Smallest Philippine block has shallow gas, deep reef potential

Record attendance levels experienced at the Apr. 20-24 Southeast Asia Petroleum Exploration farmout forum in Singapore signal an undiminished level of interest in regional exploration prospects.

The SEAPEX showing surprised many organizers and attendees in view of the world economic slump and the price of oil. Some 650 attended against the 550 expected. This bodes well for 2009-12 exploration in Southeast Asia. World class presentations, posters, and papers demonstrated the vast potential of the some 10 million plus sq km of onshore and offshore areas in the region.

The object of this article is not to dwell on the significance of the vast exploration licences and plays that can be enjoyed by majors and independent consortia in Southeast Asia. Rather, we have taken one of the smallest licenses in the region, SC 52 covering 960 sq km in northeast Luzon, Philippines, to demonstrate what can be done with careful research of existing data.

Economic woes

With the recent downturn in both oil prices and economic activity, low to midcap exploration companies have been hit particularly hard.

The prices these companies earn from production is now below 2005 levels, yet costs in association with drilling remain above double those of the same period. The consequent slashing of exploration budgets globally has limited the scope of junior exploration companies, but low-risk, low-cost plays, with an easy access to end-user markets still provide a way forward.

Southeast Asia stands out as a particularly attractive region in which to pursue such opportunities.

The lessons learned during the Asian financial crisis of the late 1990s have left middle-income countries such as Thailand, Malaysia, Indonesia, and the Philippines somewhat resilient to the economic downswing. A similar resistance can be seen in the lower-income countries in the region, with their underdeveloped financial markets providing a buffer against the adverse economic environment.

On the whole, Southeast Asia appears to have better economic parameters in view of the slump in other parts of the world, and as such it is likely a better place to explore.

Mabuhay Philippines

With its competitive fiscal regime, the Philippines stands out among Southeast Asian countries as a potential candidate for low-cost exploration and one that, until recently, has been largely ignored.

Boasting a low entry price, enticing incentives for collaboration with local partners, and a posttax contractor share of 30-45% of revenue, the Philippines has seen a resurgence of exploration activity in recent years.

The country has been largely abandoned since the mid-1970s, but the now-stable regulatory environment coupled with the successfully producing Malampaya gas project have paved the way for a revival. Most of the recent focus has been in the highly prospective Palawan basin, but this is just one of a number of potential oil and gas producing basins in the Philippines.

With an estimated resource potential of a few hundred million barrels of oil equivalent, and the only other producing gas field in the Philippines besides Malampaya, the Cagayan basin, Northern Luzon, is another “old haunt” now being revisited. It is a backarc basin of generally north-south orientation that covers about 28,000 sq km of Luzon Island with sedimentary fill estimated to be as thick as 9 km in some areas.

Service Contract 52

SC 52, in the northern Cagayan basin, is one of the smallest service contracts in the Philippines.

It was awarded to E.F. Durkee & Associates Inc. in mid-2005. After careful review of the existing data all indicators suggested that SC 52 was a highly prospective block with the Cagayan Valley providing a large onshore geological basin that has all the elements needed to perhaps provide important gas discoveries.

The oil and gas seeps found in the westerly foothills of the basin together with the San Antonio gas field (Fig. 1) and producing well are pretty conclusive evidence that the Cagayan Valley has the potential to generate hydrocarbons from within its stratigraphic fill.

Several play concepts that have been identified in the basin include Early to Late Miocene reef buildups, fault block related traps, basement drapes, and stratigraphic traps. These aspects coupled with a good market potential for produced gas created by the area’s position with respect to industrial developments, population centers, and electric power grids further enhanced the block’s prospectivity.

Ready to blow?

The Nassiping dome is a nearly perfectly shaped, ovoid, domal surface anticline with good topographic and geomorphic expression.

It is about 8 km in diameter along its slightly longer northerly axis. Based on seismic data it has perhaps 2,000 ft of vertical closure in the younger strata.

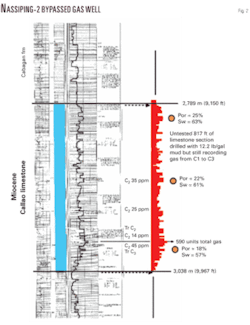

The Nassiping-2 well drilled by Petro-Canada and Philippine National Oil Co. in 1984 has been shown until recently as a deep dry hole. Field work while searching for the wellhead uncovered gas leaking into the former cellar from beneath the steel plate that caps the 85/8-in. pipe.

Often-ignored mud logs and geologic reports indicate that it was known that the well had penetrated 800 ft of gas-leaking strata. Uniquely, this well was cased to the top of the Miocene Callao limestone, which was only recently appreciated to be leaking gas. Hurrying on to other objectives estimated to be at 15,000 ft, the operator set pipe at the base of the limestone but never tested the Callao (Fig. 2).

The drillstring became stuck at 12,500 ft and was plugged and abandoned with no tests. Gas was apparently not of interest per the report.

Nassiping dome has an estimated resource potential of 35 to 350 bcf of gas and is strategically positioned less than 1 km from the local power grid.

Based on gas prices at Malampaya of around $8/Mcf, Nassiping appears to be a “freebie” to consider for testing. Durkee & Associates is seeking to farm down its equity position in SC 52.

Onshore giant reef

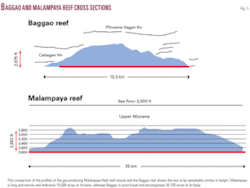

The Baggao-San Jose prospect on SC 52 is a Miocene-aged reef and possibly the largest onshore reef prospect yet identified in the Philippines (Fig. 3).

It has Malampaya-sized potential as a trap and has exceptional seismic evidence and surface geochemical methane anomalies. Drill depths vary on this tilted reef from 5,000 to 10,000 ft. It is 65 km from Port Irene, which in case of success will provide for export through that industrial zone to the Pacific region.

The Baggao reef is comparable with the 2-4 tcf reef at Malampaya off Palawan (Fig. 3).

Gas markets

Nassiping-2 is 0.7 km from the Northern Luzon Electric Grid and is a good candidate for a small gas-to-electricity project.

This type of development has already proved successful in the area, with PNOC having operated the one-well field at San Antonio. The well was tied to a 3-Mw generator that burned 1 MMcfd of gas and was on stream from 1992 until 2006.

Conclusion

SEAPEX’s success as an exploration forum indicates the interest in technical resources, financial resources, and human resources to evaluate Southeast Asia.

Two upcoming meetings to further this momentum are South East Asia Australia Oil Conference Sept. 9-11 in Darwin and the 2009 Association of International Petroleum Negotiators’ Deal Making in the New Energy World international conference Oct. 18-21 in Bangkok.

The authors

Jhana Hale has worked as a geophysicist in the US, Australia, Egypt, and the Philippines. He has a BSc (Hons.) from the University of Tasmania.

E.F. Durkee has spent a lifetime largely in international exploration including Asia, Australia, Indonesia, Papua New Guinea, Europe, and the Middle East. He has BS and MA degrees from the University of Wyoming.

AlgeriaPetroceltic International PLC resumed drilling on the Isarene permit in eastern Algeria for the first time since it shot almost 1,000 sq km of wide azimuth 3D seismic on the Ain Tsila ridge.

The INE-2 well, spud May 16, is first in a program of five to seven wells to test and appraise prior gas discoveries on the permit. The first two wells will be drilled before a rigless test crew is mobilized to the block.

Petroceltic is operator with 75% equity interest, and Algeria’s Sonatrach has 25%.

IndiaReliance Industries Ltd. and Niko Resources Ltd. reported exceptional reservoir performance as production has climbed to more than 900 MMscfd from 700 MMscfd in 7 days from the D6 development off eastern India.

Flow is expected to reach the target of 2.8 bscfd by yearend.

Meanwhile, the KG-D6 AR2 well in 1,844 m of water 5.7 km northwest of the KG-D6 R1 Late Miocene gas discovery went to TD 4,358 m and extended the R1 accumulation and enlarged its resource potential.

The KG-D6 BA2, at 80 km the farthest offshore well on the D6 block, targets the crest of a large anticlinal ridge feature that trends northeast-southwest across the entire block. The structure displays relatively late movement and trap closures that have formed in intervals that range from Early Pliocene to Cretaceous. The well is projected to 7,128 m in Upper Cretaceous.

The KG-D6 AS1 appraisal well is to go to 3,639 m in 1,791 m of water 11.2 km west of the KG-D6 R1 Late Miocene gas discovery.

TanzaniaMaurel & Prom, Paris, plans to spud an exploration well in August 2009 on the Delta Rufiji block in Tanzania.

The well is to probe the same formation in which the company discovered gas in the Mafia Deep well on the Bigwa Rufiji permit.

Meanwhile, the company drilled Mafia Deep ST-1 to 5,519 m and set a 360-m cement plug and 7-in. liner. Drilling will resume in order to evaluate the gas zone beneath the cement plug. Maurel & Prom operates the block with 70% interest.

UgandaTower Resources PLC said it is rigging up on 6,040 sq km Block 5 in northern Uganda using a rig transported from southern Sudan.

The Iti-1 exploration well in the Albert graben is expected to spud during the last week in May after the arrival of two further convoys of drill pipe and other equipment.

YemenCalvalley Petroleum Inc., Calgary, plans to drill six horizontal development wells in Hiswah field in 2009 and one exploration well each on the Ras Nowmah and Salmin prospects.

Both are projected to less than 1,500 m. Salmin is 5 km northwest of the Auqban discovery and targets a light oil carbonate structure. Ras Nowmah is between Hiswah and Al Roidhat fields.

The company is trying to resolve marketing issues to accelerate oil production from Block 9.

MississippiKFG Resources Ltd., Natchez, Miss., plans to redevelop Fayette field in Jefferson County, Miss.

The company is seeking permits for three wells to Eocene Wilcox at 4,000-5,500 ft based on results of 3D seismic shot in 2008.

The shallow development will precede the planned drilling of a 9,800-ft Lower Tuscaloosa well in the last quarter of 2009, KFG said.

The company holds 4,100 acres and has farmed out its working interests in all undeveloped acreage.

TexasEast

Goodrich Petroleum Corp., Houston, said its first horizontal Haynesville shale well tested at a rate of 7 MMcfd of gas on a 30/64-in. choke with 2,800 psi pressure.

Goodrich is operator with 100% working interest in the Williams-7H well in the Beckville/Minden area of Panola County, Tex.

Goodrich also has 50% working interest in two Haynesville wells operated by Chesapeake Energy Corp. in Bethany-Longstreet field in Caddo and DeSoto parishes, La. Branch 2H-1 tested at 14.3 MMcfd with 6,750 psi on an 18/64-in. choke, and ROTC 1H-1 tested at 14.1 MMcfd with 7,150 psi on an 18/64-in choke.