Looming Mideast olefin production may—or may not—spell oversupply

With an abundance of cheap feedstock, the Middle East is poised to become one of the world’s largest exporters of petrochemicals, targeting markets in Europe and Asia.

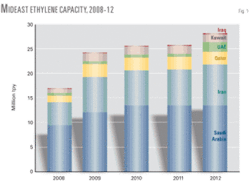

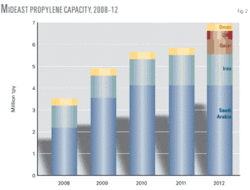

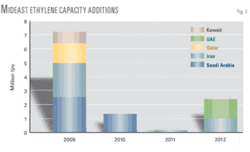

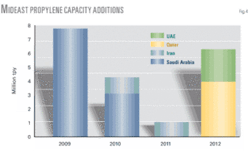

Currently, several new mega petrochemical projects are under construction in Saudi Arabia, Iran, Qatar, the UAE, and Kuwait. After the completion of these projects, Middle East ethylene production capacity will increase to roughly 28.1 million tonnes/year (tpy) in 2012 from 16.9 million tpy in 2008. Middle East propylene production capacity will increase to 7.0 million tpy in 2012 from 3.5 million tpy in 2008.

With global economic recession depressing ethylene and polyethylene demand, the new wave of petrochemical projects, especially those coming online in 2009, may face an oversupplied market.

Large capacity additions in the Middle East and Asia during 2009-12 combined with weakness in demand may affect the operating rate of petrochemical complexes in the Middle East, which is currently higher than 90%. This down-cycle will be difficult for Asian naphtha-based projects, especially the smaller ones (less than 300,000 tpy) that face relatively high operating and feedstock costs.

Although the availability of inexpensive gas prompted many companies to move forward with massive expansion plans, the region is facing new uncertainties in providing sufficient feedstock. This is a serious concern for new proposed projects, especially in Iran and Saudi Arabia.

At the same time, Middle East domestic natural gas prices are likely to increase as production costs have risen sharply. This may push governments to set higher prices for petrochemical feedstock. New feed-gas prices for petrochemical projects in Saudi Arabia could even top $2/MMbtu, well more than the $0.75/MMbtu seen in the past.

Even with higher feed-gas prices, Middle East petrochemical projects are still economical but certainly less attractive for new investment.

Ethylene, propylene production

Ethylene and propylene are the principal petrochemical products and a major feedstock for production of other polymers. The world’s largest expansion ever for the construction of new ethylene and propylene plants is taking place in the Middle East. These additions have a major influence on the global petrochemical industry in the near future.

Several new mega petrochemical projects are currently under construction at Jubail and Yanbu in Saudi Arabia, Bandar Imam and Assaluyeh in Iran, and Messaid in Qatar. Fig. 1 illustrates the growth of ethylene production capacity in the region.

For propylene, Middle East production capacity is likely to jump to 7.0 million tpy in 2012 from 3.5 million tpy in 2008, representing an average growth rate of 18%/year during 2008-12 (Fig. 2).

In 2009 alone, FGE expects a 7.3-million-tpy ethylene capacity increase, coming mainly from Saudi Arabia, Iran, and Qatar.

Saudi Arabia

Saudi Arabia will play the main role in propylene capacity increase in the region over the next 4 years. The country will add at least 1.4 million tpy of new propylene capacity in 2009.

It is the largest ethylene producer in the region with current capacity roughly 9.5 million tpy. Ethylene is being produced in such large Saudi petrochemical complexes as Sadaf, Yanpet, Kemya, United, PetroKemya, Tasnee, and Yansab.

Overall, propylene capacity in Saudi Arabia increased to 2.2 million tpy after completion of the Tasnee and Yansab petrochemical plants. Propylene is also being produced in other petrochemical complexes, such as Al-Fassel, Jubail Chevron Phillips, and PetroKemya.

The Saudi petrochemical sector will see a massive increase in ethylene and propylene production capacity, securing the country’s position as a leader in the global petrochemical industry. Jubail and Yanbu will be the focus of Saudi Arabia’s petrochemical development in the future.

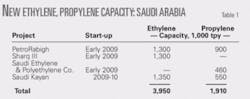

Currently, four key petrochemical projects are under construction in Saudi Arabia and are scheduled for completion during 2009-10. The new projects will add 4.0 million tpy of ethylene capacity. An additional 1.9 million tpy of propylene production capacity will be completed by 2010 (Table 1).

The recently built ethylene cracker owned by the Tasnee Petrochemical Co. (a joint venture of Tasnee, Basell, Sipchem, and Sahara) was completed in late September 2008 in Jubail. The complex is designed to produce roughly 1.0 million tpy of ethylene, 285,000 tpy of propylene, 400,000 tpy of high-density polyethylene, and 400,000 tpy of low-density polyethylene.

The Yansab complex was completed in late October 2008, adding more than 4 million tpy of petrochemical capacity, including 1.3 million tpy of ethylene, 400,000 tpy of propylene, 700,000 tpy of monoethylene glycol (MEG), 400,000 tpy of polypropylene, and 800,000 tpy of linear low-density polyethylene and HDPE as well as butane, benzene, and methyl tertiary butyl ether.

The first phase of the PetroRabigh complex, a JV between Saudi Aramco and Japanese company Sumitomo Chemical, is to start commercial production in second-quarter 2009. It will produce 1.3 million tpy of ethylene and 900,000 tpy of propylene. The plant is to produce 600,000 tpy of MEG as well. The feedstock is to be roughly 95 MMscfd of ethane and about 15,000 b/d of LPG, both provided by Saudi Aramco.

The Sabic Eastern Petrochemical Co. (Sharq III) is planning to bring its new unit on stream by early 2009, including 1.3 million tpy of ethylene, 700,000 tpy of ethylene glycol, 400,000 tpy of HDPE, and 400,000 tpy of LLDPE.

Another important petrochemical project is the Saudi Kayan mega complex. The Saudi Kayan petrochemical complex will be located at the industrial city of Jubail with a production capacity of 4.0 million tpy.

The complex will add some specialized chemicals to the Saudi marketplace that will be produced in the country for the first time. These products include aminoethanols, aminomethyls, dimethylformamide, choline chloride, dimethylethanol, dimethylethanolamine, ethoxylates, phenol, cumene, and polycarbonate. This is in addition to production of ethylene, propylene, polypropylene, ethylene glycol, and butene-1.

It should be noted that by 2012, Saudi Arabia’s petrochemical industry will raise ethylene production capacity to 13.5 million tpy and propylene production capacity to at least 4.1 million tpy.

Saudi Arabia also plans to invest more to produce ethylene and propylene beyond 2012. Dow Chemicals and Saudi Aramco signed a joint-venture agreement to build a petrochemical complex for producing 1.2 million tpy of ethylene, 400,000 tpy of propylene, 400,000 tpy of benzene, 460,000 tpy of paraxylene, and 640,000 tpy chlor alkali. Saudi Aramco plans to supply feedstock to the plant from its nearby 550,000-b/d Ras Tanura refinery and Ju’aymah gas processing plant. Target completion for the plant is 2013.

It should be noted that Saudi Aramco provides feed gas for petrochemical projects at a fixed price of $0.75/MMbtu, and the cheap feedstock is a great advantage for the petrochemical industry in Saudi Arabia.

Iran

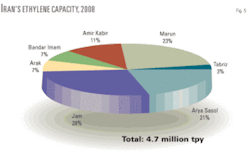

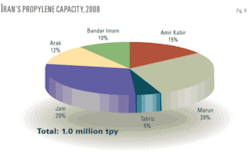

Iran represents the second major petrochemical player in the region. Currently, the country produces ethylene in Amir Kabir, Marun, Tabriz, Arya Sasol, Jam, Arak, and Bandar Imam. Current ethylene and propylene capacities are around 4.7 million tpy and 1.0 million tpy, respectively.

Figs. 5 and 6 illustrate Iran’s ethylene and propylene production capacities by project in 2008.

The Jam petrochemical complex is the largest ethylene producer in Iran with capacity of about 1.32 million tpy. The plant also produces 305,000 tpy of propylene, 216,000 tpy of pyrolysis gasoline, 444,000 tpy of ethylene glycol, and 600,000 tpy of LDPE and HDPE, and other products.

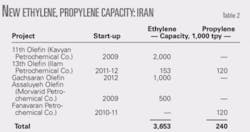

FGE forecasts that Iran’s combined ethylene and propylene production capacity will increase greatly after the completion of the new petrochemical projects (Table 2). By 2012, Iran’s ethylene production capacity will increase to 8.4 million tpy, while its propylene capacity will increase to 1.4 million tpy.

It should be noted that Iran has also announced a planned project for production of ethylene and propylene (Persian Gulf Petrochemical Co.). It is to be completed in 2014-15 and will produce 1.3 million tpy of ethylene and more than 1.0 million tpy of propylene.

Currently, Iran provides feed gas for its petrochemical projects in the range of $0.39-0.56/MMbtu (2008). The government’s projects are still paying $0.39/MMbtu, and new private projects pay $0.56/MMbtu for their feed gas. The feed-gas price is fixed with an annual escalation approved by the Iranian government. A price increase is expected, but a massive increase in the feed-gas price is unlikely, as the government tries to encourage industrial development in the country.

Qatar, others

Ethylene is being produced by two major petrochemical companies in Qatar with a total production capacity of 1.2 million tpy.

Qatar Petrochemical Co. (Qapco) and Qatar Chemical Co. (Q-Chem) are ethylene producers in the country. Qapco’s ethylene production capacity is roughly 720,000 tpy, while Q-Chem has a production capacity of 500,000 tpy. The companies plan several ethylene crackers but the most important project in the near term is a 1.3-million-tpy ethylene cracker in Ras Laffan, under construction by Technip. The project is to come on stream this year.

The country currently has no propylene production, but that is likely to change sometime in 2012-13 when a plant will come on stream with capacity of 700,000 tpy.

It should be noted that Qatar Petroleum has two agreements for construction of ethylene crackers, but construction has yet to start.

In 2005, Shell and Qatar Petroleum signed a letter of intent to build a 1.3-1.6 million tpy ethylene plant in Qatar. The project is still in negotiation and start-up is unlikely before 2013-14.

In 2006, ExxonMobil and Qatar Petroleum also signed a heads of agreement for construction of a 1.3-million-tpy ethylene cracker in the industrial city of Ras Laffan. The proposed petrochemical complex will include a worldscale,1.3-million-tpy steam cracker and associated derivative units, including LDPE (420,000 tpy), LLDPE (570,000 tpy), and ethylene glycol (700,000 tpy). Start-up of the new ethylene cracker is to be in 2013-14 at the earliest.

It should also be noted that feed-gas prices for Qatari petrochemical projects are extremely low, at around $0.50/MMbtu, giving great advantage to the petrochemical industry.

• UAE. Only ethylene is being produced in Abu Dhabi. The Brouge petrochemical company operates a 600,000-tpy ethylene plant in the Emirate. The second ethylene plant (Brouge 2) is under construction and will come on line in 2012. After completion of the project, total ethylene production in the country will increase to 2 million tpy.

• Kuwait. In September 2008, Kuwait’s ethylene production capacity was roughly 800,000 tpy. Equate Petrochemical Co. operates the ethylene plant.

In November 2008, an expansion by Equate allowed Kuwaiti ethylene production capacity to increase to 1.6 million tpy. The new ethane steam cracker is to produce ethylene at its plateau capacity during 2009.

• Oman. Oman is producing propylene at the Sohar refinery. The refinery operates in an olefin mode to enable it to produce roughly 327,000 tpy of propylene feedstock for the polypropylene plant owned by Oman Polypropylene LLC (OPP).

• Iraq. Currently, Petrochemical Complex No. 1 (PC1) in Khor al-Zubair, near Basrah, is producing ethylene with capacity to produce 130,000 tpy ethylene, 110,000 tpy of ethylene dichloride, 66,000 tpy of vinyl chloride monomer, 60,000 tpy of polyvinyl chloride, and 90,000 tpy of LDPE and HDPE. The plant, however, is operating below its nameplate capacity and needs rehabilitation.

Feedstock challenges

It should be noted that low gas prices in the Middle East provide an attractive environment for gas-based petrochemical projects, which is a great advantage for Middle East petrochemical producers. Naphtha-based ethylene in Asia is much more costly than ethane-based ethylene in Saudi Arabia.

Middle East ethylene producers, however, will face several challenges. The first is uncertainty in securing feedstock, which has become a serious concern for new projects, especially those in Iran and Saudi Arabia.

Except for the Karan gas project, which could provide 1.5 bscfd of dry gas for new industrial projects 2011-12, the prospects for nonassociated production in Saudi Arabia indicate a likely unmet supply for new petrochemical projects. In fact, construction of a new 2-million-tpy ethylene cracker by the NEOS/Delta Oil Co. was put on hold due to feedstock issues.

In Iran, a massive gas shortage, especially in winter 2007, interrupted gas supply for many petrochemical projects. This gas shortage will likely continue during 2008-12.

Delayed South Pars gas projects will affect gas and ethane supplies to Iranian petrochemical projects. The most critical concern appears to be for new polyethylene units in the west and northwest of the country. It should be noted that new projects in these areas will receive their feedstock by a 2,163-km ethylene pipeline (the West Ethylene Pipeline).

This project, now only 50% complete, was due to be completed in 2007. The initial plan was for construction of five petrochemical complexes along the pipeline. Now, however, the number of complexes has increased to 11 projects. The availability of feedstock from the West Ethylene Pipeline is a serious challenge.

In Oman, recently, a new gas-based olefin plant at Sohar was cancelled or postponed because of gas-supply obstacles. In the UAE and Kuwait, gas supply to petrochemical plants has become a critical problem because the countries have a massive gas shortage, especially in the summer.

Market implications

The global olefin market will be oversupplied in the near term, and this will likely depress market prices. Middle East olefin suppliers, however, will be less affected than Asian petrochemical producers because the Middle East has access to relatively low-priced feedstock. In Asia, small naphtha-based projects (less than 300,000 tpy) will be most affected.

For new projects, the era of extremely low feed-gas prices is over. Governments in the Middle East, however, are not expected to increase feedstock prices dramatically because they want to encourage industrial development. The new range of feedstock prices may be $1.5-2.0/MMbtu and still allows projects to move forward economically. Some new projects will be less attractive when compared with the past.

The author

Siamak Adibi ([email protected]) is a senior consultant and head of the Middle East gas team for FACTS Global Energy. He specializes in natural gas and LNG with a focus on the Middle East and CIS. Adibi holds an MA in energy economics from Tehran’s Azad University and was previously employed with the National Iranian Gas Export Co. (NIGEC) 2003-06.