SPECIAL REPORT: Emerging Asia-Pacific LNG markets must sort pricing, supply uncertainties

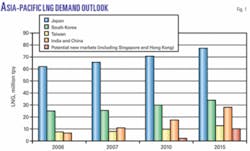

Preliminary data for 2007 show that worldwide LNG trade grew by 7.9% to 172 million tonnes. The Asia-Pacific market accounted for about 65% of worldwide LNG trade, or 112 million tonnes. LNG imports into Asia increased by 9.6% because of strong demand from both established markets (Japan, Korea, and Taiwan) and emerging markets (India and China).

This article will analyze LNG demand outlook for emerging buyers and potential new buyers (Singapore, Hong Kong, and Thailand). Fig. 1 presents LNG demand for the region through 2015.

India’s gas consumption has been increasing rapidly and future demand outlook remains strong. Having become in 2004 Asia’s fourth LNG buyer, India has imported 8.5 million tonnes/year (tpy) in 2007, according to preliminary data.

While domestic gas demand will increase further, LNG demand growth will depend on its price competitiveness relative to coal, piped gas, and fuel oil. In short, it is difficult for India in the future to pay what established marketsones that have already become dependent on LNGwill have to pay.

Meanwhile, China has become Asia’s fifth largest LNG importer with the inaugural cargo arriving at China’s sole operating terminal at Guangdong from Australia’s Northwest Shelf (NWS) project in May 2006. Estimated 2007 Chinese imports are 2.9 million tonnes.

The country has long had ambitious plans for LNG imports. Like India, however, its ambitions have increasingly encountered the reality that LNG has become increasingly scarce and expensive. A couple of years ago, nearly every province along the coast planned to import LNG. Many of these plans, however, have been dealt a hard blow by rising gas prices since 2005 and have been shelved.

As demand for gas continues to increase, China has relied more on domestic sources to meet its need. In the long run, however, China still has the potential to be an important player in the Asian LNG market.

Other Asian countries, such as Singapore, Hong Kong, and Thailand, are planning to import LNG as well. Singapore’s government approved a project to build a 3-million-tpy LNG terminal by 2012. Hong Kong has decided to build a 3-million-tpy receiving terminal, with LNG imports possibly commencing in 2012. Thailand is another potential LNG market by 2017.

India

Currently, gas consumption in India stands at nearly 4.0 bscfd. Demand has grown at about 9.2%/year between 1995 and 2006. Despite this high growth rate, natural gas only accounts for a 6% share in the total primary energy consumption mix, due to the dominance of coal and CR&W (combustible renewables and & waste) sources of energy. Two factors will play a key role in determining future gas demandsupply of gas and the affordability for Indian consumers.

We believe gas demand in India is infinite at $2-3/MMbtu but limited at $6-7/MMbtu. It is a question of what prices are affordable to which sectors. Power generation and fertilizer production are mature sectors for gas and are partly subsidized by the government. On the other hand, the industrial and city gas sectors are emerging markets with higher affordability.

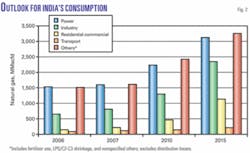

Fig. 2 shows that the power sector has the largest share of gas consumption, accounting for 38.6% in 2006. Based on our assumption that overall electricity demand will grow at an average growth of 5.5-6%/year through 2015, gas consumption in the power sector will grow at 8-9%/year through 2015.

Gas use in power generation, however, will be heavily influenced by price and would have to compete with domestic and imported coal. The preferred price for gas in the power sector is less than $6/MMbtu (delivered) in order to keep generation costs at 5.6-6.7¢/kw-hr. Beyond the $6/MMbtu price, demand for gas in power generation would decline significantly. We project that increased volumes of domestic gas (mainly from offshore basins on the east coast) will be used for power generation.

Industrial users (such as steel and petrochemical industries, glass and ceramic companies, electronic device manufacturers, and others) are significant users of gas. Gas-consumption growth in the industrial sector will be strong due to the higher affordability of this sector. Gas-consumption growth in the industrial sector will be about 15-16%/year between now and 2015.

The “other” sector, consisting of the fertilizer industries and LPG/C2-C3 shrinkage, is the second largest gas consumer (accounting for 38% in 2006) in India. Growth in the fertilizer sector will be due to new gas-based urea plants, as well as conversion of naphtha-based plants to gas. Overall, “other” sector will grow at about 7-8%/year through 2015.

The transport sector is likely to show strong growth in gas consumption with growing CNG usage. This follows the decision of the government of India progressively to extend the CNG program to more than 10 cities. Consumption in the sector will grow by 9%/year through 2015.

Domestic gas consumption, then, will grow at 13-14%/year through 2010 before slowing to 8-9%/year between 2010 and 2015. Thus, India’s gas demand will be 6.6 bscfd by 2010, rising to 10.0 bscfd by 2015.

LNG demand outlook

India became the fourth LNG importer in Asia in January 2004, with LNG imports entering the Petronet LNG Ltd. (PLL) terminal at Dahej. These imports were from Qatar’s RasGas at 4.3 million tonnes in 2005 and an estimated 5.0 million tonnes in 2006.

Shell’s Hazira terminal began operating in early 2005 and has been importing spot cargoes. Further spot volumes were from various sources, thereby bringing India’s total imports to 4.5 million tonnes in 2005 and 6.2 million tonnes in 2006. In 2007, India’s total imports will likely be 8.5 million tonnes (consisting of 6.8 million tonnes to Dahej and 1.7 million tonnes to Hazira).

The future of LNG demand depends on its price competitiveness compared with coal, piped gas, and fuel oil. The recent discovery of gas by Reliance Industries Ltd. (RIL) of 30-50 tcf in the KG basin is bound to bring about changes in the competitiveness of piped domestic gas relative to LNG imports. KG Basin will not be sufficient, however, to meet India’s growing gas demand, and gas imports (in the form of LNG or piped gas) will be necessary.

There is a pipeline import possibility from Iran that presents, however, many hurdles to clear for this option. For now, India has backed down from signing the Iran-Pakistan-India pipeline agreement after failing to reach an agreement on the gas price and transit fees through Pakistan.

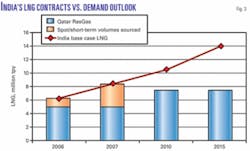

But things could change. Although pipeline-gas import volumes could be potentially substantial, LNG imports will remain essential, as there is a significant amount of uncertainty and instability associated with the pipeline imports from Iran. In our base-case scenario, India’s total LNG imports will rise to 10.5 million tpy by 2010 and to 14.0 million tpy by 2015.

LNG contracts

Currently, India has two long-term sales and purchase agreements (SPAs) and one short-term contract.

- The first contract was signed between Petronet and Qatar’s RasGas for 20 years, in which RasGas would supply 5 million tpy of LNG on FOB basis. Petronet and RasGas signed a side letter of agreement in August 2006 that covers the increase of the contractual volumes up to 7.5 million tpy from 2009.

- In June 2005, Iran and India (by GAIL and IOC) signed an LNG deal5 million tpy for 25 years starting in December 2009. The LNG export deal has not been approved by the Iranian High Economic Council, however, while progress on the upstream side in Iran has been very slow.

As a result, there is no agreed price, delivery time, or firm commitment. In our view, the chances of Iran LNG coming to India prior to 2015 are slim. - On a short-term basis, Qatar’s RasGas has been supplying Petronet about two cargoes/month since July 2007. This agreement will last until September 2008, with a possible extension to December 2008.

Fig. 3 summarizes India’s supply and demand balance until 2015. LNG imports will continue increasing as the government further deregulates the gas sector and the affordability of Indian consumers rises. India’s uncommitted demand (demand less existing LNG contract volumes) will likely increase toward 2015, while there is spot demand in the future.

China

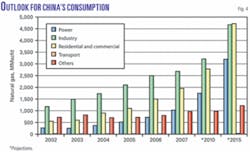

In 2006, China’s natural gas use reached 5.6 bscfd, up substantially from 1.5 bscfd in 1990 and 2.3 bscfd in 2000. In 2007, China’s natural gas consumption is likely to have reached 6.7 bscfd, nearly 21% higher than for 2006.

Between 1990 and 2006, China’s total natural gas consumption advanced at an average of 8.7%/year, faster than the growth of primary energy consumption as a whole. As a result, natural gas’s share of primary commercial energy (including noncommercial biomass) mix rose from to 2.7% in 2006 from 1.6% in 1990. China’s share of natural gas in total primary energy consumption, however, is far below the regional average in Asia-Pacific.

While natural gas only accounted for less than 3% of the total primary energy consumption in 2006, it plays an important role in China’s chemical industry (fertilizer) and in regions that are close to gas producing fields. In 2006, the estimated share of industrial natural gas use was 45%. Within the industrial sectors, chemical use for natural gas (mostly in fertilizer plants) accounted for 40% of consumption. The residential and commercial sector ranked second in natural gas use at 27% of the total. Electric power and heating accounted for around 13% of total natural gas use in 2006.

China’s gas consumption, led by residential and commercial power and by industrial sectors will grow rapidly. Natural gas consumption as a whole will grow by 10.6%/year on average, between 2006 and 2015 under our base-case scenario. As a result, the share of natural gas in China’s total primary energy consumption will increase to 4.6% in 2015 from less than 2.7% in 2006.

LNG demand outlook

The first cargo from Australia’s NWS project arrived in China at the end of May 2006, at the 3.7-million-tpy Guangdong LNG (GDLNG) terminal, operated by Guangdong Dapeng LNG, a joint venture between CNOOC and BP. For 2006 as a whole, 11 cargoes of LNG were imported by China, totaling 0.7 million tonnes.

During the first 11 months of 2007, China imported 44 cargoes of LNG totaling 2.7 million tonnes, including 37 cargoes from Australia and 7 spot cargoes from Algeria, Nigeria, and Oman.

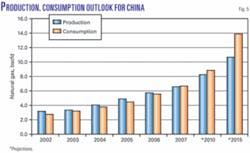

As Fig. 4 shows, China’s future natural gas consumption growth is likely to come from domestic production, which is supplemented by LNG imports and imports of pipelined gas. In 2007, China’s estimated LNG imports are slightly less than 3 million tonnes.

Under our base-case scenario, China will import 7.0 million tonnes of LNG in 2010 and 14 million tonnes in 2015 (Fig. 5). This scenario also means China has growing amounts of uncommitted LNG demand over the next couple of years beyond the existing contracts.

LNG contracts

Currently, China has three firm LNG SPAs, one for Guangdong LNG, one for Fujian LNG, and one for Shanghai LNG (the latter two terminals are under construction). In addition, PetroChina reached two separate agreements with Royal Dutch Shell PLC and Woodside Petroleum, respectively, for future LNG supply.

After a series of international bidding rounds, Australian LNG won the bid; the source of supply to Guangdong is the NWS gas project in Australia. The SPA was signed between CNOOC and Australian LNG on October 2002. The Fujian LNG SPA was signed in September 2002 between CNOOC and BP for supply from the Indonesia’s Tangguh gas project. The contract volume is 2.6 million tpy for 25 years. The originally planned start-up year was 2007, but it has since been delayed.

The Shanghai LNG SPA was signed on July 31, 2006, with Malaysia LNG Tiga. Shanghai LNG Co. Ltd. is a joint venture between Shenergy Group Ltd. (55%) and CNOOC Gas & Power (45%), a wholly owned subsidiary of CNOOC. The contract volume is about 3 million tpy for 25 years.

The accompanying table summarizes China’s supply and demand balance until 2015.

In early September 2007, PetroChina signed a binding heads of agreement (HOA) with Shell for 20 years of LNG supply at 1 million tpy. The HOA covers the key terms of the transaction and the two parties are aiming to conclude a SPA in the near future.

Also in September 2007, PetroChina signed a nonbinding agreement including key commercial terms with Woodside for 15-20 years of LNG supply at 2-3 million tpy from the proposed Browse basin gas reserves. The agreement is subject to conditions, including final investment decisions on both Gorgon and Browse projects and relevant government approvals.

Separately, two Chinese state oil companies have signed a preliminary agreement with Iran. Sinopec has a memorandum of understanding (MOU) with Iran LNG for 10 million tpy. Iran LNG has marketed more gas than the project can supply, however, and is facing indefinite delays. PetroChina has an HOA with Pars LNG for 3 million tpy over 25 years, but there has been little progress lately for executing the agreement.

China currently has one LNG terminal in operation, Guangdong, which has been quietly expanded to 5 million tpy recently from 3.7 million tpy. Two terminals are under construction: Fujian (2.6 million tpy) and Shanghai (3.0 million tpy). Fujian is nearing completion and may be operating this year if spot deals are made.

In addition, China has at least four terminal projects approved by the National Development and Reform Commission (NDRC) of China, which is the decision-making body on LNG business. Moreover, nearly a dozen projects are proposed. Unless supply contracts are secured, however, many of these projects will be seriously delayed.

The biggest problems facing the Chinese natural gas industry and future growth of natural gas use lie in these areas: prices, market developments, distribution networks, and foreign investment in China.

Globally, oil and gas prices are entering high plateaus. Rising LNG prices have delayed all but a few terminal projects in China in the recent past. Natural gas use for power generation is still a big problem. China’s natural gas market is fragmented with multiple rules and price regimes. The market needs to be developed further to facilitate the expansion of natural gas use. Lack of a distribution network or lack of investment in a distribution network for various cities may hinder town-gas use for years after the pipelines are in place and LNG terminals are built. China is also still lagging behind in providing proper fiscal and price regimes to attract foreign investment in the country’s upstream sector, gas pipelines, and town gas. It has a long way to go.

Potential markets

Three markets present possible growth areas for LNG in Asia.

Singapore

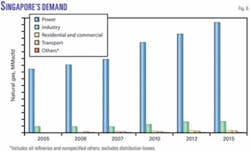

Natural gas currently accounts for about 18% of Singapore’s primary energy consumption, while oil dominates the balance. By 2015, natural gas will likely account for around 18% of its primary energy consumption, mainly due to increased demand from the power sector.

Singapore relies on gas imports for supplies, as there are no domestic gas fields. Imports are from three pipelines: one from Malaysia, one from Indonesia’s offshore West Natuna fields, and another from Indonesia’s Sumatra fields.

Before 1992, Singapore’s power was generated solely by petroleum products. Since the start of natural gas imports, however, gas’s share of power generation has risen dramatically to around 74% in 2007, from around 18.5% in 2000. Its market share will reach 83% by 2015.

Gas use in the power sector will post an average growth of around 5%/year from 2007 to 2015. For the same period, industrial sector demand will increase by 5.1%/year on average. The two fastest demand growth rates will come from transportation and residential sectors albeit from a small base (Fig. 6). Overall, gas consumption will post an average growth of 5%/year.

Prospects for LNG

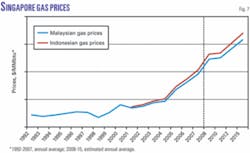

A small-scale LNG receiving terminal in Singapore makes sense, as a means of diversifying gas supply and creating price competition for piped gas imports. The price of piped natural gas is currently very high because it is linked to high-sulfur fuel oil, which has increased in price due to a variety of factors including rapid growth in Chinese fuel-oil imports (Fig. 7).

When gas imports first started in the early 1990s, from Malaysia, gas prices were in $2-3/MMbtu. This stimulated demand growth for the fuel in power generation. Prices today, however, have moved in tandem with increased oil pricesand increased fuel-oil pricesresulting in average import prices at around $10/MMbtu.

Singapore’s government approved the project to build a 3-million-tpy LNG terminal (capacity capped at 6 million tpy) by 2012. Exclusive LNG import license will go to the aggregator, which is expected to be chosen by April 2008. This exclusive right will lapse only in 2018. While Singapore expects to import 1 million tpy of LNG by 2012, rising to 3 million tpy by 2018, we believe the buildup in import volumes may likely be slower at 2 million tpy by 2018.

Hong Kong

Natural gas’s share accounts for 15% of Hong Kong’s primary energy consumption in 2007, while the balance is dominated by oil (47%) and coal (34%). By 2015, natural gas will likely account for about 22%, mainly due to increased demand in the power sector.

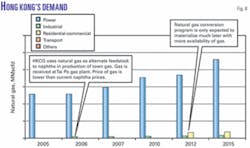

Gas demand as of 2007 stands at around 325 MMscfd, with almost all volumes consumed in the power sector and marginal consumption in the industrial sector (for the production of town gas). This will eventually change, as there are plans for Hong Kong to introduce natural gas to the residential and commercial sector while increasing city gas use.

Introduction of natural gas in the residential and commercial sector was originally to come online in 2006-07. Because of technical (lack of infrastructure) and gas supply issues, however, the natural gas conversion program will only move ahead sometime around 2012 when LNG imports commence (Fig. 8).

The main driver for natural gas growth in the future will derive from environmental concerns. As power companies in Hong Kong are the main sources of pollution, the shift in preference away from coal and petroleum products toward gas has been prevalent in the economy.

Currently Hong Kong imports gas from two sources:

- China’s Yacheng 13-1 field via a 778-km gas pipeline.

- Regasified LNG received through the Guangdong LNG terminal.

Declining field production from Yacheng field and increasing demand for Guangdong LNG in China will reduce gas for exports to Hong Kong.

Prospects for LNG

With a shortfall in contracted gas supply occurring as early as 2012, Hong Kong has decided to build a 3-million-tpy LNG receiving terminal by Hong Kong utility CLP Holdings Ltd., mainly for power generation. As with Singapore, Hong Kong pays international prices for oil products and has a threshold for internationally priced LNG. FGE forecasts Hong Kong LNG imports will commence in 2012 with a minimal import of 0.5 million tpy, rising to around 1.5 million tpy by 2015.

Thailand

Thailand’s natural gas demand has grown dramatically over the last 2 decades. From 1990 to 2000, natural gas demand grew at an average 13.5%/year, while from 2000 to 2005 demand slowed slightly to 8.9%. Natural gas has the second largest share of Thailand’s primary energy consumption, accounting for 27% of the country’s demand, outweighed only by oil (47%), followed by coal, combustible renewables and waste, and hydropower. Although oil will continue to dominate all fuels in absolute numbers, natural gas will post strong growth averaging 4.9%/year 2007-15 compared with oil at 3%/year

The power sector dominates Thailand’s gas demand. In 2007, it accounted for 68% of gas demand followed by the others sector at 21%which primarily consists of gas processing plantsand the industrial sector at 11%. Within the power sector itself, natural gas as a fuel made up 70% of power generated followed by coal (21%) and hydro (5%). Thailand also imports around 3% of its electricity, while fuel oil and diesel oil constitute only 2% of power generated.

Thailand currently imports gas solely from Myanmar via the Yadana and Yetagun pipelines under long-term take-or-pay contracts. In 2008, Thailand will begin to import gas via the Malaysia-Thailand joint development project from Blocks A-18 (400 MMscfd), while delivery of gas from B-17 and B-17-01 will begin in first-half 2008 at 135 MMscfd for the first 10 years.

Prospects for LNG

Since domestic production cannot keep up with rising domestic demand, Thailand increased its import dependency from Myanmar. That dependency on pipeline gas imports has raised the issue of supply security, however, and PTT PLC has set up a subsidiary, PTTLNG, to handle LNG issues for the country.

PTT’s initial enthusiasm for the LNG terminal was tempered, however, by higher prices reflecting the emerging LNG sellers’ market in 2006. Nevertheless, PTT still appears keen to proceed with the planned 5-million-tpy receiving terminal at Map Ta Phut in the Rayong Province. The company has announced that it will spend nearly $1 billion to construct a deepsea port and receiving terminal at the planned site by 2011.

PTT also signed a preliminary agreement in July 2006 to receive 3 million tpy of LNG from Iranian Pars LNG, reflecting thereby the company’s desire for an LNG project. Such uncertain issues, however, as Iran’s ability to supply LNG in the near future and whether Thailand can pay market rates led FGE to extend its base-case scenario forecasts of LNG imports to 2017 with initial volumes at around 1.3 million tpy.

The authors

Kang Wu ([email protected]) is a senior fellow at the East-West Center in Honolulu and conducts research on energy policies, security, demand, supply, trade, and market developments, as well as energy-economic links, oil and gas issues, and the effect of fossil energy use on the environment. Wu is an energy expert on China and supervises the China Energy Project at the center. Wu holds a PhD in economics from the University of Hawaii.

Tomoko Hosoe ([email protected]) is project specialist at the East-West Center, where her primary focus is on downstream oil and natural gas and LNG East of the Suez, energy policy, environmental and nuclear power issues, with a special emphasis on Japan. She has participated in various projects involving Japan’s gas and power market deregulation, oil and gas demand outlook, and LNG pricing analysis. Hosoe holds a master’s in public affairs from Indiana University.

Vijay Mukherji ([email protected]) is a senior consultant and head of the Middle East/South Asia oil team of FACTS Global Energy. He holds a degree in chemical engineering from the National University of Singapore and has held positions at Royal Dutch Shell PLC and Foster Wheeler and served as a process engineer for Shell Global Solutions. At FGE, Mukherji’s research focuses on the downstream oil and gas industry in India and South Asia, crude and product markets for major Middle Eastern countries, demand, pricing, and refinery analysis.

Alexis Zhiying Aik ([email protected]) is a senior consultant and head of FGE’s information and analysis group. She holds as a bachelor’s in business management from Singapore Management University and is a former fellow of the East-West Center’s Asia-Pacific Leadership Program. Aik’s coverage at FGE is pricing and issues for both natural gas and LNG and downstream oil business in Asia-Pacific. For natural gas and LNG, she specializes in Southeast and Northeast Asia and the Middle East.