SPECIAL REPORT: Global pipeline plans expand

Planned pipeline construction to be completed in 2008 rose by more than one-third from the previous year, driven by large crude oil transportation projects in both the US and Asia-Pacific. Plans for 2008 construction of both natural gas and products pipelines also expanded from those for 2007.

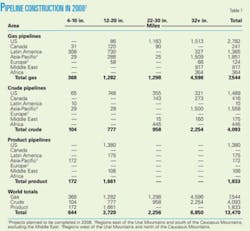

Operators plan to install nearly 13,500 miles in 2008 alone (Table 1), with natural gas construction making up 56% (more than 7,500 miles) of the plans, based on reports from the world’s pipeline operating companies and data collected by Oil & Gas Journal.

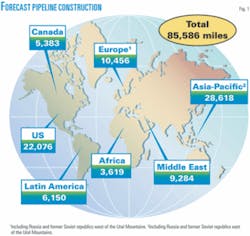

Looking forward to 2008 and beyond, greater mileage is planned for both natural gas and products pipelines than had been the case a year ago, with a slight downturn in crude lines stemming from the large quantity of mileage expected to be completed this year.

US demand for natural gas continued to drive large infrastructure projects such as pipelines in 2008, with a growth of planned construction for the year in the US helping balance a temporary downturn in Asia-Pacific activity. Long-term natural gas pipeline plans (2008 and beyond) in Asia-Pacific more than doubled year-on-year, however, driving much of the future increase seen in planned miles.

Large expansions in crude systems in both the US and Asia-Pacific keyed a nearly four-fold 2008 increase in miles expected to be completed in that sector from global totals the previous year.

Plans for construction of product pipelines in 2008 were nearly flat globally, with a large increase in US construction expected to be completed this year making up for steep declines in both the Asia-Pacific and Europe.

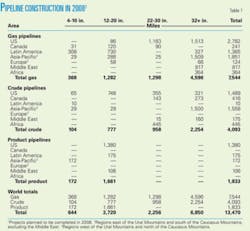

As 2008 began, operators had announced plans to build more than 85,500 miles of crude oil, product, and natural gas pipelines beginning this year and extending into the next decade (Fig. 1), a substantial increase over data reported last year (OGJ, Feb. 19, 2007, p. 48) in this report. Most (nearly 72%) of these plans are for natural gas pipelines, an increase from the previous year.

Outlook

The continued up-tick in worldwide pipeline construction trends follows US Energy Information Administration energy consumption forecasts, which show continued growth, even if at a slower rate than predictions from a year ago.

EIA forecast world marketed energy consumption to increase by 57% through 2030 (using a 2004 baseline), a period that encompasses the long-term pipeline construction projections stated here.

Energy demand growth will be strongest, according to the midyear 2007 analysis, among non-OECD countries. This non-OECD growth will be led by non-OECD Asia, which includes China and India, where demand will grow more than 3.2%/year.

Fueling this energy demand growth is an acceleration of projected gross domestic product growth in non-OECD Asia to 5.8%/year through 2030led by China at 6.5%/year, the highest projected growth rate in the worldcompared with 4.1% worldwide. EIA ascribed the stronger global growth projection (up from 3.0/year projected in 2006) to more optimistic assumptions of growth in China and India.

Structural issues that have implications for medium to long-term growth in China include the pace of reform affecting inefficient state-owned companies and a banking system that is carrying a large number of nonperforming loans, according to the EIA. The development of domestic capital markets to help macroeconomic stability and ensure China’s large savings are used efficiently supports the medium-term growth projections, according to the EIA.

In December 2007, the EIA reduced projected US energy consumption in 2030 to 123.8 quadrillion btu, 7.4 quadrillion btu lower than the previous year’s projection. Even with this nearly 6% drop, however, energy consumption is still likely to increase more rapidly than energy production. Projections for imports’ share of consumption in 2030 slipped to 29% from 30%, with rising fuel prices expected to both spur domestic production and moderate demand growth.

EIA projects domestic natural gas production in 2030 of 19.9 tcf/year, compared with the 21.15 tcf/year projected for 2030 in the prior year’s report. After a 2019 peak at 4.5 tcf/year, EIA sees Lower 48 offshore production declining to 3.5 tcf/year in 2030, as investment is inadequate to maintain production levels. This is both a later peak and larger 2030 production level than the EIA projected the previous year.

EIA, however, made a large downward revision in its projections of natural gas consumption in 2030, now pegged at 23.4 tcf/year vs. the 26.9 tcf/year projected a year earlier. Expected consumption is lower in all sectors, particularly industrial and electric power, which will be slowed by higher natural gas prices and slower growth in electricity demand.

Net pipeline imports of natural gas from Canada and Mexico will fall from 2.9 tcf in 2006 to 0.5 tcf in 2030, according to the EIA, which last year pegged 2030 net pipeline imports at 0.9 tcf. EIA ascribed the difference to both increased exports to Mexico as the growth rate of Mexican production sinks and decreased imports from Canada due to resource depletion in Alberta and Canada’s growing domestic demand.

EIA also sharply reduced the amount of LNG it expects the US to be importing annually in 2030, from 4.5 tcf in its 2007 annual outlook to 2.9 tcf in this year’s publication, ascribing the lower projection to higher costs, especially of liquefaction capacity, and decreased US consumption due to higher natural gas prices, slower economic growth, and expected global competition for available LNG supplies.

Even these smaller projected volumes, however, will have to be brought to the end-user market via pipeline, as will future unconventional domestic production and any new supplies from Alaska.

OGJ has for more than 50 years tracked applications for gas pipeline construction to what is now called the Federal Energy Regulatory Commission. Applications filed in the 12 months ending June 30, 2007 (the most recent 1-year period surveyed), suggest continued strength in US interstate pipeline construction.

- Some 2,032 miles of pipeline were proposed for land construction, but only 18 miles were proposed for offshore work. For the earlier 12-month period ending June 30, 2006, more than 1,450 miles were proposed for land construction.

- FERC applications for new or additional horsepower at the end of June 2007 also continued their recent surge, reaching more than 713,000 hp, all onshore, compared with 583,000 hp of new or additional compression applied for a year earlier and 175,000 hp the year before that.

In line with the upswing in FERC applications, prospects for oil, natural gas, and products pipeline construction appear healthy (Tables 1 and 2), led by a surge in expected work in the US and Asia-Pacific.

US energy demand in 2008, however, will be nearly unchanged from last year. Weakness in the US economy, in addition to a global economic slowdown, could hold growth in check. Federal Reserve Chairman Ben Bernanke told the US House Budget Committee last month that downside risks to US economic growth in 2008 are now more pronounced.

As tight fundamentals, difficult geopolitics, and fears that an economic recession will reduce demand continue to worry energy markets, it is important to bear in mind that large infrastructure projects such as pipelines can slip in their schedules or be canceled outright as the perceived ability to construct and operate them at a profit erodes.

Bases, costs

For 2008 only (Table 1), operators plan to build nearly 13,500 miles of oil and gas pipelines worldwide at a cost of about $37 billion. For 2007 only, companies had planned more than 10,000 miles at a cost of more than $18 billion.

For projects completed after 2008 (Table 2), companies plan to lay more than 72,000 miles of line and spend nearly $201 billion. When these companies looked beyond 2007 last year, they anticipated spending more than $107 billion to lay nearly 57,000 miles of line.

- Projections for 2008 pipeline mileage reflect only projects likely to be completed by yearend 2008, including construction in progress at the start of the year or set to begin during it.

- Projections for mileage in 2008 and beyond include construction that might begin in 2008 and be completed in 2009 or later.

Also included are some long-term projects judged as probable (such as at least two pipelines competing to bring Arctic gas to the continental US), even if they will not break ground until after 2008.

US average costs-per-mile for onshore and offshore pipeline construction (Table 4, OGJ, Sept. 3, 2007, p. 51) on FERC applications submitted by June 30, 2007, were $2.8 million and $3.2 million, respectively.

Based on historical analysis and a few exceptions and variations notwithstanding, these projections assume that 90% of all construction will be onshore and 10% offshore and that pipelines 32 in. OD or larger are onshore projects.

Following is a breakdown of projected costs, under these assumptions and OGJ pipeline-cost data:

- Total onshore construction (12,808 miles) for 2008 only will cost more than $35.5 billion:

- $1.6 billion for 4-10 in.

- $9.3 billion for 12-20 in.

- $5.6 billion for 22-30 in.

- $19 billion for 32 in. and larger.

- Total offshore construction (662 miles) for 2008 only will cost nearly $2.1 billion:

- $204 million for 4-10 in.

- $1.2 billion for 12-20 in.

- $715 million for 22-30 in.

- Total onshore construction (70,217 miles) for beyond 2008 will cost nearly $195 billion:

- $2.2 billion for 4-10 in.

- $19.5 billion for 12-20 in.

- $25.7 billion for 22-30 in.

- $147 billion for 32 in. and larger.

- Total offshore construction (1,899 miles) for beyond 2008 will cost more than $6 billion:

- $279 million for 4-10 in.

- $2.5 billion for 12-20 in.

- $3.3 billion for 22-30 in.

Action

What follows is a rundown of major projects in each of the world’s regions.

North America

Pipeline construction projects mirror end users’ energy demands, and much of that demand, both in the US and globally, continues to center on natural gas, with the industry remaining focused on how to get that gas to market as quickly and efficiently as possible. The following sections look at both natural gas and liquids pipelines, starting with North America.

Gas, NGL

The Calypso pipeline, proposed by Calypso US Pipeline LLC, a subsidiary of SUEZ Energy North America Inc., once premised on the construction of an LNG terminal at Freeport Harbor on Grand Bahama Island, will now run to shore from an anchor-and-buoy deepwater port 8-10 miles off Port Everglades, Fla.

The 1-bcfd Calypso Deepwater Port project received its draft environmental impact statement in November 2007. The facility mirrors the design of a SUEZ port planned for offshore Massachusetts and will move gas to shore through a truncated version of the already FERC-approved pipeline. Calypso expects to start construction this year.

The 842-MMcfd Ocean Express pipeline, proposed by AES Corp., is premised on construction of an LNG terminal at Ocean Cay, an industrial site in the Bahamas. It would entail installation of 54.3 miles of 26-in. mostly subsea pipeline from the EEZ boundary to Broward County, Fla.

AES is currently pursuing final permits for the project and will have a construction schedule in place once these are secured.

Elsewhere in North America, the race continued to bring Arctic gas south to major US consuming centers.

Alaska Gov. Sarah Palin notified ConocoPhillips in January that she rejected the company’s proposal to build an Alaska gas pipeline to transport North Slope gas to the Lower 48 states. Meanwhile, a 60-day public comment period began Jan. 5 regarding TransCanada’s gas pipeline proposal under the Alaskan Gasline Inducement Act. ConocoPhillips’s application was outside the AGIA solicitation.

TransCanada’s application was the only one of five formal AGIA applications to meet all the state’s requirements. Other applications were submitted by Sinopec of China, AEnergia of California, and two Alaska groups: the Alaska Gasline Port Authority and the Alaska Natural Gas Development Authority.

Following the allotted period for comment, Palin can submit the proposal to the state legislature.

TransCanada proposed a 48-in. pipeline extending from Prudhoe Bay to Alberta, where it would tie into existing pipelines that transport gas to US markets. The project’s estimated cost is $26-35 billion, andif authorized by lawmakersthe proposed pipeline could start operation in 2017.

The proposed pipeline would follow the route of the existing trans-Alaska oil pipeline and the Alaska Highway, and continue through northern British Columbia to link with the pipeline grid in northwestern Alberta.

In Canada, the proposed Mackenzie Valley pipeline would stretch more than 750 miles to transport Mackenzie River Delta gas to Alberta and beyond. Plans call for initial capacity of 1.2 bcfd, expandable to 1.9 bcfd. The project is currently in regulatory reviews. Participants expect permits to be awarded by spring or late summer 2008 and gas to begin flowing in 2014, although major unanticipated expenses could create setbacks.

Questions remain, for instance, concerning who will pay for the proposed gathering system in the Mackenzie Delta. The Northwest Territories government has suggested that Canada’s federal government build it because it could be a facilities investment extending beyond oil and gas.

In addition to the Aboriginal Pipeline Group, other pipeline partners are Imperial Oil Ltd. 34.4%, ConocoPhillips Canada 15.7%, Shell Canada 11.4%, and ExxonMobil Canada 5.2%

The partners updated cost estimates in March 2007 to $16.2 billion (Can.) from the $7 billion (Can.) filed by Imperial just 3 years ago. Costs include $7.8 billion for the Mackenzie Valley mainline, $3.5 billion for the gas gathering system, and $4.9 billion for anchor-field development.

Large domestic west-to-east natural gas expansions also continued to be planned in the US. The Rockies Express pipeline, running 1,323 miles of 42 in. pipe from Cheyenne, Wyo., and Colorado to Clarington, Ohio, is the largest new US pipeline project undertaken in 20 years (Fig. 2). The 1.8 bcfd, $3 billion line has firm commitments in place for 900 MMcfd, including a binding 500 MMcfd by EnCana Corp. and a conditional 400 MMcfd from the Wyoming Natural Gas Pipeline Authority.

Kinder Morgan Energy Partners LP will operate the pipeline and owns two thirds of the project. Sempra Pipelines & Storage holds one third of it. In exchange for capacity commitments, some shippers may exercise options for equity in the project, which could give KMP a minimum of 50% and Sempra 25% after construction.

The pipeline, which KMP expects to be completed by June 2009, will be brought on line in three segments.

REX-Entrega, running from Greasewood, Kanda, and Wamsutter to the Cheyenne Hub in Colorado is already in service. REX-West, covering the next 710 miles from the Cheyenne Hub in Colorado to Audrain County, Mo., and interconnecting with five other interstate pipelines, is scheduled to be in service this month.

The 639-mile REX-East segment from Missouri to Ohio received its draft environmental impact statement in November 2007. In addition to the 42-in pipeline, FERC’s REX-East draft EIS covered the possible environmental impacts of 20 metering stations and 7 new compressor stations, including 2 to be built along the REX-West in Wyoming and Nebraska.

FERC noted that the REX-East project would follow existing rights-of-way for more than 59% of its route and would be consistent with or conform to federal resource management plans.

Construction is scheduled to begin in summer 2008, with targeted partial service of the pipeline, meter stations, and most compressor stations by the following December. Full service is expected by June 2009.

Kinder Morgan and Energy Transfer Partners LP will jointly develop the Midcontinent Express Pipeline. The 1.4-bcfd pipeline will be about 500 miles long, originating near Bennington, Okla. It will run through Perryville, La., and terminate at an interconnect with Transco in Butler, Ala.

Pending regulatory approvals, the $1.25 billion project will be in service by February 2009. MEP has prearranged binding commitments for 800 MMcfd, including a commitment from Chesapeake Energy Marketing Inc. for 500 MMcfd.

MEP filed with FERC requesting a certificate of public convenience and necessity in October 2007 that would authorize construction and operation of the system. Construction on the pipeline is to begin this August.

Spectra Energy Transmission plans another capacity expansion of its 9,040-mile Texas Eastern pipeline system connecting Texas and the Gulf Coast to the US Northeast. The project, designated Time 3, involves expanding the pipeline system from Oakford, Pa., through addition of compression and pipeline looping. Existing rights of way will be used where possible. At an estimated $300 million, the Time 3 project is to enter service in late 2010.

ONEOK Partners LP and a subsidiary of Williams Cos. Inc. have formed a joint venture to construct and operate the 760-mile Overland Pass NGL pipeline from Wyoming to Kansas. The 110,000-b/d pipeline, consisting of 14 and 16-in. pipe will enter service by the middle of this year, with a 150 mile, 14-in. lateral from the Piceance basin entering service in 2009. When combined with its 440 mile, 160,000-b/d Arbuckle pipeline, from southern Oklahoma through the Barnett Shale to Mont Belvieu, Tex., and also set for 2009 completion, ONEOK will have more than 1,300 miles of NGL line in service by then.

Crude

Canadian oil sands will surpass deepwater wells as the single largest global source of new oil exports by the end of this decade, according to Jeff Rubin, chief market strategist and economist at CIBC World Markets, the wholesale and corporate banking arm of Canadian Imperial Bank of Commerce. Rubin also stated that Canada’s oil sands represent 50-70% of the world’s oil reserves open to private investment, depending on the investment climate in Nigeria and Kazakhstan (OGJ Online, Oct. 8, 2007).

This supply’s proximity to US demand has helped make export lines for Canadian crude a large portion of the work to be completed in the US for 2008. TransCanada Corp. is preparing to begin construction this spring on the 1,379-mile US portion of its Keystone oil pipeline project, which will transport oil from Canada to the US Midwest.

Keystone will total 3,456 km, including additions to existing Canadian pipelines and mainline flow reversals. It is to start up in late 2009 with capacity to deliver 435,000 b/d of crude oil from Hardisty, Alta., to the US at Wood River and Patoka, Ill.

The company has entered into contracts or conditionally awarded about $3 billion for major materials and pipeline construction.

TransCanada applied to Canada’s National Energy Board in November for additional pumping facilities to expand Keystone’s capacity to 590,000 b/d and extend the line to Cushing, Okla., starting in 2010. Based on the increased size and scope of the project and the executed material and service construction contracts, the Keystone project cost is now estimated at $5.2 billion.

The plans to expand Keystone follow successful completion of an open season that secured an additional 155,000 b/d of firm contracts for oil delivery from Hardisty to Cushing (OGJ, July 16, 2007, p. 10).

The project has secured firm long-term contracts totaling 495,000 b/d for an average of 18 years.

Keystone received NEB approval this year for two major applications to construct and operate the Canadian portion of the project. Keystone received its final EIS from FERC in January.

The Keystone project is one of two currently progressing systems planned to deliver crude oil from Hardisty to the US Midwest. Enbridge Energy Partners LP, also of Calgary, plans its own pipeline expansion to deliver 400,000 b/d of crude oil to the US.

The Southern Access system expansion will use 42-in. pipe to allow for future expansions of as much as 800,000 b/d on its Canadian mainline from Hardisty to the international border near Neche, ND, and new pipeline construction in the US. The new pipeline will be added between Superior, Wis., and Flanagan, Ill., just west of Chicago, on Enbridge’s Lakehead system.

The US portion of the expansion will cost about $1 billion and will take place in the three stages. The first stage added 44,000 b/d of capacity in 2007 and is to begin operations this year. An additional 146,000 b/d will be constructed this year and enter service in spring 2009, with the final 210,000 b/d also to be built in 2008 and enter service in 2009, bringing the system up to its 400,000 b/d capacity.

The final stage will run 286 miles of 36-in. pipe from Flanagan south to Patoka and can be expanded to 800,000 b/d by adding pumps.

At Flanagan, the new line will also have access to Chicago and will interconnect with Enbridge Inc.’s Spearhead pipeline, which began deliveries to Cushing Mar. 1, 2006.

Accompanying the Southern Access expansion is Enbridge’s Southern Lights 180,000-b/d Chicago-to-Edmonton diluent pipeline. Shippers have committed to 162,000 b/d, with the balance retained for spot suppliers. Enbridge will build 674 miles of 16 or 20-in. pipe from the Chicago area to Clearbrook, Minn. About 442 miles of this construction uses the same right of way as the Southern Access expansion. Enbridge will reverse the flow of its existing Line 13 to carry the diluent from Clearbrook to Edmonton, replacing this volume with a new 20-in 185,000 b/d pipeline from Cromer, Man., to Clearbrook and an expansion of its existing Line 2.

Beyond these two projects, Enbridge intends to build the Alberta Clipper crude pipeline between Hardisty and Superior, Wis. This 1,000-mile segment is designed to resolve expected capacity constraints and to be in service by mid-2010, after the Southern Access program is completed and as crude oil supplies from Western Canada continue to increase. Initial capacity will be 450,000 b/d, with ultimate capacity of up to 800,000 b/d available.

Enbridge expects supply from Western Canada oil sands developments to grow by as much as 1.8 million b/d by 2015.

Enbridge and ExxonMobil Pipeline Co. also announced in December that they will conduct commitment solicitation for a proposed new pipeline system to transport crude from Patoka to the Texas Gulf Coast. The new Texas Access Pipeline would transport crude oil sourced from the Canadian oil sands region in Alberta and from the upper US Midwest to refiners in Nederland and Houston.

The proposed project consists of construction of a 768 mile, 30-in. pipeline to Nederland and an 88 mile, 24-in. pipeline from Nederland to a delivery point in east Houston.

The commitment solicitation is to secure shipper interest in executing binding commitments to transport specified volumes of crude oil on the new pipeline, expected to be completed in 2011. Its results will guide and determine further development.

Minnesota Pipe Line Co. is expanding its pipeline system to transport additional Canadian crude to Minneapolis-St. Paul-area refiners. The company’s MinnCan Project will add a new 300 mile, 24-in. pipeline to its existing system. Minnesota Pipe Line expects 100,000 b/d to move on the pipeline once completed in late 2008, though it will actually have 165,000 b/d of initial capacity and the potential to expand to 350,000 b/d. Work began on the pipeline in August 2007.

Enterprise Products Partners LP will construct, own, and operate an oil export pipeline to provide firm gathering services from the BHP Billiton-operated Shenzi field located in South Green Canyon, Gulf of Mexico. The Shenzi pipeline will start in 4,300 ft of water at Green Canyon Block 653, about 120 miles off the coast of Louisiana. The 83 mile, 20-in. pipeline will have the capacity to transport 230,000 b/d and will connect the field to the Cameron Highway Oil Pipeline and Poseidon Oil Pipeline systems at Enterprise’s Ship Shoal 332B junction platform.

BHP Billiton expects Shenzi production to begin in mid-2009. Saipem America began installation of precrossing concrete mattresses for the pipeline in September 2007.

Products

Colonial Pipeline Co. received assurances from FERC encouraging it to invest $1 billion in an expansion of its mainline petroleum products pipeline. To ease constraints on its system, Colonial plans to construct and operate 500 miles of 36-in. pipeline between Louisiana and Georgia to transport at least 800,000 b/d, a 30% increase in capacity.

In July 2007, Colonial filed an application with the Georgia Department of Transportation requesting permission to build between the Alabama state line and suburban Atlanta, using the same right-of-way of its two existing mainlines.

Colonial estimates the expansion will enter service in 2010.

Kinder Morgan is continuing the development of its $400 million CALNEV pipeline expansion following July 2007 FERC approval of its rate structure. Expansion of the 550-mile pipeline involves construction of a 16-in. pipeline from Colton, Calif., to Las Vegas, Nev., and will increase the system’s capacity to 200,000 b/d, transporting products for the military at Nellis Air Force Base. The company said a further capacity increase to more than 300,000 b/d is possible with the addition of pump stations.

The new pipeline will parallel existing utility corridors between Colton and Las Vegas. Following its completion, the existing 14-in. line will be transferred to commercial jet fuel service for McCarran International Airport and any future airports planned in Las Vegas, with the 8-in. pipeline that currently serves the airport purged and held for future service.

Start-up of the new line is scheduled for late 2009 or early 2010.

Holly Corp. and Sinclair Transportation Co. plan to build a products pipeline extending from Salt Lake City to Las Vegas. The UNEV Pipeline project includes construction of associated terminal facilities in Cedar City, Utah, and northern Las Vegas.

The 430 mile, 12-in. line will cost about $300 million and have an initial capacity of 62,000 b/d, expandable to 120,000 b/d. It will serve refineries and shippers along its route and interconnect to the Pioneer Pipeline.

The system is slated for completion by the end of this year.

Latin America

Intergovernmental meetings held in 2006 regarding construction of a 7,776-mile pipeline to transport natural gas from Venezuela to Argentina through Brazil, Uruguay, and Paraguay have yielded little concrete progress on the project since. The line, if constructed, would cost $25 billion and could take 5 years to construct. It has a projected capacity of 150 million cu m/day.

Talks culminated in the January 2007 signing of a declaration between Brazil and Venezuela authorizing construction of the pipeline’s first leg, to begin in 2009.

Venezuelan President Hugo Chavez ascribes the subsequent slowing of progress to dissent between potential participating nations and attempts at subversion by the US government.

Petrobras signed an accord with the Goias state government to build the country’s first ethanol pipeline, a $226 million, 975-km line to transport 1.056 billion gal/year. The pipeline will run from Goias to a refinery in Paulinia, near Sao Paulo. Japan’s Mitsui and Brazil’s Camargo Correa are also participating in the project, with plans for a feasibility study announced in March 2007. Petrobras plans to have the line in service by 2010.

Three other Brazilian ethanol pipeline proposals have also emerged; a second from Petrobras and two non-Petrobras projects

Ethanol producers in Parana state proposed a $315 million, 528-km pipeline to Paranaqua, to be completed in 2011. The other non-Petrobras line would run 300 km across Sao Paulo state from Paulinia to the port of Sao Sebastiao, carrying 1.32 billion gal/year.

Tidelands Oil & Gas Corp. subsidiary Sonora Pipeline LLC received permitting in March 2007 from FERC for construction of the US portion of the Burgos Hub Export-Import project. Tidelands subsidiary Terranova Energia had previously received approval from the Mexican government for both the Occidente and Oriente sections of the project.

The Occidente section will use 323 km of 30-in. pipe, running from the Brasil storage field to Nuevo Progresso, Mexico, with a proposed international pipeline crossing into South Texas from Mexico at the Donna Station. This crossing will allow interconnections with TETCO, TGPL, and Texas Gas Services. The pipeline will also include a stretch from Brasil to Arguelles, where another proposed crossing into South Texas would facilitate interconnection with Houston Pipeline, Calpine, and Kinder Morgan.

The Oriente section will use 36-in. line spanning 149 km. It will run from a proposed offshore LNG regasification terminal to Norte Puerto Mezquital and from there to the Brasil storage field.

Proposed US construction totals 29 miles of 30-in. pipeline.

The system is designed to flow natural gas bidirectionally between Texas and Mexico at a rate of 1.2 bcfd, but is being built to address an expected sharp increase in Mexican demand for imported gas starting in 2010.

Asia-Pacific

Industrial growth in Western Australia prompted an increase in the size of the proposed Stage 5 expansion of the Dampier-Bunbury natural gas trunkline to handle an additional 140 terajoule/day of natural gas expected to come online in 2008-10.

Stage 5A will duplicate about half the current mainline length, comprising 10 loops that will connect to previously constructed Stage 4 loops. The new loops will total 570 km, adding around 100 TJ/day of capacity. Stage 5A is expected to cost $660 million (Aus.). Work began in late February 2007, with commissioning expected next month.

Stage 5A(2) will add another 40 TJ/day and has been approved by Dampier Bunbury Pipeline. It will involve an additional 140 km of looping, some compressor station modifications, and is expected to be commissioned by 2010.

The Indonesian government tendered in January 2006 for the construction of a 1,219-km natural gas pipeline between Bontang in East Kalimantan and Semarang in Central Java. The pipeline, estimated to cost $1.7 billion, would carry 700-1,000 MMcfd of natural gas.

PT Bakrie & Bros. won the tender to build and operate the pipeline and in December 2006 said it plans to proceed with the project despite doubt voiced by officials about its feasibility. In May 2007 the Indonesian government said it would revoke PT Bakrie & Bros. building rights unless construction started by July of that year, but reversed course in June, stating that Bakrie’s progress reports had been sufficiently detailed to justify their continued participation.

PT Perusahaan Gas Negara was in the early stages of building the South Sumatra to West Java Transmission Pipeline Project Stage 1 in November 2007. Stage 1 will use 375 km of 32-in. pipe to move gas from Pagardewa (South Sumatra) to Cilegon (Banten). Stage 2 will transport natural gas from Pagardewa to Labuhan Maringgai (South Sumatra) and from Muara Bekasi (West Java) to Rawa Maju (West Java) using a combined 100 km of 28 and 32-in pipe.

Indonesia has also offered construction of both the Gresik to Semarang and Semarang to Cirebon pipelines to private contractors.

In December 2007 Russia and Turkmenistan agreed to accelerate development of the proposed Caspian Gas Pipeline. The decision followed agreement the prior month on amendments to the gas supply contract governing the export of Turkmen gas to Russia. On completion in 2012, the pipeline will extend 510 km along the coast of the Caspian Sea360 km through Turkmenistan and another 150 km through Kazakhstanbefore connecting with the existing Central Asia-Center gas pipeline network at the Russian-Kazakh border.

Turkmen gas will also be moving east to China. Kazakhstan and China agreed in August 2005 to build a 40 to 48-in. natural gas pipeline running from western Kazakhstan to China. Now extended into Turkmenistan, the 4,350-mile pipeline is scheduled to deliver 30 billion cu m/year by 2012. Construction began on the Turkmen section in August 2007. About 117 miles will be laid in Turkmenistan, 329 miles through Uzbekistan, 803 miles through Kazakhstan, and 2,796 miles in China as that country’s second West-East Gas Pipeline, terminating in Guangzhou.

China plans more that 20,000 km of domestic pipeline construction, more than 15,000 km of which will be built by the end of 2010, a large portion consisting of this system.

The first West-East Gas Pipeline, running 4,000 km from the Xinjiang Uygar Autonomous region to Shanghai and other eastern provinces, entered service in 2004. It is being expanded to 17 billion cu m/year from 12 billion cu m/year. Construction on the second line is scheduled to start next year. It will parallel the first line until Gansu before separating to reach Guangzhou.

The project will comprise more than 8,500 km of line when eight branch lines are included, at an estimated cost of nearly $20 billion. Construction is expected to begin this year.

The Caspian nations are not the only countries actively pursuing export projects to China, with much of the crude mileage planned in the Asia Pacific region for 2008 consisting of the Eastern Siberia-Pacific Ocean crude line running to China from Russia.

The first stage of the 4,700-km project includes construction of a 2,400-km oil pipeline from Taishet to Skovorodino near the Chinese border and of a rail oil terminal at the Perevoznaya Bay at a combined cost of $7.9 billion. The second stage, depending on development of Eastern Siberian oil fields, involves construction of a pipeline link between Skovorodino and Perevoznaya on Russia’s Pacific Coast.

China looks to import as much as 30 million tonnes/year of crude if a pipeline spur is built from Skovorodino to Daquing. In November 2007 the premiers of both countries agreed that the spur would be built and the entire line placed in service by the end of this year, but progress has slowed since, Transneft cautioning that completion of the first stage could be delayed by several months.

Supplies along the Skovorodino-Perevoznaya route would total 50 million tonnes/year, the bulk of which would be exported to Japan, but hinge entirely on a combination of continued development of the Siberian fields, other fields, and Russia’s continued desire to export to Japan.

Urals Energy in October 2007 received approval from Transneft to build a pipeline tie-in from its Dulisminskoye field to ESPO. First oil from the field is expected to flow into ESPO during the first half of 2009.

In December 2006, OAO Gazprom agreed to acquire, for $7.45 billion, a 50%-plus-one share stake from Sakhalin-2 project operator Sakhalin Energy Investment Co. Ltd.Royal Dutch Shell PLC, Mitsui & Co., and Mitsubishi Corp. Construction of one onshore pipeline section halted in July 2007 due to safety and environmental concerns, even as the rest of construction activity continued pace.

The total pipeline project comprises two 800-km systems (one gas, one oil) running from production at the northeastern edge of Sakhalin Island to terminals at the southern tip.

Beyond the export projects to Russia and China described earlier in this section, Turkmenistan has also agreed to supply natural gas to Pakistan over 30 years via the proposed $2 billion Turkmenistan-Afghanistan-Pakistan pipeline. India has also expressed its willingness to participate in the 1,680-km pipeline.

A 735 km Afghani segment lies between a 145 km Turkmen length and the final 800 km through Pakistan.

Turkmenistan and Afghanistan reached an agreement to revive the line in July 2007, with Turkmen President Gurbanguly Berdymukhammedov saying that Turkmenistan would send 30 billion cu m/year through the line. Outside analysts, however, have voiced skepticism regarding Turkmenistan’s ability to meet these supply commitments at the same time it has agreed to ship large volumes of gas to both Russia and China.

Europe

Work started in early December 2005 on the Russian onshore section of the Nord Stream pipeline in Babayevo. This 56-in. segment will stretch 917 km to the Baltic Sea coast near Vyborg, linking existing gas pipelines from Siberia to the NEGP project. Seven compressor stations will provide the necessary pressure. The pipeline will cross the Baltic, making landfall near Greifswald, Germany. This section will be 1,200 km in length with a 48-in. OD. Environmental studies regarding offshore pipelay activities and pressure testing began last month.

The full system is scheduled to start operations in 2011 at a capacity of 27.5 billion cu m/year. The project includes building a second, parallel pipeline, doubling capacity to about 55 billion cu m/year. This second pipeline is planned to come on stream in 2012.

A joint venture consisting of Gazprom (51%), Wintershall AG (20%), E.ON Ruhrgas AG (20%), and NV Nederlandse Gasunie (9%) is building the pipeline. The total cost for the offshore project will amount to more than €5 billion, with Gazprom investing an additional €1.3 billion in the onshore section.

Gaz de France, and Finland have also voiced interest in participating in the project.

Russia began production at the 825.2 billion cu m Yuzhno Russkoye oil and gas condensate field in December 2007. Gas from this field will be shipped through Nord Stream once it is completed.

Gazprom and Eni SPA agreed in December 2007 to build the 560-mile South Stream gas pipeline under the Black Sea and through Bulgaria. Bulgaria and Russia reached agreement last month. On completion, the $10 billion line could distribute gas to northern and southern Europe, with an estimated capacity of 30 billion cu m/year. A feasibility study is set to be completed by the end of this year. Participants plan to deliver first gas through South Stream by 2013.

Medgaz began onshore trenching for the 8 billion cu m/year Algerian-European gas pipeline bearing the same name in July 2007, having received all regulatory approvals within the scheduled timeframes. The first shipment of offshore pipe (35,000 tons of 12-m lengths with a 24-in OD) arrived in Spain in October 2007. The project is expected to cost €900 million, with start-up slated for 2009. This figure includes past costs of the project, construction, start-up, and preinstallation of future extension points in the coastal section.

Medgaz’s offshore length is 210 km, and it will reach a maximum water depth of 2,160 m. Supplies will come from the Hassi R’Mel-Beni Saf gas pipeline operated in Algeria by Sonatrach. Upon landfall in Spain, the pipeline will link with the Almería-Albacete gas pipeline operated by Enagas, facilitating its connection to the Spanish and European gas grid. Gaz de France, which owns a 12% stake in the project, contracted for 1 billion cu m/year of gas through Medgaz starting in 2009 with a 20-year term.

Other interests in Medgez are: Sonatrach (36%), Cepsa and Ibedrolla (20% each), and Endesa (12%).

Plans to export Algerian gas via Italy have also progressed, Galsi SPA and Snam Rete Gas SPA having signed a memorandum of understanding in November 2007 to construct the Italian section of the planned 8 billion cu m/year Galsi natural gas pipeline, which will deliver Algerian gas to Italy via Sardinia.

Gasli shareholders are Sonatrach, Edison SPA, Enel SPA, Hera Trading, Regione Sardegna, and Wintershall AG.

The project envisions four pipeline segments: 640 km onshore between Hassi R’mel gas field in Algeria and El Kala on the Algerian coast; 310 km between El Kala and Cagliari on Sardinia in water as deep as 2,850 m; 300 km between Cagliari and Olbia on the northern Sardinian coast; and 220 km between Olbia and Pescaia, southeast of Florence, in water as deep as 900 m.

Sardinia is set to receive gas supplies starting in 2012 from the new line.

Sonatrach will deliver 3 billion cu m/year into the system, Enel, 2 billion cu m/year, and Hera Trading, 1 billion cu m/year.

Austria’s OMV AG continues to advance the 56-in. Nabucco pipeline, which will bring some combination of Central Asian, Caspian, and Middle Eastern gas to the Baumgarten hub in Austria near the Slovakian border at a rate of 31 billion cu m/year, before moving it on to Western Europe. The $6.5 billion pipeline, spanning 3,300 km, is to be completed by 2013.

Feasibility studies have led to a two-stage construction plan. The first phase, starting construction next year, calls for 2,000 km of pipe between Ankara, Turkey, and Baumgarten, allowing 8 billion cu m/year of gas from the existing Turkish pipeline network to be transported by 2012. Second-stage construction would begin in 2012 and build eastward from Ankara to the Iranian and Georgian borders (Fig. 3).

The European Union has given its backing to the proposal, appointing a coordinator who seeks to make the line the core of European Union energy policy and asking the five-company consortium (OMV, MOL Rt., Botas, Bulgargaz, and Transgaz SA) developing the project to allow RWE AG and Gaz de France to participate. The lack of firm gas-supply commitments, however, continues to weigh on project financing.

Middle East

Iran, Pakistan, and India continued discussions toward building the long-contemplated gas export line from Iran to India during 2007. Gazprom has also expressed interest in participating in the $7 billion project, which would transport as much as 120 million cu m/day of natural gas from the South Pars field in the Persian Gulf through 2,100 km of 56-in. OD line (Iran, 1,100 km; Pakistan, 750 km; India, 250 km).

Natural gas pricing agreements have been reached between Iran and Pakistan, but India’s status remains uncertain. In addition to difficulties reaching economic terms, India is under US pressure to not participate in the project and has security concerns regarding having such a major energy artery running through Pakistan.

Pakistan has said that it will build its portion of the pipeline between 2009 and 2011, while Iran stated in July 2007 the construction of its section was 18% complete.

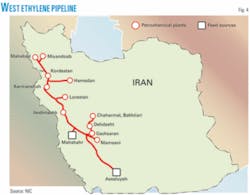

Iran is also building a 2,163-km ethylene pipeline from Assaluyeh in southern Iran to the country’s northwestern provinces (Fig. 4). The pipeline will transport ethylene to meet the feed requirements of new petrochemical complexes in Gachsaran, Kermanshah, and Mahabad.

Construction of the pipeline began in 2003 and is targeted for completion in 2009-10. The West Ethylene Pipeline was initially to transport 1.5 million tonnes across 1,500 km to feed five planned petrochemical complexes. The Iranian Parliament, however, instructed the Petroleum Ministry to build five more complexes in the cities of Andimeshk, Dehdasht, Hamedan, Kermanshah, and Miyandoab as a means to boost production in the less-developed parts of the country. The pipeline’s length, therefore, was extended to 2,163 km and capacity increased to 2.8 million tonnes.

Olefin plants in Assaluyeh and the Bandar Imam special economic petrochemical zone in Mahshahr City will supply the ethylene.

Bakhtar Petrochemical Co., which is constructing the pipeline, is a private joint stock holding company.

Calvalley Petroleum Inc. will build and operate 250 km of 16-in. crude oil pipeline in Yemen between Blocks 9 and 18, crossing a number of development areas before reaching a tie-in to an export pipeline already in place running from Block 18 to the Ras Isa terminal on the Red Sea.

Last month the company awarded and received Yemeni approval of an engineering, procurement, and construction management contract for the pipeline.

Africa

Nigeria, Algeria, and Niger hope to start gas exports via the proposed 18-25 billion cu m/year Trans-Sahara gas pipeline in 2015. Once built, the 4,300-km line would transport gas from the Niger Delta in southern Nigeria through Niger and into Algeria and Europe. Cost estimates for the project are $10-13 billion.

A senior energy delegation from Algeria, Nigeria, and Niger visited Brussels in August 2007 to promote TSGP to potential investors and European gas consumers seeking to diversify gas supply sources.

According to the feasibility report published by engineering company Penspen Consulting, TSGP would comprise a 48-56-in. pipeline from Nigeria to Algeria’s Mediterranean coast at Beni Saf and subsea pipelines of 20-in. between Beni Saf and Spain.

Europe expects to import 500 billion cu m of gas in 2020. Europe’s Energy Commissioner Andris Pielbags cautiously welcomed the pipeline, stressing the need for Europe to diversify gas suppliers and enhance security of supply. Pielbags, however, said it was important to determine the availability of proved gas reserves, the feasibility of the project, its economic viability, and geopolitical developments in the region.

Tony Chukwuku, Director of Nigeria’s Petroleum Resources, admitted that Nigeria’s export plans were ambitious, particularly as it is trying to boost the use of domestic gas for electric power generation.

India has also voiced interest in participating in the project.

Sonatrach has secured cathodic protection for the 665 km NK-1 Haoud el Hamra-to-Skikda oil pipeline. Construction of the line is to be completed this year.