Bakken, Barnett, Manitoba fuel EOG’s liquids binge

EOG Resources Inc., Houston, is emphasizing North American liquids and natural gas plays as it develops and explores unconventional and conventional plays in US and Canadian basins.

A leader in horizontal drilling and multifrac application in shales, the company reminded followers May 5 that its “standard plays” are also performing well and provide a production support base.

The company raised the forecast liquids production 2.5 percentage points to a 5.5% increase in 2009, said Mark Papa, chairman and chief executive officer.

Papa expects company-wide production of crude oil, condensate, and natural gas liquids to grow to 75,000 b/d in 2009 and 90,000 b/d in 2010 compared with 61,000 b/d in 2008 and 43,000 b/d in 2007.

EOG, however, is also poised to capitalize when gas prices improve, Papa said.

“Practically speaking, we can grow our North American gas production at any annual rate between zero and double digit per-year growth for at least the next 7 years by simply deciding what level of capital to deploy each year. We already have the organic inventory captured at early-mover cost levels.”

Even so, EOG’s $3.9 billion 2009 capital budget is directed towards liquids investments.

Williston basin

A trend of increasing North American liquids production will continue for several years as the company’s horizontal oil plays begin to have greater effect, Papa said.

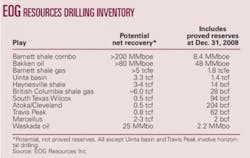

The company’s main liquids plays are the North Dakota Bakken, North Texas Barnett combo play, and an emerging play in a tight siltstone at Waskada field in Manitoba, Canada.

Papa said the company’s holding of 500,000 net acres is industry’s best position in the Bakken Trend.

Coming off of 2008’s service and supply price spike, EOG Resources restricted its Bakken oil production for the first 6 months of 2009 due to marketing issues. Initial potential of the Bakken wells it completed in 2008 averaged 1,700 b/d.

The company shrank Bakken drilling to eight rigs from 10 last year and deferred almost all completions until mid-2009 when fracs can be performed more economically and road conditions improve in the Williston basin (OGJ Online. May 6, 2009).

Bakken production is to ramp back up in June and be fully restored in July. A plan to ship Bakken oil by rail to Cushing, Okla., is to take effect in February 2010. This expected to improve netbacks vs. pipelining the oil to the Clearbrook, Minn., hub.

In southwestern Manitoba’s Waskada field, just north of the border with North Dakota, EOG Resources has drilled 29 successful horizontal wells and expects to build production from 1,900 b/d at present to 9,500 b/d by the end of 2012.

The producing formation is a tight siltstone with an underlying water zone, Papa said.

Vertical wells yielded very low recoveries, but EOG Resources has booked 2.2 million bbl of reserves as of the end of 2008 and expects to ultimately recover 25 million bbl from the field due to the technology advance.

Barnett shale

EOG Resources’ net liquids production from all Barnett shale plays is to grow from 12,000 b/d at present to 21,000 b/d in 2010 and more than 42,000 b/d by 2012, Papa said.

The company’s 2009 plan is to drill 60 wells in the combo play. It averages 11 Barnett rigs this year, down from 24 in 2008.

The average combo well IP is 300 b/d of oil, 940 Mcfd of gas, and 130 b/d of natural gas liquids.

A gas processing plant came on line in February 2009.

Pattern work in the Barnett combo play in Montague County involves drilling and simultaneously completing groups of 4-8 wells, and 12 first quarter 2009 completions turned in 30% direct after-tax rates of return at current Nymex prices. EOG Resources controls the vast majority of the combo acreage.

Other plays

EOG Resources is still finding many successful vertical plays, Papa said.

These plays act as a support base that contributes to company-wide volume growth.

One example is the Travis Peak stack and frac play in East Texas, where the company has captured 800 net bcf of ultimately recoverable gas at $1.65 Mcf direct finding cost. It expects to develop the play in the next few years.

EOG Resources has an inventory of 13,250 drillable locations and 12,250 other probable locations in its North American plays. Papa said 59% of the locations are to be horizontally drilled, and 100% of the locations are horizontal in the Barnett gas and combo plays, Midcontinent area, and Appalachian and Horn River basins.