For several years prior to 2004, the LNG industry was a buyers’ market, and buyers were in the driver’s seat with respect to pricing terms and flexibilities introduced into LNG sales agreements. Since then, however, LNG has moved strongly into a sellers’ market due to strong gas demand and delays in sanctioning and constructing new liquefaction capacity. Many analysts see a sellers’ LNG market prevailing well beyond 2010.

Some of the largest project financings closed in 2004-06 were in the LNG sectoralong the whole supply chain. Many involved large components of bank debt secured at modest margins. In addition, during the same period, several liquefaction projects that had entered the postcommissioning phase were able to refinance in the highly competitive bank lending market, achieving lower lending margins.

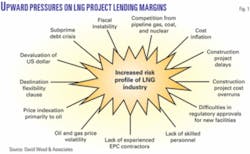

Despite such a recent golden age for the borrowing parties in LNG project finance deals, recent events seem to be conspiring to mark a turnaround in financing conditions. Fig. 1 illustrates the pressures and risks offsets at the upstream end of the LNG supply chain in 2007 by the sellers’ market and unprecedented high oil and gas prices.

Several events have had a major impact on financing:

- The US subprime debt crisis of August 2007 and the consequential global tightening of debt markets.

- Fiscal instability and toughening terms for international oil companies (IOCs) in upstream gas supply contracts.

- Rampant and sustained oil and gas industry cost inflation (2005-07).

- Devaluation of the US dollar by some 67% against the euro since 2002.

- Volatility and future uncertainty in gas markets, in terms of both supply-demand fundamentals and price. For example, the UK LNG market has deteriorated with the commissioning of new pipelines in 2006; the Japanese market for LNG strengthened in 2007, with significant loss of nuclear power capacity; and the US LNG market remains uncertain because of possible increases in domestic gas exploration and production and the delays in building key LNG receiving terminals.

- Less security of offtakes underpinning LNG sales contracts.

- Substantial delays and massive cost overruns in some large liquefaction projects such as Sakhalin II and Snohvit.

- Lack of skilled personnel and the unavailability of experienced engineering, procurement, and construction (EPC) contractors.

- Difficulties gaining regulatory approvals to build new LNG receiving terminals in key markets: California and New England.

Despite a strong global LNG demand and a lack of sufficient supply increases, these events have substantially increased the risks and costs for lenders, which may lead to increased lending margins and make debt financing for LNG projects more difficult to secure.

Impact on projects

LNG projects typically are quite capital-intensive. In addition, they are influenced by multicomponent, long supply chains; require a long period of capital expenditure during the planning, design, engineering, procurement, and construction phases before there is any income; and due to their large size and complexity, are nearly always multiparticipant projects.

For all but the largest IOCs, project financing is required as part of a funding package for LNG infrastructure development. The IOCs and national oil companies (NOCs) often together form special-purpose companies to engage in project finance for LNG projectsespecially for upstream activities such as field development and liquefaction and for shippingin order to leverage their deployed capital and spread financial risk. Having creditworthy IOCs involved provides a means for less creditworthy NOCs to secure access to project debt at more-favorable terms than they could secure on their own.

Large gas field development projects have loan collateral that can be evaluated based on the associated field reserves. Gas volumes available for loan valuation are usually the proved reserves, although in recent years some lenders have been willing to add at least a fraction of probable reserves.

Due to the very large investments, long payback periods, and large volumes of reserves that must be processed by the typical liquefaction project to achieve payback, the project’s recoverable hydrocarbon reserve collateral is not liquid until the liquefaction plant’s postcommissioning stage is reached. Gas reserves cannot be monetized without all of the upstream and liquefaction facilities plus (usually long-term) LNG purchase agreements, and transportation and handling contracts along the supply chain.

Although there is a primary focus on potential project revenues, lenders for liquefaction and regasification projects are frequently preoccupied with credit support for project finance. Key issues here are the creditworthiness of the seller and the buyer, or their parent organizations. The concern is the risk to future project revenues from nonperformance by any party, including EPC contractors and suppliers. If the borrower’s counterparty in the purchase agreement is not well capitalized or creditworthy, lenders usually seek another creditworthy entity to provide some form of financial guarantee.

In supply chains where the LNG purchasers include utilities in countries such as India, China, and Mexico without established international credit ratings, additional guarantees become essential to secure project finance. LNG project loan terms typically have long durations of a decade or more following the commissioning of the facilities. Credit-ratings triggers may be involved in loan terms; if the borrower’s credit rating deteriorates during the long repayment period, for example, a higher loan repayment dedication or loan margin may be applied.

Despite such limited loan collateral issues, it has become commonplace for greenfield and expansion, base-load liquefaction plants to obtain limited recourse or nonrecourse project financing. This usually has been achieved on the back of long-term sales agreements to creditworthy LNG buyers, incorporating take-or-pay and minimum or floor gas price provisions. This type of exposure for equity and debt providers requires conservative project evaluation and risk analysis. In the competitive lending market of 2004-06, lenders became less conservative. Expectations in late 2007, however, were that they may again become more conservative.

Global finance trends

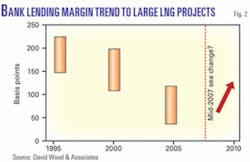

Trends in the pricing of commercial loans to Qatar’s LNG projects over the past decade are indicative of global LNG project finance trends. In the mid-1990s Qatargas-1 project financing attracted a margin of 165 basis points (bp), compared with Rasgas-1 bank loan margins of 95-200 bp. Rasgas-1 refinanced on better terms in 2004.

The Qatargas-2 projecta joint venture of Qatar Petroleum, ExxonMobil, and Totalin 2004 marked a resurgence in commercial banks’ appetite for large LNG project financings at the arranger and syndication level, as illustrated by the oversubscription of that offering, with 36 banks acting as mandated lead arranger.

Qatargas-2 was able to secure commercial bank finance at margins of 50-125 bp, followed in 2005 by Rasgas-2 and 3 project financings with bank loan margins of 45-65 bp. The downward trend in borrowing costs continued with the Qatargas-4 project sponsored by Qatar Petroleum and Shell in 2006 leveraging its project finance with bank loan margins of 30-60 bp.

It now seems unlikely that this downward trend in borrowing costs can be sustained (Fig. 2).

Another trend is the emergence of nontraditional lenders for LNG financing. In the past decade LNG financings have gone beyond traditional lenders in order to finance politically more challenging projects. Export credit agencies, a traditional resource for political risk insurance in developing markets, have also provided direct debt finance and encouraged commercial banks into projects by removing some of the credit risks of the host countries.

Multilateral lending agenciesregional and international development banks such as World Bank, European Bank for Reconstruction and Development, and African Development Bankhave also provided limited funding to developing countries for both LNG and pipeline gas projects in recent years. Islamic banks, benefiting from deposits from clients with oil revenues, have invested heavily in the Middle East LNG sector in recent years. Such lenders, although content to join syndicated loans, have yet to act as lead arrangers. Consequently they have depended on the risk appetite of the traditional lead energy banks in selecting projects deemed worthy of debt finance.

Debt raised through bonds issued on the capital markets provides borrowers with less flexibility but come with fewer obligations. For this reason such bonds have been used mainly in the LNG sector in combination with bank loans to provide more flexibility, as in the Qatar LNG projects, and have focused on tried and tested technologies deployed by robustly creditworthy organizations.

However, capital market fallouts from the 1998 Asian financial collapse made those markets cautious about funding LNG projects while the main market for LNG remained focused in Asia. Several large bond issues connected with the Qatar projects in 2004-06 seemed to be leading a reemergence of capital market financing of liquefaction projects. However with current industry trends, plus more-complex and risky pricing and cargo destination flexibility, it seems likely that bond investors will remain apprehensive that the evolving LNG industry remains too risky.

Competitive refinancing

The strong appetite of lenders for LNG projects led to some postcommissioning loan refinance of liquefaction projects benefiting from reductions in project risk profiles at the time. For example:

- The margins reported in July 2007 on the $720 million oversubscribed commercial bank tranche of the Spanish Egyptian Gas Damietta liquefaction plant 15-year refinancing package were 60-90 bp, and on two $125 million European Investment Bank tranches were 50-55 bp. To place these in context, they should be compared with margins of 60-150 bp for liquefaction train two of the Egyptian LNG (ELNG, July 2005) project and with margins of 85-235 bp for ELNG liquefaction Train 1 in 2003.

- Oman’s Qalhat liquefaction plant managed to refinance its debt in 2006 to reduce borrowing costs from the higher 55-110 bp to 45-90 bp, with lenders accepting lower project risks in the postcommissioning phase of the project and a more competitive and liquid lending market.

Competition among the big energy lenders, which made such reductions in borrowing costs for LNG projects, is unlikely to be so intense in the future.

Other opportunities exist, however. Recently profitable short-term cargoes, which account for some 12% of the global LNG market, have attracted IOCs to adopt the role of LNG aggregator. This enables them to establish a more integrated perspective of the value chain, from which, as LNG producers, shippers, receivers, and gas marketers, they control the cargo destination and optimize profitability. This is the model for Atlantic LNG (Trinidad and Tobago) and some Qatar and Egypt LNG projects aimed at targeting gas into the highest priced market at any given time. This model is difficult for lenders because it lacks secure long-term offtake agreements. IOCs that have pursued it successfully have mainly financed the uncontracted required shipping through equity rather than debt.

Cost inflation

Although gas liquefaction projects contain some peculiarities, evaluating them must be based on sound financial and economic analysis, which is common to all project decision-making.

Although this has always presented challenges for gas liquefaction projects, the problem has become critical since 2005. This is primarily because, after a period of sustained decline in unit capacity terms due to increasing economies of scale, the size and cost of a world-class, base-load gas liquefaction plant has dramatically increased due to rising steel, nickel, and other materials and labor costs impacting much of the oil and gas industry.

Gas liquefaction facilities are built of high-cost, critical-process components, and they frequently require innovative technology tailored to specific geographic environments. That was the case with Snohvit and Sakhalin II facilities. Such components tend to suffer from the highest inflation rates.

In 2003, base-load gas liquefaction process trains were constructed for less than $200/tonne/year of plant capacity, but by 2007 costs had risen to above $600/tonne/year of plant capacity. Consequently several projects have had final investment decisions delayed, and many financiers are having second thoughts about financing projects associated with rapidly escalating budgets. In 2006 the absence of new liquefaction project sanctions exacerbated the sellers’ market. In 2007 and early 2008, companies finally made investment decisions for new liquefaction projects in Peru (led by Hunt Oil) and in Angola (led by Chevron), but both projects had increased budgets.

In such circumstances careful evaluation of project costs, technical and nontechnical risks, project schedule, and efficiency of design are critical. An LNG plant, either liquefaction or regasification, that is not complete and capable of delivering the throughput that will enable it to meet its sales contract requirements has essentially no value as an asset against the loan. The 75% complete Dabhol regasification plant, for example, sat uncompleted during 2001-06 following the unraveling of Enron’s sales agreement with its power plant customer.

The salvage value of even the best available gas processing technology installed in a remote location is very low. With the intention of completing the facility in 2007, India’s state-owned gas company GAIL and its power utility NTPC Ltd. acquired the Dabhol regasification plant by paying a discount of about 70% of the debt outstanding to the original EPC contractors and suppliers, including Bechtel and GE. This example underscores the point that the only value in such projects is the future expectation of revenue from gas sales after the facilities begin operation.

Changing risk profile

A comprehensive and holistic risk analysis of all LNG facilities is essential for both equity and debt finance participants to build the level of confidence such participants require to sanction future investments. The problem is that the LNG supply chain and market have become more complicated in recent years, changing the risk profile in ways that make lenders nervous. Further changes in the risk exposure for LNG project financing continue to materialize.

Even in 2006 some analysts were commenting that LNG buyers were continuing to call the shots, being less willing to accept rigid floor price and take-or-pay volume guarantees. European buyers for many years had made progress seeking more-flexible pricing provisions linked to gas-on-gas competition instead of fuel-oil replacement. The expectation then was that LNG around the world would continue to move away from the traditional crude oil-linked price indexing and toward gas market pricing.

The strengthening sellers’ market and booming oil prices changed that in 2007. LNG suppliers see no compelling reason to move away from crude oil price indexing. Japan in 2001 had secured price stabilization in long-term contracts through its S-curve price index back to oil in the days of the buyers’ market.

During 2007 Japan was forced by market conditions in recent long-term contracts to accept straight-line price indexation approaching parity to oil prices, which translated into gas prices of some $11/MMbtu in late 2007. Although some Japanese buyers want to change price indexation from the traditional Japanese Crude Cocktail oil price benchmark and use NYMEX Henry Hub gas prices instead, few sellers want to move away from oil price indexing with oil prices hovering around $100/bbl. Some observers expect the Henry Hub benchmark to play a greater role in LNG price indexing, particularly in Asia, over the coming years. Although this has been the case with some short-term trades and cargo diversions, it may not be for future long-term contracts.

Natural gas prices at Henry Hub in the US, at the National Balancing Point in the UK, and short-term cargoes into Japan and South Korea have fluctuated widely in recent years, leading to future cash flow uncertainty for equity and debt investors. Market dynamics in late 2007 suggested that growing gas demand and insufficient growth in LNG supply should provide upward pressure overall on prices.

In certain markets, however, where gas-on-gas competition is intensesuch as new gas import pipelines versus new LNG receiving terminals in the UKperiods of oversupply can be expected. In recent years LNG project lenders have been willing to accept more price risk.

The Qatargas-2 project marked the first occasion in which price risk was passed through to lenders, with the sales agreement for the first train shipping gas into the UK gas market at a price with no floor price guarantee. Strong demand in Asia has provided Qatargas with the extra cushion of being able to divert some gas originally contracted for UK and US markets in that direction. That may be necessary from time to time, even in a predominantly sellers’ market to avoid potential losses associated with periodically being forced to sell some cargoes at lower prices in the Atlantic basin.

The no-floor-price provisions in gas sales to the UK were deemed acceptable to lenders in 2004-05 after marketing studies showed strong future demand in the UK coupled with decreasing domestic supply, as well as sound project economics. What happened in the UK market during winter 2006-07oversupply from pipeline gas, leading to sustained low gas pricescast such analysis in doubt, however. It is doubtful whether lenders will be quite so willing to accept price risk in the current market. However, lenders’ attention has been drawn primarily upstream, with concerns about escalating project budgets and long-term fiscal stability now more acute than ever. These factors are likely to justify increases in lending margins.

Destination flexibility

Achieving destination flexibility has become popular in LNG customer sales agreements. Initially this was driven by the buyers’ perspective in terms of being able to match contracts with actual demand. Later LNG suppliers also sought destination flexibility to benefit from short-term arbitrage opportunities. From either perspective this adds potential risk for project lenders if the flexibility is to the advantage of the party other than the one to whom they are lending. Even lenders to liquefaction projects selling fob need reassurance both that the LNG buyer and its contracted shippers are able to handle the base-load contract volumes and that no adverse impacts to the seller will result from granting destination flexibility to that buyer.

Lenders for buyer and seller could be exposed to loss of revenue, additional costs, and facilities disruption when cargo diversions result from destination flexibility provisions’ being invoked. Risk and economic analysis of LNG contracts with destination flexibility are more complex and uncertain for equity and debt investors in LNG infrastructure. Thus financing will probably become more difficult and costly to secure for parties adversely affected by destination flexibility clauses.

Project ship financing

The decision to own ships directly or to lease them from a shipping company partly owned by the project sponsor (NOC, IOC, or both) is often driven by tax issues and the constraints of the upstream gas production license or contract. Financing the construction of LNG ships under long-term charter to an LNG supply chain has for many years been a low risk venture. Loans to such projects in recent years have rarely involved lending margins above 60 bp, and some multiship financings with robust IOCs have been secured at less than 30 bp.

Not all LNG shipping has proved to be without risk. Technical problems associated with leaking insulation have proved problematic for some recent constructions. However, it has been those ships built on a speculative basis with no long-term time charter agreement in place that have resulted in substantial losses for some shipping companies.

The short-term market for LNG shipping is volatile and for much of 2004-07 was oversupplied. Shipping companies with no equity positions in LNG have been unable to adopt the strategies of some IOCs that capitalize on short-term and spot markets, as they have been unable to secure cargoes.

Because long-term supply contracts dominate the LNG industry by some 88%, noncontracted vessels cannot yet secure regular cargoes. Japan’s sudden surge in demand for short-term cargoes since July 2007 has improved the situation. In the prevailing market it is highly unlikely that LNG vessel construction projects can secure bank loans unless they have long-term charter contracts.

Commercial banking may struggle to sustain the enthusiasm it has shown for financing international LNG projects in recent years unless some of the risks and complexities highlighted in this article are satisfactorily mitigated by asset owners and equity investors along the full length of the LNG supply chain.

The author

David Wood ([email protected]) is the principal consultant of David Wood & Associates UK, specializing in the integration of technical, economic, risk, and strategic information to aid portfolio evaluation and management decisions worldwide. He has more than 25 years of international oil and gas experience spanning technical and commercial operations, contract evaluation, and senior corporate management. Industry experience includes work for Phillips Petroleum, Amoco, and Canadian independents, 3 years in Colombia, and 4 years in Dubai. During 1993-98 he was UK managing director for Lundin Petroleum and then Morrison Petroleum.