Tanker earnings continue slide

Tanker market earnings for the half-year ended September 2007 softened 25%, from the same period a year earlier and 10% from the prior 6 months. An early upsurge at the start of the period as the US built inventories in advance of its summer driving season gave way in May to softer-than-expected demand for oil and an oversupply of tanker tonnage. Clarkson Research Services Ltd. detailed the reasons behind these market movements as well as offering forecasts of future market direction in its Autumn 2007 “Shipping Review and Outlook: A Half-Yearly Review of the Shipping Market.”

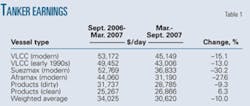

According to Clarkson data, the tanker market, comprised of both modern and early-‘90s VLCCs, modern Suezmax, modern Aframax, and both dirty and clean products carriers, averaged $30,620/day in earnings from September 2006 to March 2007, a 10% decrease from the $34,025/day seen March-September 2006. A 30.2% decrease in Suezmax earnings, to $36,833/day, led the downward momentum, with clean product tankers being the only segment experiencing an improvement from the previous 6 months, increasing 6.3% to $26,866 (Table 1).

Even with these declines, earnings remained above the costs required to build a new vessel, but barely covered the combination of capital and operating expenses, according to Clarkson.

Of greater concern, Clarkson said, was the downward trend in spot rates, which left VLCCs earning $25,000/day in October 2007, and Aframaxes, $15,000/day.

The oil tanker fleet was expected to reach 387.6 million dwt by the end of 2007, an increase of 6.8%, with another 8.4% increase forecast for 2008. The active tanker fleet for vessels over 10,000 dwt increased by 171 ships over the 6 months ending Sept. 1, 2007; 223 vessels delivered against 32 vessels scrapped. With demand remaining sluggish, Clarkson sees fundamentals as gradually moving against the tanker market.

This article will detail some of the other findings in a few of the numerous vessel categories covered twice each year by Clarkson in its Shipping Market Outlooks.

Market outlook

A combination of sluggish trade growth and rapid fleet growth shaped the tanker market for the 6 months ending Sept. 1, 2007, according to Clarkson. Clarkson cites the lack of both significant hurricanes and shipping market congestion as increasing slack in the tanker market to a greater degree than has been seen in several years.

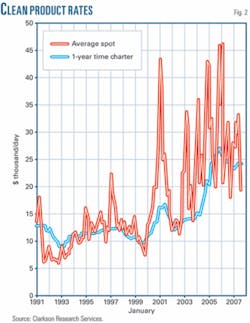

Crude tankers of all categories lost ground against 10-year average spot rates over the six months. The spot rate for 30,000 dwt clean product tankers also decreased to $17,765/day from $31,737/day in the preceding 6 months. Rates for a 1-year time-charter of the same vessel type, however, slipped just 2%, to $23,000/day, according to Clarkson.

Ship values, by contrast, continued to increase, with the value of 5-year old Suezmax tankers reaching $95 million from $82 million at the end of 2006.

The tanker order book stands at 40% of the current fleet, but Clarkson balances the bearish implications of this building rate by noting that 24% of the fleet consists of single-hulled vessels which will need to be phased out by 2015.

VLCC

On Sept. 1, 2007, the VLCC fleet totalled 148.2 million dwt. The fleet is expected to grow by a further 2.1 million dwt by the end of 2007. Lower scrapping levels and increased deliveries in 2008 will see the fleet reach 160.9 million dwt by the end of the year, according to Clarkson. Even larger increases are anticipated for 2009, when 20.1 million tonnes will be added to the fleet. Clarkson anticipates a total 2009 fleet size of 180 million tonnes, based on just one or two vessels being scrapped each year.

Clarkson described the VLCC sector as disappointing for the 6 months ending Sept. 1, 2007, with average earnings for a 1990s-build vessel plunging to $47,993/day, compared to an average of $62,193/day for the same period 1 year earlier. This coincided with rapid fleet growth, but also, more surprisingly, with a continued increase in asset values (Table 2).

Weakness also continued in the time charter market, with 1-year rates for modern tonnage dropping to $40,000/day in September 2007 from $44,000/day at the end of 2006.

Clarkson sees the buildup of tonnage in this environment as a long-term bearish factor, even as short-term rates are expected to rebound as colder temperatures boost winter heating demand.

Suezmax

On Sept. 1, 2007, the Suezmax fleet consisted of 358 vessels of 54.2 million dwt. A combination of minimal scrapping and strong deliveries will see the fleet reach 57.5 million dwt by the end of 2008, according to Clarkson.

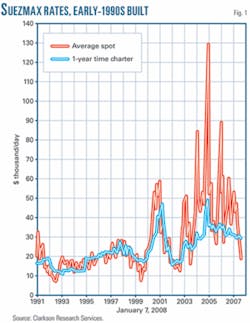

Spot rates for the 6 months ending Sept. 1, 2007, averaged $38,304/day, down 21.7% from the same period a year before, while earnings of $36,833 were down 30.2% from the previous 6 months. Time-charter rates for 1-year on a modern vessel dropped 9.7% from the end of 2006, while 3-year rates fell by 4.2% to $23,000/day (Fig. 1).

Clarkson expects spot rates in the Suezmax sector to mirror those of VLCCs over both the short and long term, with near-term demand buoying rates and a 40%-of-fleet order book potentially dampening them moving forward.

Aframax

On Sept. 1, 2007, the Aframax fleet had increased to 75.4 million dwt. A decreased scrapping rate and increased deliveries will grow the fleet to 83 million dwt by the end of 2008, according to Clarkson.

Aframax earnings fell to $32,984 during the 6 months ending Sept. 1, 2007. Time charter rates slipped 10.4%, reaching $21,500/day for a 1-year period.

Clarkson sees the 41%-of-fleet order book in the Aframax sector as leading to the same potential medium-term oversupply of vessels expected in VLCC and Suezmax vessels, noting that this could be heightened by the potential slowdown in Bosphorus traffic as planned pipeline projects in the region enter service.

Products

Clarkson expects product rates to rebound as the northern-hemisphere winter progresses. Spot rates for clean product tankers slipped below their 10-year average, falling to $17,765/day by Sept. 1, 2007. End-2006 clean rates stood at $30,685/day (Fig. 2).

Even so, average earnings for dirty products carriers rose 4% year-on-year, with an even bigger increase of 8.5%, seen in the clean market.

On Sept. 1, 2007, the 10,000- 80,000 dwt product tanker market stood at 81.2 million dwt, a 6% increase. With a 39.1 million dwt order book, the vast majority of which is due for delivery in the next 3-4 years, Clarkson expects continued rapid fleet expansion barring a large increase in the scrapping rate.

Clarkson also expects an incremental increase in the average size of the fleet.

Over the longer term, Clarkson pegs the commercial prospects for the products fleet on whether or not product demand increases year-on-year at a rate sufficient to absorb the extra tonnage.

Chemical

Sept. 1, 2007, saw spot freight rates for most chemical tanker routes having slipped below end-2006, according to Clarkson. Rates for 5,000 tonnes Rotterdam-Houston fell 20%, with Houston-Far East rates decreasing 18.2%. Rates from Houston to Rotterdam for 5,000 tonnes fell 16.4%.

Persian Gulf-Mediterranean rates were the only rates along a major route moving against this trend, rising 0.9% (15,000 tonnes). Strong Iranian methanol exports in the second quarter of 2007 keyed this strength, while Clarkson ascribed the overall softness to increased US ethanol production and midyear energy shortages in South America.

As with the other tanker segments, Clarkson sees 2008 fleet development in chemicals as hinging on the market’s ability to absorb a large number of scheduled deliveries.

LNG

Clarkson described the 18 months ending Sept. 1, 2007, as having slowed somewhat in terms of new orders as compared to the pace seen over the past 10 years; final investment decisions on new liquefaction facilities having been delayed globally. Contracts for 19 vessels had been issued by Sept.1, with many slots open for 2010 delivery due to the slow in liquefaction investment. In total, 56 vessels are scheduled for delivery in 2008 and 43 in 2009. Any orders for newly approved projects will be delivered from 2011 onwards.

Prospects for major growth longer term, according to Clarkson, depend on how successful Russian and Iranian development plans end up being. Both countries have more than 30 million tonnes/year of liquefaction planned for introduction by 2014, but have political as well as the more typical economic and technical hurdles to cross before these come to fruition, says Clarkson.

Charter rates in the medium term look relatively bleak, according to Clarkson, the combination of project delays and vessel deliveries likely leading to surpluses starting in 2011 and lasting several years.