a New regs require lower bunker fuel sulfur levels

Recently ratified International Marine Organization regulations that call for a decrease in the sulfur level of marine bunker fuels may cause refiners to invest in more desulfurization and conversion capacity. In the past, refiners have traditionally used the unregulated marine bunker fuel pool as a way to dispose of bottom-of-the-barrel streams high in sulfur.

This article reviews the current and future regulations for bunker fuel and the effect they will have on the global refining industry.

Bunker fuel

Marine bunker fuel comprises only about 5% or less of total global petroleum consumption. The product, however, has been an important outlet for difficult-to-handle, high sulfur residues as well as other undesirable streams such as slurry oils, low-quality distillates, and others.

Historically, bunker fuel quality was lightly regulated. The IMO historically did not regulate bunker fuel for emissions; instead regulations were to ensure ship and crew safety and operability of the ship’s engines.

Regulation of marine fuel quality for environmental reasons is currently being adopted.

Since the 1970s, the IMO has controlled and sought to reduce the environmental impact from international shipping. The overall program comes under the International Convention on the Reduction of Pollution from Ships (MARPOL). That treaty has been in force for decades and has been effective in reducing waterborne pollution arising from oily water wastes, bilge-water disposal, tank-cleaning emissions, and others.

MARPOL has progressed despite the fact that the principal goal of shipping regulation has been safety. Measures intended to avoid disastrous accidents have had a good record of success. Now, however, the principal focus of new marine regulations is for air quality.

MARPOL Annex VI governs air pollution aspects of marine shipping. The original Annex VI introduced global bunker fuel sulfur limits at 4.5%.

MARPOL’s Annex VI Amendments were adopted by the IMO’s Marine Environment Protection Committee (MEPC) in April 2008 and ratified at the MEPC 58 meeting in October 2008. The Annex VI Amendments represent a step forward in controlling air pollution from marine sources. National legislation of maritime governments is needed to implement the Annex VI Amendments.

Annex VI amendments

Controlling sulfur is a key feature of the Annex VI amendments. Annex VI Amendments incorporate two features of bunker-fuel sulfur control.

First, Annex VI Amendments call for Emissions Control Areas (ECAs). The ECA feature can apply to either SOx or NOx. Thus far, ECAs have been designated only for SOx. The current SOx ECAs are the Baltic Sea Area and the North Sea-English Channel area.

The US, a signatory of MARPOL and Annex VI, proposes an SOx ECA for California, the Pacific Coast, and possibly other areas. Considerable work is required to fulfill all the IMO’s data requirements for the ECA program. The US Environmental Protection Agency (EPA) and the California Air Resources Board (CARB) are taking the lead in that process.

Until 2010, SOx emissions within the ECAs are limited to the level that would come from burning fuel at 1.5% sulfur. After 2010, the limit is 1.0% sulfur, until 2015 when the required level becomes 0.1% sulfur.

Annex VI Amendments provide for alternative means of meeting sulfur emissions requirements. Effective emissions scrubbing technology may allow shippers to use bunker fuels with higher sulfur levels.

The basic technology takes advantage of naturally occurring calcium carbonate dissolved in seawater to remove SOx emissions. As part of the scrubbing process, soot, unburned fuel, and other particulates such as fuel-derived metals are also recovered in a waste material that can be disposed of onshore.

Formal approval of scrubbing technology has not occurred and ultimately may depend on approval of the maritime states’ environmental and marine safety regulators.

Outside the ECAs, sulfur in bunker fuel is more tightly controlled than in the past.

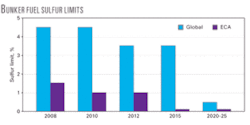

The figure shows that the current limit is 4.5% globally. This will fall to 3.5% by 2012 and then to 0.5% in either 2020 or 2025. By 2018, a feasibility review will determine whether sufficient low-sulfur fuel will be available by 2020. If that review finds that insufficient fuel will be available, then the compliance data can be delayed to 2025.

Annex VI Amendments also call for the control of NOx (see table). NOx controls apply to large marine engines with power output of as little as 130 kw, about 175.

Unlike SOx, marine NOx emissions are only partly a function of fuel quality. Although bound nitrogen in fuel contributes to NOx, emissions originate also with atmospheric nitrogen. Controlling NOx emissions is more obviously related to the combustion process than SOx emissions and the engines are the focus of NOx emissions standards.

MARPOL Annex VI Amendment program anticipates new standards for ship efficiency and CO2 emissions. Thus far, however, those efficiency standards have not been set. Several possible formats of greenhouse gas regulation and compliance are possible.

Regulating engine efficiency may seem like an obvious step. Opportunities for reducing maritime CO2 emissions, however, go far beyond engine efficiency. Considerable CO2 gains are possible with improvements in hull form, propeller design, hull and propeller coatings, vessel routing and speed optimization, and engine exhaust-heat recovery. Notwithstanding a lack of greenhouse gas regulation currently, ship operators have experienced a powerful incentive to minimize fuel consumption due to high prices alone.

In the US, bunker fuel regulation is moving as fast as it is internationally. The US is a signatory to the MARPOL treaty and in 2008 ratified Annex VI.

Regulation is moving forward on parallel state and federal paths. CARB adopted a new marine engine emissions regulation. That regulation would govern emissions in the offshore airshed areas of the South Coast air basin. Within 24 miles of the coast, ships are forbidden from using intermediate fuel oil (IFO) bunker fuel entirely and must burn solely marine gas oil or marine diesel. Sulfur content is limited to 0.1%.

CARB, regulator of mobile emissions sources in California, is preparing a submission to EPA and IMO to have the Pacific Coast designated a SOx ECA under MARPOL Annex VI Amendments.

The US Congress has several bills before it to establish a nationwide sulfur emissions control area. The bills would control emissions from marine vessels entering US ports or offshore terminals.

House Resolution 2548 and companion Senate Bill S1499 would provide for low-sulfur fuels within 200 miles of the West Coast and also within an as-yet-undetermined distance from the US Gulf Coast and East Coast. The requirements of either bill could be met by use of alternative control technologies such as sulfur scrubbers.

Cleaner fuels could be required as early as 2011. Both bills would require “greatest degree of emissions reductions available” through available technologies for NOx and particulate matter among other air contaminants.

Key uncertainties

The effect of these regulations on the refining industry is still uncertain. Several key factors remain undetermined.

The SOx ECA program could expand considerably. SOx ECAs could be established in various areas around the world where ship-derived emissions contribute to onshore pollution problems. Such areas may include most of North America and European waters, including the Mediterranean and Straits of Malacca, and seas off Northeast Asia.

Nations will establish NOx ECAs. The areas likely to incorporate NOx ECAs are basically the same as the areas probable for SOx ECAs.

Suitability of scrubbing technology for both SOx and NOx must be established. Widespread application of scrubbing technology may limit the amount of low-sulfur fuel that needs to be manufactured while at the same time cap the price premium that might be paid for it.

Extent of greenhouse gas or CO2 controls and interaction with other pollutants are as yet unknown. Production of low-sulfur fuels contributes CO2 emissions at the refinery level, which must be accounted for and balanced against gains in shipping. It is possible that more-efficient marine engines can be designed that burn higher-quality fuels.

Marine fuel quality requirements will change. The International Organization for Standardization (ISO) is undertaking that effort. Sulfur grades will be added and the detail of viscosity regulation will be simplified. More importantly, other aspects of fuel quality will be reevaluated.

New limits may be adopted for organic acid content (total acid number, TAN) in lieu of, or in addition to, the current limit on strong acid content. Introducing such limits may affect the use of high-TAN crude oils as convenient, low-priced feedstock for manufacturing low-sulfur marine fuels.

Nitrogen content may be regulated. Many heavy crudes such as Venezuelan or California grades commonly contain considerable nitrogen. Using those crudes to manufacture marine fuels may be affected depending on the stringency of any nitrogen specification that is adopted.

More-stringent standards on ignition characteristics may be adopted. Improving these characteristics may contribute to improved emissions levels. Fuel stability is important and improved stability standards are expected.

Possible new standards will more carefully regulate the use of non-refinery-derived blendstocks used for marine fuels. The marine fuels market long has been in part a disposal opportunity for unattractive stocks such as petrochemical wastes, oleochemical or biofuels wastes, recycled lube oil components, and others. The new ISO standards may directly ban some of these components.

A current problem for refiners is blending FCC slurry oils to bunker fuels. Slurry oils are attractive to bunker fuel suppliers partly because they usually are relatively low-sulfur stocks. Alumina and silica derived from the FCC catalyst in the slurry oils, however, creates problems with current bunker fuel requirements. The catalyst particles contribute to erosivity of the bunker fuel and increased stringency in that area may compound refiners’ difficulties in this area.

Refining industry

The refining industry faces major obstacles in producing higher-quality marine fuels. The average sulfur content of IFO-grade marine fuels is currently more than 2.5%. Refiners may need to reduce the sulfur level to 0.5%.

In the short term, many refiners can blend acceptable fuels for the SOx ECAs. SOx ECAs comprise only a small portion of marine fuels burned currently.

A typical container ship traveling from Singapore to Rotterdam will burn about 7,500 tonnes of bunker fuel in 24 days. Only the last 400 miles of that journey are in SOx ECA waters. A cargo ship traveling from Shanghai to Los Angeles travels about 5,800 nautical miles, of which the last 24 miles are in the sulfur-control area.

Although problems of fuel availability and segregation must be resolved for such vessels, the refining industry faces only a minor obstacle to produce small fractions of bunker fuel at current or 2010 ECA-quality levels. The new global bunker sulfur specification of 3.5% in 2012 will affect about 15% of bunker fuel from high-sulfur crudes. The preponderance of fuel already meets the requirement.

The longer term difficulties are greater. Less than 5% of current bunker fuel production meets the 0.5% sulfur level. Producing SOx ECA fuel to a 0.1% sulfur level will be quite difficult. Will low sulfur IFO be produced or will marine gas oil-type distillate materials largely displace IFO fuels?

Although running lower-sulfur crudes can help some refiners ease some refining difficulties, crude slate will not be a major contributor to solving marine fuels quality issues in the long term. Unlike diesel, gasoline, or stationary-application fuel oil, marine fuels are global. The same set of regulations is governing quality all around the world at the same time. When the 0.5% global specification comes into force, all bunker fuel producers will face the same problem at the same time and crude selection will play only a minor role.

Desulfurizing fuel oil components to the levels required is problematic. Capital and operating costs for desulfurization are high.

Although the technology exists to desulfurize residual fuels to low levels, it is not practiced to these levels in ordinary commercial fuel oil practice. It is an open question what role desulfurization may play to help produce needed fuel qualities.

The shipping industry understands that fuel quality in the 0.1-0.5% range probably implies refiners using conversion technology, not just desulfurization. Marine engines run effectively on marine gas oil as an alternative to IFO-grade residual fuels. Such fuels now are used for a minor fraction of ship fuels. Will ship owners be willing to pay the higher cost of marine gas oil fuels in such large quantities?

Of the conversion technology families available to refiners, coking and hydrocracking have the most obvious application to the marine fuels problem. It is the nature of bunker fuels that the lowest-quality conversion feedstocks often are directed to bunker fuels to preserve higher-quality resids and gas oils for conversion processing in existing equipment. As compared to desirable resid FCC feedstock, typical bunker fuel is high sulfur, high asphaltene, and high metals.

Coking technology often is found most applicable to low-quality feedstocks. Coking is tolerant of the lowest quality ranges and can solve a refiner’s requirement of residue destruction effectively.

Hydrocracking technology offers the needed flexibility of products that is more difficult to achieve with FCC-based technologies. Global demand growth patterns have increased demand for distillate fuels and lowered gasoline demand. Consequently, the typical gasoline-heavy product pattern for FCC technology is not highly oriented to the refinery output required. Indeed, converting marine IFO fuels to low-sulfur fuels could add as much as 200 million tonnes/year to distillate fuel demand at the expense of residual fuel.

Outlook

Refiners require a clear signal from the shipping industry as to the quality of fuel required. The schedule is the most daunting obstacle, providing 11-16 years for the refining industry to respond. Still, only limited progress is possible until key decisions are made.

Regulators must come to a decision on the detailed acceptability of all the various scrubbing technologies for NOx and SOx. Rapid determination of the boundaries and any tighter national requirements for NOx ECAs and SOx ECAs would be helpful to all parties to resolve the optimal means of meeting regulatory requirements while still providing cost-effective fuels and shipping services.

Ship owners must determine the extent to which they will install such technologies and what types of fuel they will require for the fleet. Of course that decision depends on the costs of the various fuels from the refining industry.

Refiners must enter into a dialogue with the shipping industry. IMO and ship owners need information on the costs of alternatives in order to make beneficial decisions.

The IMO program for a “feasibility” review in 2018 is too late to constitute the signal the refining industry requires. Whenever the IMO undertakes its review, the purpose will be to confirm for the shipping industry that enough fuel is ensured, not to confirm for the refining industry that enough demand exists.

The US refining industry must undertake its own review of marine fuels requirements to determine how these programs will affect US refiners and the best position for the refining industry to take on this global issue.

The author

John Vautrain (jhvautrain@ purvingertz.com) is vice-president and director for Purvin & Gertz Inc., Singapore. Before joining Purvin & Gertz in 1981, he worked for Phillips Petroleum Co. and Union Carbide Corp. Vautrain was manager of Purvin & Gertz’s Long Beach, Calif., office 1987-2000. Elected director in 1997, he has been based in Singapore since 2000. His Asian consulting activities include crude marketing, petroleum refining, LPG, natural gas, and LNG. Vautrain holds a BA in chemistry from the University of Texas and an ME in chemical engineering from the University of Utah.