OGJ Newsletter

Chavez shakes up PDVSA executive suite

In a move that could have implications for Venezuelan oil production, President Hugo Chavez, continues to tweak the leadership alignment within the country’s oil and gas industry and in its national oil company, Petroleos de Venezuela SA (PDVSA). He has made several recent executive appointments and approved six new members to the PDVSA board of directors.

Chavez retained oil minister Rafael Ramirez as president of PDVSA. Other members of the board are Ivan Orellana, who recently became oil vice-minister; Asdrubal Chavez, refining, trade, and supply vice-president; and Eulogio del Pino, PDVSA’s exploration and production vice-president.

Ramirez, in turn, removed from the board the former head of PDVSA’s production and exploration unit Luis Vierma; along with Dester Rodriguez, Jesus Villanueva, Carlos Martinez, and Bernard Mommer.

He also swore in six new members: Hercilio Rivas, recent president of PDVSA’s research unit Intevep; Carlos Vallejo, previous president of PDVSA’s natural gas unit; Ricardo Coronado, second in command for exploration and production in western Venezuela; Luis Pulido, head of PDVSA’s oil services unit; Faddi Kabboul, who has worked in the Venezuelan embassy in Washington, DC, on oil-related issues; and Aref Richany Jimenez, an army general who headed the state armament company.

While the changes are said to indicate Chavez’s desire to keep his most trusted allies at the top of PDVSA, especially when production needs to be boosted, those removed from the board are not necessarily out of favor.

To the contrary, Chavez last month appointed former oil vice-minister Mommer as the country’s new governor at the Organization of Petroleum Exporting Countries (OPEC). Mommer, a Marxist mathematician, is considered a key architect of Chavez’s oil policy. He served as consultant to Ali Rodriguez during his tenure as OPEC secretary-general and initiated such policy changes as having the company take majority stakes in most oil projects and raising taxes and royalty payments.

Chavez’s changes in the PDVSA board follow a restructuring of the state firm made in early August (OGJ Online, Aug. 7, 2008). At the time, reports said that the changes gave PDVSA the responsibility of “participating in ventures intended for the sustained, organic, and integral development of the country, including agricultural, industrial activities.”

Militants attack Nigerian oil, gas installations

Royal Dutch Shell PLC has suffered an explosive attack on its Alakiri flow station, gas plant, and field logistics base southwest of Port Harcourt by a militant group that has warned it will burn them to the ground.

The Movement for the Emancipation of the Niger Delta (MEND) has pledged to continue the offensive until the Nigerian government enters into dialogue to deal with the volatile situation in the Niger Delta.

It has dubbed the campaign “Operation Hurricane Barbarossa” as the first stage of an “oil war” of sabotage on oil and gas installations. According to Nigerian reports, 115,000 b/d of oil production has been shut in over the past 4 days.

Shell said one security guard was killed and four people wounded during the attack. “A section of the Greater Port Harcourt Swamp Line at Bakana, Rivers State, was attacked,” Shell said. The link is part of the Bonny Light crude system.

Chevron Corp. said there also was shooting around its Idama flow station.

Oil companies in the area have evacuated staff from the area, according to Nigerian reports, while security has tightened.

MEND claimed it is holding 27 oil workers who were kidnapped in the Delta after their oil supply vessel was hijacked last week.

Nigerian President Umaru Yar’Adua has created a new Ministry of Niger Delta, which will focus on development and peace in the area. It will have two ministers to create environmental and youth empowerment policy initiatives. The government has said there would not be any duplication between the new ministry and the Niger Delta Development Commission.

Nigeria has shut in about a quarter of its production following the sabotages, making Angola now the leading oil producer in Africa.

EPA waives Texas-specific diesel requirement

The US Environmental Protection Agency temporarily waived certain diesel fuel requirements that apply only in the state of Texas following fuel supply disruptions caused by Hurricanes Gustav and Ike.

Responding to a state request, EPA will allow the suspension of the Texas Low Emission Diesel (TxLED) requirements until Sept. 30, but federal regulations for ultralow-sulfur diesel fuel having maximum sulfur content of 15 ppm still must be met.

The Texas Commission on Environmental Quality said the goal of the TxLED rule is to lower emissions of NOx and other pollutants from diesel motor vehicles and nonroad equipment. TxLED is part of the Texas federally approved State Implementation Plan that was implemented in 2005.

The rule covers 110 counties in the eastern half of Texas, including the ozone nonattainment areas of Beaumont-Port Arthur, Dallas-Fort Worth, and Houston-Galveston-Brazoria.

EPA Administrator Stephen L. Johnson said extreme and unusual supply circumstances exist that are likely to result in a shortage of diesel compliant with TxLED requirements.

In coordination with the US Department of Energy, EPA granted the waiver to allow greater flexibility for fuel distribution systems.

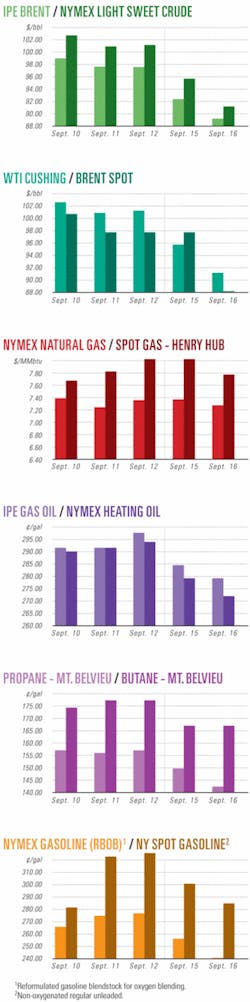

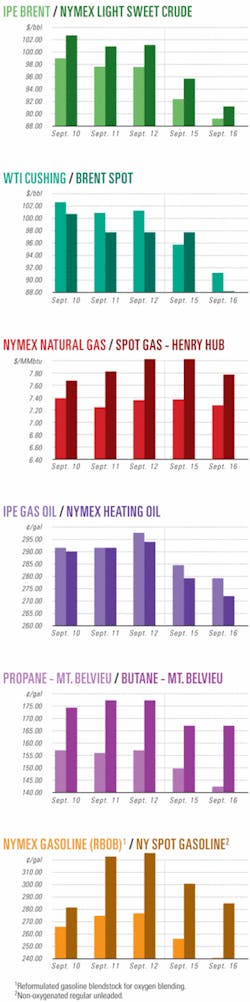

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesNorth Argentina discovery flows oil near Chivil

Gran Tierra Energy Inc., Calgary, reported a stabilized flow rate of 2,324 b/d of 43.8° gravity oil on a production test of Cretaceous Lower Palmar Largo volcanics and volcaniclastics at the Proa.x-1 exploration well on the Surubi block in northern Argentina’s Noroeste basin.

The well, tested at 12,649-661 ft and 12,620-641 ft on a 35/64-in. choke, was drilled to total depth of 12,920 ft measured depth. Water cut was 0.5%. A drillstem test in the same formation at 12,694-713 ft yielded no flow.

The company, operator with 85% working interest in the 90,688-acre block, plans to begin a long-term test within a week through a 31/2-in., 15-mile, 4,000 b/d pipeline to Gran Tierra-operated Chivil field on the adjacent Chivil block. Recursos Energeticos Formosa SA (REFSA), the provincial government company, has 15% interest.

Gran Tierra, which carried REFSA’s drilling costs, will be reimbursed for all costs incurred during drilling from 50% of the net production assigned to REFSA. Provincial royalties on production range from 12% for up to 4.7 million bbl of cumulative production to 14% on 4.7 million to 9.4 million bbl to 16% for further production.

Gran Tierra said the well’s results improve the prospectivity of identified leads in the Surubi block and in the adjoining Chivil and Palmar Largo blocks, where the company has 100% and 14% working interest, respectively.

RWE finds gas in Disouq concession in Egypt

RWE Dea AG has discovered gas for the second time within the South Sidi-Ghazy 1x-well on the Disouq concession in the Egyptian Nile Delta.

South Sidi-Ghazy 1x was spudded on Jul. 20 and reached a TD of 3,188 m within the Late Miocene. The gas was found within the Messinian formation.

“The well encountered a gas bearing interval of 24 m column. Formation evaluation and the Modular Dynamics Tester Tool confirmed the presence of gas in the intervals of 2,747-2,771 m with porosities in the range of 27%,” RWE said.

RWE Dea picked up the 5,375 sq km onshore block in July 2004. The prospect is based on a seismic anomaly within the Upper Messinian succession, which shows direct hydrocarbon indicators conformable with a four way dip closure at the top of the Messinian succession in analogue to the North Sidi-Ghazy discovery, drilled by RWE Dea in 2008.

The company will go on to drill nearby exploration well North West Khilala-1x to see if there is any more hydrocarbons in the Messinian structure.

South Sidi Ghazy-1x well is the fifth well drilled by RWE Dea in the Disouq Concession. It is 7.5-km south/south-west of the North Sidi Ghazy-1x discovery.

Petrobras makes offshore find with Iara

Petroleos Brasileiro SA (Petrobras) announced that an offshore field, in the same block as the Tupi field, is expected to yield some 3-4 billion bbl of recoverable light crude and natural gas.

The Petrobras-led consortium, which also includes BG Group and Galp Energia, completed the drilling of well 1-BRSA-618-RJS and proved “the relevant discovery” of light oil in the presalt reservoirs.

“The new discovery…was confirmed by a cable test and revealed the existence of light oil, with specific gravity between 26° and 30° API, in an area of some 300 sq km that has been very well defined seismically,” Petrobras said.

The state-owned firm said that the discoverer well, called 1-BRSA-618-RJS (1-RJS-656) and known as Iara, lies in an area north of Tupi, some 230 km offshore Rio de Janeiro. It is located at a depth of 2,230 meter, and reached a final depth of 6,080 meters.

Petrobras said the consortium partners “will give continuity to the exploratory activities and to the investments in this area via a Discovery Assessment Plan to be submitted to the NPA, as provided for in the Concession Agreement, in order to characterize the field better.”

Petrobras, operator, holds a 65% stake in the consortium, while BG Group holds 25% and Galp Energia holds 10%.

Drilling & Production Quick TakesTotal to operate Madagascar’s heavy oil license

Total SA will operate the Bemolanga heavy oil license in Madagascar with a 60% interest after signing a farm-in agreement with Madagascar Oil SA.

The partners will use mining technology to develop the estimated 10 billion bbl of heavy oil in place. The onshore 6,500 sq m license in western Madagascar was granted to Madagascar Oil in 2004.

“During the initial appraisal phase, additional core drills will be drilled to determine the license’s potential. A production pilot will be set up in a second phase to confirm the development parameters before considering a large scale development of the license,” Total said.

It believes that heavy oil will be crucial to supply world markets within the next decade and will build upon its experience developing these projects in Venezuela and in Canada.

Total already has marketing, aviation fuel, and petroleum product logistics in Madagascar.

CNOOC brings Peng Lai oil field on stream

China National Offshore Oil Co. Ltd. said another platform at the Peng Lai (PL) 19-3 oil field has come on stream.

Platform B is the third of five platforms in phase II of PL 19-3. Platforms A and C already have started production, while D and E have yet to begin.

The development facilities in Phase II of PL 19-3 include the five wellhead platforms, a central processing facility and a 190,000 b/d world-class floating production, storage, and offloading facility. PL19-3 field, which lies on Block 11/05 in the Bohai Bay, was jointly developed by CNOOC and ConocoPhillips China Inc. CNOOC holds a 51% interest in the field and ConocoPhillips holds the remaining 49%.

Peru aims to meet half domestic oil needs by 2015

Peru’s state-owned Petroleos del Peru (Petroperu) has taken the first steps toward becoming an oil producer again and aims to produce enough to meet at least half of domestic fuel demand by 2015, according to Petroperu Chief Executive Cesar Gutierrez.

“Diesel consumption will continue rising in Peru at an annual rate of 3.5%,” Gutinerrez told Spanish news agency Efe, adding that demand will increase to 90,000 b/d over the next seven years from the current 60,000 b/d.

“If we want to maintain our share of the market, we must produce 45,000 b/d because today we have 50% of the market,” Gutierrez said.

Currently, Petroperu must buy all the petroleum it refines from private firms. It currently buys about 30,000 b/d, with some 24,000 b/d produced domestically, while the remainder is imported.

Gutierrez said the remaining 30,000 b/d of fuel needed to meet domestic demand is supplied by Spain’s Repsol-YPF SA, which imports a percentage of the crude it processes.

“We buy it all at the international price and so what we want to do is exploit our fields,” Gutierrez said.

To double domestic production, Gutierrez said Petroperu will have to modernize the Talara refinery at a cost of $1 billion and start production from the 12 blocks where petroleum exploration is taking place.

“We are in six preexploratory lots with (Brazil’s) Petrobras and (Colombia’s) Ecopetrol, and now we have won four offshore lots and two other lots on land,” Gutierrez said.

According to Efe, Petroperu officially ended its petroleum exploration and production activities in 1996, when former President Alberto Fujimori’s administration privatized the remaining lots the company had stakes in.

In 2006, when President Alan Garcia took office, he agreed to a request from Gutierrez to allow Petroperu to find private partners to fund petroleum and gas exploration and production, with the state firm holding minority stakes in fields.

Under this arrangement, Petroperu formed partnerships with Petrobras and Ecopetrol in 2006 to explore six blocks, and earlier this month came to agreements with Norway’s Discovery, India’s Reliance, China’s CNPC and Argentina’s Pluspetrol.

In July, Petroperu announced plans to invest some $50 million for an extension to the 852-km Norperuano crude oil pipeline that runs to the Pacific coast from fields in the northeastern jungle region (OGJ Online, July 24, 2008).

Processing Quick TakesIran, Ecuador sign refining upgrade agreement

Iran and Ecuador, both members of the Organization of Petroleum Exporting Countries, signed a memorandum of understanding in the oil sector under which Iran will help refurbish and upgrade Ecuador’s refineries.

The MOU, signed in Tehran by Iranian oil minister Gholam Hossein Nozari and Ecuadoran minister of mines and petroleum Galo Chiriboga Zambarno, calls for the construction of an oil refinery to be co-financed by Iran, Ecuador and fellow OPEC member Venezuela.

Nozari said the two oil ministers additionally agreed to construct a petrochemical production unit in Ecuador, while Zambarno said the two countries would establish an oil company to implement the joint energy projects.

Their agreement also covers training of Ecuador’s oil industry employees by Iranian experts and cooperation in maintenance on Ecuadorean oil facilities.

Ecuador, the fifth largest oil producer in South America, currently has three refineries with a combined capacity of 176,000 b/d. The largest refinery in Ecuador is the 110,000 b/d Esmeraldas facility on the Pacific coast.

According to the US Energy Information Administration, Ecuador is a net importer of refined oil products: during the first half of 2007, Ecuador’s Ministry of Energy and Mines said the country imported 86,000 b/d of refined products, while exporting 36,000 b/d.

Japanese refiners to cut products output

Three Japanese refiners, who control some 35% of the nation’s refining capacity, plan to cut their output by the end of the year due to reduced demand for fuels.

Showa Shell Sekiyu KK will cut production by 4.4% for the remainder of 2008, while Cosmo Oil Co. will reduce output during the fourth quarter—possibly by 2%.

Idemitsu Kosan Co. said it also would reduce output in the face of declining demand in Far East markets, but has signed a contract to export gas oil to Mexico (OGJ, Sept. 15, 2008, p. 48).

Idemitsu also plans to export gasoline to Mexico and now is in talks with the Mexican government over specifications. “We are telling them that Japanese specifications are fine (for Mexico),” said Idemitsu sales director Seiji Fukunaga (OGJ Online, Sept. 10, 2008).

Kuwaiti minister confident about refinery support

Kuwaiti Oil Minister Mohammad al-Olaim, rejecting allegations that he had violated any laws in the award of contracts, expressed confidence he would win parliamentary support to construct the 615,000 b/d Al-Zour refinery.

“There was relief among the members of the committee over data presented by the ministry,” said al-Olaim after briefing parliament’s key financial committee for 5 hr. “All the steps taken…were legal and transparent,” al-Olaim said.

Members of parliament had demanded an investigation after state-owned Kuwait National Petroleum Co. (KNPC) awarded contracts worth $8.4 billion to Japan’s JGC Corp and South Korea’s GS Engineering & Construction Corp., after a tender.

Al-Olaim also came under pressure from some parliamentarians who alleged other violations, particularly in connection with the award of a utility and offsite services package without a tender to US engineering firm Fluor.

The main objections came from Kuwait’s Popular Action Bloc which insists that the bidding process and awarding of contracts must go through the Central Tenders Committee and that oil projects are no exception.

In August, al-Olaim refuted legislators’ claims of any wrongdoing in the award process for the al-Zour refinery project, and said he would make some documents on the tenders available for inspection (OGJ Online, Aug. 17, 2008).

Kuwait has announced plans to increase refining capacity to 1.415 million b/d from the current 930,000 b/d with the new plant along with upgrades to two existing refineries. Al-Zour is scheduled to start operating in 2012, two years later than initially planned.

Transportation Quick TakesIraq resumes oil exports following storm

Iraq has resumed oil exports following a storm that shut in the southern port of Basra and the completion of repairs to the bomb-damaged northern pipeline that carries crude from the northern Kirkuk fields to the Turkish Mediterranean port of Ceyhan.

On Sept. 15, Iraqi oil exports stood at some 1.53 million b/d, up from 860,000 b/d the previous day, according to shipping agents. But the flow of exports from Basra was still lower than the normal average of 1.6 million b/d.

Oil flowed at 450,000 b/d via the country’s northern pipeline system, while exports rose to 1.08 million b/d at Basra and the nearby Khor al-Amaya facility as operations at both facilities began to recover after a storm.

Oil exports at Basra slowed to 860,000 b/d on Sept. 14-15, down from 1.68 million b/d on Sept. 13, according to shipping agents. Officials stressed that the reduced throughput was due only to bad weather.

“There is a storm in the south that has contributed to the delay of exports,” said one official. “It’s just a storm, nothing else.”

Meanwhile, until the completion of repairs in the north, Iraq had suspended shipments of crude oil along pipeline route since Sept. 10 following an explosion on the line, according to government officials.

“A bomb hit a pipeline transporting crude to Ceyhan in Turkey and halted exports on [Sept. 10]. The blast occurred in an area called Hadhar,” said a spokesperson for the state-owned North Oil Co.

Virginia gas pipeline blast injures five

A natural gas pipeline exploded in Appomattox County, Virginia, the morning of Sept. 14, leveling one home and injuring five people, local and federal authorities said. Four of the injured were treated and released.

Two inspectors from the US Pipeline and Hazardous Materials Safety Administration were at the scene with state and local investigators and representatives of Williams Cos. Inc., the pipeline’s owner and operator, a PHMSA spokeswoman told OGJ on Sept. 15.

The 30-in. line is part of Williams’s Transco interstate system. Pressure-monitoring equipment registered a change, the line was shut down immediately, and the gas was rerouted to other lines, a Williams spokesman said. The incident did not affect service to any customers.

BP says WREP line remains shut in after conflict

BP PLC said its trans-Caucasus Baku-Supsa pipeline, also known as the Western Route Export Pipeline, remains shut a month after its closure due to the conflict between Russia and Georgia.

“It was shut as a security precaution,” said BP spokesman David Nicholas. “The situation remains unchanged,” he said of the line which had been carrying some 45,000-90,000 b/d of Azeri crude before the Aug. 12 shut down.

Last month, a BP spokesman said that efforts to restart the WREP had been “put on hold until we can assess the impact of this conflict on the integrity of this pipeline,” (OGJ, Aug. 30, 2008).

The continued closure of the line adds to Azerbaijan’s export problems as shipments of Azeri oil by rail across Georgia also remain halted after being stopped when railway bridge was damaged during the hostilities.

Despite the continued delays in reopening the oil export links, the region is still viewed as a viable energy corridor by neighboring governments and international oil companies.

Earlier this week, Tengizchevroil (TCO), the Chevron-led consortium developing the Tengiz oil field in western Kazakhstan, made an agreement with the State Oil Company of the Azerbaijan Republic to transport oil by rail across Georgia.

TCO will send up to 2 million tonnes/year of oil (40,000 b/d, on average) by barge across the Caspian Sea to Azerbaijan, according to a source at SOCAR, although volumes could eventually increase to 5 million tpy.

Analyst Global Insight interpreted the agreement as indicating that TCO is “more concerned with finding outlets for its growing oil production than it is about the inherent risks of relying on Georgia as a transit state in the wake of the Russia-Georgia war.”

Total to participate in Futurol project

Total SA said it will participate in Futurol, an ethanol research and development project with a €74 million estimated budget.

The project seeks to develop a process for producing ethanol by fermenting nonfood lignocellulosic biomass. The project also will seek to determine the industrial viability of such a process.

Futurol is expected to involve French research organizations, manufacturers, and financial institutions, Total said.