Ghana’s latest discovery hints at growing potential

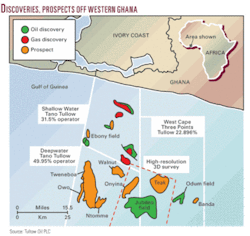

Tullow Oil PLC (“Tullow”) said its recent shallow-water Ebony discovery in the Gulf of Guinea off Ghana could be an indication of further prospectivity in deeper water.

The UK company said the Ebony-1 exploration well on the 983 sq km Shallow Water Tano license intersected two hydrocarbon bearing intervals in Late Cretaceous turbidite sands.

Tullow said the Ebony discovery improves its chance of success at the large Tweneboa downdip prospect to the south (see map).

Meanwhile, Mitsui E&P Ghana Keta Ltd. took a farmout from Afren Energy (Ghana) Ltd. to earn a 20% stake in the Keta Block in the Eastern basin off Ghana.

Ebony discovery

Ebony-1 spudded on Oct. 22 and reached a total depth of 2,640 m. The well lies in the southwest part of the Shallow Water Tano block in 86 m of water and is the second commitment well on this license.

Successful logging and sampling operations confirmed a 4-m oil bearing interval at 2,053 m and a 2-m high-pressure gas-condensate interval at 2,570 m.

Log and sample data from the high-pressure gas-condensate sands and a regional seismic interpretation indicate there may be a connection between these pinched-out sands and the material downdip Tweneboa oil prospect which lies mainly in the Deepwater Tano license. Other possible interpretations for the high-pressure cannot however be excluded at this stage, and this is subject to ongoing evaluation, Tullow said.

Tullow with 31.5% interest operates the Shallow Water Tano license on behalf of partners Interoil Exploration & Production ASA 31.5%, Al Thani Corp. 22.5%, Sabre Oil & Gas Ltd. with a 4.5% carried interest, and Ghana National Petroleum Co. with a 10% carried interest.

Tweneboa, a stratigraphic trap prospect, is set for drilling in the first quarter of 2009.

Espoir and Baobab fields off Ivory Coast are in an Albian play. Off Ghana, the Teak, Tweneboa, Onyina, Walnut, and Banda prospects and the Ebony and Odum discoveries are in a Campanian play. The Teak, Ntomme, Owo, and Tweneboa prospects and Jubilee’s Mahogany and Hyedua discoveries are in a Turonian play.

The Odum discovery drilled in February 2008 is considered commercial because it is 13 km from Jubilee. Odum, in 955 m of water, went to 3,387 m and cut 22 m of net pay in a 60-m gross column of 29° gravity oil. It opened a second new play fairway in the Tano basin.

Jubilee development

Tullow plans to invest $3.2 billion to develop nearby Jubilee field and produce the first oil there in the second half of 2010.

It intends to develop the field in phases and supply the first associated gas from Jubilee to Ghana in 2011.

Ghana has no onshore oil or gas infrastructure. Jubilee field is 9 hr by boat and 45 min by helicopter from a supply base being upgraded at Takoradi, Ghana, which in turn is 4-5 hr by road from the international airport at Accra.

Jubilee’s reservoir lies in 900-1,700 m of water and 2,100 m below the sea bed. The field will be developed using a subsea production and control system tied back to a turret-moored floating production, storage, and offloading vessel.

The development plan is for 17 wells with water injection from the start.

Besides its oily nature, Ghana’s offshore has the potential to be a major gas province, Tullow said.

The peak oil rate of 120,000 b/d of oil is expected to yield 120 MMcfd of gas. The produced gas volume is to be split between reinjection and pipelining to shore.

The gas is also expected to yield 3,000-5,000 b/d of natural gas liquids in the first phase and 10,000-15,000 b/d of NGL in future phases.

A commercial discovery at Tweneboa could confirm a new production hub west of Jubilee field, Tullow indicated.

Tullow estimates 4 billion bbl of oil and gas resources in the Gulf of Guinea offshore Ghana and Ivory Coast.

Interest holders in 1,108 sq km Deepwater Tano are Tullow, Anadarko Petroleum Corp., Kosmos Energy Inc., GNPC, and Sabre. Kosmos operates 1,761 sq km West Cape Three Points on behalf of itself and Anadarko, GNPC, E.O. Group, and Sabre.

Eastern Ghana offshore

In the Keta basin off eastern Ghana, Mitsui will share the cost of the Cuda-1X exploration well spudded on Nov. 16.

It targets a prospect estimated large enough to hold as much as 325-642 million bbl of oil. The play type is similar to the Jubilee and Odum discoveries that Tullow and Kosmos Energy are developing.

“There are also a number of additional identified prospects, which are currently in the process of being assessed by the partners on the Keta Block,” Afren said.

The consortium is using the Transocean Deepwater Discovery drillship to target the Upper Cretaceous deepwater sandstones in a combined structural and stratigraphic trap. The vertical Cuda-1X well will reach a TVD of 15,750 ft within 50 days, Afren said. Cuda-1X will be drilled 5,577 ft of water. There are no plans to perform drill stem testing on the well. Ten wells have been drilled in the Keta basin.

Osman Shahenshah, chief executive of Afren, said: “Following the Jubilee discoveries, Ghana is an emerging and significant West African hydrocarbon province. We…believe the block contains a number of exciting prospects.”

Once the deal is completed, Afren will hold 68% interest, and other partners’ shareholdings will be Mitsui 20%, GNPC 10%, and Gulf Atlantic Energy 2%.

The transaction is subject to government approvals.