OGJ Newsletter

Senate rejects oil shale moratorium

The US Senate on Sept. 26 defeated by 52 to 42 votes an economic stimulus bill containing a provision to extend a moratorium on federal oil shale leasing. The measure fell 8 votes short of the 60 votes necessary for passage.

Republicans were pleased with the outcome. “This Democrat-controlled ‘do nothing and drill nothing’ Congress is out of touch with the people that put them in office,” said Sen. Wayne Allard (Colo.), who is retiring in January. “Earlier this week, we saw the largest single-day jump in oil prices in history. How do Democrats in Congress react? They attempt to extend the ill-conceived Udall moratorium on oil shale regulations. This places over 800 billion bbl of potentially recoverable oil out of reach; that’s an energy source larger than the proven reserves of Saudi Arabia,” Allard said.

Rep. Mark Udall (D-Colo.), who is running to succeed Allard, and two other Democrats on Colorado’s congressional delegation, Sen. Ken Salazar and Rep. John Salazar, said on Sept. 24 that they would try to reinstate the moratorium when Congress comes back to work.

“The Democrat-controlled Congress is completely ignoring the needs of our nation,” Allard maintained. “This is not only unfortunate but also insulting to the American people who are struggling to pay these high fuel prices. This attempt is a clear sign that they would rather help the economy of foreign oil producers. Had this misguided moratorium continued, it would have helped [Venezuelan President] Hugo Chavez stimulate his economy more than our own.”

Statoil teams with schools in heavy oil research

StatoilHydro has partnered with universities in Canada and Norway to examine ways to improve recovery of heavy oil and oil sands in an environmentally friendly way.

The group will support PhD students at Canada’s University of Calgary, University of Alberta, and Vancouver Island University, and at the Norwegian University of Science and Technology (NTNU) in Trondheim.

The Canadian universities have broad research experience with heavy oil, and their projects will complement StatoilHydro’s research activities.

High oil prices have made development of heavy oil and oil sands projects economically feasible. NTNU rector Torbjorn Digernes said heavy oil would be important in future global energy scenarios, but these posed serious challenges. Cooperation with StatoilHydro would be important in identifying solutions.

The universities will collaborate with NTNU in their respective areas of the value chain for heavy oil production, with the University of Calgary specializing in recovery methods.

The University of Alberta focuses on emulsion stabilization mechanisms for such oils, while Vancouver Island University deals with environmental monitoring of their production.

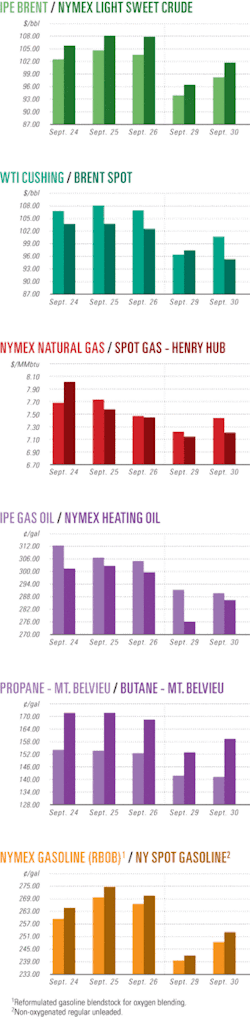

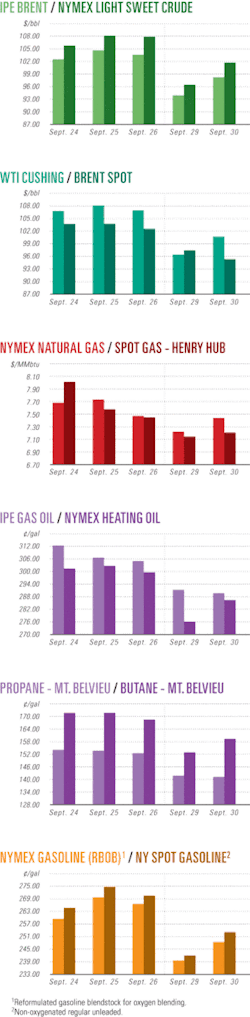

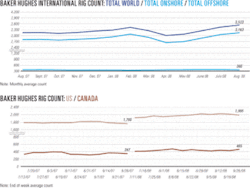

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesVerenex finds more oil in Libya’s Ghadames basin

Libya’s state-owned National Oil Co. said Verenex Energy Inc. has made a seventh oil discovery on production-sharing contract Area 47 in Libya’s Ghadames basin.

The discovery, in the Lower Acacus and Memouniat formations, is Verenex’s second on Block 4 in the northern part of Area 47 and is the eighth consecutive oil and gas discovery since drilling began in September 2006.

Exploration well C1-47/04, about 150 km southwest of Tripoli, was drilled and cased to a depth of 10,155 ft in the Memouniat Formation. The operator carried out extended flow tests on the well from 48 ft of perforations in two sandstone intervals. They included a 28-ft interval in the Memouniat Formation, starting at 9,962 ft, which flowed 900 b/d of 56¿ gravity oil and 4.2 MMcfd of gas and a 20-ft interval in the Lower Acacus formation, starting at 7,819 ft, which flowed 150 b/d of 55¿ gravity oil and 4.5 MMcfd of gas, all through a 32/64 in. choke.

The tests yielded a combined maximum measured flow rate—restricted by test equipment capability—of 1,350 b/d (gross) of oil and 10.3 MMcfd (gross) of gas through 32/64-56/64 in. chokes, Verenex said.

C1-47/04 (well No. 13) lies 14 km northwest of Verenex’s nearest oil and gas discovery at A1-47/04 on Block 4.

According to Verenex, eight new field wildcat exploration wells and two appraisal wells in the area have tested at a maximum aggregate rate of 93,800 b/d and have been suspended as potential future oil and gas production wells.

The latest find is the seventh in Area 47, in which Verenex and partner PT Medco Energi Internasional share a 13.7% interest. NOC holds the remaining 86.3%.

Inpex chooses Darwin, 850 km line for Ichthys

Japanese company Inpex Australia and joint venture partner Total of France have shunned Western Australia and selected Blaydin Point at Darwin’s Middle Arm Peninsula in the Northern Territory as the landfall for development of their Ichthys gas-condensate field in the Browse basin off northwest Western Australia.

Inpex, as operator of the project proposal, believes Northern Territory’s friendlier business environment, gas-ready location, significant in-place infrastructure, lack of domestic gas reservation policy, and closer proximity to the Asian markets will offset the costs of the 850 km undersea pipeline that will be needed to deliver the gas from the field to Darwin.

Inpex Pres. Naoki Kuroda said Sept. 26 that Darwin provided the certainty required for the project’s tight schedule to enable first LNG to come on stream in late 2014 or early 2015.

He added that environmental, economic, and engineering studies demonstrate the viability of Blaydin Point as the best location for the LNG plant. Front-end engineering and design is expected to follow shortly to enable a final investment decision by yearend 2009 or early 2010.

Ichthys field in permit WA-285-P holds an estimated 12.8 tcf of gas plus 527 million bbl of recoverable condensate.

Initial plans calls for a $20 billion (Aus.), two-train project producing more than 8 million tonnes/year of LNG, 1.6 million tonnes/year of LPG, and more than 100,000 b/d of condensate.

The project will inject about $50 billion into the Northern Territory economy over the next 20 years, beginning with site work in 2010. Inpex’s original plan was to pipe gas a much shorter distance to the Maret Islands off Western Australia’s Kimberley coast. Gas was scheduled to come on stream in 2012, but ongoing delays in Western Australian bureaucracy caused the date to slip into 2013-14.

Western Australia’s approvals process, including restrictive environmental controls, has been blamed for the delays. In addition, the WA government-federal government-backed plan to select a single Kimberley hub for all Browse basin projects has added to the uncertainties.

In contrast, Northern Territory stepped in earlier this year, ensuring Inpex that it had port access and land on which to build, and that environmental and planning approvals would be streamlined.

Inpex and Total also found gas at the Mimia-1 wildcat in nearby Browse permit WA-344-P earlier this year and that production likely will be added to the Ichthys system.

Interest now will turn to the likely landfall of Woodside Petroleum group’s Browse gas project, still in its planning stage. Inpex’s withdrawal from contention throws the question of a Kimberley hub open to conjecture.

Woodside now may take the view that its best bet also will be a pipeline extending more than 800 km from its Torosa-Brecknock-Calliance fields in the Scott Reef area direct to the Burrup Peninsula in the Pilbara area, where it is building the Pluto LNG plant. It is in need of more gas supplies to enable construction of a second and perhaps third LNG train. This would make the Kimberley hub unnecessary and obviate the need for Woodside to go through the lengthy approvals process.

Drilling & Production Quick TakesMexican production continues downward spiral

Mexico’s state-owned Petroleos Mexicanos said that during January-August 2008 its production of crude oil fell to 2.83 million b/d or 9.7% while exports dropped 16% compared with the same period in 2007.

Natural gas production, however, was 6.776 bcfd, up 14% over the first 8 months of 2007. In August alone, natural-gas production rose slightly to 6.968 bcfd, up from 6.902 bcfd in July and 5.942 bcfd in August 2007.

The decline in the country’s production of crude oil was led by its largest field, Cantarell, which dropped 29.2% to 1.11 million b/d, while output at the second-largest field, Ku-Maloob-Zaap fell 39% to 688,800 b/d.

For August alone, Mexico’s crude oil production slid to 2.76 million b/d due to the decline in overall production and to temporary production glitches.

August production was down from 2.78 million b/d in July and 2.84 million b/d in August 2007, Pemex said. Production figures for August were the lowest monthly numbers since November 1995.

Mexico exported some 1.44 million b/d of crude during the January-August 2008 period, down from 1.71 million b/d sold in the same period last year. However, due to soaring oil prices, Pemex earned $34.38 billion from exports, or about 51.4% more than in 2007.

August exports stood at 1.42 million b/d, up slightly from July, but down from 1.63 million b/d in August 2007.

Mexico President Felipe Calderon has proposed giving Pemex broad financial and managerial autonomy and exempting the state-owned firm from some government rules on procurement and outsourcing.

While Calderon insists he has no intention of privatizing Pemex, some contend the bonuses the company would be permitted to offer private contractors represented a disguised form of profit-sharing aimed at opening the door to privatization.

The administration is focusing on the search for deepwater oil in the Gulf of Mexico near areas where the US and Cuba are already exploring.

The government recently presented an analysis which concluded that the decline in production at Cantarell, Mexico’s largest oil field and located in the Sound of Campeche, was costing Pemex $10 billion/year.

The study said production at Mexico’s main oil fields would fall by 800,000 b/d by 2012, with the drop in output reaching 1.5 million b/d by 2018.

California OKs Occidental Long Beach drilling

California Governor Arnold Schwarzenegger has signed legislation enabling oil exploration and drilling in Wilmington oil field in Long Beach.

Under Bill 2165, California’s State Lands Commission can negotiate a contract with the city and Occidental Petroleum Corp. to explore and develop the western end of Wilmington field, which includes tidelands mineral deposits.

In the past, California shouldered most costs for previous oil efforts in the tidelands deposits, but Occidental offered to take on that role in exchange for a larger share of the potential revenues—an offer that required the new legislation.

Occidental spokesman Richard Kline said the Los Angeles-based firm needs a new contract with more financial incentives to make the Wilmington deal worthwhile. The current agreement gives 95% of revenue to the state and 5% to Occidental—too little to allow the firm to recover its investment.

Altogether, Occidental is expected to invest more than $200 million to increase production by injecting water, carbon dioxide, or other material into some of the field’s estimated 500-700 existing wells. Occidental would also drill as many as 200 new wells, Kline said.

Bill 2165 does not allow for offshore drilling or expansion of the existing drilling area. According to officials, Occidental would use directional drilling techniques to reach beneath the port’s tidelands, increasing output by as much as 63%.

Long Beach city analysts say that under the agreement with Occidental, reserves could rise by 22 million bbl from the current 35 million bbl in the West Wilmington unit, where the new drilling is planned.

Any drilling also must comply with existing regulations of the South Coast Air Quality Management District, as well as the California Environmental Quality Act.

Wilmington, which produces about 8,500 b/d, is California’s sixth largest oil field. It has produced more than 2.5 billion bbl since 1932, when General Petroleum, an antecedent of ExxonMobil Corp., drilled the first well.

Last year, it was reported that the central area of Wilmington field is in the midst of a redevelopment project over the next few years, with Los Angeles city authorities approving the drilling of as many as 540 directional oil and water injection wells from central facilities (OGJ Online, Feb. 19, 2007).

Indonesia approves storage facility for Cepu

Indonesia’s upstream oil and gas regulator BPMigas, rejecting earlier criticism voiced in testimony before the country’s parliament, has approved the construction of a floating oil storage facility for the Cepu oil and gas block.

“The study shows the floating storage facility is more feasible economically [than land storage],” said BPMIgas head R. Priyono, who added that the floating facility would be easier to implement as it did not require the sometimes costly and time-consuming process of acquiring land.

Earlier in September, the Indonesian parliament heard a report that a floating offshore storage project jointly planned by ExxonMobil Corp. and state-owned PT Pertamina EP might incur up to $1.2 billion in state losses (OGJ Online, Sept. 12, 2008).

The report attracted the attention of members of parliament—who currently are eyeing illegal expense claims—as it came from Hestu Subagyo, a former director of PT Pertamina EP.

Hestu claimed that the decision to build a floating storage facility was made solely by ExxonMobil, without any involvement on the part of Pertamina EP, which he said rejected the idea from the start.

According to Hestu, Pertamina had instead proposed renting land storage, which would be far cheaper than constructing the floating storage facility.

But Priyono rejected Hestu’s testimony, noting that the project feasibility study was made jointly by ExxonMobil and Pertamina.

“It’s impossible that BPMigas would approve the project without Pertamina’s participation,” said Priyono, who noted that, “Hestu also signed the report.”

BPMigas approved the proposal for a floating storage facility with a capacity of 2 million bbl in May 2007. A tender currently is underway for procurement of the facility.

Earlier this week, Pertamina announced plans to invest some $500 million of company funds in the Cepu Block, which it shares 50:50 with ExxonMobil (OGJ Online Sept. 23, 2008). The Cepu Block is estimated to hold some 600 million bbl of oil along with 1.7 tcf of natural gas.

Processing Quick TakesUOP to upgrade Abu Dhabi refinery

Abu Dhabi Oil Refining Co. (Takreer) selected UOP LLC, a Honeywell International company based in Des Plaines, Ill., to supply technology and engineering services for upgrading its 120,000 b/d Ruwais refinery 240 km west of Abu Dhabi City in the UAE.

The value of the project was not revealed.

The refinery will produce propylene, unleaded gasoline, naphtha, liquefied petroleum gas, aviation turbine fuel, kerosine, gas-oil, bunker fuel, and other hydrocarbon derivatives. Basic engineering design is under way and is expected to be completed in 2014.

The facility will utilize a wide range of UOP technologies for the production of low-sulfur distillate and gasoline, including its Unicracking and Unionfining processes to upgrade heavy feedstocks and produce ultralow-sulfur diesel and its Merox process to remove sulfur from saturated LPG streams. In addition, the company’s BenSat process will manage the benzene content in the gasoline pool.

The refinery includes a hydrotreating unit that will use UOP’s naphtha hydrotreating process and a distillate Unionfining unit to produce low-sulfur kerosine. The unit is the largest kerosine-fed hydrotreating unit licensed by UOP.

Synthesis licenses ExxonMobil’s technology

Synthesis Energy Systems (SES), Houston, signed a technology licensing agreement with ExxonMobil Research & Engineering Co. (EMRE) that provides SES the option to execute up to 15 methanol-to-gasoline (MTG) licenses.

SES assigned the first license to a 7,000 b/cd unit at its U-Gas coal gasification project under development near Benwood, W. Va., where Consol Energy Inc. has a coal mine. SES and Consol are negotiating a joint venture agreement.

ExonMobil’s MTG technology converts crude methanol directly to low-sulfur, low-benezene gasoline that can be sold directly or blended with conventional gasoline.

Although MTG technology originally processed methanol from natural gas, it can be used for methanol from coal, petcoke, or biomass.

The SES projects will gasify the coal, convert the synthetic gas to methanol, and convert the methanol to gasoline via the MTG process. Conversion of coal to gasoline through gasification and methanol conversion is one way to reduce potential pollutants from coal.

SES is investigating development of coal-based gasification facilities to replace domestic production of various industrial chemicals that has been shut down because of the high cost of natural gas.

Petrobras lets refinery contract to Skanska

Petroleo Brasileiro SA (Petrobras) awarded a $125 million contract to Skanska AB, Sweden, to build a sulfur recovery unit (SRU) and a tail gas treatment unit (TGTU) at its 47,000 b/d Capuava refinery in Sao Paulo, Brazil.

Under the project, which is part of a nationwide environmental program to reduce sulfur contaminants in petroleum byproducts, the SRU facility will have a capacity to recover 20 tonnes/day of sulfur, while the TGTU will clean 40 tonnes/day of tail gas.

The scope of the contract includes detailed engineering, purchasing, construction, electromechanical installations, and assistance with commissioning and start-up of the plant.

Work will begin in October, and is scheduled for completion within 24 months. The total contract value is $125 million, with Skanska’s share 40% or $50 million. Skanska’s partner in the consortium is Brazilian engineering firm Promon.

Transportation Quick TakesPemex lets subsea pipeline to Global Industries

Mexicanos (Pemex) awarded Global Industries Ltd., Carlyss, La., a $75 million project to lay 12 km of 24-in. OD pipe under 150 ft of water in Ixtal field in the Bay of Campeche.

Work is to begin in October and is scheduled to be completed in January. Global’s Shawnee construction vessel will perform the bulk of the work, with additional support vessels assisting.

The project also includes several pipeline crossings, risers, and expansion curves.

Fayetteville pipeline JV formed

Kinder Morgan Energy Partners LP (KMP) and Energy Transfer Partners LP (ETP) announced a 50:50 joint venture, Fayetteville Express Pipeline LLC, to build a 187-mile, 2-bcfd pipeline intended to increase takeaway capacity from the Fayetteville shale.

The pipeline will start in Conway County, Ark., continue eastward through White County, Ark., and terminate at an interconnection with Trunkline Gas Co., in Quitman County, Miss. Kinder Morgan and ETP expect the $1.3 billion pipeline to be in service by late 2010 or early 2011.

Fayetteville Express has secured binding 10-year commitments totaling 1.575 bcfd, including 1.2 bcfd from Southwestern Energy Services and 375 MMcfd—with an option for an additional 125 MMcfd—from Chesapeake Energy Marketing Inc.

Chesapeake’s parent, Chesapeake Energy Corp., reached agreement with BP America in September to establish a JV in the Fayetteville shale to produce 180 MMcfd (OGJ, Sept. 8, 2008, p. 29).

France to increase gas transportation tariffs

France’s Energy Regulatory Commission (CRE) reported that it will enable increases in usage tariffs on France’s gas transport network in order to provide “better visibility” to market players, encourage relevant investments, and induce natural gas transporters to improve service quality and better control their costs.

On Jan. 1, 2009, GRTgaz, the transport affiliate of GdF Suez will benefit from an average 6% tariff increase over a 4-year period, while Total’s transport affiliate Total Infrastructure Gaz France (TIGF) will benefit from a 10% average tariff hike on the same date.

With the new tariffs, a large balancing zone will be created covering half of northern France through the merger of the North, East, and West zones. CRE indicated that this will provide greater competition among the various gas sources: Norwegian gas, North European sources, LNG, and Russian gas. The merger was made possible through reinforcement of the network developed by GRTgaz. (OGJ Online, July 3, 2008).

In the South of France, notes CRE, investments TIGF and GRTgaz make on Artere de Guyenne will eliminate congestion where their networks meet.

CRE warned that important investments will be needed in the next few years to reduce congestion between northern and southern France and to ease access for new market entrants.

Interconnections between Belgium and Spain also are needed to satisfy markets and bolster supply security, while new methane terminal projects and gas-generated power units will require reinforcement of the transportation networks.

CORRECTIONS

In the Sept. 15 special report, OGJ200, Cano Petroleum Inc. should have been ranked No. 36 in US liquid reserves, with 42.330 million bbl. Berry Petroleum Co. would have made the top 20 in US liquid reserves, coming in at No. 20 with 116.6 million bbl.

In the Sept. 22 article revealing PDVSA’s criticism of Orimulsion, quotation marks were incorrectly placed, making it appear that an aside remark was the author’s. It should have read:

1. Making bitumen fluid would subject the Orinoco Belt to OPEC quotas. Bernard Mommer charged: “PDVSA looked for other ways to manipulate the definition of crude oil subject to OPEC quotas: Increasing production of the extra heavy (heavier than water) crude of the Orinoco Belt—the largest reserves of its kind in the world—the company argued that Orinoco deposits, which are processed into a product called ‘Orimulsion,’ did not fall under the definition of crude oil. (This assertion is technically correct, as the deposits do not constitute a liquid at normal temperatures.) Therefore, PDVSA argued, the Orinoco Belt should be classified as ‘bitumen’ and, hence, not be subjected to OPEC quotas,” he wrote.2 .

2. Orimulsion would always be indexed to coal.