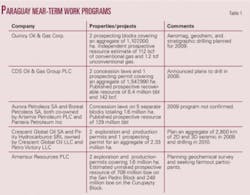

Nonproducing Paraguay’s potential conventional and unconventional

A number of external factors have come together to provide many opportunities for growth for the fledgling hydrocarbon industry in Paraguay. These include higher gas prices regionally coupled with increasing demand, particularly in Argentina, Brazil, and Chile, all of which plan to import liquefied natural gas at world prices and at great capital cost.

Paraguay consumes the equivalent of 30,000 b/d of oil as refined products such as gasoil, gasoline, lubricants, and aviation fuel, all of which are imported.

It is hoped that with proposed drilling by CDS Oil & Gas Group PLC in 2009 there will be success in finding oil in commercial quantities that can be produced for refining at the government owned 7,500 b/d Petropar refinery at Villa Elisa near Asuncion. This would reduce refined product imports and conserve hard currency.

If exploratory drilling for natural gas by any of the active exploration companies proved up commercial volumes, it might be possible to develop the gas fields, provide gas for domestic use, and build the pipelines needed to export gas to nearby markets.

Lack of production

Many have wondered why Paraguay has no oil or gas production.

They reason that the country should be productive because hydrocarbons have been produced for more than 75 years in Bolivia just to the west and for more than 25 years at Palmar Largo in Argentina a few kilometers south of Paraguay.

A combination of technical and financial factors in Paraguay influenced the oil companies that conducted the exploration in years past not to continue their efforts. Some of them were:

Exploration history

The first exploration well drilled for oil in Paraguay was in 1947 and the latest in 2005.

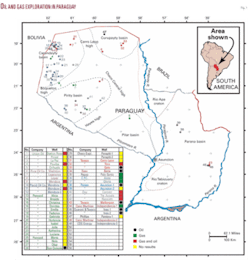

In the intervening 58 years only 48 wells were drilled by several international oil companies and two private Paraguayan companies (Fig. 1). During 1947-2008 the various companies acquired 21,434 line-km of 2D seismic data.

The Chaco basin is a large sedimentary basin located mainly in northwestern Paraguay and southeastern Bolivia. The portion in Paraguay is minimally explored.

Reprocessed seismic data since 2001, recent concepts in seismic stratigraphy and analysis, and interpretation of multiple data bases from several previous operators allowed for positive revisions to the geological model and hydrocarbon assessment of the Paraguayan Chaco basin. The revisions confirmed that five important aspects that are indicators of the potential presence of commercial hydrocarbons are present. These are adequate hydrocarbon sources, reservoirs, seals, trapping mechanisms, and migration timing.

Geology and potential

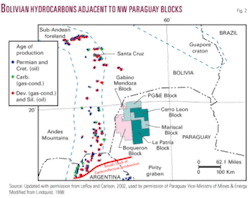

Production in adjacent areas of Argentina and Bolivia include the Chaco basin foreland in Bolivia and the Salta rift (also known as the Pirity graben, or Pirity subgraben in Paraguay).

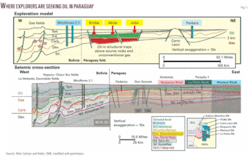

These areas produce from the same geologic formations as found in northwestern Paraguay. Fig. 2 is a summary diagram of northwestern Paraguay to illustrate these producing areas adjacent to Paraguay.

The incremental addition in Bolivia of more than 50 tcf of gas in 1999-2003 was partly the result of government incentives and privatization that are no longer in effect. The large gas reserve additions were mostly in the Carboniferous Escarpment, Tarija, and Tupambi intervals, and also the Devonian Huamampampa formation.

New technology also resulted in first production for Silurian and Cretaceous oil pools, mostly northeast of Santa Cruz, Bolivia. The source beds for these new reserves are the Silurian Kirusillas formation, the Devonian Los Monos and Icla formations, and a very minor Cretaceous oil source bed, the same source beds as are present in the Chaco basin of northwestern Paraguay.

Along the southwest boundary of northwestern Paraguay, Cretaceous oil production of 50 million bbl from 10 fields is sourced by an organic-rich shale, formed in Cretaceous lakes, in the Salta rift. Half the reserves are in one field, which supplied a portion of the crude oil for the refinery in Asuncion for many years.

A seismic line and an exploration model indicate the potential for shallow Carboniferous oil and deeper Devonian unconventional gas in northwestern Paraguay (Fig. 3).

Explorers are looking for Carboniferous oil in structural traps above the hydrocarbon source beds in Devonian and Silurian shales, which also contain unconventional gas accumulations. The diagram demonstrates extensional faulting in Paraguay, updip of the world-scale producing gas province in the Tarija basin foothills in southern Bolivia.

The concession blocks in Paraguay target reservoirs that are the same age as and at much shallower depths than those in Bolivia. As a result, Carboniferous rocks in Paraguay are oil-bearing. Devonian and Silurian rocks are mostly gas-bearing.

Above 2,000 m, oil is being generated in the Devonian today, as proved by geochemical data in wells. Below that depth, chemical reactions in the gas-generating window have changed previously generated oil to natural gas and continue to make natural gas from the available organic material in the rocks.

Outlook

The area-wide recovery potential for the Paraguayan Chaco basin, located east of the current production in Bolivia, was estimated in 2002 for the government of Paraguay by Earth View Associates, Houston, at more than 4 billion bbl of oil equivalent.

The US Geological Survey also released its own assessment in 1998.

Several factors render the Paraguayan Chaco basin attractive for hydrocarbon exploration and development. These include larger and growing markets for hydrocarbon products both domestic and for export to the neighboring countries of Argentina, Brazil, and Chile, significantly increased oil and gas prices since the early 1970s, improved infrastructure, and a positive political climate. Another big factor is decades of exploration success and production on the Bolivian side of the basin, which is regionally downdip of the Paraguayan Chaco basin.

Paraguay also has a favorable hydrocarbon law, 779/95, wherein concessions are granted and guaranteed by Congress. The production royalties and tax laws for investors offer benefits conducive to the high risk nature of oil and gas exploration and development.

New production techniques in the US Permian basin, the Montney producing area in Alberta and British Columbia, and especially the San Juan basin of northwestern New Mexico, prove that formations with unconventional reservoir properties can be commercial.

The biggest change is the large-scale production of unconventional gas in the US. By some government estimates, 40% of the production in the US is now from unconventional fields. In the past decade, new production techniques have extended commerciality to even more gas accumulations. The largest hydrocarbon resources in northwestern Paraguay are in unconventional Devonian and Silurian intervals.

The author

James Wade ([email protected]) is a cofounder in 2008 and CEO of Quincy Oil & Gas Corp., a private Canadian oil and gas exploration company with properties in the Paraguayan Chaco basin. He was a cofounder in 2002 of and is no longer associated with CDS Oil & Gas Group PLC, which has spent more than $30 million exploring the Paraguayan Chaco. He was a cofounder and chairman of the former Devran Petroleum Ltd., London, Ont., which achieved technical success in gravity assisted horizontal drainage of depleted oil reservoirs from an underground installation. He has more than 42 years in resource management and development and has worked on mining and oil and gas projects in Canada, China, Kazakhstan, Mongolia, Paraguay, Peru, Russia, and the US. He has a certificate of mining technology from Haileybury School of Mines and a BSc in mining engineering from Michigan Technological University.

ChileGeoPark Holdings Ltd., Hamilton, Bermuda, gauged a gas-condensate development well on its 100%-held Fell Block in Chile, where it has identified more drilling locations in the updip area of Monte Aymond field.

The company’s 2009 plans also call for the first drilling on the Tranquilo and Otway blocks in the Magallanes basin (see map, OGJ, Dec. 24, 2007, p. 36).

The Monte Aymond-33 well tested at 3.12 MMcfd of gas, 22.6 b/d of condensate, and 33.9 b/d of water with 654 psi wellhead pressure on a 12-mm choke from the Cretaceous Springhill formation. TD is 2,391 m. The well is to go on line in April.

ColombiaPetro Vista Energy Corp., San Clemente, Calif., acquired 100% interest in the VMM-13 block in Colombia’s Middle Magdalena basin.

Seismic and geological studies are to start in the first quarter of 2010 on the 118,816-acre block.

Meanwhile, Petro Vista signed two farmouts on its Morichito block in the Llanos basin. While remaining operator with 35% interest, the company will be reimbursed for past expenses and carried on three wells.

Drilling is to start in several weeks and will target the Carbonera C7 and Mirador formations at 3D seismic locations updip from the previously drilled Morichito-2 well, being abandoned as noncommercial. All permits are in hand, and road and pad construction is under way.

IndiaHardy Oil & Gas PLC proposed to revise the appraisal program for its Ganesha nonassociated gas discovery in the CY-OS/2 block off Pondicherry in the northern Cauvery basin off southeastern India.

Hardy, operator with 75% interest, would reduce the program to one firm and one contingent well from three firm and two contingent wells. Gas Authority of India Ltd. has 25%.

The companies are working with the Ministry of Petroleum & Natural Gas to extend the exploration license to 2012 to establish commerciality.

IrelandSerica Energy PLC expects to secure a rig shortly to drill the Bandon exploration prospect in PEL 01/06 in the Slyne basin off Ireland’s west coast.

Drilling on the large gas prospect is to start in May 2009.

Serica is operator with 50% interest, and its costs will be largely carried by RWE-Dea, which is taking a farmout to earn the other 50%.

Bandon is a gas prospect in Triassic Sherwood sandstone 45 km southwest of undeveloped Corrib gas field. Corrib, discovered in 1996, is 85 km off northwest Ireland with 800 bcf of recoverable gas in Sherwood at 3,000 m subsea.

ItalyAleAnna Resources LLC of Texas was awarded the Ponte del Diavolo exploration permit in northern Italy’s Po basin just west of its Corte dei Signori permit, where it just finished shooting 80 sq miles of 3D seismic.

Seismic identified several structures worth drilling, said Saxon Oil Co. Ltd., Dallas, which owns 20% membership interest in AleAnna. Drilling could start in late 2009.

AleAnna has applied for nine other exploration permits in Italy that are in various stages of government consideration.

NigeriaConsulting engineers estimated at least 52 million bbl and perhaps as much as 106 million bbl of oil is recoverable from Ebok field on OML 67 off southeastern Nigeria.

Operator Afren PLC said Ebok-4, fourth well in the field discovered in 1968, drillstem tested at 1,450 b/d of 20-25° gravity oil and cut 284 ft of high-quality reservoir sands at 2,560-3,718 ft.

Afren and Nigerian partner Oriental Energy Resources Ltd. are studying an early production system that could deliver 15,000-25,000 b/d in early 2010 from five or more horizontal wells and one water injection well (OGJ Online, Feb. 5, 2009). A second phase with eight more wells might boost output to 35,000-50,000 b/d.

UKVenture North Sea Gas Ltd. said logs at the 43/21b-5z Carna well in the UK North Sea indicate a gas column of more than 1,490 ft true vertical depth and 127 vertical ft of net pay.

The well, sidetracked to test a Carboniferous fault block, stabilized at 9 MMcfd of gas on a 48/64-in. choke from the target formation. No formation water was produced. Total depth is 11,500 ft measured depth.

The well is suspended pending further sidetrack to become a future production well. A field development decision is to be made after full evaluation of the data.

Carna prospect interests are Venture 56%, Ithaca Energy Inc., Calgary, 29.9%, and Dyas UK Ltd. 10.1%. Interests in the greater Carna area are Venture 40%, Ithaca 44.85%, and Dyas 15.15%.

AlbertaStealth Ventures Ltd., Calgary, moved its Cretaceous Colorado shale biogenic gas project at Wildmere, eastern Alberta, to a development play from an exploration play in 2008.

The company reduced capital spending 20% to $300,000/well to drill, complete, and tie in. The shales lie at 500 m or less in the area 120 miles east-southeast of Edmonton (OGJ, Mar. 17, 2008, p. 40).

Net December 2008 gas sales were about 3.1 MMcfd. Stealth drilled 81 wells in 2008.

The company has more than 400 development locations ready to drill and will resume drilling in the second half of 2009 to avoid spring breakup and limited access due to agricultural activity.