A strong sense of déjà vu pervaded Gulf Coast propane markets during third-quarter 2008, as comparisons of September 2008 with the hurricane season of 2005 abounded. But US propane markets also suffered from inventory accumulation rates during second quarter that fell below normal, as occurred in 2007.

The volume of propane in primary storage is an important element of supply for the winter heating season. This article discusses how markets will cope with lackluster propane inventory accumulation during second and third quarters.

Although landfall dates for Hurricanes Gustav and Ike were eerily similar to Katrina and Rita in 2005, August and September are the months of peak storm activity during the hurricane season. While Gustav and Ike traversed the Gulf of Mexico, they were substantially weaker than Katrina and Rita, both Category 5 storms at some point before making landfall.

Although all four storms came ashore in Louisiana or the Upper Texas Coast, the exact points of landfall in 2008 were significantly different from those in 2005. Katrina in 2005 moved ashore to the east of New Orleans, while Gustav in 2008 came ashore to the city’s west. Hurricane Rita in 2005 made landfall at Port Arthur, Tex., just inside the Texas-Louisiana border; Ike in September 2008 came ashore over Galveston, Tex.

Katrina affected only those plants in southeast Louisiana (20% of US capacity), while Rita affected only those plants bounded by Beaumont, Port Arthur, and Orange in the west and by Lake Charles, La., in the east. These plants comprise 17% of US capacity.

Differences in landfall points for the storms of 2008 resulted in substantial differences in their impacts on the petrochemical industry. Gustav directly affected 20% of US capacity, while Ike directly affected 67% of total US ethylene capacity or more than three times the capacity at risk due to Gustav.

Feedstock demand

Typically, feedstock demand for propane rebounds during first quarter, when the winter heating season begins winding down. During winter 2007-08, however, inventories were 9 million bbl below the 3-year average at the beginning of the heating season. Furthermore, nearly all the inventory shortfall was concentrated in Mont Belvieu and was therefore a significant constraint on availability for the ethylene feedstock market.

As a result, feedstock demand for propane averaged 299,000 b/d during first-quarter 2008 and was unchanged from fourth-quarter 2007.

Propane feedstock demand is one of the most important balancing elements of the overall propane market in North America. When colder weather pushes sales and consumption in the retail markets steadily higher during November through February, ethylene producers in the Gulf Coast use their substantial feedstock flexibility to reduce their consumption of propane. This predictable shift in feedstock demand for propane offsets the impact of colder-than-normal winters, loss of production, or low inventories. Historically, most of the seasonal decline in ethylene feedstock demand has occurred during the fourth quarter.With warmer spring weather, retail propane demand fell sharply during second-quarter 2008 and availability for the feedstock market improved. Feedstock demand for propane averaged 357,000 b/d during second-quarter 2008. Demand in second-quarter 2008 was almost 60,000 b/d more than in the first quarter but 10,000 b/d less than in 2007.

Inventories (net of nonfuel propylene) were consistently less than the 3-year average during second-quarter 2008, but they were also consistently higher than in 2007. The year-to-year inventory surplus, however, narrowed to 700,000 bbl at the end of July from 4.2 million bbl at the end of May. The steady increase in ethylene feedstock demand for propane during March through July was one of the key reasons for the narrowing inventory surplus. Specifically, feedstock demand for propane averaged 408,000 b/d in June (1.3 million bbl more than in 2007) and 423,000 b/d in July (2.2 million bbl more than in 2007).

Feedstock demand for propane was higher than in 2007 because variable production costs for propane were 10-15¢/lb less expensive than for natural gasoline and light naphthas of similar quality.

Ethylene plants operated at 86% of nameplate capacity during second-quarter 2008 and 90% of capacity during July and August. Hurricanes Gustav and Ike caused extensive downtime for most ethylene plants on the Upper Texas and Louisiana Gulf Coast during September; some plants did not return to full operations until November.

As a result, feedstock demand curtailments in October and November offset supply losses due to downtime in gas plants and refineries. This factor was an important consideration for continued accumulation of propane inventories in Gulf Coast storage.

Ethylene plants will operate at 88-92% of nameplate capacity during fourth-quarter 2008 and first-quarter 2009. Total feedstock demand will average 1.60-1.65 million b/d during fourth-quarter 2008 and 1.65-1.70 million b/d during first-quarter 2008.

Consistent with typical seasonal patterns, however, propane consumption in the ethylene feedstock market will remain weak during fourth-quarter 2008 and average 275,000-290,000 b/d or about 15,000 b/d less than in 2007.

In first-quarter 2009, feedstock demand will average 240,000-260,000 b/d, or 55,000-65,000 b/d less than year-earlier volumes. The year-to-year decline in feedstock demand during fourth-quarter 2008 and first-quarter 2009 will offset the expected inventory deficit of 2-3 million bbl on Nov. 1. Fig. 1 illustrates historic trends in ethylene feedstock demand.

Retail demand

Consistent with the seasonal in heating degree-days, retail demand fell to its seasonal low during second and third quarters 2008. We estimate that total retail propane sales averaged 420,000 b/d in second-quarter 2008. In third-quarter 2008, we estimate that retail propane sales averaged 220,000-230,000 b/d vs. 205,000-215,000 b/d in third quarter 2007.

During a cold winter, retail propane sales will be 10-20% higher than during recent winters. The record high for retail propane sales occurred during winter 2000-01 and totaled an estimated 210 million bbl.

Propane supply-demand forecasts for winter 2008-09, however, are based on total retail sales of 170-185 million bbl. In comparison, retail sales totaled 174 million bbl during winter 2006-07 and 186 million bbl during winter 2007-08.

Propane supply

Gas processors continued to experience strong profit margins in all producing regions during second and third quarters 2008. Furthermore, propane prices were consistently 40-60¢/gal higher than their btu equivalent based on spot natural gas prices in the Houston Ship Channel market–indicating that refineries had no economic incentive to use propane instead of natural gas in their fuel systems.

Propane’s use as a space-heating fuel in the residential-commercial market reaches its seasonal peak each year during December and January but begins to decline in February and falls to its seasonal minimum during the summer.Strong profitability for all gas processing plants and economic incentives for refineries lead to the conclusion that US propane production was at full recovery for both gas plants and refineries.

Based on data published by the US Energy Information Administration, total production from gas plants and net propane production from refineries averaged 835,000 b/d during first-quarter 2008 (19,000 b/d higher than year-earlier volumes) and 857,000 b/d during second-quarter 2008 (16,000 b/d higher than year-earlier volumes).

Gas plants

EIA statistics show gas plant propane production averaged 530,000 b/d for second-quarter 2008 and was an estimated 525,000-535,000 b/d during July and August. Disruptions to gas processing operations in Louisiana in September and estimated production losses show that gas plant production declined to 485,000-495,000 b/d in September and averaged 510,000-520,000 b/d for third-quarter 2008.

Gas plant production in Louisiana will gradually improve during fourth quarter but remain below full recovery until February or March 2009. As a result, production in fourth-quarter 2008 will average 510,000-520,000 b/d or 5,000-10,000 b/d lower than year-earlier volumes. Fig. 2 illustrates trends in propane production from gas plants.

Refineries

In second-quarter 2008, propane production from refineries (net of propylene for propylene chemicals markets) averaged 327,000 b/d. Net refinery production was 10,000 b/d greater than in first-quarter 2008 but declined by 10,000 b/d from year-earlier volumes, according to EIA statistics.

As with gas plant production, net supply from refineries was 320,000-330,000 b/d in July (EIA actual statistics) and August (estimated) but dropped sharply in September and was an estimated 240,000-250,000 b/d. For third-quarter 2008, propane supply from refineries averaged 290,000-310,000 b/d in third-quarter 2008 and will average 310,000-330,000 b/d in fourth-quarter 2008.

The projected decline in production in fourth quarter is consistent with general seasonal trends and also accounts for lingering hurricane-related problems at a few refineries in the Upper Texas Coast. Fig. 3 shows trends in total propane production (gas plants and refineries).

Imports

Based on data from the US Census Bureau’s Foreign Trade Division, propane imports from Canada declined in second-quarter 2008, consistent with normal seasonal patterns, and averaged 78,000 b/d. Imports were 3,000 b/d higher than in second-quarter 2007 but were 22,000 b/d lower than the average for 2000-05.

Propane imports from Canada increased to an estimated 95,000-105,000 b/d in third-quarter 2008. The increase in receipts from Canada during third quarter was consistent with historic seasonal patterns.

Contrary to seasonal supply trends, waterborne imports declined in second-quarter 2008 and averaged only 32,000 b/d, as reported by the Foreign Trade Division. Waterborne imports were 46,000 b/d less than year-earlier volumes. International propane imports averaged an estimated 70,000-80,000 b/d during third-quarter 2008 and were equal to receipts during third-quarter 2007 but were 45,000 b/d lower than the average for 2002-06. The year-to-year decline in waterborne imports during second and third quarters totaled 4.2 million bbl.

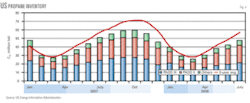

Overall inventory trends

Mar. 31 normally marks the end of the inventory liquidation season for the US. Occasionally, propane inventories continue to decline during April if temperatures are below average.

According to EIA weekly statistics, propane inventories fell to a seasonal low at the end of March 2008 and began to increase during the first week of April. EIA monthly statistics show that total inventories (including propylene for nonfuel uses) totaled 25.6 million bbl on Apr. 1. Inventories were equal to the 3-year average but were 1.4 million bbl lower than year-earlier volumes.

During 2003-06, the seasonal accumulation of propane in primary storage ranged consistently 40-45 million bbl. The seasonal inventory build, however, totaled only 31.7 million bbl in 2002 and 34.0 million bbl in 2007.

For 2008, based on EIA’s monthly statistics through July and weekly statistics for August and September, the seasonal inventory build (net of nonfuel propylene) totaled 32.2 million bbl and inventories totaled 55-57 million bbl on Oct. 1, 2008, and reached 57-58 million bbl on Nov. 1, 2008.

Including Canadian inventories in underground storage, propane markets will have access to 71-72 million bbl of supply in primary storage during the winter heating season. These volumes were equal to inventories in 2007 but 15 million bbl less than in 2006.

At the end of the 2006-07 winter heating season, purity propane inventories in underground storage in Canada fell to a low of 1.9 million bbl on Mar. 1, 2007. At this level, purity propane inventories were 1.5 million bbl below the 5-year average and 2.5 million bbl lower than in 2006.

Based on statistics from Canada’s National Energy Board, Canadian companies added 7.5 million bbl of propane during Mar. 1 through Sept. 1, 2007. The seasonal build in Canadian storage erased nearly all the inventory deficit on Mar. 1, 2007. Fig. 4 shows trends in US propane inventories.

During 2002-06, total withdrawals of propane from primary storage were 39-49 million bbl. For the 2007-08 winter heating season, however, withdrawals totaled only 35.9 million bbl and inventories fell 23.6 million bbl. If the 2008-09 winter heating season is similar to winter of the past 5 years, inventories will be adequate to meet retail demand but only if ethylene feedstock demand is weak in fourth-quarter 2008 and declines further during first-quarter 2009. Inventories will fall to a low of 23-24 million bbl on Mar. 31, 2009, but could easily fall as low as 20-21 million bbl.

Regional inventory trends

On Mar. 1, 2008, propane inventory in primary storage in US Petroleum Administration for Defense District (PADD) II fell to a low of 8.65 million bbl, or 1.4 million bbl below year-earlier levels but equal to the seasonal minimum of 2007 (Apr. 1, 2007).1 During second-quarter 2008, inventory in primary storage in PADD II increased by 8.8 million bbl and totaled 17.8 million bbl on July 1.

At this level, inventories were 1.2 million bbl higher than in 2007 but were 1.4 million bbl below the 2002-06 average. During third-quarter 2008, inventories increased by an additional 6-7 million bbl and totaled 24-25 million bbl on Oct. 1. The cumulative inventory build during second and third quarters 2008 was 1.6 million bbl higher than average.

In most markets, trends in crude oil prices determine propane’s competitive ethylene feedstock parity value as an alternative for light naphthas. Propane prices typically move in tandem with feedstock parity values vs. light naphthas.According to EIA monthly statistics, propane inventory in primary storage in PADD III (net of nonfuel propylene) totaled 11.4 million bbl on Apr. 1, 2008, and was equal to year-earlier levels but was 0.65 million bbl less than the average for 2005-07. During second-quarter 2008, propane inventory in primary storage in PADD III increased by 7.7 million bbl vs. 6.5 million bbl in 2007.

In 2005, however, PADD III inventories increased by 14.0 million bbl during second quarter. The volume of waterborne imports during second-quarter 2008 was similar to receipts in 2006 but was far less than receipts during second-quarter 2005.

On Oct. 1, inventories in PADD III (net of nonfuel propylene) totaled 24.5-25.5 million bbl and were 0.6 million bbl below the year earlier level. Inventories declined to 23-24 million bbl on Nov. 1 and were 4.5 million bbl lower than in 2007.

Pricing, economics

During second-quarter 2008, propane prices in Mont Belvieu increased to an average of 181.9¢/gal in June from 159.0¢/gal in April. Despite the increase in spot prices of 23¢/gal, propane’s ratio vs. West Texas Intermediate declined to 57.0% in June 2008 vs. 59.3% in April 2008. These comparisons indicate that spot prices in Mont Belvieu did not keep pace with the $21.30/bbl increase in monthly average prices for WTI crude oil during second-quarter 2008.

Although hurricane season began on June 1 with forecasts for an active season, WTI prices fell sharply beginning in mid July and averaged $116.58/bbl in August and $104.47/bbl in September. Propane prices fell more slowly than WTI prices during third-quarter 2008 and the ratio averaged 61.0% in September vs. 58.0% in July.

Prices averaged 152.5¢/gal in September or nearly 30¢/gal less than in June but were 23¢/gal higher than year-earlier levels. Propane retailers were probably much less impressed with the declining trend in the propane/WTI ratio than they were dismayed by the year-to-year increase in spot prices.

Parity values

During second-quarter 2008, spot prices in Mont Belvieu averaged 170.2¢/gal, while the range of propane’s feedstock parity values was 166¢/gal vs. ethane and 198¢/gal vs. natural gasoline. By these measures, propane prices were strong relative to ethane (166¢/gal) but weak relative to natural gasoline (198¢/gal) during second-quarter 2008.

In view of the ethylene industry’s capability to adjust its consumption of propane within 1-2 months, propane prices vs. alternative ethylene feedstock values are better measures of the relative strength or weakness in spot prices in Mont Belvieu.During third-quarter 2008, however, spot prices in Mont Belvieu averaged 167.8¢/gal but feedstock parity values averaged 167.2¢/gal vs. ethane and 182.1¢/gal vs. natural gasoline. Based on these comparisons, propane prices were neutral vs. ethane but remained weak relative to natural gasoline during third-quarter 2008.

2008-09 winter prices

The sharp decline in WTI prices during third-quarter 2008 may well signal the end of the 4-year bullish trend for crude oil prices. Traders now seem more concerned about the fallout of the financial crisis and the continuing decline in gasoline demand and have little concern about the threat of supply disruptions.

Crude oil inventories, however, remain at the lower end of the historic range and gasoline inventories fell to record low levels at the end of September. If the financial crisis has caused traders to have an overly bearish view of the true trends in the US economy, prices may well rebound sharply in first or second quarter 2009. For fourth-quarter 2008 and first-quarter 2009, however, price forecasts for propane are based on WTI prices of $95-105/bbl.

Based on price forecasts for competing feedstocks and coproducts, propane’s feedstock parity values will be in the range of 135-160¢/gal in fourth-quarter 2008 and 130-150¢/gal in first-quarter 2009. Propane prices will average 145-155¢/gal during the winter heating season 2008-09.

Reference

1. http://www.eia.doe.gov/pub/oil_gas/petroleum/analysis_publications/oil_market_basics/paddmap.htm.

The author

Daniel L. Lippe ([email protected]) is president of Petral-Worldwide Inc., Houston. He founded Petral Consulting Co. in 1988 and cofounded Petral Worldwide in 1993. He has expertise in economic analysis of a broad spectrum of petroleum products including crude oil and refined products, natural gas, natural gas liquids, other ethylene feedstocks, and primary petrochemicals. Lippe began his professional career in 1974 with Diamond Shamrock Chemical Co., moved into professional consulting in 1979, and has served petroleum, midstream, and petrochemical industry clients since that time. He holds a BS (1974) in chemical engineering from Texas A&M University and an MBA (1981) from Houston Baptist University. He is an active member of the Gas Processors Association, serving on the NGL Market Information Committee and currently serving as vice-chairman of the committee.