Reoriented Talisman evaluating unproven Utica, Lorraine shales

A self-redirected Talisman Energy Inc. expressed encouragement earlier this month at results from its first well in Ordovician Utica shale in Quebec’s St. Lawrence Lowlands.

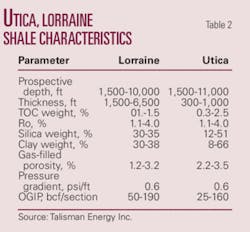

While it describes the overlying Lorraine shale, as yet untested by Talisman, as having the potential to be just as prospective as the Utica, the company describes the play as “unproven.”

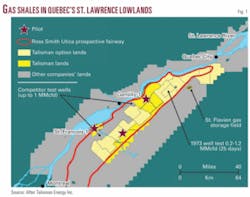

Talisman’s acreage position is large. The Calgary firm holds 760,000 net acres spread across 940,000 gross acres (Fig. 1). And it points out that it has to drill wells to earn 600,000 acres from independent company farmors.

Talisman plans to drill three more wells by the end of 2008.

The company reported a sustained, 18-day test rate of 800 Mcfd from a single completed Utica interval at Gentilly-1, a well previously drilled to test the deeper Ordovician Trenton-Black River formation (OGJ, Sept. 8, Newsletter).

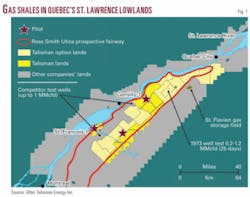

The company plans to move up the hole to test the Basal Lorraine and Lorraine shale intervals (Fig. 2).

Even though Talisman holds industry’s largest land position in the play for gas in the two Quebec shales, the company’s projected timeline doesn’t call for it to enter the development phase there until late 2010.

Talisman and shales

The Quebec shales are the least evaluated of several North American onshore gas and oil shale plays that Talisman chose to pursue as it refocused in May 2008.

The potential in Quebec, however, is quite large. Talisman estimated 48 tcf of original gas in place in the formations, and the gas content per square mile compares favorably to gas content in the other shale plays in which the company is involved (Tables 1 and 2).

Eastern Canada consumers, most of their gas shipped 2,200 miles from western Canada, would certainly welcome the development of a substantial local supply.

Talisman said in May that it would spend $1.1-1.3 billion through the end of 2009 evaluating a material part of the gas potential in its 2.5 million net acres of unconventional land in North America. Of the total, it budgeted $900 million for development programs in areas where the company experienced early success, including 200 wells in the Western Canada Outer Foothills and Devonian Montney shale gas plays and the US Williston basin Bakken shale oil play.

Another $420 million is earmarked to drill pilot areas in other parts of the Outer Foothills and Montney, Quebec, and Appalachia.

“By the end of 2009, we will be able to make informed choices about ongoing levels of investment into our unconventional resource plays,” Talisman Energy said.