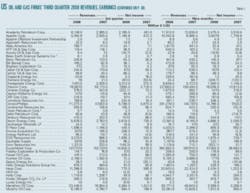

US, Canadian producers post strong 3Q results

Record oil prices in July and strong refining margins in September resulted in a surge in earnings for a group of US-based oil and gas producers and refiners for the third quarter of this year.

The sample of companies recorded a combined 103% spike in earnings for the period.

For the first 9 months, the group’s collective profits climbed 39%.

OGJ also looked at a sample of producers and pipeliners based in Canada. These companies’ earnings during the third quarter increased 155% from a year earlier, while their profits in the first 9 months moved up 67%.

Meanwhile, the combined earnings for a group of service and supply firms was little changed from a year earlier for both the 3-month and the 9-month periods.

Prices, margins

The peak near-month futures closing price of crude on the New York Mercantile Exchange was $145.29/bbl, set on July 3. The same day, the near-month natural gas futures contract closed at $13.577/MMbtu. Through the remainder of the quarter, the closing prices of each of these commodities declined, with oil falling 31% by the end of September and gas down 45%.

An active Gulf of Mexico hurricane season, which curtailed imports of crude and shut down power at refineries along the upper Texas coast, drove refining margins much higher in September from a month earlier.

With a September average of $21.29/bbl, the Gulf Coast cash refining margin in the third quarter averaged $10.95/bbl, according to Muse, Stancil & Co. For Midwest refineries, the cash margin averaged $16.18/bbl in the third quarter. The average cost of imported and domestic crude for US refiners during the third quarter was $115.55/bbl. This compares with the third-quarter 2007 average of $71.41/bbl, as reported by the US Energy Information Administration.

US operators

A group of US-based oil and gas producers and refiners doubled their earnings in the third quarter from a year earlier, largely as a result of strong oil and product prices. The group’s combined revenues were up 46% from third-quarter 2007.

Most of the independent producers as well as the integrated firms posted improved results in the recent quarter compared with a year earlier. Only 9 of the companies in the sample of 77 US operators recorded a net loss for the most recent quarter.

ExxonMobil Corp. reported record earnings of $14.8 billion for the third quarter on revenues of $137.7 billion. The company’s upstream earnings, excluding the gain related to the sale of a German natural gas transportation business, were $9.35 billion, up $3 billion from third-quarter 2007.

Higher oil and gas realizations increased earnings about $4.4 billion, while lower sales volumes decreased earnings about $1.3 billion. During the third quarter, ExxonMobil’s total worldwide production declined 8% from the third quarter of 2007.

As a result of higher margins, ExxonMobil’s downstream earnings of $3 billion were up $1 billion from third-quarter 2007. Unfavorable foreign exchange effects were a partial offset, and product sales of 6.7 million b/d were 413,000 b/d lower than in third-quarter 2007, reflecting asset sales and lower demand.

Chevron Corp. reported net income of $7.9 billion for this year’s third quarter, compared with $3.7 billion a year earlier, as upstream and downstream earnings soared. Chemicals earnings declined in the recent quarter.

While upstream earnings benefited from much higher oil prices than during the 2007 third quarter, earnings for the most recent quarter were tempered by the effects of hurricanes in the gulf in September, Chevron said.

Like many of the independent producers in the sample, Petrohawk Energy Corp. reported improved results for the recent quarter. Petrohawk’s third-quarter earnings of $305.5 million were up from $26.8 million a year earlier. The company’s net gain on derivatives contracts was $388.2 million in the recent quarter vs. $20.3 million in third-quarter 2007.

Similarly, Carrizo Oil & Gas Inc. reported a surge in earnings to $66.2 million from $4.2 million a year earlier, mostly due to an $81.8 million mark-to-market gain on derivatives.

Cabot Oil & Gas Corp. posted $67 million in third-quarter earnings, up 89% from a year earlier. The Houston-based producer reported higher realized prices and higher gas production levels. Realized gas prices grew 27%, and crude realizations increased 40% from third-quarter 2007.

Refiners

For the first 9 months of this year, most US refiners posted lower earnings from a year earlier as a result of high crude costs. For the most recent quarter, the refiners in the sample posted varied results.

Holly Corp. and Valero Energy Corp. recorded lower net income compared with third-quarter 2007, but Sunoco Inc. and Tesoro Petroleum Corp. reported jumps in their earnings for the same quarter vs. a year earlier.

Valero’s earnings declined 10% to $1.15 billion in the recent quarter, as the San Antonio-based refiner posted $35.96 billion in revenues for the 3 months. This includes a pretax gain of $305 million on the sale of the Krotz Springs, La., refinery, which was effective July 1. Bill Klesse, Valero chairman and chief executive officer, said conditions were volatile for third-quarter product margins.

“Low gasoline margins in July were followed by higher margins in August as production adjusted to demand,” Klesse said, adding, “When the hurricanes hit the Gulf Coast and reduced refinery production, gasoline inventories fell to historically low levels, and margins responded, which increased average margins for the third quarter. In contrast to the volatile movement of gasoline margins, distillate margins remained very good throughout the third quarter as global supply and demand balances were tight.”

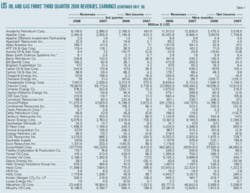

Canadian operators

A sample of producers and pipeline operators based in Canada posted a combined surge in third quarter net income to $15.3 billion (Can.), up from $6 billion (Can.) a year earlier.

Nearly all of the firms in this group improved on third-quarter 2007 results, with the larger producers turning in much stronger earnings vs. year-earlier results. EnCana Corp., Talisman Energy Corp., and Canadian Natural Resources Ltd. each recorded net income for the recent quarter of about four times that from a year earlier. EnCana reported that its third-quarter gas, oil, and natural gas liquids production increased 6% from a year earlier, led by a 16% rise in production from key natural gas resource plays and an 8% increase in total gas production. The company’s oil and NGL production declined 2% year-on-year during the quarter.

But the majority of EnCana’s earnings increase related to unrealized mark-to-market accounting gains, which were due to a large decrease in commodity prices during the recent quarter. The gain essentially reversed unrealized mark-to-market losses that were included in net earnings earlier in the year when gas prices were rising, EnCana said.

Talisman Energy’s net income was a record $1.4 billion (Can.), up 305% from a year earlier, driven by increased netbacks, mark-to-market gains on derivative contracts, and stock-based compensation recovery. Production averaged 443,000 boe/d during the recent quarter, 1% above the third quarter of 2007, despite the sale of 40,000 boe/d of noncore assets during the past year. Production also climbed 3% from the previous quarter.

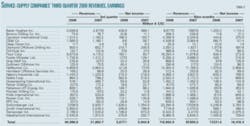

Service, supply firms

In a sample of 26 oil and gas service, supply, and engineering firms, only two recorded a net loss for the recent quarter, and another two companies posted a loss for the first 9 months of this year.

Collectively, the group’s net income declined for the recent quarter as a result of Halliburton Co.’s $21 million net loss. The group of firms posted a combined 29% increase in third-quarter revenues.

Halliburton reported that the loss in the quarter was the result of hurricanes in the gulf and a $693 million nontax deductible loss on the cash-settled portion of a premium on convertible debt.

Revenues climbed 23% for the recent quarter and 20% in the first 9 months of this year, Halliburton reported. The company said that its North American market experienced revenue growth of 22% year-over-year, as unconventional resource activity throughout the US and Canada accelerated.

Meanwhile, offshore drilling contractor Transocean Inc. posted a 107% jump in revenue and a 14% increase in earnings for third quarter compared to a year earlier, as the company’s costs and expenses more than doubled from the 2007 period.