OGJ Newsletter

Alaska lawmakers asked to fund in–state gas line

Alaska Gov. Sarah H. Palin urged state legislators Apr. 17 to approve $9 million in preparatory funding for pipeline work in an effort to avoid delays in constructing an in–state natural gas pipeline system.

Her action came after some members of the state’s House Finance Committee expressed concern the preceding night that the governor’s administration had not adequately communicated its position on an in–state gas pipeline.

Originally proposed as part of the huge proposed project to move gas from Alaska’s North Slope to markets in the Lower 48 states, a system to bring gas to the state’s widely scattered communities has attracted growing support as a stand–alone project from several government officials in the state.

“My focus is Alaska, and this administration has not shifted from our top priority: commercializing natural gas for Alaskans,” Palin said. “This session we have been working diligently to address statewide energy needs, and the in–state gas pipeline project is a critical component of that effort. I appreciate lawmakers’ assistance in moving this effort along.”

Members of her administration have testified before state legislative committees, and the proposed project’s manager, Harry Noah, has conducted open working groups with legislators, she noted. Palin said she also has met with Alaska House and Senate leaders to discuss plans to jump–start an in–state gas pipeline development.

Palin said she introduced two in–state gas development bills, HB 163/SB 135 and HB 164/SB 136, which have been heard in House and Senate energy committees. The House and Senate have passed several in–state gas resolutions, and the House amended HB 44 on Apr. 14 to include language for HB 163, the governor’s bill, to expand the Alaska Natural Gas Development Authority’s powers, she said.

The $9 million of funding would advance the proposed project through the second phase of a four–phased plan to develop an in–state gas pipeline, which her administration presented on Mar. 3, Palin said. Her office distributed an overview of the plan to House Finance Committee members Apr. 17, she said.

Texas wholesaler, officials plead guilty to charges

A Texas oil wholesaler and two of its executives pleaded guilty to violating the federal safe drinking–water law, the US Department of Justice said Apr. 16.

Texas Oil & Gathering Inc., its owner John Kessel, and its operations manager Edgar Pettijohn pleaded guilty to violating the Safe Drinking–Water Act for disposing of oil–contaminated waste water from its refinery process at an underground injection well permitted to accept wastes only from exploration and production operations, DOJ’s Environment and Natural Resources Division said.

It said the Alvin, Tex.–based company also pleaded guilty to conspiracy and violating the Resource Conservation and Recovery Act (RCRA) for disposing of waste at a facility that did not have a permit. The crimes took place from January 2000 through January 2003, DOJ said.

The defendants misrepresented that the wastewater it was disposing at a Rosasharon, Tex., injection well came from an oil well the company had leased and was developing when the waste water actually came from various refinery and chemical liquids Texas Oil & Gathering had reclaimed, federal prosecutors said.

The government began to investigate after the well exploded and killed three workers. Although the defendants did not cause the blast, a closer review of waste in the well led to their prosecution, DOJ said.

It said that Texas Oil & Gathering faces a maximum $500,000 fine or twice the monetary gain or loss for the conspiracy count, and $50,000/day, twice the gain or loss, or $500,000, whichever is higher, for the RCRA count. Kessel and Pettijohn face up to 8 years in prison and a fine as high as $500,000, it added.

The pleas were entered in US District Court for Texas’ Southern District. Judge Keith P. Ellison scheduled sentencing for Sept. 15.

Producers settle air pollution charges in Utah

Six independent producers agreed to spend $6.4 million to comply with the US Clean Air Act at their eastern Utah natural gas production facilities, federal regulators said Apr. 17.

The three settlements with Bill Barrett Corp., Wind River Corp., XTO Energy Inc., Dominion Exploration & Production Inc., Whiting Oil & Gas Corp., and Miller Dyer & Co. mandate air pollution reductions and conservation practices at the companies’ wellheads, pipelines, and compressor stations, the US Environmental Protection Agency and Department of Justice said in a joint announcement.

They said the agreements cover operations on the Uintah and Ouray Indian Reservation near Vernal. They were filed in federal district court in Salt Lake City.

The $6.4 million of outlays include retrofitting pneumatic controls with lower emitted components, reviewing processes to increase gas recovery and reduce air emissions at compressor stations and wellsites, installing low–bleed or no–bleed pneumatics, and controlling emission sources such as large engines, gas dehydrators, and condensate tanks at all new facilities constructed in the next 5 years, the federal agencies said.

It also includes shale–plating all future access roads, spending $100,000 to fund two ambient air monitoring stations’ operation and maintenance for a year, and using less polluting and more energy–efficient technologies in pilot programs, they added.

The companies also agreed to pay $632,000 in fines and to spend $200,000 on supplemental environmental projects, EPA and DOJ said. They said complaints, which were filed along with the settlements, alleged that the producers violated hazardous air pollutant emissions standards; federal permitting, emissions monitoring, and reporting requirements; and other Clean Air Act provisions.

EPA said Dominion E&P and Miller Dyer came forward and discussed their violations under the agency’s self–audit program. All of the producers cooperated to resolve the violations, it noted.

The investments will reduce air pollution by more than 1,300 tonnes/year and conserve enough gas to heat 1,080 homes/year, according to EPA.

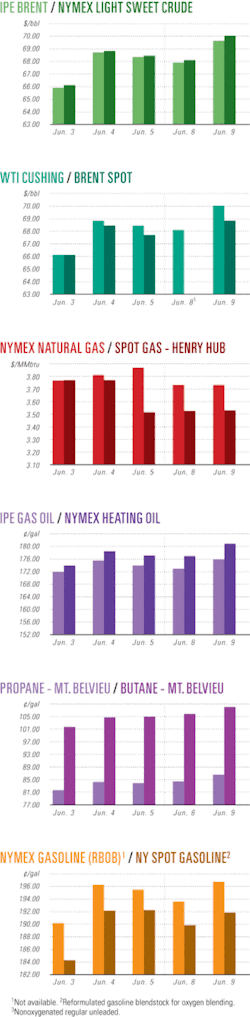

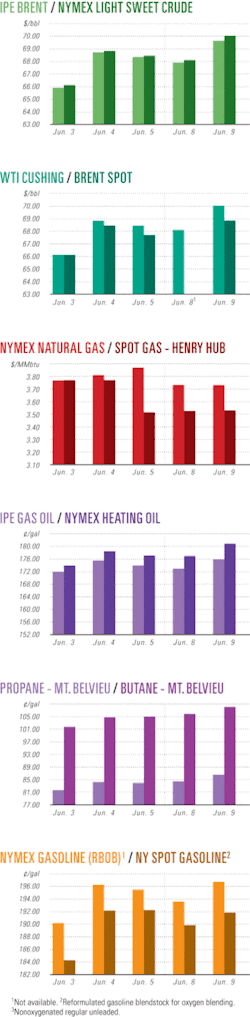

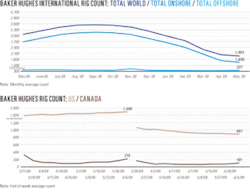

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesExxonMobil moving in rig at Point Thomson

ExxonMobil Production Co. has mobilized the drilling rig for the Point Thomson Project.

The rig, owned by Nabors Alaska, has been upgraded to drill the high pressure wells at Point Thomson. It was moved from Deadhorse to the drilling site in modules, some weighing more than 1 million lb.

No permanent roads exist to Point Thomson, so Fairweather E&P Services Inc. and Nanuq/AFC constructed more than 30 miles of ice road to enable the transport of heavy equipment and materials while protecting the North Slope environment. Most of the ice road follows the Beaufort Sea shore.

The Alaska Department of Natural Resources authorized the ice road permits on Jan. 27, 2009, allowing mobilization of the rig, and provided guidance to other regulatory agencies to expedite permitting to allow drilling to begin.

Craig Haymes, Alaska production manager for ExxonMobil, said, “We are moving forward with drilling and development activities at Point Thomson, for the mutual benefit of Alaskans and the Point Thomson Unit working interest owners. DNR staff and other local, state, and federal agencies have worked tirelessly to process permits necessary to allow drilling to begin.

“We are on schedule to begin production at Point Thomson by yearend 2014 and look forward to working with the state to resolve the remaining Point Thomson issues to ensure the project schedule is not impacted.

“Construction crews recently completed the final installation of camps and support facilities at the existing gravel pad to accept the rig. Over 250 people will work on these drilling operations, with an average of over 500 people at yearend 2014, when we expect to begin production,” Haymes said.

The initial phase of the project will process 200 MMcfd of Point Thomson gas in order to produce 10,000 b/d of condensate into the Trans–Alaska Pipeline System by the end of 2014. The remaining gas will be recycled into the Point Thomson reservoir.

The Point Thomson Unit working interest owners committed $120 million to the drilling and development activities in 2008, with additional investments of about $250 million expected in 2009.

In addition to ExxonMobil, the other major Point Thomson owners participating in the current drilling and development activity include BP Exploration (Alaska) Inc. and ConocoPhillips Alaska Inc.

EnCana boosts Haynesville shale activity

EnCana Corp., Calgary, has a $580 million program to drill 50 Haynesville shale gas wells in East Texas and North Louisiana in 2009.

The company reported encouraging results from its own drilling and those of other producers, and the 2009 program will enable it to improve its understanding of the play, further evaluate its lands, and retain prospective acreage.

To facilitate unrestrained market access for its gas, the company has committed to supply 150 MMcfd on the proposed Gulf South pipeline expansion and 500 MMcfd on the proposed ETC Tiger pipeline.

Meanwhile, EnCana chalked up a 50% production increase in the Deep Bossier play in East Texas, where it averaged 409 MMcfd of production in the first quarter compared with an average of 334 MMcfd for all of 2008.

EnCana drilled 15 wells in the first quarter and 78 in all of East Texas in 2008.

Initial 30–day production rates in Amoruso field averaged more than 19 MMcfd, and the Charlene–1 well completed in January flowed at more than 50 MMcfd on initial tests.

Horn River drilling, gas plant take shape

EnCana Corp., Calgary, and its partner Apache Corp., Houston, have adopted a more efficient way to develop gas in the Horn River basin shales of Northeast British Columbia, EnCana said.

The companies hope to be able to drill fewer wells by increasing the number of fracs per horizontal leg to as many as 14 from the eight initially planned.

The companies will drill 12 wells in 2009, down from 20 originally planned.

EnCana is to build the Cabin gas processing plant 60 km northeast of Fort Nelson, BC, on behalf of industry co–owners that are major landholders in the basin. Its first phase is due in service in the third quarter of 2011. Initial capacity is 400 MMcfd, and the plant will be expanded in stages as the basin’s gas production grows.

Salazar announces OCS revenue shares

Six US coastal states will share nearly $500 million from offshore oil and gas revenues in fiscal 2009 and 2010 to help restore and protect coastal wetlands, wildlife habitat, and marine areas, US Interior Secretary Ken Salazar said on Apr. 20.

Salazar said Alabama, Alaska, California, Louisiana, Mississippi, Texas, and their coastal local governments will have access to the money authorized under the 2005 Energy Policy Act (EPACT), which is allocated based on each state’s qualified Outer Continental Shelf revenues generated off its coast.

The distributions will take place under the Coastal Impact Assistance Program, which was created under EPACT and is administered by the US Department of the Interior’s Minerals Management Service.

In each of the two fiscal years, Louisiana will receive $121 million, Alaska $37.5 million, Texas $35.6 million, Mississippi $23.8 million, Alabama $19.7 million, and California $5 million. Portions of the money will go directly to 67 coastal political subdivisions, DOI said.

It said that Alaska’s allocation rose more than 1,500% from the minimum in 2007 and 2008 because of about $2.6 billion of bonus payments in OCS Lease Sale No. 193 in the Chukchi Sea, held in February 2008, and variability of production in the Gulf of Mexico due to recent hurricanes.

Drilling & Production Quick TakesBP ramps up Thunder Horse production

BP America has ramped up production by more than 100,000 boe/d from its Thunder Horse platform in the deepwater Gulf of Mexico through new wells.

Last month, the $1 billion platform produced more than 300,000 boe/d from seven wells. In December, production was over 200,000 boe/d from the third and fourth wells, signaling completion of commissioning and full operation. Thunder Horse now accounts for 1 of every 6 bbl of oil produced in the US.

Another two wells are to be added later this year to Thunder Horse, the gulf’s largest deepwater producing asset, which is 150 miles southeast of New Orleans. The additions are key to boosting BP’s future production in the area.

Designed to process 250,000 b/d and 200 MMcfd of gas, Thunder Horse produced its first shipment of oil last June. Operations with the technologically innovative project had been delayed by years due to technical problems and hurricanes. The field was originally discovered in 1999 in a reservoir 3 miles beneath mud, rock, and salt with pressures of 13,000–18,000 psi and temperatures of 88–135° C.

The Thunder Horse semisubmersible platform is in 6,050 ft of water on Mississippi Canyon Blocks 778 and 822. It has a deck load capacity of 40,000 tonnes. Production–drilling–quarters (PDQ) functions enable drilling subsea wells from the platform and processing production from the wells. Subsea wells are connected to production manifolds on the seafloor and then to the PDQ via riser flowlines.

Production is delivered to existing shelf and onshore pipelines via the Proteus and Endymion oil pipeline systems and the Okeanos gas pipeline system, which are part of the Mardi Gras Transportation System, the highest capacity deepwater pipeline system ever built.

BP operates the asset with 75% ownership, and ExxonMobil Corp. has 25%.

Premier signs Shelley field FPSO deal

Premier Oil PLC plans to continue development of Shelley oil field in the UK North Sea after signing a memorandum of understanding with Sevan Production UK Ltd. to use the floating production, storage, and offloading system.

Premier Oil is purchasing Oilexco North Sea Ltd. (OSNL), former operator of Shelley, which announced insolvency in January after failing to secure finance for its development program (OGJ Online, Mar. 27, 2009).

Shelley, now being drilled, is expected to produce more than 30,000 b/d starting in summer with the Sevan Voyageur FPSO, which is already moored at the field.

Sevan expects to operate the FPSO and receive reimbursement for the operating cost and a tariff payment based on actual monthly revenue from oil production from the field. “Work will now commence towards conclusion of a fully termed agreement,” said Premier Oil.

Timing of Shelley’s production depends on the availability of diving support vessels.

OSNL’s creditors approved a company voluntary arrangement that will help in the $505 million sale of the company to Premier Oil. It is awaiting approval from its shareholders, among other measures, before the deal can be finalized.

Sevan Marine licenses FPSO technology

Sevan Marine ASA has agreed to license to Eni Norge AS the technology required for its circular floating production, storage, and offloading vessel that will process oil and gas from Goliat field in the Barents Sea.

Sevan Marine’s 1000 FPSO will have an oil production capacity of 100,000 b/d, gas production of 3.9 million cu m/day, and oil storage capacity of 1 million bbl. Subsea wells will be linked to the FPSO, with flowlines and risers scheduled to be installed in June–July 2010 and May–August 2011. The field will start production in 2013 and is expected to produce for 15–20 years.

Eni in March awarded the postfeed engineering contract to Sevan for the FPSO, but it has not yet selected a contractor for the engineering, procurement, and construction work (OGJ Online, Feb. 9, 2009).

Goliat is northwest of Hammerfest in 400 m of water. Eni is operator and holds a 65% stake, while StatoilHydro has 35%.

Processing Quick TakesMarsden Point refinery expansion under way

New Zealand Refining Co. Ltd. (NZRC) has begun construction on a 35,000–b/d expansion of its 107,000–b/d Marsden Point refinery.

The company is adding the capacity by modifying a 90,000–b/d distillation tower. The project, scheduled for completion by yearend, will eliminate the need to import resid as supplemental feed for a 30,000–b/d hydrocracker.

The Marsden Point facility is New Zealand’s only refinery.

In February, NZRC said one of its four major–company shareholders, Shell New Zealand Holding Co. Ltd., was reviewing ownership options, which might include divestment of its 17% interest.

Other major–company shareholders are BP New Zealand Holdings Ltd. 24%, Mobil Oil NZ Ltd. 19%, and Chevron New Zealand 13%.

The international companies are NZRC’s largest customers.

Aramco, Sumitomo to expand Rabigh JV

Saudi Aramco and Sumitomo Chemical Co. have signed a memorandum of understanding for phase two development of their $10.3 billion Petro Rabigh petrochemical joint venture.

The two firms signed the MOU to carry out a feasibility study to assess investments needed to expand Petro Rabigh’s existing ethane cracker for an additional 30 MMscfd of feedstock ethane, to build a new aromatics complex using about 3 million tons/year of naptha, and to construct other petrochemical units.

The study is to be completed by September 2010, while the new facilities are scheduled to start operating in the July–September quarter of 2014, if found feasible. The two firms are considering producing high–performance resins for autoparts, acrylic resins for LCDs, and about 10 other products at the new site.

The two companies’ joint Rabigh Refining & Petrochemical Co. began full–scale operations on Apr. 8, producing polyethylene and four other general–purpose resins for China and other Asian markets.

Transportation Quick TakesCrude oil port partners leave joint venture

A partnership to build a large offshore crude oil receiving terminal in the US Gulf of Mexico has dissolved.

Houston–based Enterprise Products Partners LP and TEPPCO O/S Port System LLC, an affiliate of TEPPCO Partners LP, have jointly withdrawn from the Texas Offshore Port System partnership in a disagreement with the third partner, an affiliate of Oiltanking Holdings America Inc.

Enterprise announced its decision Apr. 21; TEPPCO on Apr. 16.

Enterprise and TEPPCO each relinquishes its one–third interest, forfeits its initial investment, and has taken a one–time noncash charge of $34 million against second–quarter 2009 earnings.

In August 2008, affiliates of Enterprise, TEPPCO, and Oiltanking Holding Americas Inc. formed a joint venture to design, construct, own, and operate a new Texas offshore crude oil port and pipeline system for delivering waterborne crude to refining centers along the upper Texas Gulf Coast.

TOPS was to include an offshore port, two onshore storage facilities with about 5.1 million bbl of crude storage capacity, and an associated 160–mile, 1.8 million b/d pipeline. Total cost of the project was estimated at $1.8 billion.

According to nearly identical press releases from both companies, Oiltanking has responded by alleging that the dissociation is wrongful breach of the TOPS partnership agreement. Both companies say their actions “are permitted by, and in accordance with, the terms of the TOPS partnership agreement,” and they will, “should the need arise,…vigorously defend” their actions. At presstime Apr. 22, a promised statement from Oiltanking had not been issued.

Arrow’s CSM–LNG proposal gets approval

Brisbane–based Arrow Energy Ltd. and its partner Liquefied Natural Gas Ltd. of Perth have taken another step towards building the world’s first coal seam methane (CSM)–to–LNG plant following Queensland’s approval of the group’s environmental impact statement (EIS) for the proposed Fisherman’s Landing plant site near Gladstone, Queensland. The approval completes the EIS process and enables the partners to progress to development approvals stage.

Five specific approvals are now needed to enable a final investment decision to be taken on the project by yearend.

The group also is working with the Gladstone Ports Corp. to obtain access to the site so that early preparation works can begin in October. The overall plan involves construction of a 450 km pipeline from Arrow’s CSM fields in the Surat basin of southeastern Queensland to Gladstone where LNG Ltd. will build the initial 1.5–million–tonne/year LNG plant at Fisherman’s Landing. A second train of similar capacity also is planned.

Arrow will have primary responsibility for the CSM development, while LNG Ltd. will focus on the plant development.

Arrow can acquire up to 20% interest in the Fisherman’s Landing facilities and also has an option to acquire a 50% stake in any other CSM–LNG plants subsequently developed.

The scheduled on–stream date for the first train is 2012.

AGA Gas awards LNG terminal contract

AGA Gas AB plans to import LNG through a small scale terminal 55 km south of Stockholm by May 2011, a company spokesman told OGJ. The terminal with capacity to process 300,000–400,000 tonnes/year of LNG will be at Brunnsviksholme outside Nynashamn. It will be supplied with LNG from the Skangass liquefaction plant in Stavanger, which has a capacity of 300,000 tonnes/year, and other terminals in Europe.

“Our terminal will have 20,000 cu m of storage capacity,” said the company representative. “We have awarded the construction contract of the terminal to NCC Construction Sweden.”

A new LNG tank will be built in slip form 33 m high and 38 m in diameter. It is expected to be finished during the first half of 2010. The terminal and tank will cost 275 million Swedish Krona.

“The terminal…will be the first of its type in Sweden and will facilitate the utilization of natural gas in Central Sweden. Fortum, among others, will use the natural gas to replace petroleum for city–gas production in Stockholm and the Nynas refinery will use the natural gas in its production of hydrogen gas,” said NCC Construction. The harbor for the terminal will receive tankers 160 m in length with a depth of 9 m. “These will be ships with a capacity of 50,000 cu m,” the AGA Gas spokesman told OGJ.

A 100–m bridge will connect Brunnsviksholme with the mainland. The contract also includes construction of a service building, an access road to Norviksvagen, a vehicle bay for receipt of LNG, and some ground work.