OGJ Newsletter

EIA: OPEC oil export revenues climbed 10% in 2007

Members of the Organization of Petroleum Exporting Countries earned an estimated $674.7 billion in net oil export revenues during 2007, 10% more than in 2006 when revenues totaled $612.7 billion, the US Energy Information Administration said on Feb. 12.

Saudi Arabia had the biggest share, $193.8 billion, or 29% of the 2007 total, it indicated. That was $11 million, or 6%, more than its $182.8 billion of oil export revenues in 2006.

On a per capita basis, OPEC’s net oil export revenues rose 8% year-to-year to $1,147 from $1,059, according to EIA. Qatar had the largest share of 2007’s total, $29,235, followed by the UAE with $23,817 and Qatar with $21,619.

EIA bases its figures on estimates of countries’ production and consumption in its latest short-term energy outlook and assumes that exports are sold at prevailing spot prices. When a country exports several different crude grades, EIA assumes that the proportion of total net exports represented by each grade represents its share of total domestic production.

The federal energy forecasting and analysis service predicted that OPEC’s total oil export revenues could reach $863 billion in 2008 and $797 billion in 2009, based on its latest short-term energy outlook. In that forecast, EIA said it expects global oil markets to ease as production increases outside OPEC and planned capacity additions within the cartel more than offset expected moderate world demand growth.

Cold winter trims Iranian oil, petrochem output

An unusually cold winter has cut production of crude oil and petrochemicals in Iran, reports FACTS Global Energy, Honolulu.

The chill has raised residential and commercial use of natural gas, diverting supplies away from gas-lift operations in Iranian oil fields and from petrochemical manufacture, says FACTS analyst Siamak Adibi.

Since early January, Adibi says, residential and commercial demand has represented 90% of total Iranian gas consumption of 15.67 bscfd and has been 18% higher than its level of a year earlier.

Gas has been cut off to reinjection projects in Parsi, Karang, and Kupal oil fields. Reinjection at Maroon oil field has dropped to 200-300 MMscfd from 900 MMscfd, Adibi reports.

Together, those fields had been producing 930,000 b/d of crude, about 512,000 b/d of it from Maroon field alone.

National Iranian Oil Co. (NIOC) had planned to raise gas reinjection in all of Iran’s oil fields to 7.9 bscfd in 2010 and to 10.9 bscfd by 2015.

Some Iranian engineers believe the country’s predominantly fractured-carbonate reservoirs will require more gas reinjection than that, Adibi says, noting that the overall decline rate for Iranian oil fields is 9-11%/year.

“Many industrial projects such as gas-based petrochemical plants at Assaluyeh have no production because gas supply has been temporarily halted to meet the increased demand from the residential and commercial sector,” Adibi says. “NIOC has also cut LPG supply to petrochemical projects.”

Gas processing plants fed by gas from Phases 4 and 5 of giant offshore South Pars gas field have cut LPG exports and moved the gas into the national grid.

Iran has halted pipeline gas exports to Turkey, to which it had committed 970 MMscfd. Late last year it trimmed the exports to 140-180 MMscfd.

“Turkey will have a serious gas shortage if the Iranian supplies are not resumed,” Adibi says.

The Iranian government has blamed the gas shortage on a reduction in imports from Turkmenistan related to price disputes.

But Adibi notes that the Turkem problem should have affected only northeastern cities in Iran and says, “This shortage, which has covered the whole country, has been caused by a failure in network management.”

Adibi attributes the problem to conflicting gas requirements for gas reinjection in projects managed by NIOC and for rapidly developing downstream uses in projects managed by National Iranian Gas Co.

Nigeria’s new gas policy favors domestic market

Producers of natural gas in Nigeria will be expected to sell gas at an affordable price to the domestic market under a new pricing policy approved by Nigerian President Umaru Musa Yar’adua.

Gas producers also will allocate a share of their production and resources to the domestic market rather than export it. No details were given on what this quantity would be.

The plan underpins Yar’adua’s commitment to ensure that Nigeria develops its gas reserves for domestic use focusing in particular on electric power generation. Industries such as fertilizer and methanol that require gas as feedstock will be able to compete with their counterparts in other low-cost gas producing countries, according to presidential spokesman Olusegun Adeniyi.

Adeniyi said the amount of gas reserved for domestic consumption will be periodically determined by the Minister of State (Gas) in the Federal Ministry of Energy. Also, a new gas department will be established in the federal energy ministry to implement the gas policy and regulations.

Nigeria’s proved gas reserves are estimated at 184 tcf, but it has struggled to attract investment in the electric power sector because of low prices and a lack of regulations, leaving investors to prefer exporting gas as LNG. Nigeria’s gas flaring has amounted to 3.5 billion boe over the past 26 years because it does not have the infrastructure to distribute gas locally (OGJ Online, Jan. 29, 2008).

Experts said that the challenge for any projects in Nigeria would be to strike the right balance between selling gas domestically and selling more profitably in the international LNG market.

Iraq, Kurdistan continue row over oil contracts

Disagreement over the development of Iraq’s oil and gas persists between the country’s central government in Baghdad and the Kurdish Regional Government (KRG), as both sides continue to insist on their respective rights.

Kurdistan Region Prime Minister Nechirvan Barzani said he will lead a delegation to Baghdad in the next 2 days for talks with the central government over the country’s draft oil law, among other topics.

Mahmud Uthman of the Kurdistan Alliance said the delegation will hold talks with Iraqi Prime Minister Nuri al-Maliki on the status of the Oil and Gas Law, as well as recent and pending contracts KRG signed with international oil companies.

KRG Oil Minister Ashti Hawrami told an oil conference in London that the Kurds have not made any decision to stop signing new contracts with foreign firms, despite threats from the central government to block oil exports as a result of disputes over the legality of KRG contracts.

“Talks with other firms are still under way,” said Hawrami.

Meanwhile, reaffirming that the KRG oil contracts are illegal, Iraqi Oil Minister Husayn al-Shahrastani has threatened to blacklist international oil firms if they sign them.

In a published interview, Al-Shahrastani dismissed Kurdish aspirations by saying Iraq has lost decades of opportunities and wasted a year discussing the draft Oil and Gas law.

He noted that the government has decided to expedite the rehabilitation of oil wells, adding that the exact specifications required for developing oil wells in the long run have not yet been approved.

Al-Shahrastani also said a good contract that would give the Iraqi government full ownership and control over the country’s oil will be designed to encourage international oil companies to introduce technology and provide financial resources to his country.

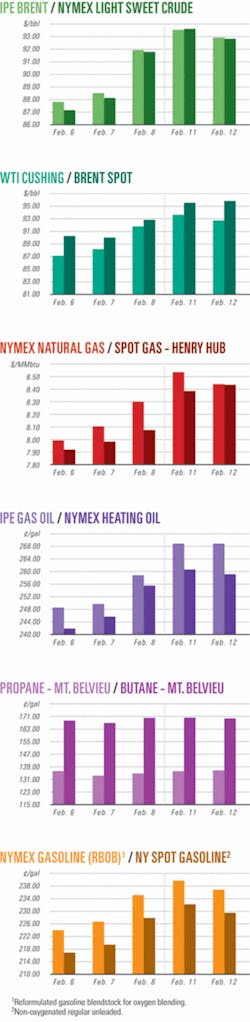

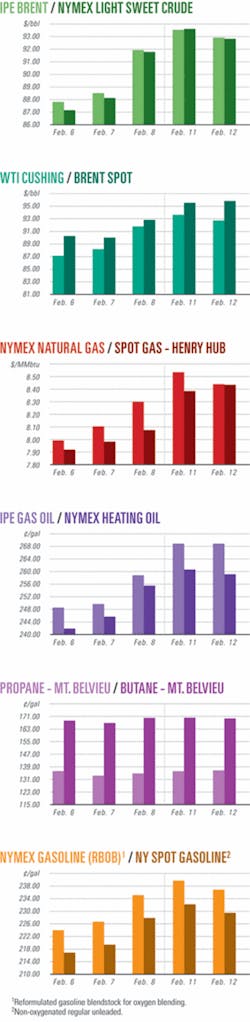

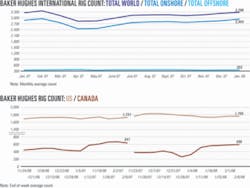

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesMMS expects $362.5 million in latest RIK oil sale

The US Minerals Management Service expects to gross $362.5 million from its latest royalty-in-kind crude oil sale from federal offshore leases in the Gulf of Mexico and Pacific Ocean, the Department of the Interior agency reported.

Six companies submitted winning bids for the 4,264,500 bbl of crude in the January sale, or 29,050 b/d over the terms of the contracts, MMS said Feb. 12. Delivery is scheduled to begin Apr. 1 and to conclude June 30, with the exception of one Pacific Ocean package that was awarded for 1 year.

MMS based its estimated revenue from the sale on the current $85/bbl for oil of this quality. It periodically conducts such sales as part of a program which allows it to take some crude in kind instead of receiving a cash payment. MMS then competitively sells this royalty crude on the open market.

Chevron Products Co., ConocoPhillips Co., Exxon Mobil Oil Corp., Sempra Trading Co., Shell Trading, and Plains Marketing LP submitted the winning bids in the latest RIK oil sale, MMS said.

Eni nets 18 exploration leases in Alaskan sale

Eni SPA has picked up 18 exploration leases off northern Alaska under Lease Sale 193 held Feb. 6 in Anchorage.

The blocks, described as having “high exploration potential,” lie in 30-50 m of water in the Chukchi Sea. Of the 18 leases for which Eni was the highest bidder, 14 were joint bids with StatoilHydro AS, and the remaining 4 were solely Eni, the company said.

In Alaska, Eni owns 158 leases on the North Slope, and recently started development of Nikaitchuq oil field, its first project as an operator in the region.

The acquisition of the Alaskan blocks requires the approval of the local authorities before the deal can be finalized.

Norway awards 52 licenses in latest lease sale

Norway has offered 52 production licenses to 19 operators that applied to develop blocks in the Norwegian North Sea, the Norwegian Sea, and the Barents Sea.

Competition for the licensing round, dubbed Awards in Predefined Areas 2007, was intense as it received 113 applications, the Norwegian energy ministry said. “There is a large potential in proving new, smaller resources close to existing infrastructure in the mature areas of the [seas],” it said.

The energy ministry is keen to see rapid development of potential resources and maximize exploration in mature areas on the Norwegian Continental Shelf. Among the companies with successful bids were BG Norge AS, Centrica Resources Norge AS, Dana Petroleum Norway AS, E.On Ruhrgas Norge AS, Endeavour Energy Norge AS, Eni Norge AS, Esso Norge AS, Genesis Petroleum, and Faroe Petroleum Norge AS.

Drilling & Production - Quick TakesStatoilHydro lets Troll C modification contract

StatoilHydro AS awarded Aker Kvaerner an engineering, procurement, construction, and installation contract for modifying the Troll C semisubmersible accommodation and processing platform. The modifications will allow processing low-pressure oil production from subsea completed wells in Troll West, about 80 km off Bergen, Norway.

The 450 million kroner project has a scheduled completion date of January 2010. Aker Kvaerner plans to immediately commence design and procurement work, with prefabrication of steel and piping starting in October at Aker Kvaerner Egersund.

The contract also includes a 400-tonne compressor module that will be installed on Troll C during August 2009.

The offshore installation work is planned for 2009.

The Troll C platform is one of the assets included in Aker Kvaerner’s long-term maintenance and modification contract with StatoilHydro.

Troll C was installed on Troll West in 1999, and also handles production from Fram West and East fields.

Partners in Troll West are Petoro AS 56, StatoiHydro 30.58%, Norske Shell 8.1%, and Norske ConocoPhillips AS 1.62%.

Kvitebjorn gas, condensate production resumed

StatoilHydro AS has restarted gas and condensate production from Kvitebjorn field in the Norwegian North Sea after repairs were identified for the pipeline from the field to the Kollsnes processing plant on the west coast. The line was damaged by a ship’s anchor last fall. Gas exports from Visund, which uses the same pipeline, also have resumed to Kollsnes.

This summer StatoilHydro will repair the pipeline, which suffered damage to its weight coating. However, in the meantime internal experts and consultants said it has “sufficient technical integrity” for temporary operation.

Kvitebjorn was scheduled to start up again in November after production was temporarily stopped in May to stem falling reservoir pressure during its complex drilling program (OGJ Online, May 5, 2007). The field had operated at about 50% of its 190,000 boe/d capacity since December 2006.

Production problems with this field, which started in 2004 and came to 11 million cu m/day, was one of the reasons StatoilHydro missed its 2007 production target. “There are no capacity restraints now,” a company spokesman told OGJ.

Kvitebjorn is on Block 34/11, east of Gullfaks field in the North Sea. According to current plans, some 55 billion cu m of gas and 22 million cu m of condensate will be produced.

Shell lets contract for Perdido oil field

Royal Dutch Shell PLC has let to Technip an engineering, fabrication, and installation contract for a flowline and riser on ultradeepwater Perdido oil field in the Gulf of Mexico.

Together the flowline and steel riser will cover 8.24 miles and the pipelines will extend 9,700 ft along the route. Technip will weld the pipelines in Mobile, Ala., and will install them with its Deep Blue deepwater pipelay vessel.

In November, Shell awarded Technip an EPC contract for the Perdido umbilicals, spar hull, and mooring system (OGJ Online, Nov. 27, 2007). Moored in about 8,000 ft of water, the spar will be the world’s deepest spar production facility and the first with direct vertical access, Technip said.

Perdido is 200 miles south of Freeport, Tex. Shell is the operator with a 35% interest. Other partners include Chevron Corp. 37.5% and BP PLC 27.5%.

Aker Clean Carbon plans Karsto CO2 capture unit

Aker Clean Carbon and the Norwegian government will establish a 725 million kroner carbon dioxide capture and sequestration unit at Karsto on the west coast of Norway. Operations are scheduled to begin in 2009. Aker said it expects the plant’s carbon sequestration to be cheaper than releasing emissions.

“The plant will have a capacity to remove 100,000 tonnes/year of CO2 from exhaust gasses. Operating costs are estimated at 150 million kroner over a 3-year period,” Aker said.

Parent company Aker Kvaerner will design and construct the CO2 capturing facilities.

Processing - Quick TakesTotal to build coker at Port Arthur refinery

Total SA will build a 50,000-b/d coker and desulfurization, vacuum distillation, and related units at its 231,000 b/d refinery in Port Arthur, Tex. Commissioning is scheduled in 2011.

The $2.2 billion increase in the refinery’s deep-conversion capacity will boost output of ultralow-sulfur automotive diesel by 3 million tonnes/year.

Hunt to boost output at Tuscaloosa refinery

Hunt Refining Co. plans to install two new units at its Tuscaloosa, Ala., refinery to increase crude throughput by more than 30% to 69,000 b/d, double its production of gasoline and diesel for the southeastern US, and help it meet benzene regulations.

US Environmental Protection Agency mandates require that refineries adhere to annual averages of 0.62% benzene content in gasoline by 2011.

Hunt selected Honeywell International Inc. subsidiary UOP LLC, Des Plaines, Ill., to supply basic engineering services, technology, and equipment, including its proprietary continuous catalytic reformer and unicracker. The technology will process light naphtha to produce high-octane gasoline blending components with low benzene content.

The CCR process produces high-octane gasoline from naphthenes and paraffins, and unicracking technology upgrades light cycle oil feedstocks to make ultralow-sulfur diesel and naphtha.

Construction on the new units will begin this year for service to begin in late 2009. The project is planned to complete in 2010.

Hunt’s Tuscaloosa refinery provides 52,000 b/d of gasoline and distillate fuels, home heating oil, diesel fuel, and asphalt to the Southeastern US and East Coast.

Transportation - Quick TakesMaritimes & Northeast to expand pipeline capacity

Maritimes & Northeast Pipeline (M&NP), Halifax, NS, plans to invest $240 million to expand the capacity of the 330-mile US mainline portion of its natural gas pipeline system. The decision followed a successful open season for the additional capacity.

M&NP will install additional compression at existing stations and will lay about 4.5 miles of 24-in. loop on its existing 24-in. mainline to enable transmission of as much as 170 MMcfd year-round and an additional 30 MMcfd during winter months.

These Phase 5 facilities will accommodate gas to be supplied by EnCana Corp.’s planned Deep Panuke project off Nova Scotia. It will be delivered to markets in Atlantic Canada and the US Northeast. M&NP expects to place the expanded system into service in November 2010.

M&NP is owned by affiliates of Spectra Energy 77.53%, Emera Inc. 12.92%, and ExxonMobil Corp. 9.55%.

Siberian pipeline commissioning may be delayed

The Russian government will hold a meeting next week to discuss postponement of the commissioning date for the ESPO pipeline from East Siberia to the Pacific Ocean.

“I will call a meeting on the ESPO project to discuss this issue,” said Russian Deputy Prime Minister Sergei Naryshkin, who is responsible for the project to build the pipeline.

The announcement follows a public disagreement that took place in late January over the pipeline’s commissioning date.

No official proposals to postpone dates of the construction of the ESPO line had been submitted to the Industry and Energy Ministry, according to Sergei Mikhailov, director of the ministry’s department for state energy policies.

“There has been no talk about any postponement,” said Mikhailov on Jan. 31. “Slight adjustments could be made in the construction schedule. No one has cancelled the agreed timeframe.”

But on the same day, Andrei Sharonov, a member of the board of directors of state pipeline monopoly Transneft, said the company had established new deadlines for the launch of the first ESPO section, adding that letters had been sent regarding the changes.

Transneft Vice-Pres. Mikhail Barkov has since said the new dates were to be confirmed before mid-February by a commission of industry and energy ministry officials.

In late November 2007, Transneft’s board reported a more than 25% backlog in welding and assembly work by contractor firms. That resulted in the pipeline’s becoming some 700 km shorter than originally planned.

Due to that shortfall, Transneft reportedly sought to delay the launch of the first section until September 2009.

Sasol to expand Mozambique gas pipeline

The Republic of Mozambique Pipeline Investments Co. (Pty.) Ltd. (Rompco) has awarded Foster Wheeler South Africa (Pty.) Ltd. an engineering, procurement, and construction contract to increase to 147 megajoules the capacity of Rompco’s 120-megajoule pipeline between Temane gas field in Mozambique and a Sasol coal-to-liquids complex in Secunda, South Africa. Initial plans for the pipeline called for an eventual capacity of 240 megajoules.

The 26-in. pipeline, which began operations in 2004, extends for 865 km, including 340 km in South Africa. The capacity expansion involves adding a new compressor station, including two gas turbine-driven compressors units, at Komatipoort, South Africa, near the border with Mozambique.

Mozambique’s Instituto Nacional de Petroleos estimates Temane’s reserves at 1 tcf, with a planned 25-year production life from initial start-up in early 2004. Temane is held by Sasol 70% and the Mozambican government 30%.

Foster Wheeler announced the pipeline capacity expansion award Feb. 7. Rompco is a joint venture of Sasol Gas 50%, Mozambique’s state Companhia Mocambicana do Gasoduto 25%, and South Africa’s state iGas 25%.

Queensland Gas, BG plan Queensland LNG plant

Brisbane coal seam methane producer Queensland Gas Co. and BG Group are proposing construction of a 3-4 million tonne/year gas liquefaction plant on the east coast of Queensland.

This makes the fourth proposal for LNG from coal seam methane in Queensland over the past 12 months following similar plans from Santos, Arrow Energy, and Sunshine Gas.

Queensland Gas says its facility will use a feedstock of 190 petajoules/year from its Surat basin fields in the State’s southeast.

The $8 billion (Aus.) project will require construction of the LNG facility, to begin production in 2013, and a 380 km pipeline.

The company has not specified a location for the plant, but it is likely to be near the port of Gladstone, which is the chosen location of the other three LNG hopefuls.

The BG Group will pay $250 million to purchase 9.8% of Queensland Gas’ issued shares. In addition it will pay an additional $415 million in cash for 20% of Queensland Gas’ interests in the Surat coal seam methane acreage.

Queensland Gas will receive a further $207 million cash for the sale of an additional 10% stake when a final investment decision is made on the construction of the LNG plant and certification of 7,000 petajoules of 2P gas reserves.

Finally, BG Group has agreed to buy the whole of the planned LNG production under a 20-year contract.

To prove up sufficient reserves for the deal Queensland Gas is planning a $230 million exploration program to increase the current level of its certified 2P gas reserves (1,317 petajoules) to the required 7,000 petajoules.

At the moment the company has more than 7,255 petajoules of reserves and contingent resources as assessed by independent consultants Netherland Sewell & Associates.

FERC issues draft EIS for Midcontinent Express

The proposed Midcontinent Express natural gas pipeline would have minimal environmental impact under recommended mitigation measures, the US Federal Energy Regulatory Commission concluded in a draft environmental impact statement Feb. 8.

The 500-mile system will be developed by Midcontinent Express Pipeline LLC, a joint venture of Kinder Morgan Energy Partners LP and Energy Transfer Partners LP. It will extend from southeastern Oklahoma across Texas, Louisiana, and Mississippi, to Alabama.

The system would have 1.4-1.5 bcfd of gas capacity, which could be expanded to 1.8 bcfd of gas with compression. It is planned to go into service on Mar. 1, 2009, assuming regulatory approvals.

The project also would include a 4.1-mile lateral pipeline in Louisiana, 111,720 hp of compression at one booster station and four mainline compressor stations, and associated ancillary facilities, FERC said.