OGJ Newsletter

WoodMac: Operators still vexed by high costs

High oil prices have not resulted in high returns on projects because of an increase in exploration costs and the taxes earned by host governments, according to energy consultancy Wood Mackenzie Ltd., Edinburgh.

Operators now need to assume an oil price of $70/bbl to earn close to 15% on exploration, delegates at International Petroleum Week in London were told. Alan Murray, WoodMac exploration service manager, said, “Cost increases mean that pretax margins on new fields have not increased with oil prices.”

Many host governments such as the UK, Algeria, and Bolivia changed their fiscal regime as oil prices soared, leaving fiscal certainty a major issue for companies. This is having the greatest impact on exploration economics, Murray said. Other governments such as India, Malaysia, and Angola have tried to capture the upside in their progressive production-sharing contracts, which allow them to benefit if oil prices increased.

Companies are using different methods to build on their assetseither through exploration programs, mergers and acquisitions, or participating in developing major resource opportunities such as Russia’s Shtokman gas field in the Barents Sea.

But dry holes remain a major risk with exploration, and high development costs are key problems in a volatile market. Pursuing M&A deals also is costly, with the risk high of overpaying for assets in a high-priced environment.

“Exploration is the better option as a resource capture strategy because this has better returns and allows more flexibility compared with other strategies,” Murray said.

IP Week: Technology to aid in skills shortage

Technology will aid in improving the productivity of skilled labor as the petroleum industry struggles to attract and retain new recruits, IP Week delegates were told in London.

Antoine Rosand, a senior executive with Schlumberger Business Consulting, said remote, real-time drilling centers with features such as model-based surveillance and integrated well planning would enable companies to boost production and handle risk better.

Encouraging new entrants to pursue petroleum careers would be tougher in the West, compared with Africa and Asia, where the energy industry has a more acceptable public image and people compete for jobs in the industry. India and China in particular are producing thousands of graduates for the petroleum sector. “Most universities are still based in the West, but they need people who attend them to become technical leaders and innovators to bring in students from local areas,” Rosand added.

Although the exploration and production industry has sharply increased its recruitment of geologists, geophysicists, and petroleum engineers, global graduate supply is barely meeting the industry’s needs, Rosand said. For 2006-10, the net supply of geologists and geophysicists entering the E&P industry is expected to be 60% and for petroleum engineers, 80%.

UK subsea sector rises to £4.3 billion in value

The UK subsea oil and gas sector has grown by almost 30% in value to £4.3 billion in 2007, according to industry association Subsea UK.

“The year-on-year growth rate...exceeds market expectations, with further increases expected for 2007-08,” Subsea UK said.

Exports, an important element for companies involved in the subsea sector, constitute 50% of revenues and are expected to grow dramatically compared with the domestic market. Exports have risen by 26%, increasing at a rate similar to market growth.

But the UK risks losing its global leadership position because companies are finding it challenging to find qualified engineers and rapidly deliver new technology to the market, Subsea UK said.

Industry collaboration with the support of government and academia is vital to developing skilled people and an effective technology program, Subsea UK noted.

CERA: Collaboration key for energy industry

Company collaboration will be essential to address the energy industry’s changing dynamics as competition increases for resources and as fiscal terms become more stringent, said StatoilHydro AS Chief Executive Helge Lund.

Speaking at CERA Week in Houston Feb. 13, Lund stressed that exploration has become more difficult because of harsher environments, heavier oils, and tougher projects. “Politically, resource nationalism is an emerging reality,” Lund said.

The merger of Statoil and Hydro has given the company the clout to face the challenges with confidence. Although companies have prospered from high commodity prices, there is now limited access to exploration and production opportunities, which has intensified competition for them.

“I think we are all now faced with a new game: How to accommodate interests and expectations in a world that has prospered even [with oil at] $50-100/bbl,” Lund said.

He argued that the industry is now in a phase of realignment and rebalancing of business models where companies must align interests to create genuine successful partnerships.

But any downturn in the US economy is likely to affect economies in other countries and their demand for oil. “The uncertainty is bigger than it has been in the past,” Lund said.

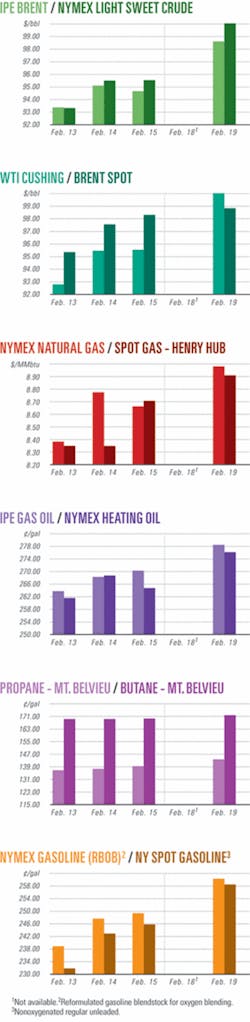

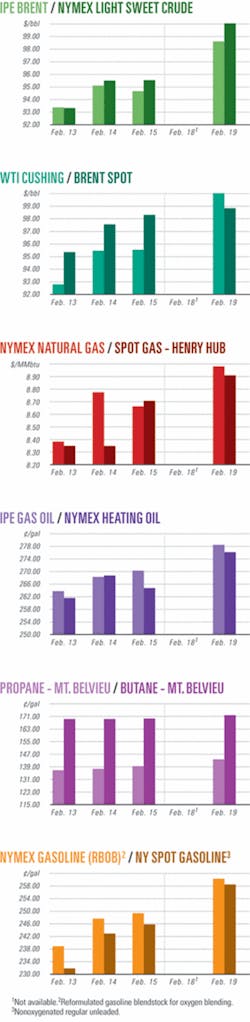

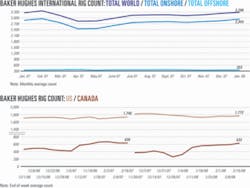

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesBP sets 2010 target for Libya exploration well

BP PLC plans to drill its first onshore well in Libya’s Ghadame basin in 2010, assuming it can secure the necessary rigs, said BP Exploration Pres. Libya Peter Manoogian at International Petroleum Week in London.

BP will invest more than $2 billion in its work program, which will include the drilling of 17 exploratory wells.

Manoogian said he remains “very optimistic” about onshore development, as the company knows the basin well. “We are targeting gas accumulations, and if we find any, then production could start in 2018.”

Seismic acquisition will begin in the third quarter. Although the company’s strategy in North Africa is gas, if it found oil, that would not be “a bad thing,” it said, adding, “We will monetize the oil if it’s found, and that is covered in our contract with [Libya’s National Oil Co.]”

Last year BP and partner Libya Investment Corp. signed an agreement with NOC to explore 54,000 sq km of the Ghadames and offshore frontier Sirt basins (OGJ Online, June 1, 2007).

If hydrocarbons are found, offshore production could start in 2020, Manoogian added. Sirte is challenging, however, because it is in deep water with seismic imaging issues, and it is 300 km from the nearest well.

With the Ghadames basin holding tight gas, there are complex reservoirs, and BP will utilize advanced drilling and completion technology during its exploration program.

NOC, through an aggressive offshore and frontier exploration program, wants to boost Libya’s oil reserves to 20 billion boe under a plan covering 2005-15.

NOC expects to increase production to 3.5 million b/d by 2020 by encouraging the drilling of at least 50 wildcats/year and acquiring at least 4,000 sq km/year of 3D seismic data and 10,000 km/year of 2D seismic data.

Manoogian said: “We think that partnerships between international oil companies and national oil companies are desirable. The transparency in regulation and its proximity to Europe makes Libya an attractive investment.”

But fierce competition between IOCs in accessing new hydrocarbon resources led them to reduce their share of benefits in bidding for acreage under Libya’s recent gas licensing round, Manoogian said. “We can’t say that was imposed by the NOC. IOCs have to take bigger risks because of the competition for resources.”

ONGC, Shell ink NELP-VII bids, joint projects

India’s Oil & Natural Gas Corp. (ONGC) and Royal Dutch Shell PLC recently revised their joint participation memorandum of understanding for projects to be auctioned in the forthcoming seventh round of India’s New Exploration Licensing Policy VII.

The original MOU was aimed at cooperation in field optimization using Shell’s proprietary enhanced recovery technology and in other areas such as LNG importation, development of coalbed methane, underground and surface coal gasification projects, refinery upgrades, and trading and development of supply chains.

The exploration and production giants have agreed to evaluate jointly setting up surface coal gasification facilities to create synthesis gas for power generation or other uses.

They also plan to jointly explore opportunities for technology induction in field optimization and integrated brownfield development in mutually agreed assets.

Shell will provide technical knowledge, including operational experience.

Depending on the outcome of a planned prefeasibility study, Shell may commission a detailed feasibility study to evaluate the possibility of taking equity in such projects under a separate licensing agreement.

The energy majors also agreed to study the feasibility of gasifying petcoke produced by ONGC subsidiary Mangalore Refinery & Petrochemicals Ltd.

Drilling & Production - Quick TakesBPZ Energy working to restart oil output off Peru

BPZ Energy Inc. expects to restart production of its 21XD and 14D wells within 3 weeks. The wells in Corvina field off northwestern Peru were shut in following an accident involving a BPZ-chartered tanker.

A Peruvian Navy tanker, the Supe, caught fire and sank on Jan 30, resulting in the death of one sailor and serious injuries to four other sailors (OGJ, Feb. 11, 2008, Newsletter).

The tanker, being used for oil storage, was moored near BPZ’s CX-11 platform in Block Z-1. Consequently, platform operations were halted. The 21XD and 14D wells produced 4,200 b/d of oil when they were shut in. The platform and wells had no fire damage.

BPZ hired Clean Caribbean and Americas (CCA) to conduct an environmental damage assessment. CCA concluded most of the 1,300 bbl of oil in the tanker was burned.

Divers inspected the sunken tanker, resting in 200 ft of water. No crude oil or fuel was detected in any tanks. Tests to seawater indicated no contamination to water and marine life.

BPZ of Houston is an exploration and production company having exclusive license contracts for 2.4 million acres in four properties in northwest Peru. It also owns a minority working interest in a producing property in southwest Ecuador.

StatoilHydro leases deepwater drillship

StatoilHydro AS will use the GSF Explorer ultradeepwater drillship to drill three exploration wells on Indonesia’s Karama Block off West Sulawesi in late 2009. The company has a 51% stake, and Pertamina holds a 49% share in the block.

StatoilHydro is a member of the Makassar Strait Explorers Consortium, which signed the 2-year contract to lease the rig; together the group will drill 12 exploration wells. Marathon International Petroleum Indonesia Ltd. is the lead operator for the consortium, and each company is responsible for its own committed wells. However the group is now planning products procurement and services programs.

The first of the three wells in the Karama license is scheduled for second half 2010, StatoilHydro said. Karama is in deep water in Indonesia’s Makassar Strait.

The MSEC members are Anadarko Popodi Ltd., ConocoPhilips (Kuma) Ltd., Eni Bukat Ltd., and Talisman (Sageri) Ltd.

Petrobras lets contract for P-57 FPSO unit

Petroleo Brasileiro SA (Petrobras) reported signing a $1.195 billion turnkey contract for the construction of the P-57 floating production, storage, and offloading unit with Single Buoy Moorings Inc. (SBM). The P-57 FPSO will be ready in 3 years and will help Brazil reach its production goal of 3.45 million boe/d by 2015. Current production is about 1.85 million boe/d.

Separately, SBM Offshore NL said the P-57 FPSO would likely be converted in Singapore using one of SBM’s very large crude carriers in inventory, the Accord. Topsides will be integrated in Brazil, “in accordance with new local content requirements.”

Petrobras said 65% national content is required and the topsides work would be completed at Brasfels, in Angra dos Reis, Rio de Janeiro state.

The P-57 will have the capacity to process 180,000 b/d and compress 2 million cu m/day of gas. It is destined for the Jubarte field off Espirito Santo state, where it will be installed in 4,100 ft of water. The field produces 17º gravity oil, according to Petrobras.

Petrobras also awarded SBM a $63.55 million, 3-year operating contract.

In January 2007 Petrobras canceled orders for the construction of the P-55 platform, which would have had the capacity to produce 180,000 b/d of oil from Roncador field off Rio de Janeiro state, as well as construction of the P-57 FPSO because of excessive cost.

StatoilHydro starts Volve oil and gas production

StatoilHydro has begun oil and gas production from Volve field in the Norwegian North Sea from the large Maersk Inspirer jack up rig, while Navion Saga will be used as a storage vessel for further transport.

Gas will be exported from the Sleipner A platform. The company drilled eight wells to develop reserves of 78.6 million bbl of oil and 1.5 billion cu m of gas. An additional five wells are planned.

Volve production, which will continue for 4-5 years, is expected to plateau at 50,000 b/d by the end of first quarter 2009.

Volve is 200 km west of Stavanger in the southern section of the Norwegian continental shelf. StatoilHydro has a 59.6% interest in the field and has partnered with ExxonMobil Corp. 30.4% and PA Resources 10%.

Processing - Quick TakesAlon USA updates Big Spring refinery after fire

Independent Dallas refiner and marketer Alon USA Energy Inc. reported last week that all but one of the four workers injured in the early morning Feb. 18 explosion and fire at its 70,000 b/d Big Spring, Tex., refinery have been released from the hospital.

“The cause of the explosion, which occurred in the area around the propylene splitter unit, has not yet been determined,” Alon USA said. “However, the fire has been extinguished, allowing the investigation to begin as soon as reasonably possible.”

The extent of the damage is still being evaluated, but an initial assessment showed that the propylene recovery unit was destroyed and equipment in the alkylation and gas concentration units were damaged in the fire, the company said.

The one remaining injured employee was treated for burns and at presstime last week was in stable condition, Alon USA said.

Alon USA’s Big Spring refinery lies 290 miles west of Dallas in west-central Texas. The facility employs about 170 workers and is one of four refineries owned by Alon USA, which was formed when Alon Israel Oil Co. Ltd. acquired certain US assets from Total SA.

Alon Pres. and Chief Executive Officer Jeff D. Morris said, “We are developing contingency supply plans for our customers and expect to have those in place in the next few days. We are also in the process of developing an operating plan for repairing the facility and bringing the refinery back into operation as soon as possible.”

Based on preliminary assessments, Alon said it plans to resume partial operations in about 2 months.

Trinidad and Tobago to build second refinery

Trinidad and Tobago’s Minister of Energy and Energy Industries Conrad Enill has announced that the twin-island nation will construct a $3-4 billion refinery next to its existing 168,000 b/d refinery at Pointe-a-Pierre.

The Minister said, although the final figure is not yet in, he expects the refinery’s capacity to be in the order of 200,000 b/d.

Enill told a BG Trinidad & Tobago-sponsored luncheon the new refinery would be export oriented. “As a producer of approximately 150,000 b/d of oil, the country would benefit from being able to refine its own crude and convert it into salable products for the fuels retail market,” Enill said.

The energy minister said bottom-of-the-barrel products from state-owned Petrotrin can be utilized as feedstock for the new facility.

The government is close to hiring a contractor, Enill said, but the final figures are not in so the final cost has not yet been determined.

Dinaz to start refinery construction in 2010

Latvia’s Dinaz plans to start construction of the country’s first refinery in 2010 so it can reduce product imports.

Dinaz Pres. Nikolay Yermolayev said the €2 billion, 6 million tonne/year refinery would be built near Daugavpils just north of the Belarus-Lithuania border. The greenfield site is 4 km from Druzhba pipeline, which transports Russian oil to Europe.

Yermolayev said the company is conducting a feasibility study for the refinery and will start the environmental process in 2009. Dinaz also is seeking partners in developing the refinery.

Separately, Dinaz also plans to construct a 10 million tonne/year oil terminal in Riga that would increase its trade links and improve domestic fuel trading, Yermolayev said.

Preem seeks permits for coker at refinery

Swedish refiner Preem Petroleum AB is seeking envrionmental permits to build a new 4 million tonnes/year coker unit near its 220,000 b/d Lysekil reinery on Sweden’s west coast.

The expansion will propel the company’s move from fuel oil into transportation fuels, according to Michael Low, Preem president and chief executive, who spoke at International Petroleum Week in London. Preem hopes to make a final investment decision on the project by yearend, although if the project proves uneconomical, the company will examine other options. Low declined to comment on what these other options would be, however.

The coker would have high feedstock flexibility and utilize spare hydotreating capacity. Low said it was unclear how much it would cost, but high costs, exacerbated by a shortage of contractors and materials, are impacting timely delivery of projects and whether refiners should progress with upgrades.

“Supply bottlenecks faced by the refining sector will not go away until at least 2009-10,” Low said.

However, tightening environmental standards are also increasing costs and workloads for companies in the petroleum sector to ensure they produce cleaner fuels. Utilizing a coker unit would produce more carbon emissions, and Preem is investigating methods of carbon capture and sequestration with research institutions.

Europe’s surplus of gasoline in the near future will be a major challenge as it has lost an export market to the US where the preference is to use diesel-run cars instead. Attractive incentives have also encouraged a boost in diesel production. “The car industry needs to come up with ways to make efficient gasoline cars; it’s not a problem that we can solve by ourselves,” Low said.

Low was also doubtful that the European Union will reach its target of having 5.75% of its transportation fuels coming from renewable sources by 2010 as EU members are at different levels in boosting their share of alternative fuels in the energy mix. “In Germany the government stopped subsidizing grapeseed oil, and that has left many companies bankrupt,” Low said.

Transportation - Quick TakesRussia, Ukraine settle gas debt dispute

Russia and Ukraine have resolved their disagreement over the supply, pricing, and transit of Central Asian natural gas following a meeting between the leaders of the two countries.

“We regret that problems of the kind are still popping up,” said Russian President Vladimir Putin, who said, “Our partners told us that they would soon start repaying the debts.”

Ukrainian President Viktor Yushchenko explained that the debt would be repaid at last year’s price of $130/1,000 cu m, rather than this year’s price of $179.5/1,000 cu m. “We agreed that Ukraine would [on Feb. 14] start repaying the debt of last November-December,” he said.

Ukraine’s debt for gas supplied by Russia since Jan. 1 reportedly is nearing $500 million, while the country’s overall gas debt exceeds $1.5 billion. Ukraine is said to have received 1.7 billion cu m of Russian gas for which it has not yet paid.

Meanwhile, OAO Gazprom Chief Executive Officer Alexei Miller said Neftegaz Ukrainy, which plans to settle the gas problem by the end of February, will join with his firm to establish two new companies involved in supplying gas to Ukraine.

“We are forming a new structure of Ukrainian gas imports, which includes the establishment of a new gas importing company on 50-50 terms. Fifty percent will belong to Gazprom, and another 50% to Neftegaz Ukrainy,” he said.

In addition, Miller said, “We will form a company to sell gas on the Ukrainian domestic market, again on a 50-50 basis.”

While Gazprom and Neftegaz Ukrainy will soon start working on a new formula of gas supplies, the disputed RosUkrEnergo will remain the only supplier of Central Asian and Russian gas to Ukraine.

Russia recently threatened to cut off all supplies of its natural gas to its neighbor after incoming Ukrainian Prime Minister Yulia Timoshenko suggested increasing the tariffs for Russian gas transiting her country and dispensing with RosUkrEnergo (OGJ Online, Feb. 8, 2008).

Suez JV obtains approval for Chile LNG terminal

GNL Mejillones (GNLM), a 50-50 joint venture of Suez Energy International and copper company Codelco, has obtained the environmental permit for its planned LNG regasification terminal in Mejillones in northern Chile.

The terminal will have a planned annual send-out capacity of 5.5 million cu m of gas, sufficient to produce 1,100 Mw of electricity.

GNLM plans to start preparatory field work immediately and will begin construction of the jetty and onshore terminal within the next few months, Suez said.

Gas is expected to start being delivered at yearend 2009 or early 2010.

For LNG storage, GNLM will use a conventional LNG carrier that will remain permanently moored to the jetty. Suez Global LNG will provide the floating storage unit (FSU). Onshore facilities will include pumps, compressors, vaporizers, and pipelines.

Mining companies BHPB-Escondida, Collahuasi, El Abra, and Codelco Norte have all signed gas purchase contracts with GNLM to cover electricity generation needs for 3 years, beginning in 2010. GNLM also signed an LNG supply agreement with Suez for identical volumes and duration.

The company expects to reach a decision by yearend on Phase 2, the construction of an onshore storage tank to replace the FSU.