OGJ Newsletter

Interior orders mineral reforms after report

US Interior Secretary Dirk A. Kempthorne, after receiving the final report of an independent study panel on Jan. 25, ordered immediate implementation of recommended mineral management reforms that can be carried out administratively.

The report, having more than 100 recommendations, came from a bipartisan panel the secretary formed last year that was cochaired by former US Sens. Bob Kerrey (D-Neb.) and Jake Garn (R-Utah). “Where it is within our power to do so, the responsible officials will take action to rectify identified problems. However, other recommendations may require further study or legislative action,” Kempthorne said.

His directive to Minerals Management Service Director Randall B. Luthi and Bureau of Land Management Director James L. Caswell also orders the two agencies to develop action plans based on the report’s recommendations and to submit a progress report within 30 days. The recommendations, to be implemented immediately, include additional ethics training for all MMS employees, especially those who deal with oil, gas, and other lessees in a regulatory, collections, or enforcement role.

MMS also is upgrading its communication and coordination to ensure the accuracy of lease and royalties collections, Interior said. It indicated that the agency also recently issued an Indian Oil Valuation Rule to provide added certainty to the valuation of oil produced from American Indian lands, a key issue that the study panel identified.

Kempthorne said some of the panel’s recommendations need further exploration through consultations with state and Indian tribal officials and, in some cases, industry organizations before they can be adequately implemented.

Nigeria, Portugal hold gas development talks

Portugal has joined Russia, China, and India in seeking to cooperate with Nigeria in tapping into that African country’s gas potential as it seeks to ramp up domestic gas utilization as a priority and develop export projects.

Following a meeting of Nigeria’s Gas Minister Odusina Olatunde Emmanuel and Portugal Ambassador Maria De Fatima Perestrello, Emmanuel said there was sufficient gas in the country to meet both commitments, and gas for power generation is high on its agenda.

Perestrello assured Emmanuel that it was possible to combine gas development with environmental protection. Portugal is seeking a “very close relationship” with Nigeria, a statement from the minister said.

Under a Niger Delta Development Plan, which aims to resolve the problems that have plagued the region and led to outbreaks of violence and unrest, the government is “working hard” to restore peace in the Niger Delta “very soon,” Emmanuel said.

Nigeria’s zero gas-flaring target, which has been continuously postponed, could be achieved by December, he said, and he was optimistic that all stakeholders would comply with the mandate this time.

Ecuador gives IOCs ‘new contract’ deadline

Ecuador’s President Rafael Correa, advancing a deadline mooted earlier, said Jan. 26 that international oil companies operating in his countryincluding City Oriente, Petroleo Brasileiro SA (Petrobras), Perenco, Repsol-YPF SA, and Andes Petroleumwould have 45 days to accept new agreements.

The government wants to change the current contracts from joint ventures, which allow IOCs to include Ecuadorean reserves on their balance sheets, to subcontracting deals, which do not.

Oil and Mines Minister Galo Chiriboga, who earlier spoke of a May deadline for the changes, also warned the companies that the new contracts would end their option of appealing to the World Bank’s International Centre for Settlement of Investment Disputes.

In 2007 Correa’s government unilaterally altered the allocation of the windfall produced by the rise in international oil prices: the government now takes 99% of the windfall and the companies get 1%a decision the companies are fighting in the courts.

Correa gave the companies three choices: to accept the 99% decree, to accept the new contracts, or to leave the country. If they leave, Correa said, the government will reimburse them for their investment and turn the fields over to state-owned oil company Petroecuador.

Economy Minister Fausto Ortiz recently said the government expects to receive an additional $1.1 billion in oil revenues during 2008, all coming as a result of the new taxation on foreign companies’ extra oil revenues.

Ortiz acknowledged that the additional revenue will depend on the renegotiation of contracts with the five oil companies.

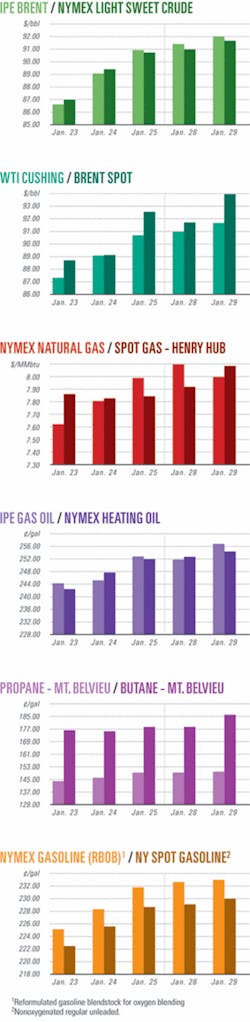

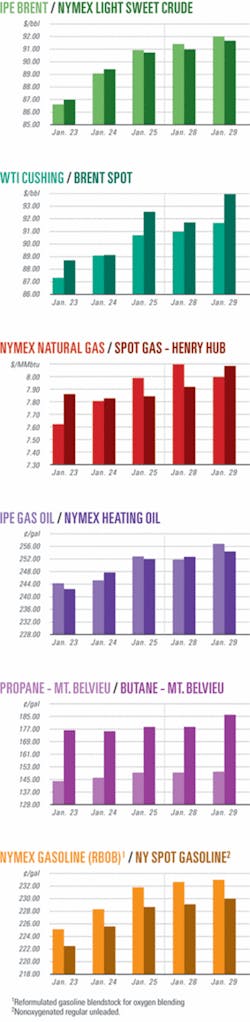

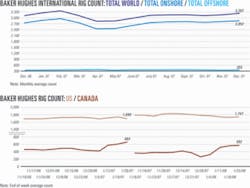

Industry Scoreboardnull

null

null

Exploration & Development - Quick TakesPetrobras to spend $12 billion in Santos by 2012

Brazil’s Petroleo Brasileiro SA (Petrobras), following earlier remarks about its recent offshore discoveries, said it will invest $12 billion in the Santos basin by 2012.

Production from Mexilhao field alone was expected to reach 15 million cu m/day of gasa volume equal to about 30% of Brazil’s current gas demand, Petrobras said.

Other Santos basin projects include the development of Urugua, Tambau, Caravela, and Cavalo Marinho fields as well as the construction of a gas treatment unit in Caraguatatuba. Petrobras said it was expecting production of 30 million cu m/day of gas and 100,000 b/d of oil.

Petrobras’s recent discovery of Jupiter gas-condensate field in the basin reinforces the notion that there is practically no exploratory risk in the presalt layer, a Petrobras executive said.

The first Jupiter well, 1-BRSA-559-RJS (1-RJS-652), was drilled to 5,252 m in 2,187 m of water about 290 km off Rio de Janeiro state, just 37 km from the Tupi area.

Repsol-YPF makes gas find in Peru near Camisea

Repsol-YPF SA made a gas discovery with its Kinteroni X1 exploration well, drilled on Block 57 in Peru near the Camisea project.

Initial production tests registered gas flows of 1 million cu m/day and 198 cu m/day of associated liquids. The field’s reserves are estimated at 2 tcf of gas.

Repsol-YPF is operator with a 41% stake.

Domestic demand for gas is estimated to total 6 tcf in the next 20 years, according to Energy and Mines Minister Juan Valdivia.

Peru’s proved gas reserves total 16 tcf, including the reserves in Blocks 88 and 56 of the Camisea project, the recently discovered gas by Repsol-YPF on Block 57, and the discoveries of BPZ Energy Inc. and Peruvian oil company Petro-Tech Peruana in northern Peru.

Valdivia said the government will invest $35-37 million in 2008 to expand the country’s gas distribution networks. He said the government will invest part of the sum to replace old copper pipes with ones made of aluminum.

Apache makes finds in Egypt, Australia

Houston independent Apache Corp. reported the first two hydrocarbon discoveries of its 2008 exploration program, in Australia and Egypt.

On test, the Hydra-1X exploration well in Egypt’s Western Desert flowed 41.6 MMcfd of natural gas and 1,313 b/d of condensate from the Jurassic Lower Safa formation. The well, which is in a sparsely drilled area in the Shushan “C” concession in which Apache retains 100% interest, logged 178 ft of net pay in the Lower Safaone of the thickest pay zones in that formation since Apache’s 2003 discovery at Qasr.

The well also encountered 45 ft of probable condensate pay in the Jurassic Alam El Bueib (AEB) Unit 6 sand and 30 ft of probable oil pay in the Lower Cretaceous AEB Unit 3.

“Although the accumulation is not as large as Qasr, the Hydra-1X penetrated the same Lower Safa sandstone that we discovered 25 miles away at Qasrthe largest field we’ve ever discovered, with estimated proved reserves of 2.3 tcf of gas and 80.4 million bbl of condensate,” Apache said.

The latest discovery extends the known Lower Safa production trend across Apache acreage an additional 9 miles north of the Kahraman B-22 Lower Safa discovery, which flowed 16 MMcfd of gas and 480 b/d of condensate after fracture stimulation when it was tested in October 2006.

Separately, in Australia, the Brulimar-1 well in Commonwealth waters on the North West Shelf encountered 113 ft of net pay in the Upper Triassic Mungaroo sandstone. Brulimar-1 is the fourth consecutive exploration success on the WA-356-P block. Apache, with a 65% interest, operates that block in a joint venture with Kuwait Foreign Petroleum Exploration Co.

TNK-BP lets contract for Kamennoi field

TNK-BP has awarded to Gulf Interstate Engineering Co., Houston, a contract to provide engineering services for the early planning stages of the Kamennoi field development project involving seven oil and gas fields in Russia.

The first phase of the project anticipates the recovery of 30 million tons of oil, with 330 wells being drilled. An export pipeline and additional oil processing facility will be built.

The second phase involves long-term development of the most reliable reserves.

Gulf Interstate will assist TNK-BP in the early planning stages of this major oil and gas producing field. The firm is to compare development alternatives to determine the optimum configuration and recommended sequence of field development. It also will provide a technical, commercial, and planning basis for subsequent stages and developments.

Second zone tests gas off eastern Trinidad

A second zone has tested gas at an exploratory well 60 miles off eastern Trinidad.

A group led by Canadian Superior Energy Inc., Calgary, said the Victory well on Intrepid Block 5(c) averaged more than 30 MMscfd on a restricted basis at high pressures. The first zone, also on restricted test, gauged 40-45 MMscfd plus condensate (OGJ Online, Jan. 15, 2008).

The group has identified possible other prospective horizons in the well that will be evaluated in other planned wells. The second well, Bounty, is to spud by mid-February.

Participating with Canadian Superior are BG International Ltd. and Challenger Energy Corp., another Calgary independent.

Petro-Canada group finds Moray Firth oil

A group led by Petro-Canada made a potentially commercial discovery 110 km north of Aberdeen, Scotland, in the UK North Sea’s Inner Moray Firth area.

The 13/21b-7 well went to TD 2,398 m in 89 m of water and found oil in two Lower Cretaceous sandstone reservoirs. Wireline samples tested 34.5° gravity oil in the deeper reservoir with a 21-m gross column.

The shallower reservoir drillstem tested 21° gravity clean oil at unassisted rates of up to 200 b/d. Petro-Canada said, “Evaluation of the test data indicates that this reservoir has the potential to yield commercial flow rates through the application of horizontal wells and appropriate completion technology.”

It is the first exploration commitment well on acreage awarded to Petro-Canada in the UK 23rd round in December 2005.

Interests are Petro-Canada operator with 50%, Samson North Sea Ltd. 35%, First Oil Expro Ltd. 10%, and Reach Exploration (UK) Ltd. 5%.

Drilling & Production - Quick TakesTCO consortium starts up Tengiz field extension

Chevron Corp. affiliate Tengizchevroil LLP, a joint venture of Chevron 50%, KazMunaiGas 20%, ExxonMobil Kazakhstan Ventures Inc. 25%, and LukArco 5%, has started up new facilities as part of the first phase of its expansion at Tengiz field in Kazakhstan.

The total capacity of the TCO consortium will increase to a total of 400,000 b/d following the first phase expansion of 90,000 b/d, while the start-up of full facilities in this year’s second half will further increase production capacity to 540,000 b/d.

The start-up includes the sour gas injection project, which reinjects produced sour gas into the reservoir at high pressure to boost production, as well as the front end of the second-generation plant.

According to Chevron, the second-generation plant was brought up to about one third of its full capacity and is currently separating gas for injection while stabilizing and sweetening the oil. Once fully online, the plant also is designed to process sour gas into gas products and elemental sulfur.

When the plant is fully fuctional, about a third of the sour gas produced from the expansion will be injected into the reservoir. The remaining volumes will be processed as commercial gas, propane, butane, and sulfur.

In 2007, the TCO consortium was the largest oil producer in Kazakhstan, with output of 13.93 million tonnes of oil, or 20% of the country’s total production. The country’s overall oil production rose 3.7% in 2007, according to government figures.

Eni to start Nikaitchuq oil production in 2009

Eni SPA will spend $1.45 billion developing Nikaitchuq oil field off Alaska’s North Slope. Field production is scheduled to begin at yearend 2009.

The field, in about 3 m of water, will have 35 production wells and 35 injection wells drilled in it, “about one third of which will be drilled from onshore and the remainder drilled from an offshore artificial island built 4.5 km from the coast,” Eni said.

Production will be sent to a newly built 40,000 b/d processing facility onshore near the field and then transported some 22 km to the Kuparuk network, which is linked to the Trans-Alaska Pipeline System.

Nikaitchuq has reserves estimated at 180 million bbl of oil. This will be the first project that Eni will develop in Alaska after acquiring a 30% stake from Armstrong Oil & Gas’ Alaskan assets and the remaining 70%, together with operatorship, from Anadarko Petroleum Corp. in first quarter 2007.

In this year’s first half Eni expects to begin production in Alaska from Oooguruk field (Pioneer 70% and operator Eni 30%), which also is on the North Slope about 25 km west of Nikaitchuq.

Mexico’s oil production down 5.3% in 2007

Mexico’s oil production fell by 174,000 b/d or 5.3% in 2007 to an average of 3.08 million b/d, according to state-owned Petroleos Mexicanos, which said the drop was due to inclement weather and an expected decline in the Cantarell complex in the Gulf of Mexico.

Pemex said its production of super-light crude was greater than expected along the coast of Tabasco state, and output in the Ku-Maloob-Zaap region, also in the Gulf of Mexico, exceeded forecasts.

Meanwhile, the energy ministry is expecting Cantarell’s crude production to decline gradually over the next 3 years and then sharply, beginning in 2011.

The most serious weather events of 2007 were Hurricane Dean’s passage through the Gulf of Mexico in August, which forced bridges to be shut down, and cold fronts in October that forced a halt to operations for several days.

Pemex posted $38 billion in foreign oil sales, up 9.3% over 2006, while exports by volume averaged 1.68 million b/d. The company earned some $44.05 billion from domestic sales, 9.6% more than last year. Mexico is the No. 2 foreign supplier of oil to the US.

Processing - Quick TakesNNPC to restart 125,000 b/d Warri refinery

Nigeria National Petroleum Corp. will restart operations at its 125,000 b/d refinery in Warri in southwest Nigeria on Feb. 6, a company spokesman told OGJ. The refinery has been idle for the past 2 years.

If the restarted refinery works consistently, and at a high throughput, Nigeria’s importation of petroleum products will fall significantly. In the beginning, the Warri facility will operate at 70% of capacity.

Vandalism had halted feedstock from being transported to the refinery through the Chanomi Creek Channel pipeline, and NNPC found it difficult to hire international companies to carry out repairs because of safety fears and rising costs (OGJ Online, Aug. 7, 2007). Repairs by a local company were reported to have cost $100 million.

NNPC wholly owns the Warri refinery and also owns two refineries at Port Harcourt, with a total capacity of 210,000 b/d, as well as the 110,000 b/d Kaduna refinery. None of these facilities is operating at capacity. These facilities were sold last year to Blue Star Consortium, but the sale was revoked by President Umaru Yar’Adua after NNPC told the National Assembly it could fix them.

Port Harcourt’s fluid catalytic cracking unit has been damaged by power surges, and the Kaduna refinery, which also shares the Chanomi Creek Channel pipeline, is without feedstock. Crude is expected to reach Kaduna within the next 3 weeks after Warri is restarted.

In August the Department for Petroleum Resources received 26 applications from private companies wishing to build refineries in Nigeria (OGJ Online, Aug. 20, 2007).

Petroperu to upgrade Talara refinery

Peru’s state-owned Petroperu, in an effort to increase output by as much as 50%, announced plans to modernize its largest refinery this year. Bidding is to begin in March.

Upgrading northern Peru’s Talara refinery, which is expected to cost $1 billion, will increase its oil production capacity to 90,000 b/d from 62,000 b/d, according to Petroperu Pres. Cesar Gutierrez.

Work on the renovation is expected to begin in June, said Gutierrez, who added that Brazil’s state-run Petroleo Brasileiro SA will serve as a consultant on the project.

JAC Singapore aromatics project moves ahead

Jurong Aromatics Corp., Singapore, reported UOP LLC, Des Plaines, Ill., is under way with the basic engineering and design of Jurong’s planned aromatics plant in Singapore. The project’s financing is being finalized, and SK Engineering & Construction is expected to begin construction in this year’s first half.

When it starts up in 2011, the complex will produce about 1.5 million tonnes of petrochemicals, including 800,000 tonnes of paraxylene, 200,000 tonnes of orthoxylene, and 450,000 tonnes of benzene. The complex also will have a $400 million condensate splitter and will produce about 2.5 million tonnes of petroleum products such as jet fuel and kerosine.

StatoilHydro puts out fire at Mongstad refinery

StatoilHydro AS has launched an internal investigation after a fire broke out in a coupling flange at its 186,000 b/d Mongstad, Norway, refinery on Jan. 23.

The fire was extinguished and the refinery is now operating at about 75% of its capacity, a company spokesman told OGJ, adding, “It’s a bit early to say what the damage was, and the cause of the fire hasn’t yet been identified.”

No personnel were injured during the fire and StatoilHydro has informed the Petroleum Safety Authority Norway about the incident.

Transportation - Quick TakesTalisman, CNOOC settle over Tangguh project

Talisman Energy Inc. has settled a legal dispute with CNOOC Ltd. over Indonesia’s Tangguh LNG project, according to reports.

China Business News said Talisman will pay $40 million to CNOOC for a 2% stake in the BP PLC-led project, which will supply CNOOC’s Fujian LNG terminal.

According to earlier reports sent through Talisman’s Fortuna Resources unit, Talisman had claimed the right to 44% of CNOOC’s 17% interest in the Tangguh project. Lawrence Bernstein, senior manager for exploration at Talisman’s Malaysian unit, told China Business News he believed the dispute had been settled, although he had yet to be officially notified.

The reported settlement coincided with news that CNOOC has started building two new gas storage tanks at its Fujian LNG terminal. The two tanks, expected to be completed in 2011, will boost the terminal’s storage capacity to 640,000 cu m, the company said in a statement.

Phase I of the Fujian LNG terminal, which involves total investment of 21.9 billion yuan, includes two new gas storage facilities; three gas-fired electric power plants in Putian, Jinjiang, and Xiamen; and distribution facilities in five cities.

CNOOC signed a deal in 2006 to source gas for the Fujian terminal from BP’s Tangguh field in Indonesia, which is due to start operating in 2009.

The company will supply 2.6 million tonnes/year of LNG for 25 years to Fuzhou, Putian, Quanzhou, Xiamen and Zhangzhou, and will also supply the fuel for three gas-fired power plants in the province.

StatoilHydro extends Snohvit start-up period

StatoilHydro has asked the Norwegian Pollution Control Authority for a permit to emit more carbon dioxide as it seeks an extension for the start-up period at the Snohvit LNG project near Hammerfest.

Unexpected repairs to leaks in the cooling system have affected the 6-10 month start-up timetable to increase LNG production, and StatoilHydro is now unsure how long it will take. Gas production, which began last September, is expected to plateau at 5.7 billion cu m/year.

A StatoilHydro spokesman told OGJ that Snohvit will run at reduced capacityabout 60%. “But there’s great uncertainty around this,” he said. Efforts are under way to ensure that Snohvit will run at full capacity in 2009.

Ordinarily the plant would emit 200,000 million tonnes/year of carbon but StatoilHydro estimates this could jump to 1.5 million tonnes/year of CO2 and 2,200 tonnes of soot during the start-up period. Reduced capacity utilization and other possible modifications have resulted in higher carbon emissions during the start-up.

Total appeals Erika tanker verdict

Total SA said it will appeal the Jan. 16 Paris Criminal Court verdict concerning the sinking of the Erika tanker off Brittany. The vessel, which was chartered by Total, sank in December 1999 and polluted the coastline with 20,000 tonnes of heavy fuel oil.

Total did not dispute, however, the €375,000 fine to compensate the victims for “ecological damage” of the pollution. In a press release, Total said it would ensure payments were made “immediately” and are “full and final whatever the result of the appeal.”

Total said it has already spent €200 million in cleaning efforts. Total is disputing the part of the verdict requiring it to pay €192 million in damages for causing the ship to sink. The court said these damages were caused “through lack of care during the tanker-selection process.” Total said it was misled by the certification company, Rena, on the tanker’s true condition.

“Total is merely a user of ships. It is not its role or its business to act as a substitute for inspection companies and classification societies, the ship owners, or the flag state,” the company said.

Christophe de Margerie, Total chief executive officer, said, “We are not happy to appeal. This judgment is aimed at ‘the deep pockets’...but in no way does it contribute to rendering the whole maritime chain more responsible.”