OGJ Newsletter

Indonesia, ExxonMobil disagree over tax debt

Indonesia is still in dispute with ExxonMobil Corp. and Kodeco Energy Co. Ltd. over the companies’ alleged tax debts totaling $63 million, while three other firms have settled their outstanding bills.The two firms and Indonesian state auditors still hold different opinions about how the tax is calculated and the amount owed, according to R. Priyono, director of BPMigas, Indonesia’s upstream oil and gas regulator.

Priyono told a hearing at the House of Representatives Commission VII for energy and mineral resources that ExxonMobil, based on an audit result from the State Development Finance Comptroller (BPKP), still owed the state $30.65 million in unpaid corporate taxes.

According to the BPMigas’ report given to legislators, ExxonMobil claims it was to receive a tax reduction because of a royalty it paid to PT Asamera Oil Indonesia Ltd.

But Priyono said the royalty has nothing to do with the production-sharing contract between the government and ExxonMobil and “cannot be used as a tax reduction.” Priyono added that the dispute still is being deliberated by a tax tribunal.

Meanwhile, Kodeco claims taxes that it owes are calculated on the basis of revenues and costs across all fields in one working area. But BPMigas and the BPKP argue that tax must be calculated separately for each field.

Under that formula, the BPKP says Kodeco owes $32.23 million in tax, while “Kodeco still disagrees with the BPKP,” Priyono said.

Three other firms have agreed to settle their debts. BPMigas named them and their debts as Kangean Energy Indonesia Ltd., $45.06 million; Santos UK (Kakap 2) Ltd., $2.39 million; and Golden Spike Raja Blok, $10.62 million.

MEND threatens to block Nigeria’s oil waterway

The Movement for the Emancipation of the Niger Delta (MEND) plans to block key channels for oil vessels to increase pressure on Nigeria’s troubled oil and gas industry.

“We have ordered the blockade of key waterway channels to oil industry vessels both for the export of crude and gas and importation of refined petroleum products,” MEND said. “This means vessels now ply such routes at their risk.”

It claimed responsibility for blowing up two recently repaired pipelines near Escravos in the Niger Delta as retaliation for military attacks on its camps around Warri. The military launched its operations on May 15 following the hijacking of two oil vessels and assaults upon its soldiers. According to MEND, two hostages were killed during the fighting and it will return the bodies to the Red Cross charity. “The British hostage, Mathew Maguire has been relocated to Delta state and will be a guest of one the camps there,” MEND added.

According to Nigerian press reports, there were also explosions at a manifold operated by Shell in the Bayelsa state, which the company is investigating.

MEND accused the military of “indiscriminate use of missiles and bombs on several defenseless Ijaw communities in Delta state,” describing this “as the height of cowardice.”

Ijaw’s National Congress, which represents the region’s largest ethnic group, said that the military has killed over 1,000 civilians, which the military has denied.

There have been conflicting reports on how many hostages were rescued last week and the number of civilians affected in the stand off between MEND and Nigerian troops.

MEND is fighting for a greater share of the revenue from oil and gas produced in the Delta and it pledged that for the Nigerian government to declare victory, troops must be able to secure every inch of pipelines and eliminate over 500 camps stretching from Ondo to Akwa Ibom.

The attacks on Nigeria’s oil and gas facilities has cut oil production from 2.6 million b/d in January 2006 to about 1.8 million b/d.

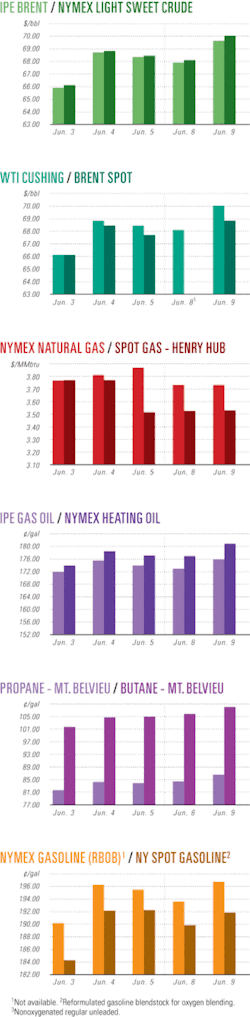

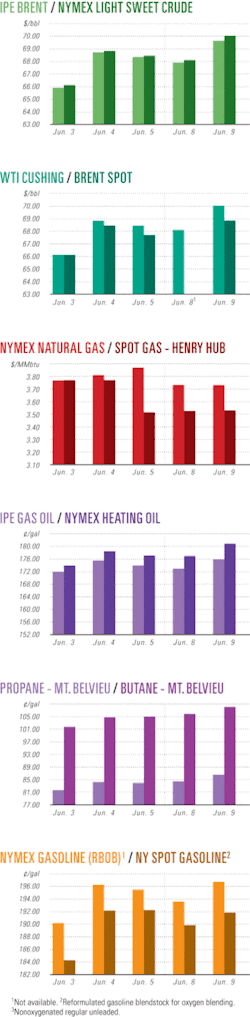

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesJV confirms Poseidon find off W. Australia

The ConocoPhillips-Karoon Gas Australia Ltd. joint venture declared its Poseidon-1 wildcat a significant gas discovery despite being unable to carry out planned production tests.

The find is in Browse basin permit WA-315-P about 480 km north of Broome off Western Australian. It lies immediately north-northeast of and on trend with the Woodside Petroleum Group’s Torosa gas-condensate field and north northwest of the Inpex group’s Ichthys gas-condensate field.

A downhole mechanical failure when operator ConocoPhillips attempted to retrieve the liner-hanger setting tool irreparably plugged the well above the planned test interval.

The consortium said the well penetrated a 317 m gross gas-bearing Plover Frmation reservoir between 4,795 m and 5,112 m containing three gross gas sands totaling 228 m thickness.

The gas-water contact was not penetrated, indicating the potential for additional gas below the well’s total depth. Estimations of reservoir permeability based on log-derived porosity and four pressure data points suggest the reservoir section will flow gas.

Current mapping indicates the well is more than 100 m below the crest of the Poseidon trap, giving an interpreted gross gas column for the structure of more than 430 m. The aerial extent is mapped at around 280 sq km.

The JV estimates proved reserves to be 3 tcf of gas.

The joint venture has begun inquiries to secure a rig for further appraisal drilling on the discovery.

The Sedco 703 semisubmersible rig has been moved to the next well in the multiwell program called Kontiki-1.

Interests in WA-315-P are ConocoPhillips 51% and Karoon Gas 49%.

Firm to explore carbonate reefs in Palau

Palau Pacific Exploration, Brisbane, seeks to drill a 5,000-ft exploration well in 130 ft of water off northern Palau in the southwestern Pacific.

The company secured an option on a farmout covering a 1 million acre concession on the North Block in Kayangel state and sought investors to participate in a €30 million private placement to fund part of the drilling program.

By drilling the well, the company would earn a 75% working interest and a 66% net revenue interest in the block.

Palau Pacific defined the prospect by reprocessing in late 2007 about 140 miles of high-resolution seismic shot in 1997. Reprocessing with cutting edge frequency dependent processing resulted in the identification of multiple reefs and overlapping anomalies for drilling, the company said.

“Potential reservoirs, determined from seismic sequence stratigraphy, are thick Miocene age carbonate reef systems. Geochemical analysis confirms the presence of thermogenic hydrocarbons. Amplitude versus offset gradient analysis indicates shallow gas,” the company said.

Consulting engineers suggest the existence of shallow Pliocene gas as a bailout option should oil not be found, and they estimated production lives of more than 20 years for Miocene oil and Pliocene gas if discovered. A power generation market exists for gas that would back out imported diesel.

Palau is formulating a hydrocarbon law and planning an exploration license round (OGJ Online, May 7, 2009).

EOG-Seneca gauge Marcellus shale gas

A Marcellus shale well operated by EOG Resources Inc., Houston, was flow-tested at an average rate of more than 3 MMcfd of gas for 7 days, said 50% interest owner Seneca Resources Corp., Buffalo, NY.

Seneca Resources, which holds a 60% net revenue interest, said the well “confirms our expectations for the potential of our Marcellus shale position, most of which is fee mineral acreage.” A hydraulic fracture is under way at another well where flare tests should begin by the end of May.

Seneca Resources said it should soon be in a position to estimate the resource potential of its extensive acreage position. The company is the third largest acreage holder in the Marcellus play with more than 725,000 acres (OGJ Online, Jan. 15, 2009).

The EOG-Seneca acreage is centered 80 miles northeast of Pittsburgh. Seneca plans to operate 10 vertical wells and 2-3 horizontal wells in fiscal 2009 and participate in 8-10 wells to be operated by EOG Resources.

StatoilHydro eyes exploration off Bahamas

BPC Ltd., Perth, and Norway’s StatoilHydro ASA formed a joint venture to explore for oil and gas off the Bahamas if the government approves licenses applications.

The companies propose to explore licenses in southwestern Bahamas waters that lie between Miami and central Cuba. The Bahamas commonwealth government could approve the license applications by yearend, BPC said.

The joint venture territory lies between four other Bahamas blocks wholly held by BPC southwest of Andros Island and six blocks in the Florida Straits off northwestern Cuba operated by Repsol YPF SA in which StatoilHydro holds 30% interest.

Meanwhile, BPC identified 22 exploration leads on its fully owned Bain, Cooper, Donaldson, and Eneas licenses 225-425 km southeast of Miami and the Miami license 85-150 km east of Miami. The licenses, awarded in 2007, total 3.874 million acres in 5-535 m of water on the southern Great Bahama Bank and have potential in a Jurassic-Cretaceous carbonate petroleum system.

BPC noted that five wells have been drilled in the Bahamas since 1947, the last one by Tenneco Oil Co. to 21,740 ft about 50 km off Cuba in 1986 that had oil shows in Lower Cretaceous.

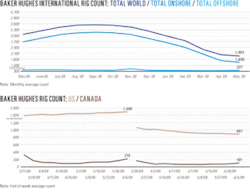

Drilling & Production Quick TakesDrilling activity continues to diminish

The US rig count continued to contract, down by 10 to 918 rotary rigs working the week ended May 15, less that half of the 1,862 units that were active in the same week a year ago, said Baker Hughes Inc.

Land operations showed the latest loss, down 13 rigs to 855 drilling. Inland-water activity remained unchanged with 7 rigs working. Offshore drilling increased by 3 to 55 rotary rigs working in the Gulf of Mexico out of a total of 56 on federal offshore leases.

Of the rigs still working, 728 are drilling for natural gas, down 2 from the previous week. The number drilling for oil fell by 9 to 181. There were 9 rigs unclassified. Horizontal drilling was down 1 to 379 rigs. Directional drilling totaled 160 rigs, 4 fewer than last week.

Texas continued to lead the decline among major producing states, down 13 rigs with 342 still working. Arkansas lost 4 rigs to 44. North Dakota and New Mexico laid down 3 rigs each, to respective counts of 33 and 31. California was down by 1 to 20. Oklahoma was unchanged at 84.

Wyoming and Alaska increased by 1 rig each to 36 and 6, respectively. Colorado was up 2 to 45 rigs working. Louisiana’s rig count jumped by 8 to 146.

BP brings Dorado, King South fields on stream

BP PLC has begun production from Dorado and King South fields in the Gulf of Mexico. Both are subsea tiebacks to BP’s Marlin tension-leg platform.

The Marlin TLP is on Viosca Knoll Block 915. Dorado, 2 miles from the TLP, features three subsea wells operated by BP with a 75% working interest. Shell has 25% working interest.

King South, 18 miles from the TLP, features one subsea well and is 100% owned and operated by BP (OGJ, Oct. 8, 2007, p. 49).

Dorado utilizes dual completion technology enabling production from five Miocene zones, and King South is produced through the existing King field subsea pump.

BP installed the Marlin TLP in 1999 as a production hub for Marlin field. Since then, Marlin, King, Nile, and King West fields have been producing across the Marlin TLP.

With the addition of the four new wells, a total of 11 wells produce into the Marlin TLP with daily gross production of 60,000 b/d oil and 70 MMscfd of gas.

Jordan, Shell sign oil shale agreement

The Kingdom of Jordan has signed a concessionary agreement with Jordan Oil Shale Co. BV, a subsidiary of Royal Dutch Shell PLC, to explore for oil in the country’s shale deposits, according to a senior government official.

Oil Minister Khaldoun Qteishat, who said the agreement will be sent to parliament for final approval next month, announced that the Shell subsidiary will invest up to $540 million in the project’s preliminary exploratory and assessment phase.

Qteishat acknowledged that the “long-term concessionary agreement will take many years to prove and study” whether Jordan’s reserves will produce the oil which his country needs.

The concession agreement will allow Josco to assess oil shale resources in an area spanning 22,500 sq km in the country’s central, southern,/ and northwestern regions.

Shell Vice-Chairman Malcolm Brinded said Shell will examine the most promising of Jordan’s 21 oil shale locations and then “hone in on the area that is most promising” of all for its pilot program.

The Jordanian government and Shell concluded an initial agreement on the contract in December, which sees production of oil from the shale within 12-20 years of the conclusion of the agreement.

The agreement between Jordan and Shell is the second in recent months. In April, the Jordanian cabinet approved memorandums of understanding between Inter Rao of Russia and Aqaba Petroleum for oil shale exploration and mining.

As reported by the Jordan Times, the areas that the two companies will explore are near Al Attarat in the southern part of the country.

Meanwhile, other companies seeking oil shale agreements are Estonia’s Eesti Energei, Petroleo Brazileiro SA, Total SA, Jordan Energy & Mining, and a Jordanian-Saudi joint venture called International Corp. for Oil Shale Investment.

According to Jordanian figures, 40 billion tonnes of oil shale exist in the country’s 21 locations near the Yarmuk River, Buwayda, Bayt Ras, Ruwayshad, Karak, Madaba, and Ma’an districts.

Premier to develop Gajah Buru gas field off Indonesia

Premier Oil Natuna Sea BV let an engineering, procurement, construction, and installation contract to a consortium led by Saipem SPA for a central processing platform and other equipment needed to develop Gajah Buru gas field off Indonesia.

First gas is expected in October 2011, and Premier estimates the field holds recoverable reserves of 325 bcf. It was discovered in 2004 with proved gas in stacked reservoirs in the Arang formation.

The deal is valued at $430 million, and the field is on the Natuna Block A in the West Natuna Sea. The central processing platform will weigh 12,900 tons. Saipem and its partner, PT SMOE Indonesia, will produce a wellhead platform, connecting bridge, and a 3-km, 16-in. subsea gas export pipeline to be laid in 80 m of water.

The pipeline will be linked to the existing export trunkline, with a capacity of 140 MMcfd to deliver gas to Sembgas in Singapore.

Facilities on the central processing platform will include compression, separation, glycol regeneration, gas metering, mechanical refrigeration, utilities, and living quarters for 60 staff. The wellhead platform has an estimated topside weight of 900 tons and a jacket weight of 1,400 tons. Construction is scheduled to commence in August.

The Central Processing Platform will be installed using the ‘floatover’ method, while other platform facilities and pipeline will be installed using Saipem’s Castoro Otto derrick-lay barge, said Saipem.

Agip KCO awards Kashagan field contract

Agip KCO let a $2.6 billion contract to Saipem SPA and Aker Solutions to do the hook-up and commissioning of the offshore facilities, inshore completion, and prefabrication work for the first development phase of Kashagan field in the north Caspian Sea.

Saipem said the work would focus on oil and associated gas production by an artificial offshore facilities system called Block D and Block A. The inshore completion and prefabrication will happen in the Kuryk yard in Kazakhstan. All of the contracts will be completed by 2012.

“The very shallow water, the severe weather and the stringent environmental restrictions alongside the lack of infrastructure for the offshore industry make the project particularly complex and challenging,” added Saipem. It will use five barges to carry out the work.

The hook-up contracts are the follow-ups of the letter of intent and preliminary agreements signed between Agip KCO, Aker Solutions, and Saipem in March 2007 for the early work for the hook-up.

Phase 1 of the project, dubbed the experimental program, is due online in late 2012 and will be under the responsibility of Eni SPA. Under Phase 1, oil production is expected to reach 300,000 b/d, increasing to 450,000 b/d during Phase 2 (OGJ Online, Feb. 2, 2009). The field, which is 80 km southeast of Atyrau, is expected to reach plateau production of 1.5 million b/d by the end of the next decade.

Saipem’s portion of the contract is worth $1 billion while Aker Solutions’ contract value is $1.6 billion.

Kashagan is one of the world’s largest discoveries in the last 40 years and will cost $136 billion to develop, eventually doubling Kazakhstan’s oil output to about 3 million b/d.

Processing Quick TakesKuwait, China to build Guangdong refinery

Kuwait and China have signed an agreement to establish a $9 billion, 300,000 b/d refinery at Zhanjiang, a city on the coast of Guangdong province in southwestern China.

Under terms of the agreement the refinery will be built in Zhanjiang instead of in Guangzhou, as originally planned, due to environmental concerns.

Sinopec will hold a 50% stake in the venture, which is scheduled to start operations in 2013, while state-owned Kuwait Petroleum International will hold 30%. The remaining 20% will be divided equally between Dow Chemical Co. and Royal Dutch Shell PLC.

PetroChina selects Chevron’s RDS technology

PetroChina Sichuan has awarded a contract to Chevron Lummus Global to provide residual desulfurization (RDS) technology to the new processing facility in Pengzhou County, Chengdu City, in China’s Sichuan province.

The RDS unit will process 3 million tonnes/year of resid and vacuum gas oil for pretreatment to a resid fluid catalytic cracker. The RDS unit will employ CLG’s upflow reactor technology, an advanced guard bed technology that minimizes pressure drop buildup in the guard bed.

The facility will be designed to process heavy crudes and will meet modern environmental and industrial standards.

Transportation Quick TakesChevron LNG JV awards contract

Offshore Marine Services Alliance (OMSA), a joint venture of Skilled Group, Perth, Ezion Holdings, Singapore, and Pacific Basin Shipping, Hong Kong, secured a $350 million (Aus.) contract to supply marine vessels and labor to the Chevron Australia-led Gorgon-Jansz LNG project off Western Australia.

The contract is for a minimum 3 years beginning in the third quarter.

The Gorgon-Jansz development proposal involves linking two offshore gas fields by subsea pipelines to Barrow Island where a three-train LNG plant will be built with a total capacity of 15 million tonnes/year.

The plans also include a 300 terajoule/day domestic gas plant and a pipeline to the Western Australian mainland as well as a carbon dioxide geosequestration plant capable of separating the carbon dioxide content from Gorgon flow and pumping it down into deep formations below the island.

The project joint venturers are Chevron with 50%, and ExxonMobil and Shell, 25% each.

Oman LNG signs service agreement with GE-OG

Oman LNG and General Electric Oil & Gas (GE-OG) have signed a 16-year, $200 million contractual service agreement for the 12 GE gas turbines at Oman LNG’s Qalhat complex.

Under the agreement, GE will supply a comprehensive range of services for the six critical gas turbines that drive the three LNG liquefaction trains and an additional six gas turbines that generate power for the Qalhat Complex.

Oman LNG is a joint venture comprised of the Omani government 51%, Royal Dutch Shell PLC 30%, Total SA 5.54%, Kogas 5%, Mitsubishi 2.77%, Mitsui 2.77%, Partex 2%, and Itochu 0.92%.

Southern Corridor Summit produces agreement

The Southern Corridor Summit on May 8 in Prague produced “an agreement on a common strategy and clear scheduling for the completion of relevant projects” contributing to diversification of energy sources and routes for the European gas supplies, said European Commission Pres. Jose Manuel Barroso.

The southern gas corridor is one of the European Union’s highest energy security priorities to develop gas supplies from Caspian and Middle Eastern sources and possibly other countries in the longer term. The Prague summit brought together Barroso and the EU’s revolving president, Czech Prime Minister Mirek Topolanek, with potential partners from Azerbaijan, Egypt, Georgia, Iraq, Kazakhstan, Turkey, Turkmenistan, and Uzbekistan.

It also was attended by Russia, the US, and Ukraine as observers as well as members of the international financial institutions.

A joint declaration was signed by the EU presidents and the leaders of Azerbaijan, Georgia, Turkey, and Egypt but not by gas-rich Kazakhstan, Turkmenistan, or Uzbekistan. Iraq’s oil minister did not sign either, but Barroso indicated EU negotiations for a memorandum of understanding to export Iraqi gas to Europe.

Barroso declared, “Today we have commitments from producer, transit, and consumer countries. We now need to work quickly on the follow-up.” Pending gas line projects were bolstered by the signing of the declaration.

By midyear, Barroso wants to see the signing in Turkey of the intergovernmental agreement on the Nabucco gas line slated to bring gas from Central Asia to the EU while avoiding Russia. By yearend, he also expects strong support for the Italy-Greece interconnector project as well as conclusion of a feasibility study on the possible shape of the Caspian Development Corp. initiative in cooperation with international financial institutions. This should lead to concrete proposals for obtaining sufficient gas volumes to be transported through the Southern Corridor including encouraging the market-based participation of public and private companies.

Barroso called the Southern Corridor “a new Silk Road” opening the potential for enhanced relations with the countries of the Southern Caucasus and Central Asia.

The memorandum of understanding between the EU and Iraq would receive strong support as well as cooperation between the EU and Egypt to determine specific projects to develop Egypt’s gas reserves and the export potential for the EU via the Southern Corridor.