OGJ Newsletter

E&Y: Alternate energy investments could slow

The credit crunch and falling oil prices could dampen investment in alternate energy companies until stock markets again stabilize, said speakers at an Ernst & Young energy forum on Oct. 9.

Investment momentum for solar, wind, and other alternate forms of energy could slow if oil prices continue to drop, said Dan Pickering, head of research for Tudor, Pickering, Holt & Co.

Before the credit crunch started, alternate energy was very popular in the US, he noted.

“The perception of the American public is alternative energy is very sexy to fund and very cool to do,” Pickering said. “But don’t forget about grandpa. Grandpa is conventional energy.”

Alternate energy still needs traditional fossil fuel as a backup for days when the sun does not shine or the wind does not blow, Pickering said.

Joseph Muscat, Ernst & Young Americas director of venture capital, said access to capital could become more difficult for alternate energy companies. For instance, he noted that initial public offerings for such companies essentially stopped in July.

Venture capital funds are attracted to clean technology energy companies, Muscat said, adding that only software companies get a bigger share of global joint venture investment than clean technology energy companies.

On a US level, Muscat noted that government subsidies and tax credits for renewals appear to be here to stay. The $700 billion federal bailout package recently approved by the US Congress renewed subsidies and tax credits for wind, solar, and biofuels.

President George W. Bush signed an 8-year extension of tax credits for investments into solar energy and a 1-year extension for investments into wind energy.

IEA again trims global oil demand forecast

The International Energy Agency, Paris, has again trimmed its global oil demand forecast.

In its monthly oil market report for October, IEA cut its outlook for oil demand in 2008 by 240,000 b/d, and reduced the 2009 outlook by 440,000 b/d.

The new projections come as a result of weaker-than-expected oil deliveries to member countries of the Organization for Economic Cooperation and Development during July and August and in light of the International Monetary Fund’s downward revisions to 2009 global gross domestic product assumptions, which foresee no US economic growth in 2009.

IEA now expects world oil demand to average 86.5 million b/d in 2008, up 400,000 b/d from last year, and 87.2 million b/d in 2009.

Oil demand in the OECD will average 48.1 million b/d in 2008, down 2.2% vs. 2007, and 47.5 million b/d in 2009. Revisions to both North America and Pacific data were significant, IEA said, as rapidly weakening economic conditions, financial turmoil, and high prices should have a marked impact upon OECD demand, most notably in the US.

Meanwhile, oil demand outside the OECD is forecast to average 38.4 million b/d in 2008, up 4.2% from a year earlier, and 39.7 million b/d in 2009, or 40,000 b/d higher than projected in IEA’s previous monthly report. This minor upward revision is related to stronger-than-expected demand in almost all non-OECD regions. Overall, non-OECD demand growth should continue to offset the severe OECD demand contraction, IEA said.

Oil demand is forecast to post moderate growth next year in the former Soviet Union, China, Latin America, and the Middle East. IEA expects oil demand in other non-OECD Asian countries and Africa to increase as well during 2009.

Barclays forecasts 2009 E&P spending

Investment bank Barclays Capital on Oct. 14 released estimates for 2009 exploration and production spending and bases its findings on reduced oil and natural gas prices.

Barclays analysts James Crandell and James West in New York reduced their forecast for oil next year to $75/bbl from a previous forecast of $90/bbl. Their gas forecast now stands at $7/Mcf, down from $8.50/Mcf.

Based on these average price levels, they estimate that E&P spending in North America will drop 15% in 2009 vs. 2008 levels, while E&P spending elsewhere will increase 20% next year.

The new oil price forecast remains above threshold pricing for most international projects, both onshore and offshore.

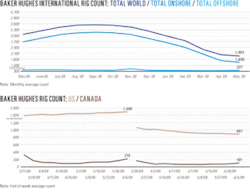

“We had previously expected spending to increase in North America during 2009; however, lower natural gas prices due to supply growth, announced budget cuts, pressure on cash flows, credit market issues, and concerns about demand growth have led us to revise our forecast,” the analysts said. Crandell and West estimate that a 15% decline in E&P spending in the US will lead to a drop in the rig count of about 400 rigs from today’s levels.

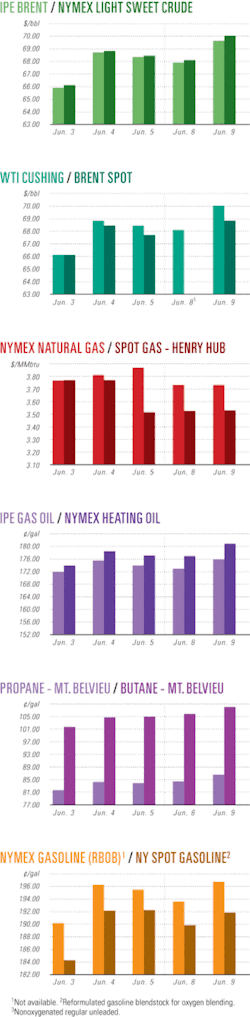

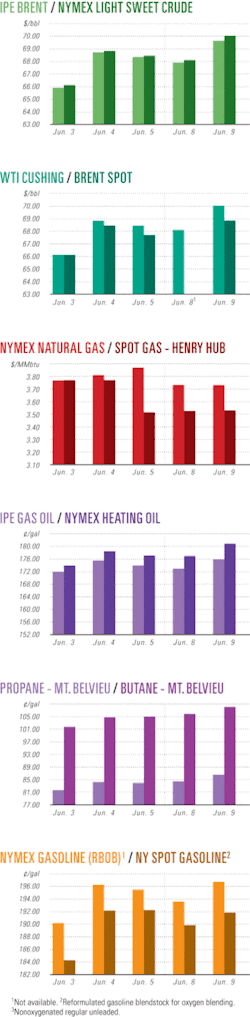

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesEni discovers oil off Angola

Eni SPA and Sonangol EP tested 22.5° gravity oil in its discovery on the western area of Block 15/06 off Angola, underscoring the potential of the acreage because it exceeded forecasted rates.

The Ngoma-1 well, 350-km from Luanda, reached a TVD of 3383 m. It was drilled in 1,421 m of water and struck an oil column of 127 m in high permeability Miocene sands.

Eni said the deepwater discovery could be synergized with other nearby structures following the drilling of exploration wells.

Eni secured the acreage in November 2006 after an intensive international bidding round. Eni operates Block 15/06 with a 35% interest and Sonangol EP is the concessionaire. Other partners are Sonangol Pesquisa e Produ¿ao SA 15%, SSI Fifteen Ltd. 20%, TEPA (Block15/06) Total 15%, Falcon Oil Holding Angola SA 5%, Petrobras International Braspetro BV 5%, and Statoil Angola Block 15/06 Award AS 5%.

BP lets development contract for In Salah fields

BP Exploration (El Djazair) Ltd. has let a front-end engineering and design contract to Foster Wheeler Ltd. for development of the southern fields of the In Salah project in Algeria.

The value of the contract was not disclosed.

Foster Wheeler’s contract underpins the second phase of the In Salah gas (ISG) development, which is the largest dry gas joint venture development in Algeria. It will update design; develop the technical data, specifications, and requisitions; and provide a detailed cost estimate for the engineering, procurement, and construction scope of work.

Under the second phase, gas output will be maintained at plateau levels when production from the three northern fields starts to drop. “It involves the development of the four fields to the south of the current development, Garet el Befinat, Hassi Moumene, In Salah and Gour Mahmoud, located near the town of In Salah in the Walia of Tamanrasset,” Foster Wheeler said (see map, OGJ, Dec. 4, 2000, p. 45).

ISG currently produces 9 billion cu m/year from three northern fields. Seven proved gas fields are under development in the southern Sahara, 1,200 km south of Algiers. ISG is also the world’s first full-scale carbon dioxide capture project at an onshore gas field.

The partners in the ISG venture are Sonatrach, BP, and StatoilHydro.

BP has Freedom deepwater find in Gulf of Mexico

BP America Inc. has discovered oil for the third time in the deepwater Gulf of Mexico and will appraise it to determine its size and commerciality.

The Freedom discovery, 70 miles southeast of Louisiana, is on Mississippi Canyon Block 948 in 6,100 ft of water. It follows BP finds in nearby Tubular Bells and Kodiak fields. The well reached 29,280 ft TD and encountered more than 550 net ft of hydrocarbon-bearing sands in Middle and Lower Miocene reservoirs.

“We believe that Freedom straddles Mississippi Canyon Block 948 (BP, operator) and Mississippi Canyon Block 992 (BHP, operator 32.25% and BP 67.75%),” said Andy Inglis, BP chief executive, E&P.

BP Exploration & Production Inc., a wholly owned subsidiary of BP America Inc., operates the exploration well on Block 948 with a 25% working interest. Its partners are Noble Energy Inc. with a 37.5% interest, Samson Offshore Co. 25%, and Marathon Oil Co. 12.5%.

Noble Energy and Samson Offshore acquired the lease at federal OCS Lease Sale 198 in March 2006.

BP makes oil find on Block 31 off Angola

BP Exploration (Angola) Ltd. has made an oil find with its Dione exploration well, which was drilled in the ultradeep waters of Block 31 off Angola.

The Dione well, which tested more than 5,000 b/d of oil under production conditions, lies on the southern portion of the block and is the sixteenth discovery to date for BP off Angola. The well lies 9 km southwest of the Juno-1 discovery, which tested at a mechanically restricted rate of 2,676 b/d of oil in 2005.

Dione reached 3,272 m TD and was drilled in 1,696 m of water about 390 km northwest of Luanda.

Block 31 covers 5,349 sq km and lies in 1,500-2,500 m of water.

Sonangol is the concessionaire of Block 31 with a 20% interest. BP operates the block with a 26.67% stake. Other partners are Esso Exploration & Production Angola (Block 31) Ltd. 25%, Statoil Angola AS 13.33%, Marathon International Petroleum Angola Block 31 Ltd. 10%, and Total SA unit TEPA (Block 31) Ltd. 5%.

Anadarko reports presalt discovery off Brazil

Anadarko Petroleum Corp. has reported a presalt discovery at the Wahoo prospect in the Campos basin off Brazil.

The 1-APL-1-ESS discovery well on Block BM-C-30 lies in 4,650 ft of water 25 miles southeast of and syncline separated from Petroleo Brasileiro SA’s (Petrobras) previously announced presalt discoveries at giant Jubarte field off Espirito Santo state.

Preliminary Wahoo results, based on wireline logs, indicate at least 195 ft of net pay with play characteristics similar to those of the nearby Jubarte 1-ESS-103A well. It is Brazil’s first producing presalt field having recently achieved reported initial rates of 18,000 b/d of light oil (OGJ Online, Sept. 2, 2008).

“Our first operated presalt test in Brazil is a resounding success as we’re seeing data that mirrors other very significant presalt discoveries in this prolific area,” said Bob Daniels, Anadarko senior vice-president of worldwide exploration. “It’s still early in the process, and we plan to continue drilling toward additional targeted objectives to a total depth of approximately 20,000 ft. The positive results so far provide encouragement and validate our decision to relocate the Transocean Deepwater Millennium drillship to Brazil to execute our ongoing presalt exploration program, which includes at least four additional wells in the deepwater Campos and Espirito Santo basins through the middle of next year.”

The Wahoo well is drilling at about 18,400 ft. To fulfill the work program, the partners have run a full suite of wireline logs, including porosity tools. The partners plan to conduct additional logging, including pressure and fluid sampling, once the well reaches total depth, with the potential to conduct a drillstem test at a later date.

After completing operations at Wahoo, Anadarko plans to move the Deepwater Millennium to the Serpa prospect, where it holds a 30% working interest, to reenter the BM-ES-24 well. The well initially encountered presalt hydrocarbon-bearing zones in secondary objectives but did not reach the primary objective because of rig limitations.

Anadarko, through a wholly owned subsidiary, holds a 30% working interest in and is operator of BM-C-30. Devon Energy Corp. holds 25%; EnCana Brasil Petroleo Ltd., a wholly owned subsidiary of Bharat PetroResources Ltd. and Videocon Industries, holds 25%; and SK do Brazil Ltda. holds the remaining 20%.

Oxy signs up for Jarn Yaphour, Ramhan fields

Occidental Petroleum Corp. has signed a preliminary agreement with Abu Dhabi National Oil Co. (ADNOC) to appraise and develop the Jarn Yaphour and Ramhan oil and gas fields in Abu Dhabi.

“The development of these two fields provides an exciting opportunity to create value for the people of Abu Dhabi and for our stockholders,” said Ray Irani, Oxy chairman and chief executive officer. Oxy will operate both fields and hold a 100% interest in the newly created concessions.

Development activities at Jarn Yaphour field, which lies onshore near the capital city of Abu Dhabi, will start immediately. First production from the field, which is expected in 2009, will see 10,000 boe/d of gross production from the initial development.

The Ramhan discovery, which lies in very shallow water near the Abu Dhabi refinery, was tested in 1992 and flowed at a combined rate of 1,750 b/d of oil and 14 MMcfd of gas from one well.

Appraisal activities will commence immediately and, if technically and commercially successful, first production from the Ramhan initial development could begin as early as 2011 in the range of 10,000 boe/d.

Oxy said its total capital investment in both development projects is expected to be $500 million over the next 3-4 years.

“In addition to the initial field developments, this investment will include further field appraisal activities to determine the full upside potential of each area,” Oxy said.

Nile Delta gas-condensate discovery gauged

Dana Gas, Sharjah, UAE, estimated that its Al Tawil-1 discovery in Egypt’s eastern Nile Delta has located 90 bcf of gas and 4 million bbl of condensate recoverable.

The discovery well, in the West Manzala onshore concession 15 km south of the company’s El Wastani gas processing plant, flowed 23.5 MMcfd and 1,027 b/d after encountering 34 m of net pay in the Miocene Qawasim formation. TD is 3,163 m measured depth.

The company plans to drill more exploratory wells in the West Manzala and West Qantara concessions in 2008-09 and is determining how to develop the discovery, the third in its $170 million 2008 drilling campaign.

Drilling & Production Quick TakesAPI: Third quarter US completions up 16%

US oil and gas drilling continued to outpace year-ago activity during the third quarter and is nearly twice the levels seen during the 1990s, the American Petroleum Institute said Oct. 10.

During the 3 months ended Sept. 30, an estimated 16,379 oil wells, natural gas wells, and dry holes were completed¿16% more than the comparable 2007 period, API said in its latest quarterly well completion report.

It said the estimates show that the resurgence in US oil well drilling that began in 2000 has continued during 2008. An estimated 6,244 oil wells were completed this past quarter, 34% more than in 2007’s third quarter and the highest third-quarter domestic oil activity estimate in more than 2 decades, API indicated.

Gas continued to be the primary domestic drilling target. An estimated 8,467 wells were completed during the third quarter, 6% more than in the same period a year earlier and more than double the number 10 years ago, it continued.

Estimated exploratory well completions increased 8% year-to-year, while the estimated number of development wells drilled climbed 17% year-to-year, largely because of a 36% surge in oil development wells from 2007’s third quarter, according to API.

Total estimated footage drilled during the most recent 3-month period grew 26% year-to-year to a third-quarter record of 107,631,000 ft as estimated oil well footage rose 40% year-to-year, the agency said.

StatoilHydro to install Marulk production system

StatoilHydro will select the concept and install the production system for Marulk gas-condensate field in the Norwegian Sea under an agreement signed with operator Eni Norge.

The field, which is estimated to hold 80-120 million boe, will be tied in to the Norne vessel, utilizing idle capacity.

Oivind Dahl-Stamnes, vice-president for StatoilHydro’s partner-operated fields said StatoilHydro would realize synergies from the agreement because it has worked on similar projects in the same area, which will help to reduce costs.

Marulk, appraised in January, is on PL 122 about 21 km southwest of Norne field at Haltenbanken. Exploration well 6507/2-4 was drilled in water 365 m deep and confirmed the extension of the discovery. The well reached a TD of 3,600 m.

Eni 20% and StatoilHydro 50% share Marulk along with Dong E&P Norge AS 30%.

Processing Quick TakesPetroperu again delays Talara refinery upgrade bid

Recent alleged irregularities at Peru’s state-owned Petroperu have led the company to further extend to Oct. 30 its deadline for bids on the front-end engineering design and the engineering, procurement, and construction of facilities to modernize its Talara refinery at Piura, 1,200 km north of the country’s capital Lima.

The delay, one of several in recent weeks, apparently stems from news of alleged irregularities in the country’s latest bidding round, which led to the resignation of Energy and Mines Minister Juan Valdiva, along with Petroperu head Cesar Gutierrez.

Their resignations came after Pres. Alan Garcia fired Petroperu board member Alberto Quimper Herrera, allegedly for participating in a kickback scheme with Discover Petroleum in the recent bids for oil exploration licenses.

In September Petroperu extended the bidding deadline to Oct. 15 from Oct. 3. Petroperu said it intended to present the contract on Oct. 29.

At the time, Gutierrez said the Talara modernization project was part of a wider effort to double Peru’s production. To do so, he said, Petroperu would have to modernize the Talara refinery at a cost of $1 billion and start production from the 12 blocks where petroleum exploration is taking place (OGJ Online, Sept. 16, 2008).

Modernization of the Talara refinery will include revamping existing units and adding facilities for desulfurization of diesel and gasoline, production of sulfuric acid, and electricity generation. According to the US Energy Administration, the capacity of the facility is to be increased to 90,000-100,000 b/d from 62,000 b/d.

PDVSA breaks ground on Santa Ines refinery

Venezuela’s state-owned Petroleos de Venezuela (PDVSA), aiming to process more of the country’s heavy oil at home, has begun construction of the 100,000-b/d Santa Ines refinery, located in the state of Barinas.

The refinery will help the country “achieve economic independence, financial independence as banks and stock markets in the US and Europe sink,” said Venezuelan president Hugo Chavez. “Latin America has finally begun assuming its course,” he said.

The complex, valued at some $1.2 billion, is being developed in two phases: the first is scheduled for completion in 2011 with an initial capacity of 30,000 b/d, while the second will be reached in 2014, bringing the plant to full capacity.

The facility will refine crude oil from Barinas and Apure states, as well as oil from the Orinoco heavy crude belt. It will produce regular and high-octane gasoline, LPG, diesel, kerosine, fuel oil, and asphalt.

Rafael Ramirez, who doubles as PDVSA president and Venezuelan energy minister, said the new refinery will refine mostly crude oil for the domestic market.

Santa Ines is one of four domestic refineries either under way or planned. The others include the 50,000-b/d Caripito refinery, a 200,000-b/d refinery in the state of Zulia, and a 400,000-b/d refinery at Cabruta.

In September, Chavez said his country and China plan to construct two refineries, one in each country. Chavez said the Venezuelan refinery will be built in the Orinoco basin (OGJ Online, Sept. 23, 2008).

FACTS: Asia ethylene capacity to rise 60% by 2015

The Asia-Pacific region is experiencing a massive expansion during which it will increase its ethylene production capacity to more than 64 million tonnes/year (tpy) from 40 million tpy by 2015, according to a report from FACTS Global Energy, Honolulu.

The report, “Asia’s Petrochemical Industry: Implications for Future Naphtha Demand,” said a wave of additions will take place during 2009-11, with strong peaks in first-quarter and fourth-quarter 2009.

Most of the new capacity will be added in China. The second-largest global producer of ethylene, China will add 14 million tpy by 2015 to its existing 10 million tpy of production capacity. “Firm and likely additions” will occur mainly in 2009 (4.95 million tpy) and 2011 (3.8 million tpy), according to the report.

China will increase its naphtha consumption from to about 825,000 by 2010 and more than 1.1 million b/d in 2015 from 600,000 b/d in 2007.Because most of the new ethylene production capacity is based on naphtha feedstocks, its consumption also will increase greatly. China will become the largest naphtha consumer in Asia by 2011, according to the report.

Transportation Quick TakesKMEP completes ethanol test, begins biodiesel

Kinder Morgan Energy Partners LP has successfully completed tests to determine the commercial viability of moving batched denatured ethanol between Tampa and Orlando in the 195-mile, 16-in. gasoline line on its Central Florida Pipeline (CFP) system.

It is finalizing mechanical modifications to the pipeline to offer ethanol transportation services to its customers by mid-November and is evaluating batched ethanol transport possibilities for other parts of its pipeline system.

The company says the short length of the pipeline will limit transmix.

CFP has segregated storage for the ethanol at the Orlando end of the pipeline. Total storage capacity is 546,000 bbl, contained in 28 tanks of 8,190 gal¿80,000 bbl each. Land is available for expansion (OGJ Online, Apr. 9, 2008).

Kinder Morgan has completed more than $60 million in ethanol projects including modifications to tanks, truck racks, and related infrastructure for new or expanded ethanol service in the Southeast US and Pacific Northwest and has approved an additional $27 million for ethanol projects in the Southeast.

The company is also undertaking tests to assess commercial transportation of biodiesel through its pipelines, running blended B-5 biodiesel through a segment of its Plantation Pipe Line system between Collins, Miss., and Spartanburg, SC. The company expects test results by the end of October. It also is evaluating transporting biodiesel on its Portland-Eugene, Ore., line to support Oregon’s forthcoming biodiesel mandate.

Appalachian gas projects starting up

East Tennessee Natural Gas plans to have added 95 MMcfd of contracted long-term, firm capacity on its pipeline system in the Central Appalachian basin by yearend.

Spectra Energy Partners LP, Houston, said its ETNG affiliate has placed the Glade Spring project into service in southwestern Virginia. With the improvements to the Glade Spring compressor station and related facilities, contracts associated with the project took effect on Oct. 1. Glade Spring is just south of ETNG’s Saltville gas storage field.

The CNX and Greenway/Nora projects, also in southwestern Virginia, are expected to be available for service on Nov. 1 and Dec. 1, respectively.

Transportation services under the three contracts are slated to increase to 134 MMcfd in 2010.