DRILLING MARKET FOCUS: Operators announce capex budgets, drilling programs

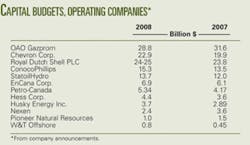

Operators have committed billions to exploratory and development drilling in 2008.

OAO Gazprom announced in late December that it will invest 710.13 billion rubles ($28.8 billion) in 2008, down about 10% from its total 2007 investment. But the press release said the allocation toward capital investment, 479.42 billion rubles, was a 43% increase from 2007.

In mid-December, Chevron Corp. announced it would spend $22.9 billion in 2008, up 15% from 2007. The company has 30 projects under development estimated at $1 billion or more.

In early December, ConocoPhillips, the third largest US operator, announced a $15.3 billion budget for 2008, up 13% from 2007.

StatoilHydro announced an estimated capital expenditure budget of 75 billion kroner ($13.8 billion) for 2008, up from 65 billion kroner in 2007. The company expects to drill 70 exploration wells this year.

Petro-Canada has budgeted $5.34 billion (Can.) for 2008, according to a mid-December company announcement, up 28% from 2007. The company focuses on eastern Canada, western Canada, oil sands development, and the North Sea.

Husky Energy Inc. announced a $3.7 billion 2008 budget in mid-December, about 28% above its 2007 expenditures.

Pioneer Natural Resources board approved a $1 billion capital budget for 2008, down about 33% from 2007. The company’s Dec. 20 announcement said that 90% of the budget was focused on “low-risk development drilling and resource play extension in Pioneer’s four core onshore areas” (350 oil wells in Spraberry field, West Texas; 175 gas wells in Raton basin, southeast Colorado; 35-40 gas wells in the Edwards trend, South Texas; 15-20 oil wells in Tunisia); and the other 10% would be spent drilling 15 wells at Oooguruk, off Alaska, and 15-20 development wells in the Barnett shale.

Hess Corp. announced a $4.4 billion capital and exploratory budget in late December up from $3.6 billion in 2007. About $4.3 billion targets E&P, including $1.6 billion for production, $1.5 billion for field developments, and $1.2 billion for exploration.

Gulf of Mexico

Hess will use part of its field expenditure budget to drill production wells at the deepwater Shenzi field throughout the year. A tension-leg platform and topsides will be installed in February, and production will begin in mid-2009. Hess has 28% working interest.

Hess will use the exploration and exploitation budget to drill appraisal wells at the Hess-operated Pony discovery (Green Canyon Block 468) and Tubular Bells discovery (Mississippi Canyon Block 725), both in the deepwater gulf. Hess holds a 20% working interest in Tubular Bells, with ChevronTexaco (30%) and BP PLC (50%, operator).

In early January, W&T Offshore Inc. released a 2008 budget of $800 million, up 77% from the revised 2007 budget of $453 million. The company plans to drill 50 wells, including 44 exploration and 6 development wells. Most (40) are on the conventional shelf and 10 are on the deep shelf or in deep water.

Tracy W. Krohn, W&T Offshore’s chairman and chief executive officer, said that the company looks forward to “an exciting year with the drillbit.”

Canada’s Nexen Inc. announced a 2008 budget of $2.4 billion, down from $3.6 billion in 2007. The company will drill as many as 11 exploration wells in the Gulf of Mexico, the North Sea, and Yemen, it said in December. Nexen will drill three deepwater wells and one shelf well in the gulf. Two of the deepwater wells will test subsalt Miocene prospects.

Bois d’Arc Energy Inc. has $250 million budgeted for the Gulf of Mexico in 2008. In a Jan. 7 press release, the company said it will spend $139 million to drill 21 wells (18.5 net), and an additional $92 million for completion and facilities costs. The program includes 11 deep shelf, shallow water wells (8.75 net) that will be drilled deeper than 15,000 ft.

The company is drilling the first well, OCS-G 24977 No. 1, to 18,500 ft to test its Chinook prospect on South Pelto Block 21. It’s expected to reach TD this month.

Bois d’Arc had a conference call scheduled for Feb. 12, to discuss fourth-quarter earnings and operations.

Eastern Canada

Calgary-based PetroWorth Resources Inc. announced a four-well drilling program on its Rosevale lease in New Brunswick. The company will drill two wells near the West Stoney Creek E-08 (Feenan No. 2) natural gas discovery well (OGJ, Nov. 26, 2007, p. 38), and “two previously postponed exploration wells on the southwestern part of the lease.” Petroworth wants to drill all four wells in the first half of 2008, and is currently looking for a land drilling rig in eastern Canada.1

PetroWorth has 100% working interests in nine exploration permits in New Brunswick, Nova Scotia (Cape Breton), and Prince Edward Island, totalling nearly 1 million acres.

On Prince Edward Island, PetroWorth singed a multiwell farm-in agreement with Corridor Resources Inc. PetroWorth drilled the New Harmony No. 1 well in fourth-quarter 2007 on their exploration license 03-02, according to the company’s Dec. 12, 2007, press release.

Calgary’s Contact Exploration Inc. is also focused on eastern Canada. It will spud an the Pound Hill C-67-2328 exploration well at its South Stoney Creek prospect this month, and is completing four wells in a 10-well workover program. In a Jan. 15 press release, Contact said it was “examining the future feasibility of a low-cost, high-density drilling program” for Stoney Creek field.

Husky Energy Inc. announced Jan. 21 that it has a 3-year, $380 million contract to use Transocean’s GSF Grand Banks semisubmersible, with two, 1-year optional extensions.

Husky will use the rig to complete subsea tiebacks at White Rose and to drill at North Amethyst off Newfoundland in mid-2008. The rig has already drilled 18 development wells for the White Rose project.

Western Canada

Calgary’s Vero Energy Inc. announced its $50 million (Can.) initial 2008 capital budget on Jan. 8. The company will drill 10-12 wells in the first-quarter, including four horizontal wells. Over the year, Vero expects to drill 30-32 wells, and has more than 3 years of drilling inventory ahead.

ARC Energy Trust has committed $85 million (Can.) in 2008 to acquire 3D seismic and drill several vertical wells in the Montney resource play, greater Dawson area, BC, the company announced in early January.

Husky Energy will spend about $50 million (Can.) to drill two exploration wells in the central Mackenzie Valley, NWT.2

Europe

Contact Exploration also plans to drill two wells in Hungary during the first-half of 2008. According to a news release from Dec. 19, 2007, Contact signed a joint-venture agreement with Toreador Hungary Ltd. to drill the exploration wells and acquire 170 sq. km of 3D seismic in the 262,000-hectacre Szolnok exploration licence area in east-central Hungary. The total cost of the two wells and seismic is €6.7 million ($9.67 million), of which Contact will pay €1.4 million. Toreador Hungary, a subsidiary of Dallas-based Toreador Resources Corp. (formerly Toreador Royalty Corp.), will operate the two drillsites.

Toreador also has operations in Turkey, Romania, and France, with a total of 4.3 million net acres in Europe. The company holds nearly 3.5 million acres under license in Turkey, and discovered gas in its Ayazli-1 exploratory well in the western Black Sea, September 2004. It then drilled 15 wells in the area, dubbed the South Akcakoca subbasin project (SASB), during 2005-07; 13 encountered natural gas (Fig. 1). First gas sales were in May 2007, and three shallow-water platforms (Dogu Ayazli, Ayazli, and Akkaya) began production in 2007, according to the company. However, a vessel damaged the pipeline spur running to the Akkaya platform in late November, causing a temporary shutdown.

TPAO (the Turkish national oil company) has a 51% interest in the permit area, Toreador has 36.75%, and Calgary’s Stratic Energy Corp. has 12.25%.

In August 2007, Toreador sold all its US properties (interest in about 700 wells in five states) to RTF Realty Inc. for $19.1 million (OGJ, Aug. 27, 2007, p. 33) in order to concentrate on the Black Sea.

According to a presentation at the NYSSA Conf. in November, Toreador’s first priority is continued development of the SASB project off Turkey. It will provide $44 million of the $120 development costs, including $2 million already spent in 2007, $27 million budgeted for 2008, and $15 million budgeted for 2009. This will include drilling as many as four additional development wells by 2009. Toreador wants to develop the deeper water, Thrace portion of the SASB, with its 50:50 Turkish industrial partner, Hema Endustri AS.

References

- “Petroworth updates E-08 results and announces four-well drilling program in New Brunswick,” news release, Jan. 17, 2008.

- “Husky Energy Announces 2008 Capital Expenditure and Production Guidance, “ news release, Dec. 13, 2007.