Altex CEO guides newbuild sands crude transport project

Altex CEO and Pres. Jack Crawford, as one of the principals in the Alliance Pipeline project, is familiar with the problems accompanying large new infrastructure projects such as the Altex Pipeline.

Most of the transportation projects focused on moving sands production south include conversion or repurposing of existing infrastructure to bridge at least a large portion of the gap between Alberta and the US Gulf Coast. TransCanada’s Keystone and Enbridge’s various proposals–Texas Access, Trailbreaker, and it’s most recent partnership with BP–all fall into this category.

Altex Pipeline

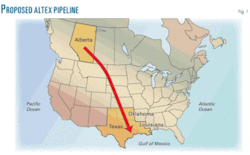

Altex Energy, however, is pursuing a completely newbuild 36-in. pipeline running directly from northern Alberta to the US Gulf Coast (see figure). The line’s initial capacity will be 425,000 b/d, but the company says expansion to 1 million b/d is possible as demand warrants.

The Alliance Pipeline project was a newbuild line that brought then-isolated natural gas from northeastern British Columbia and northwestern Alberta to the also newbuild Aux Sable gas processing plant near Chicago.

The partnership behind the Alliance Pipeline was officially formed in May 1996 and the line entered service Dec. 1, 2000. Altex has a similar 4-5 year development time line planned. Despite having been announced in October 2005, however, it has yet to begin formal permitting and other processes associated with eventual construction.

“The difficulty is, we’re not going to kick off major project work until we have a firm customer base with signed contracts,” explains Crawford. “And the difficulty with that of course is, we’re asking customers to sign long-term ship-or-pay types of contracts, which end up being a drag on their balance sheets. So they’re not going to do that until they’re ready.”

The pipeline’s roughly 4-year development time cycle runs beyond the 3-year window of typical oil sands production projects from the time of sanctioning to the beginning of production. This time line essentially requires prospective customers to sign up for transportation a year before those customers have sanctioned their own projects.

Even so, oil sands producers are typically more willing to enter into long-term shipping agreements than producers in other areas, according to Crawford, because they believe their projects will be producing for 30, 35, or more years and the customary exploration and development risk isn’t really there.

Huge capital commitments, however, are present and have proven problematic to a number of oil sands’ production projects. The scope of activity going on around Fort McMurray, Alta., has created a shortage of labor, driven costs up, and slowed projects, says Crawford.

Crawford recognizes that the current economy and crisis in the financial sector has the potential to create at least a pause in demand growth, if not an actual reduction in demand. He believes, however, that its ultimate effect will be limited on both the Altex Pipeline and sands projects in general

“It won’t surprise me if there’s a 1 or 2% drop in demand” at some time, says Crawford. He believes potential problems associated with the two primary heavy crude suppliers to the US Gulf Coast–Mexico and Venezuela–will outweigh any small overall demand dip for projects such as his.

“Mayan production in Mexico has declined precipitously, and there’s no readily available means to bring it back up,” Crawford says. “Venezuela’s production capacity could probably do the trick, but you’ve got two other things going on there, both politically driven. [Venezuelan President Hugo] Chavez basically kicked out the foreign oil companies and confiscated their property. So even if this were to change, they’re not likely to go charging back. And [Venezuela] has announced a bunch of deals with China, which if I remember correctly would raise their current claimed heavy crude exports to China of 300,000 b/d to 1 million b/d in 3-4 years. Given the lack of investment to bring production up, it’s basically got to come out of their current supply.”

Crawford also acknowledges the slowdown in sands development has already affected the Altex Pipeline, moving what was initially a 2010-11 start-up target to 2014.

Shortly after its announcement, Altex considered the viability of stopping in other markets between Alberta and the US Gulf Coast, looking particularly at Billings, Wyoming, and Denver. These three were eventually decided against as uneconomical, but the line’s route will carry it close enough to Cushing to make a potential stop there at least still possible.

Preliminary routing decisions on river crossings and other difficult stretches of line have already been done, with fine-grain planning next.

Transport costs

Altex claims its finished system will offer total transport costs (TTC) 50-65% lower than those of competing systems, either existing or planned. The pipeline will use conventional line technology, keeping capital costs similar to other projects and allowing for competitive tolling costs. What brings real savings to the system, according to Altex, is its patent-pending Thermo-LEVR diluent, the relatively small commodity value loss of which allows for the dramatic TTC savings.

Crawford acknowledges the line will run at a somewhat elevated temperature, but not to a degree that it would bring costs out of the conventional realm.

The Thermo-LEVR itself will be either removed at the Altex terminus and replaced by conventional diluent for shipment to facilities, or left in the stream and removed by the consumer. Crawford says Altex expects at least some of the refiners will pursue the latter course, custom-blending their batches to match their plants.

The Altex terminus will include new facilities built near Port Arthur, Tex., but will also take advantage of existing terminals in the area for ease of transport to final customers.

Thermo-LEVR will not be recycled or returned upstream once removed but will instead be marketed locally, according to Crawford. Crawford declined to comment on what sort of product it would be sold as. He did, however, voice the expectation of “a large and liquid market” for the material. More details regarding its nature will emerge “as appropriate, likely during open season, public consultation, and regulatory phases,” said Crawford.

Altex has also received inquiries from abroad regarding purchasing batches of Thermo-LEVR for use as a diluent, according to Crawford, which the company will likely pursue once patents have been granted.

Chicken, egg

In the meantime, however, development of the Altex Pipeline remains in slow motion, hampered by the previously mentioned need to secure shippers at the same time regulatory approvals are also needed if further headway is to be made. Crawford says work is currently under way to resolve these issues contractually with the prospective shippers.

Altex is in active discussions with five prospective shippers. Crawford adds, “there are four or five more players rethinking their whole plans,” and discussions will begin with at least some of them shortly. “But the existing group is certainly capable of making the line go, even without additional interest,” at the initial planned capacity of 425,000 b/d.

In comparing the Alliance and Altex projects, Crawford sees the largest difference in the commercial pressures of the two projects. Alliance required nearly full participation from the natural gas shippers in the region because “if you ended up with surplus capacity, that capacity was going to be marketed at less than full cost, and anybody holding that capacity was effectively holding a devalued asset. We ended up with something like 37 shippers when Alliance entered service.”

Alliance reached an understanding with its shippers that by signing up for something that might be “slightly out of the market cost-wise for a small portion of their production, the rest of their production would benefit from a lift in prices in the basin” by virtue of being able to get the gas to market.

With Altex by contrast, “because we think we can soundly beat the competition from the price perspective, we don’t need every producer in the basin,” says Crawford.

Looking beyond his current project at the health of the industry in general, Crawford is fairly bullish on oil prices and cautiously optimistic regarding the steel and labor markets.

“I don’t think we’ll see a sustained drop below $100/bbl crude and I do think we’ll see a fair bit of volatility. But I don’t think there’s enough $80 oil in the ground to sustain this market. The marginal cost will have to be above that and I think it will remain closer to $100/bbl.”

The big question regarding steel and labor costs is what happens with the economy, says Crawford. “We have seen some softening in steel prices lately, as well as increased steel-making and pipe-making capacity. I think it remains an open question as to whether this will moderate prices of the materials and labor required to build a pipeline.

“It also depends on what else is going on. If you get the Alaska pipeline, and the Mackenzie Valley pipeline, and all of the connections occurring to bring the shale plays to market, you’ll have a pretty intensive market in which you probably won’t see much softening. But if these projects slow down and things back up a little bit, prices could come off.”

Career highlights

Jack Crawford is president and chief executive officer of Altex Energy Ltd., an energy infrastructure company formed in 2005.

Employment

Prior to forming Altex, Crawford spent 10 years developing, building, and operating the Alliance Pipeline System. From 1996 to 2000, he served as vice-president, public, government, and regulatory affairs, for Alliance Pipeline and Aux Sable Liquid Products.

In 2001, he assumed the position of executive vice-president and chief operating officer for the two Alliance Pipeline partnerships, a position he held until the end of 2004. Crawford’s career spans more than 30 years and includes stints in pipeline engineering, project engineering, regulatory work, project development, and marketing.

Education

Crawford holds a BS in mechanical engineering and an MBA, both from the University of Calgary. He is a professional engineer registered in the province of Alberta. He sits on the board of the Calgary Philharmonic Orchestra and is a member of the Engineering Associates program at the Schulich School of Engineering, University of Calgary.