OGJ Newsletter

Alberta offers incentives to boost drilling

Alberta oil and gas producers have been offered royalty incentives from a provincial government hoping to revive drilling.

The government has reduced royalty for conventional wells spudded between Apr. 1 and Mar. 31, 2010, and for wells coming onto production in that period.

The drilling incentive is a crown royalty credit of $200/m of hole drilled. The credit can’t reduce an operator’s overall royalty rate to below 5%.

Benefits will be greatest for the smallest producers, determined by a sliding scale based on production.

New wells eligible for the production incentive will receive a maximum royalty rate of 5% for 12 calendar months or until production reaches 50,000 bbl of crown production or 500 MMcf of natural gas.

A single qualifying well can receive both the drilling and production incentives.

The incentives don’t apply to oil sands drilling or production.

“This program is focused on keeping drilling and service crews at work while also recognizing the enormous economic benefits this activity has in Alberta communities,” the provincial energy department said in a statement.

Tristone Capital Inc., noting that drilling in Alberta is expected to decline 28% this year, greeted the incentives skeptically.

“We are long [on] supply in North America, and adding productive capacity today is not desirable,” it said. “And we believe the margin of cash that is retained by the incentives will predominantly focus on debt reduction.”

Venezuela to allow Panama to join Petrocaribe

Venezuela, following a meeting between Panamanian President Martin Torrijos and his Venezuelan counterpart Hugo Chavez, will allow Panama to join Venezuela’s Petrocaribe fuel assistance program.

Venezuela “takes note” and accepts “with great satisfaction” Torrijos’ request, which “will contribute to strengthening the ties of cooperation among the countries making up the initiative,” said Venezuela’s foreign ministry after the two presidents met.

Launched by Chavez in 2005, Petrocaribe now includes 18 countries in and around the Carribbean Sea. Under the initiative, member countries pay 60% of the cost of Venezuelan oil at the time of purchase and can defer the remaining 40% as financing for development projects, repayable over 25 years at a 1% interest rate.

During 2005-08, Petrocaribe distributed some 59 million bbl of oil and derivatives to its members, who saved $921 million, according to Venezuelan government data. Cuba is the main beneficiary, receiving about 92,000 b/d of Venezuelan oil, while the other nations in the scheme each receive around 80,000 b/d.

Last December, Panama’s trade and industry ministry reported that studies on the proposed construction of a 350,000 b/d refinery at the Port of Armuelles were almost finished. In 2007, Panama agreed to cooperate with Qatar Petroleum and Occidental Petroleum on the project. The two companies commissioned Foster Wheeler to conduct the studies.

Oil market tough on lower-middle income areas

Lower-middle income countries were the most vulnerable to global oil price increases over 10 years, according to a new study released by the World Bank’s Oil, Gas & Mining Policy division.

The study, presented Mar. 3 during the bank’s week-long extractive industries conference, defined vulnerability as the ratio of the value of net oil imports to gross domestic product. A country’s oil price vulnerability rises if its oil consumption increases and its oil production decreases per unit of GDP, it explained.

“For countries that consume more [oil] than they produce, a change in the balance of—the value of net oil imports is a measure of the adjustment that will have to be made when oil prices rise (in the absence of other offsetting exogenous shocks). The adjustment will have to be made by deflating the economy to restore the balance of payments or running down foreign exchange reserves,” it said.

The study, “Vulnerability to Oil Price Increases,” included data for 161 countries and covered the 1996-2006 period. It was written by Robert Bacon, a consultant to the World Bank division, and Masami Kojima, a lead energy specialist in the group. A summary is available online at http://rru.worldbank.org/documents/publicpolicyjournal/320-OilPrices.pdf.

The report also found that factors related to oil’s consumption and production other than its price also influenced a country’s oil price vulnerability. Consumption-related factors are oil’s share in total commercial energy use, the ratio of commercial energy consumed to GDP (or energy intensity), and the proxy-real exchange rate. Production-related influences also included oil production levels and the inverse of GDP, it said.

“This study demonstrates that policymakers can, to varying degrees, reduce the vulnerability of their countries’ economies to oil prices by influencing import dependence and reducing the economy’s energy intensity, among other factors,” said Somat Varma, the World Bank department’s director.

Mixed results to come from USFS move to DOI

Moving the US Forest Service (USFS) into the US Department of the Interior could potentially create long-term benefits and short-term problems, the Government Accountability Office said in a Feb. 24 report.

GAO said according to many agency officials and experts, where the mission of the USFS, which now is part of the US Department of Agriculture, is aligned with those of DOI agencies (in particular, its multiple use missions which is comparable to that of the US Bureau of Land Management), a move could increase some of the agencies’ programs and policies overall effectiveness.

“Conversely, most agency officials and experts GAO interview believed that few short-term efficiencies would be realized from such a move, although a number said opportunities would be created for potential long-term efficiencies,” GAO’s report continued.

“Many officials and experts suggested that if the objective of a move is to improve land management and increase the effectiveness and efficiency of the agencies’ diverse programs, other options might achieve better results,” it added.

The proposal is periodically discussed because BLM and the USFS often manage adjacent federal acreage. The agencies already work together on some activities, including onshore oil and gas lease sales in which BLM sometimes includes some USFS tracts at that agency’s request.

Algeria’s Khelil calls for tax changes in Europe

Gas-consuming nations need to rethink their tax policies if they are to encourage gas imports and remove barriers, said Chakib Khelil, Algeria’s energy minister, at a forum in Algiers. He said that existing tax policies only protected narrow interests and hindered the expansion of the gas industry in Europe.

Algeria is the third-largest exporter of gas to Europe. Khelil said that, as gas is cleaner than coal, it must be given a tax advantage.

State-owned Sonatrach is constructing two major gas pipelines to Europe, each with a capacity of 8 billion cu m/year. Medgaz and Galsi are expected to be completed by yearend and in 2012 respectively. Sonatrach also announced plans to boost capacity of two existing pipelines linking it to Italy and Spain by 7.7 billion cu m in 2009.

But whether Algeria can deliver these output increases is questionable, according to analysts, considering the few companies that were awarded licenses in its latest licensing round, the location of small discoveries, and the need to build new pipelines to bring them to market (OGJ Online, Feb. 10, 2009).

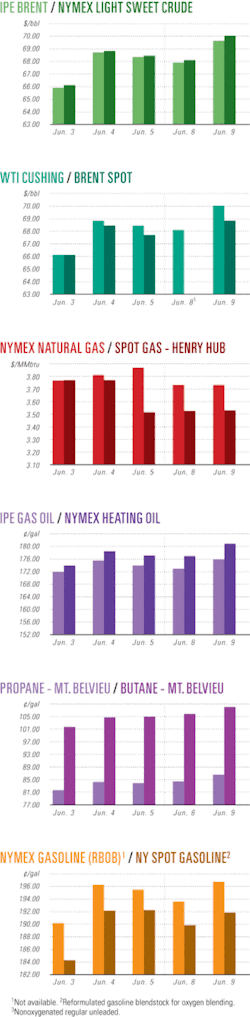

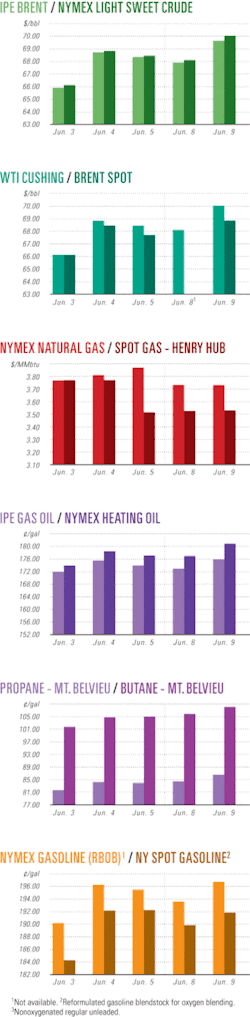

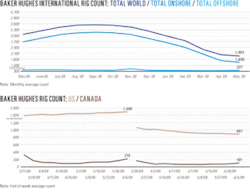

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesBP makes oil discovery with Leda off Angola

BP Exploration (Angola) has made its seventeenth discovery with its Leda well, which was drilled on ultradeepwater Block 31. On test, Leda flowed 5,040 b/d through a 36/64-in. choke.

The Leda well, which reached 5,907 m TD subsea, was drilled through salt to access the oil-bearing sandstone reservoir.

Leda lies in the central northern portion of Block 31, 415 km northwest of Luanda field and 12 km southwest of Marte field. It was found in 2,070 m of water.

BP, as operator, holds a 26.67% interest in Leda. Partners are Esso Exploration & Production Angola (Block 31) Ltd. 25%, Sonangol P&P 20%, Statoil Angola AS 13.33%, Marathon International Petroleum Angola Block 31 Ltd. 10%, and TEPA (Block 31) Ltd. 5%.

InterOil’s Antelope-1 shows promise in PNG

InterOil Corp. reported that its Antelope-1 wildcat onshore Papua New Guinea could contain sufficient gas to supply the first LNG train in its proposed Liquid Niugini Gas project near Port Moresby after the well flowed a record 382 MMcfd of gas. The flow was accompanied by 5,000 b/d of condensate.

Antelope has reportedly intersected the largest onshore vertical hydrocarbon column—2,600 ft (gross)—in the Asia-Pacific region. The company’s reservoir engineers estimate the discovery could contain more than 10 tcf of gas. Independent estimates are now being conducted.

Put with previous discoveries at the Elk field in the region InterOil says it is proceeding with plans for a two-train LNG plant capable of producing up to 9 million tonnes/year of LNG beginning late 2013 or early 2014.

Liquid Niugini Gas was originally a joint venture of InterOil, Merrill Lynch, and finance firm Clarion Finance. InterOil says it has now acquired Merill Lynch’s stake in the project.

It previously selected Bechtel to carry out front-end engineering and design as well as engineering, procurement, and contract work for the LNG plant. In addition, the JV had also chosen ConocoPhillips’s optimized cascade process technology for the plant design.

The plant is to be built near InterOil’s Napa Napa refinery in Port Moresby and will be capable of producing 5 million tonnes/year of LNG from a single-processing train. Despite the success at Antelope, the second train remains an option that has yet to be confirmed.

Pemex makes oil, gas finds in Gulf of Mexico

Mexico’s state-owned Petroleos Mexicanos, which has budgeted more than $12.2 billion for oil and gas exploration in 2009-12, has discovered “significant” amounts of natural gas and condensate with its Tsimin-1 wildcat well drilled in the Gulf of Mexico.

The Tsimin-1 well had initial production of 4,400 boe/d, Pemex said.

Meanwhile, the state firm also announced the onset of gas production of the Cali-1 well in its Burgos project, with production starting at 9.1 MMcfd of gas.

Pemex, which drilled the discovery well in August 2008 on Mision block in Burgos, said the development of the field will provide an additional 90-110 MMcfd of gas.

Pemex also listed four light oil discoveries in its fourth-quarter 2008 financial results, with the Xanab-DL1 offshore well being the most productive at 9,200 b/d of oil.

The discoveries coincide with a statement by Pemex Chief Executive Officer Jesus Reyes Heroles stating that the firm likely discovered 30-35% more oil and gas in 2008 than in 2007.

“It was a very good year in general terms and very important with respect to the previous year,” Reyes Heroles said. During 2007, 1.053 billion boe were incorporated, he said.

He said the firm, before making any more details public, is awaiting final certification of its reserves by independent consulting firms.

Corcel block in Colombia’s Llanos emerges

Production has built to more than 13,000 b/d from two wells on the Corcel block east of Villavicencio in Colombia’s Llanos basin, said Petrominerales Ltd., Bogota.

With Corcel-D1 and D2 producing from Eocene Mirador, Corcel-D3 topped Mirador 8 ft high to prognosis and encountered hydrocarbon shows. Corcel-E1 is to spud later in March.

The Corcel central processing facility is capable of handling 70,000 b/d of fluid, and an upgrade to 140,000 b/d is to be complete in the third quarter.

An offloading station at Monterrey, 77 km from Corcel, that will provide preferential rights to deliver as much as 20,000 b/d into Colombia’s main export pipeline is 42% complete. Early start-up of 11,000 b/d of delivery capacity is planned for May 2009. Full capacity is due in the third quarter. The facility is to cut trucking costs by as much as $6/bbl.

Petrominerales was awarded blocks 25 and 31 totaling 333,708 acres north of Corcel in late 2008. It will spud its first exploration well on the Guatiquia block just southwest of Corcel in July targeting a 3D seismic prospect.

Drilling & Production Quick TakesKipper drilling to begin in 12 months

Esso Australia, Melbourne, has contracted to begin development drilling on its Kipper gas-condensate field in Bass Strait early in 2010.

The company has secured the use of the Ocean Patriot semisubmersible under an agreement with Diamond Offshore and Apache Energy for some well slots in between its program for Apache in the region next year.

The Kipper drilling project could take 3-6 months.

The field lies 45 km offshore in 100 m of water. It has a confirmed resource of 620 bcf of gas and 30 million bbl barrels of condensate.

First gas production, which will be piped to shore via the West Tuna platform, is targeted for the first half of 2011. Output is expected to be around 75 terajoules/day with an estimated field life of 11 years.

Partners in the Kipper JV are Esso as operator with 32.5%, Santos 35%, and BHP Billiton with 32.5%.

Rwanda’s Lake Kivu gas project advances

ContourGlobal, New York, signed a contract with Rwanda’s government to extract solution gas from Lake Kivu to generate electricity.

The $325 million KivuWatt project is to start generating 25 Mw in 2010 and another 75 Mw 2 years later. Power from a plant at Kibuye, Rwanda, is expected to ultimately supply Uganda, Congo (former Zaire), and Burundi as well as Rwanda.

ContourGlobal plans to develop, build, and operate several barges to extract methane from lake water at 350 m. It will process the gas and move it by pipeline to the Kibuye generator, which will more than double the amount of power produced in Rwanda.

Rwanda’s Electrogaz power distributor will buy the electricity under a 25-year contract.

ContourGlobal has been designing and developing the project for 2 years and has run extensive seabed surveys and methane gas sampling at the lake’s lower depths.

The lake is estimated to contain nearly 2 tcf of methane and five times that much carbon dioxide subject to explosive release within a few hundred years in connection with nearby volcanic activity. About 1.3 tcf is believed recoverable. The volumes are believed to be growing.

Lake Kivu, 485 m deep, covers 2,400 sq km. Its surface elevation is 1,462 m.

The project is designed to overcome a severe electricity shortage, cut deforestation, and reduce the risk of an uncontrolled release of the lake’s gas, the company said.

The government placed in operation a 4 Mw pilot plant in November 2008 that is feeding electricity to the national grid, ContourGlobal said.

IOSC JV to boost oil production in Iraq

Mesopotamia Petroleum Co. Ltd. (MPC) has signed an agreement with Iraqi state-owned Iraqi Drilling Co. (IDC) to form a new joint venture focusing on increasing oil and gas production in Iraq.

“This is the Iraqi ministry of oil’s first joint venture agreement of its type signed with a foreign company since the fall of the regime of Saddam Hussein in 2003,” said MPC.

The company’s name will be Iraqi Oil Services Co. LLC (IOSC), which will drill several wells for the nation’s oil companies and international operations. On a conservative basis, these are expected to yield 5,000 b/d/well. About 60 wells/year are to be drilled around Basra as soon as possible, according to IDC.

In 2008 Iraq produced 2 million b/d, which the ministry is eager to boost to 3 million b/d as soon as possible and to 4.4 million b/d within the next 4 years. Iraq wants to achieve 6 million b/d of production by 2013.

“The parties to the joint venture intend to invest a total of $400 million to enable [IOSC] to purchase and operate 12 new drilling rigs and for provision of logistical support and working capital in order to deliver state-of-the-art performance in its operations,” MPC said. IOSC also wants to improve local Iraqi expertise and integrated drilling technology.

IOSC is owned on a 51-49 basis by IDC and MPC respectively. MPC was founded by Ramco Energy PLC and Midmar Energy Ltd.

Idriss Al-Yassiri, director general of IDC, said IOSC had great potential inside and outside of Iraq.

Steve Remp, executive chairman of MPC, added that IOSC’s longer-term ambition is to emerge as a partner with Western oil consortia in future field development projects.

This initiative builds on a wave of deals Iraq has signed to encourage investment and boost oil production, such as the $3.55 billion reconstruction agreement with SK Corp. (OGJ Online, Feb. 24, 2009) and an upgrade of its oil export terminal (OGJ Online, Feb. 20, 2009).

Processing Quick TakesPertamina renews refinery upgrade plan

Indonesia’s state-owned PT Pertamina, renewing interest in an earlier plan, has signed a memorandum of understanding with Dubai-based Star Petro Energy (ETA Group) and Japan’s Itochu Corp. to upgrade the country’s 260,000 b/d refinery at Balikpapan in East Kalimantan.

“By signing the memorandum of commitment, Pertamina and those companies will hold further talks on upgrading Balikpapan refinery,” company spokesman Anang Noor said of the signing, which took place at the World Islamic Economic Forum in Jakarta.

Karen Agustiawan, Pertamina president director, expressed hope that negotiations with ETA Group and Itochu would be concluded soon so that the project could be started on time.

State Enterprise Minister Sofyan Djalil, who said that negotiations with the two firms are continuing, estimated the venture as worth up to $1.7 billion. “It is still a tentative figure,” he said, adding, “We still have to explore the actual price.”

Pertamina has previously said it wanted to boost capacity at the Balikpapan refinery, which has two crude distillation units with respective capacities of 200,000 b/d and 60,000 b/d.

Pertamina said it wanted to increase total capacity to 280,000 b/d, switch from sweet crude to cheaper sour crude, and add a 50,000 b/d cracking unit to process heavy residue into gasoline and petrochemical products.

In October 2008, Pertamina set up a joint venture with Itochu and ETA Star to revamp the Balikpapan refinery. Pertamina processing director Rukmi Hadihartini said, “Each company’s stake is yet to be decided” and that a project feasibility study was “expected to be ready in January 2009.”

In January, however, Pertamina cancelled plans for expansions at two of its largest refineries—Cilacap in Central Java and the Balikpapan facility—due to the economic crisis and low oil prices.

At the time, Pertamina President and Director Ari Soemarno said the expansion plans could continue once the market stabilized, adding that the contractors—Japan’s Mitsui and Toyo engineering corporations and South Korea’s SK Corp.—were unwilling to provide quotes for services because of the volatile oil market.

Neither Pertamina nor the two other firms explained what brought about the change in policy since the decision in January not to proceed with the upgrade.

Last month, Pertamina, aiming to reduce fuel imports by boosting domestic supply, announced plans to construct two new refineries: one at Bojonegara, Banten, and another at Tuban, East Java. It also announced plans to upgrade a third facility at Balongen, West Java (OGJ Online, Feb. 15, 2009).

Transportation Quick TakesShell’s Escravos pipeline suffers explosions

Shell Petroleum Development Co. (SPDC) reported that its trans-Escravos oil pipeline in Nigeria’s Delta state has been breached in three places.

A company spokesperson told OGJ that it had shut-in oil installations in the Niger Delta to minimize potential damage to the environment. No details were given on how much had been lost at the pipeline.

“It was first reported on [Feb. 28] and confirmed during an assessment on the ground; the authorities have been notified,” she said.

There have been explosions on the 24-in. line, which transports oil from the fields in the western Niger Delta to the Escravos export terminal.

SPDC is carrying out an investigation with the authorities and local communities to confirm the cause and the extent of the damage. “The incident was first reported by surveillance personnel on [Feb. 28],” she added.

The company declined to say how long the investigation would take or when the pipeline would be restored.

Vietnam proceeds with expansion of tanker fleet

Vietnam’s Dung Quat Ship Building Co., based in the central province of Quang Ngai, has held a keel-laying ceremony for a long-planned 105,000-tonne Aframax oil tanker.

The 244-m tanker, which is scheduled to be completed during third-quarter 2010, is one of three new ships that will be placed in the service of Vietnam’s newly built 140,000-b/d Dung Quat refinery.

In June the Dung Quat refinery also is scheduled to receive a second Aframax oil tanker, slightly smaller at 104,000 tonnes, from Dung Quat Shipping Industry Co.

The two ships appear to be part of a larger 3-ship plan worked out by the Vietnamese government last year to ensure adequate shipping for the new refinery, as well as others under construction or in the planning stage.

Last December Petrovietnam’s shipping arm PV Trans said it planned to invest as much as $3 billion altogether over the next 7 years to upgrade its crude and oil product tanker fleet to meet demand from Vietnam’s refineries.

At the moment, the Dung Quat facility is the country’s only refinery, but Vietnam has set a target to have at least three major refineries by 2013 as part of efforts to reduce product imports.

The Ho Chi Minh City-based company also said it aims to expand its businesses to operating floating storage and offloading vessels for Vietnam’s oil producers.

A week before making that announcement, PV Trans secured a $175 million loan from a group of foreign banks led by Citigroup to purchase three 80,000-120,000-tonne Aframax tankers to transport oil for the Dung Quat plant.

In addition to Citigroup, lenders include Calyon Corporate & Investment Bank, Fortis Bank, and Societe Generale, while the 13-year loan was guaranteed by Nippon Export Investment Insurance and Petrovietnam.

In February 2008, ahead of the $175 million loan facility, the Dung Quat Ship Building Co. said it had imported nearly all the steel and other building materials needed to build the three Aframax oil tankers.

At the time, Dung Quat Ship Building Co. General Director Cao Thanh Dong, said each of the three oil tankers would likely cost more than $60 million.