower for Gulf Coast, Midwest, and East Coast refiners, but West Coast margins climbed 8% from a year earlier to average $15.04/bbl, according to Muse, Stancil & Co.

The Gulf Coast margin averaged $4.32/bbl in this year’s first quarter, while the East Coast margin averaged $1.29/bbl, MSC reported.

US operators

The large, integrated US oil and gas producers posted positive but lower earnings in the first quarter, while many independent operators recorded losses.

But three of the oil and gas producers in a sample of US-based operators swung to a first-quarter profit from a loss position a year earlier. These producers are Abraxas Petroleum Corp., Belden & Blake Corp., and Goodrich Petroleum Corp.

Goodrich Petroleum reported that its first-quarter earnings were positively impacted by a $37 million gain on derivatives not designated as hedges, including a $21 million realized gain and a $16 million noncash, unrealized gain, compared with a $24.5 million loss on such derivatives in first quarter 2008. First-quarter production volumes were up 31% from a year earlier.

Meanwhile, just a few of the independents, including Cabot Oil & Gas Corp., Range Resources Corp., and others, reported an improvement in revenue and earnings from last year’s first quarter.

Cabot said its recent earnings benefited from a gain on the sale of assets and a gain on derivatives. Range Resources’ net income climbed to $32.6 million from $1.7 million due to noncash hedging gains.

ExxonMobil Corp.’s first-quarter earnings were $4.6 billion, down 58% from first quarter 2008 due to lower oil and gas prices and higher operating costs.

ExxonMobil’s upstream earnings were $3.5 billion, down $5.282 billion from first quarter 2008, the company reported. Lower oil realizations reduced earnings by $4.4 billion, while lower gas prices cut earnings about $500 million. Higher operating expenses reduced earnings about $300 million. Excluding the impacts of entitlement volumes, OPEC quota effects and divestments, production climbed 2% during the recent quarter from a year earlier.

ExxonMobil’s downstream earnings were $1.133 billion, down $33 million from first quarter 2008, and its chemical earnings of $350 million were $678 million lower than first quarter 2008.

Marathon Oil Corp. reported first quarter 2009 net income of $282 million, down from $731 million in first quarter 2008. E&P income was $100 million in this year’s first quarter, down from $684 million a year earlier on lower oil and gas prices realizations.

Marathon’s oil sands mining segment reported a $24 million loss for the recent quarter, compared with earnings of $27 million a year earlier. This was primarily driven by a 57% decrease in average realizations, although synthetic crude sales volumes increased slightly and operating expenses, primarily those driven by commodity prices, were down, the company said.

Meanwhile, Marathon’s refining, marketing, and transportation segment income was $159 million in the first quarter compared with a loss of $75 million in first quarter 2008. The increase was primarily the result of a higher refining and wholesale marketing gross margin, which increased to 7.92¢/gal in the first quarter from –0.26¢/gal in first quarter 2008.

Refiners

Houston-based Frontier Oil Corp. was among the refining and marketing companies that posted improved earnings from the first quarter of last year despite a decline in revenues.

Frontier’s quarterly revenues were down 29% year-on-year to $846 million. Due to lower costs, the company’s net income in the recent quarter was $73.5 million, up 60% from a year earlier.

Valero Energy Corp. and Holly Corp. also reported higher earnings on lower revenues. Valero’s net income increased 18% to $309 million, mainly due to higher refining margins on gasoline, fuel oil, asphalt, and petroleum coke. Also, refining operating expenses were down primarily due to lower energy costs.

Partially offsetting the increase in first quarter results was a decline in sour crude discounts and lower diesel and jet-fuel margins. Throughput volumes also declined due to downtime at certain refineries, Valero reported.

Holly’s earnings jumped to $23.9 million in the recent quarter from $9.5 million in first quarter 2008. Meanwhile, Sunoco Inc. and Tesoro Inc. each swung to a profit for the first 3 months of 2009 from a loss in the year-earlier period.

Canadian companies

A group of 13 oil and gas producers and pipeline companies headquartered in Canada reported a collective 46% decline in net income for the first quarter of this year. Five of these firms incurred a loss, while two improved on their earnings from a year earlier.

EnCana Corp. reported its first-quarter net earnings increased 934% primarily due to an aftertax unrealized mark-to-market hedging gain, compared with an after-tax loss in the first quarter of 2008. The Calgary-based company’s operating earnings declined 9% from the first 3 months of last year, while revenues were down 15%.

Lower price realizations were partly what sunk the quarterly results of Suncor Energy Inc. The company incurred a $189 million (Can.) loss for the first quarter, compared with $708 million (Can.) in earnings in the first quarter of last year. Revenues declined 20% to $4.8 billion (Can.). Mitigating some of the loss were improved downstream margins and lower oil sands royalty expenses.

Suncor said that excluding unrealized foreign exchange impacts on the company’s US dollar denominated long-term debt, mark-to-market accounting losses on commodity derivatives, and costs related to start-up or deferral of projects, first quarter 2009 earnings were $227 million vs. $805 million in first quarter 2008.

Service, suppliers

A sample of oil and gas service and supply companies recorded a collective 27% decline in first-quarter earnings from a year earlier. The group’s combined revenues were down nearly 6%.

In this group of 22 firms, only one incurred a loss for this year’s first quarter. Seven of the companies improved on their positive first-quarter 2008 net income, while 14 posted a decline in earnings from a year earlier.

Baker Hughes Inc. reported a 51% earnings decline to $195 million from first quarter 2008, as the company’s revenues were little changed at $2.668 billion.

Chad C. Deaton, Baker Hughes chairman, president, and chief executive officer, said, “Our first-quarter results for North America reflect the severe contraction in customer spending and activity. Profit from North America operations was impacted by significantly lower activity levels, severance charges, and price deterioration.

“Results from operations outside North America reflected the relative strength of international markets as contraction in the Saudi Arabia, Russia, Caspian, and UK markets was partially offset by strength in the Latin America, Norway, and Africa markets. Profitability was also impacted negatively by changes in foreign exchange rates and charges related to severance and allowances for doubtful accounts,” Deaton said.

Diamond Offshore Drilling Inc. posted one of the largest first-quarter earnings gains in the group, with $348.6 million in net income. This was up 20% from a year earlier, as the driller’s revenues climbed 12%.

Contract drilling revenue for Diamond Offshore’s rigs, including high-specification floaters, intermediate semisubmersibles, and jack ups, climbed 11% from the first 3 months of last year. Day rates were higher from a year earlier, but utilization declined for Diamond Offshore’s high-specification floaters and jack ups. Utilization of the companies’ intermediate semisubmersibles was steady from a year earlier at 85%.