US may become net gasoline exporter by 2010, study says

Shifts in energy demand and biofuels capacity will disrupt the global refining industry, potentially turning the US into a net exporter of gasoline by 2010.

An analysis by Booz & Co. entitled “Refining Trends: The Golden Age or the Eye of the Storm? Part IV: Tough Choices” examines the effect of rising gasoline and diesel demand in Asia and other countries, biofuel mandates, and alternative fuel vehicles on the global refining industry.

These factors create opposing forces on worldwide refiners. The study says that, in the short term (2008-13), overall margin levels have already topped out and will move lower. In addition, a recession could accelerate the downward trend in margins. Finally, trade flows could shift margins to Asia.

In the long term, through 2025, the study says that global demand for transportation fuels will continue to grow, despite the emergence of alternative-fuel vehicle technologies, due primarily to increasing economic growth in Asia.

Long-term margin levels will depend on economic growth in developing economies. This is a shift from refining margin cycles of the recent past, which were solely a factor of how fast refining capacity was added.

In addition, regulations on dieselization, high-efficiency vehicles, and biofuels will influence refining margins.

Short-term demand

Despite sustained high prices, demand for transportation fuels has continued to grow due to worldwide economic growth, according to the study. Fig. 1 shows that US demand, however, has started to decrease. High gasoline prices and economic fears prompted US consumers to use less gasoline in the first 9 months of 2008.

The study’s analysis shows that gasoline consumption is correlated highly with consumers’ personal disposable income (PDI), which varies due to economic growth and inflation. Increases in PDI raise gasoline consumption overall and reduce individual sensitivity to price changes.

In the last 3 decades, while gasoline spending as a percentage of PDI has dropped, the absolute price elasticity of gasoline in the US has decreased by an order of magnitude. This fact, until recently, dampened the effect on demand of historically high real gasoline prices in the US, according to the study.

In terms of demand, the short-term effect of alternative fuel technologies will be limited because it takes so long to replace the vehicle fleet.

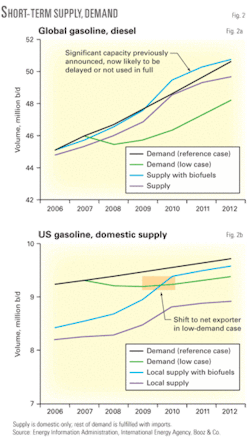

Short-term supply

Refining capacity 2003-07 increased by about 3-4 million b/d of distillation capacity, and more than 9 million b/d in capacity via other processes. The pace of construction has accelerated significantly—capacity of crude distillation and other processes under construction more than doubled to 3.0 million b/d in spring 2008 from 1.2 million b/d in spring 2007.

The study says that distillation capacity will increase about 6 million b/d during 2008-12, based on capacity announcements and the likelihood of completion.

New aggressive biofuels mandates enacted in the 2008 US energy bill represent an increase of 600,000-700,000 b/d of biofuels demand by 2012. This is equivalent to as much as 7% of the total US transportation fuel demand in 2012, and more than the total gasoline demand growth during 2007-12, the study says.

The overall percentage of biofuels in the gasoline pool by 2012 will be slightly more than 10%, implying that only a small penetration of E85 vehicles into the vehicle fleet will be required.

The study says that all these recent events have changed an imminent, although modest, global supply crunch into an oversupply. In addition, the US may become a net exporter of gasoline by 2010. This is particularly likely if an economic slowdown or recession further lowers demand (Fig. 2).

Such a shift would change global supply and demand balances, Europe will need to import more diesel, and Asia will continue to demand fuels in general. More gasoline from Europe and possibly from the US will flow to Asia.

Europe, exporting longer distances to Asia, will have lower gasoline netbacks relative to exporting to the US. For the US, this change could mean gasoline would be priced at export parity rather than import parity, reducing gasoline crack spreads by $4-6/bbl, according to the study.

Lower relative gasoline prices would, for the same crude price, reduce the differential between light and heavy products, thereby reducing refining margins. Refiners will have three choices: ship gasoline, shift operating modes to produce more diesel, or reduce runs.

The study says that, in the short term, the refining industry in the US and EU could experience a shake-up, even if the industry continues to do well in Asia.

Long-term demand

Many economic and political factors could influence long-term demand, the study says. Small changes in economic growth in emerging markets would significantly change demand—an additional 1%/year growth in GDP in Brazil, Russia, India, and China (BRIC countries) would add 3 million b/d of demand for gasoline and diesel by 2025.

The adoption of ultracheap vehicles, such as Tata’s $2,500 car, would increase fuel demand.

A different scenario would have the opposite effect. Entirely new auto technologies such as plug-in hybrids may decrease demand for ground transportation fuels. It, however, takes about 15-20 years to replace the vehicle fleet, significantly delaying the effect of new technologies.

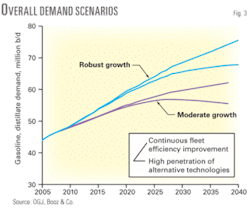

The study evaluates four demand scenarios (see table):

- Robust economic growth with continuous fleet efficiency improvements.

- Robust economic growth with high penetration of alternative vehicle technologies.

- Moderate economic growth with continuous fleet efficiency improvements.

- Moderate economic growth with high penetration of alternative vehicle technologies.

The study leaves biofuels out of the demand scenarios and considered them as part of supply.

The likelihood of a given demand scenario depends on future fuel prices. High prices would deter global economic growth while favoring a high penetration of alternative technologies. Low prices favor global economic growth and reduces the attractiveness of alternative vehicles.

Limited availability of crude feedstocks will support high prices.

The study’s demand forecast (Fig. 3) highlights the emergence of two centers of demand moving in opposite directions. One demand center consists of developed economies where demand growth is slow and will eventually turn negative as new technologies become entrenched. The other center consists of developing economies, particularly in Asia, that will increase demand growth even after new technologies become available.

Demand will peak much earlier in developed economies. This is particularly true for US gasoline consumption, which will likely peak in the next 15-20 years, according to the study. Diesel demand will continue to grow for another decade after that.

The dieselization trend is global—the worldwide gasoline:diesel demand ratio will move to 45:55 in 2030 from 50:50 in 2007.

Long-term supply

Increased scrutiny on biofuels and concerns about adverse effects on food prices could slow biofuels’ penetration into fuel markets, substantially limiting their adoption. The study assumes that EU and US will meet their biofuel mandates.

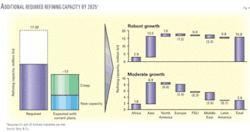

For the study’s scenario of moderate economic growth, the world will need 3 million b/d of distillation capacity by 2025 beyond what is already announced (Fig. 4). If the global economy experiences strong growth, 16 million b/d of additional distillation capacity will be needed.

There is a significant regional imbalance, however, in two areas. The Middle East is adding more capacity than is required for local demand. Conversely, Asia is adding insufficient capacity for local demand due to the sheer volume of expected demand growth.

The study says that two factors are influencing the refining industry—the speed at which capacity (biofuels and refining) is added and the cycles of economic growth in developing economies. These trends are different from past cycles, which varied due to the overbuilding of refining capacity against a backdrop of consistent and predictable demand growth.

Industry implications

The study says that the global refining industry will experience a “severe dislocation” due to changing regional supply-demand balances, which will change global trading flows and, therefore, refining margins. The entire industry depends on demand growth in Asia.

Although the outlook for global demand is positive for the next 20 years, the study says, refining margins could drop and never recover due to demand destruction and alternative supplies.

Refiners must consider:

- Canceling or delaying investments in expansion projects in developed economies.

- Expanding into Asia.

- Adjusting refinery configuration to favor diesel or to gain more operational flexibility.

- Finding a material way to participate in biofuels.

- Improving operational performance to maximize the value of existing assets.

The study advises refiners to cancel or delay investments in capacity additions in developed economies; at least until the biofuel supply situation becomes clearer. In these countries, only investments related to improving the competitive advantage of specific refineries is advisable.

There may be opportunities for consolidation in mature economies, the study says. Some refiners may wish to preserve some cash for consolidations if the industry hits bottom again. US refiners must consider this if the market forces margins down and presents acquisition opportunities.

Conversely, the study says, Asia and emerging economies will increase demand for transportation fuels; refiners will need to establish a firm presence in these regions to increase the likelihood of solid returns. Currently, local refiners are capturing most opportunities in Asia to the degree that local price regimes allow.

In addition, regardless of geography, when refiners invest in capacity, they should favor diesel instead of gasoline production. Refiners should aim for increasing operational flexibility, the study says.

Refiners must also consider expanding their energy portfolios to include biofuels; several of the skills required to succeed in biofuels, such as process engineering, transportation, optimization, and marketing, are core competencies of refiners.