Russia redesigns fiscal policy to boost oil E&P

This article is the second of two parts addressing the challenges facing Russia’s oil and gas industry. In Part 1, executives from Rosneft, Lukoil, and Gazprom Neft outlined the excessive taxes and duties that eat into operating expenses and obviate exploration efforts (OGJ, Mar. 9, 2009, p. 27). This article explains the actions the government is taking to address those problems and to encourage exploration and production.

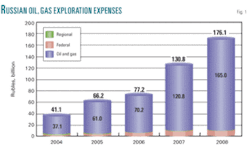

Since 2004, private Russian oil and gas companies’ exploration expenses, in nominal terms, increased 4.4 times, reaching 165 billion rubles in 2008 ($6.7 billion; Fig. 1). Despite this major inflation of costs—more than 30% in 2008—actual work accomplished remained almost flat. This is explained partly by the rapid decline in the price of crude oil and the expansion of the global financial crisis. However, the major reasons for decreasing exploration attractiveness are an unfavorable fiscal system and the absence of stimulus for the regions to finance exploration activities.

The Russian Federation’s Ministry of Natural Resources and Environment (MNR&E) is paying close attention to these conditions and is developing and implementing economic instruments to stimulate activities in the industry.

Among the ministry’s major responsibilities, it ensures rational subsoil use, allocates mineral rights, classifies new oil and gas reserves, conducts geological studies, and provides oversight for exploration efforts and oil and gas production.

Since 2005 the ministry has revised and approved a long-term program of geological study and mineral resource-base restoration to 2020. According to the program, during 2005-20, Russian exploration expenditures should reach about 4.5 trillion rubles (more than $180 billion), from which oil and gas would account for 88%.

The ministry believes that about 90% of total expenditures should be private, and it is keen to stimulate these companies’ exploration activity. To stimulate exploration, MNR&E proposes several actions:

- It proposes introduction of tax credits or deductions for exploration expenses against the mineral extraction tax (MET).

- It proposes to allow regions to collect a share of auction revenues for areas explored at their own expense.

The first measure, a direct stimulus for private investments, is new for Russian tax legislation and may sufficiently increase exploration attractiveness. The other, in addition to generating higher spending, may improve exploration efficiency as knowledge of local geology may be better at the regional level.

Amendments to the Subsoil Law in 2008 define “strategic oil fields” as oil fields containing reserves of more than 70 million tonnes and strategic gas fields as having reserves above 50 billion cu m or that are located offshore.

If foreign investors discover strategic reserves and the Russian government decides to withdraw the license, the investor will get full cost recovery (bonus and exploration expenditures) plus a reward.

Foreign investors may further participate in the development of strategic fields through joint ventures as minority stakeholders while operatorship is granted to state-controlled companies. From the ministry’s prospective, clear rules and fair rewards should compensate foreign investors for restrictions in accessing strategic reserves.

Reclassification

New Russian oil and gas reserves classification should be implemented in 2012. The idea is to harmonize the existing system inherited from the Soviet era with internationally accepted standards. The major reason for modifying the current classification is to introduce economic principles into the methodology of recoverable reserves calculation.

Since the beginning of the work on new classification, one of the most popular questions was whether Russia should modify its existing system or just switch to some widespread standard such as is used by the Securities and Exchange Commission (SEC) or the Society of Professional Engineers’ Petroleum Resources Management System (SPE PRMS). While very tempting, the latter seems inappropriate for Russia, mainly because of the difference in its purpose. Classifications for financial markets (e.g., that used by SEC) is designed to improve the quality of financial reporting, help raise capital, and create fair market value. International classifications such as SPE PRMS are used by oil companies for investment planning, portfolio management, development plans, raising capital, and in mergers and acquisition activity.

Governmental classification should serve the following, somewhat different purposes:

- Accounting for the country’s reserves balance.

- Managing an efficient resource base.

- Controlling and stimulating rational subsoil usage.

- Developing oil and gas industry infrastructure.

- Improving subsoil and tax legislation.

- Promoting market capitalization growth of domestic companies.

Although hundreds of different classifications exist simultaneously in the world, the general trend is a global unification. Thus SEC will adopt most of the SPE PRMS principles in 2010, and Norwegian classification has been closely aligned with SPE since 2001. For Russia, however, it will be more efficient to modify its existing classification to incorporate economics and a project-based approach but leave some degree of freedom in treating conditional resources and defining economic assumptions to better reflect national goals.

Production decline

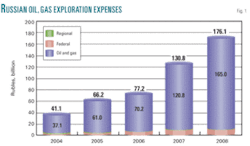

Since 2004, upstream oil investments increased 2.8 times—to 723 billion rubles in 2008 from 260 billion rubles (Fig. 2). Such impressive dynamics resulted both from activity growth and from cost escalation. High base decline rates in mature provinces (about 20% in West Siberia) force companies to increase drilling to keep production flat, while strong demand for oil field services and pipes drives cost inflation. Nevertheless, Russian oil production decreased in 2008 for the first time after 8 years of continuous growth despite a 30% increase in upstream capital expense.

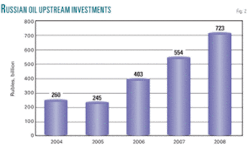

To stimulate upstream expenditures, it is necessary to improve the investment climate, in particular, the fiscal regime. Major changes occurred in 2002 when the mineral extraction tax (MET) was introduced and Russian oil taxation became essentially revenue-based. Export duties and MET account for about 95% of total tax payments by oil producers, with the tax burden exceeding 68% of gross revenue. The system has been very effective for rent collection and worked well for mature projects with low finding, development, and lifting costs. However, due to their nature and because neither MET nor export duties reflected rapid cost inflation and foreign exchange dynamics, they failed to stimulate upstream investments. It is no wonder that, since 2005, upstream free cash flow decreased despite oil price growth (Fig. 3).

Encouraging investment

To improve the investment climate, the Russian government introduced several tax initiatives in 2008. From Jan. 1 of this year, the MET threshold price increased to $15/bbl from $9, equivalent to a tax decrease of $1.3/bbl; the corporate income tax rate was cut to 20% from 24%; the DD&A (depreciation, depletion, and amortization) allowance grew to 30% from 10%; and MET holidays were extended to more Russian regions.

Further work may be completed in indexing export duties and MET for cost inflation and foreign exchange dynamics. But the right strategic decision will be a gradual decrease of revenue-based taxes in favor of profit-based ones. This is expected to be implemented for new prospective regions of oil production—Eastern Siberia and the continental shelf.

As for the new provinces, in addition to taxation other issues will matter. For example, the economics of projects in East Siberia will be strongly affected by tariffs on the East Siberia-Pacific Ocean (ESPO) pipeline, which have not yet been defined.

Another important issue is development of such basic infrastructure as transportation facilities. Several large oil producing centers such as Yurubcheno-Kuyumbinsky are located hundreds of kilometers from the main pipeline and must be linked to it via additional interconnectors. All of those factors may lead to delays in full-scale development of Eastern Siberia and to the decrease of Russia’s total production. In the midterm, ESPO will be partly utilized by up to 15 million tonnes/year of eastern oil from Talakanskoye and Verkhnechonskoye fields, while the rest should be provided by western oil from Vankor or Samotlor.

Financial solutions

Financial crises hit Russian oil producers heavily in fourth-quarter 2008 due to oil price declines and an export duty lag. The latter favored oil companies during periods of oil price increases but squeezed their income when the trend reversed. This was especially painful for small independents that have difficulties borrowing money and do not have refining capacity and thus can’t enjoy a healthy domestic products market premium over export netback parity. This critical situation prompted the government to revise its rules for export duty calculation by decreasing the monitoring period from 2 months to 1 month and moving it closer to the accounting period. The new tax relief should help the industry to overcome such crises in 2009.

Another important support comes from the ruble devaluation from 23 rubles/US dollar in mid-2008 to 33 rubles/US dollar in April 2009. Because most of the operating and capital costs of Russian companies are ruble-nominated (except export duty and MET) while revenues are effectively in US dollars, this should improve upstream profitability considerably. In the current oil price and exchange rate environment, oil producers are expected to demonstrate good performance in 2009.

One of the highest priorities for MNR&E is stimulating rational subsoil use. With oil provinces maturing and oil recovery decreasing, there is a high proportion of idle and ownerless wells and evidence for selective reserves development.

One measure includes possible development of more small oil fields via MET differentiation. The exact parameters for a new tax formula will be defined after companies disclose their cost structure and true project economics.

Another challenging task is stimulating enhanced oil recovery techniques through deduction of investments in improved oil recovery against MET. Such an instrument may be implemented only if companies prove the efficiency of their applied methods. MET redemption for production of idle wells may be used if separate metering exists for those wells.

Flaring solutions

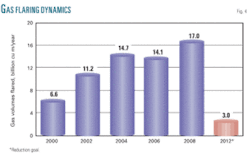

Gas flaring is a well-known problem for Russia. According to official estimates, annual flaring exceeds 17 billion cu m/year, but this number is not very accurate due to poor associated gas production measurement. For example, fewer than 50% of flares are equipped with flowmeters.

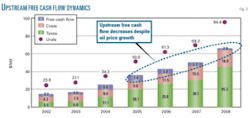

To decrease emissions and use the components of gas that otherwise would be flared, the Russian government established a goal of achieving a 95% utilization level for associated gas by 2012 (Fig. 4). To stimulate investments in gas utilization programs, the government will impose penalties on emissions caused by flaring volumes exceeding the limit after 2012. Higher rates will be levied if direct measurement systems are absent.

However, this may not work for small oil fields due to the high cost of implementation and resulting poor economics. To solve that particular problem, it is suggested that several companies pool utilization programs on a regional basis.

All additional economic instruments proposed for fine-tuning the current tax system impose strict requirements on tax administration, metering, control, and financial transparency. The efficiency of their implementation will depend strongly on the trustworthiness between business and government. That’s why MNR&E works closely with oil companies while creating a favorable environment for exploration, development, and production in a rational and mutually beneficial manner.

The author

Grigory Vygon is director of the department of economy and finance at the Russian Federation’s Ministry of Natural Resources and Environment. Before joining the ministry, he worked as a chief economist for TNK-BP. He also served as director of the corporate finance department for the Institute for Financial Studies and for other financial companies. Vygon graduated with honors in 1996 from Moscow Institute of Physics and Technology, Department of General and Applied Physics. In 2000 he defended his dissertation in central economics and mathematics at the Institute of the Russian Academy of Science with his thesis “Methods of oil companies evaluation under uncertainty.” His scope of major activity is economics of natural resources and environmental management. Professional and scientific interests are companies’ and investment projects evaluation, taxation, and pricing in commodity and financial markets, derivatives, and auctions.