SPECIAL REPORT: Mideast operators using more artificial lift surveillance, optimization technology

As the number of electrical submersible pump installations has increased in the Middle East, operating companies have started deploying more surveillance and optimization technology.

Deployment of artificial-lift systems throughout the Middle East continues to grow rapidly, especially ESPs. In many other parts of the world, operators install ESPs in wells producing from nearly depleted reservoirs. In the Middle East, however, ESPs are in wells that produce from reservoirs that are far from depleted.

These installations provide a means to increase production rates and improve recovery. For instance in Saudi Arabia, Saudi Arabian Oil Co.’s (Aramco) aggressive goal is to recover in excess of 50% of the original oil in place, a recovery factor much higher than the industry average.

In fewer than 3 years ago, fewer than 150 ESPs were in Kuwait. Since then, the number has more than doubled. During the next few years, expectations are that the number of artificially lifted wells in Kuwait with ESPs will increase by more than 50% annually.

While ESPs can increase substantial well production, they are inherently the most complex and expensive artificial-lift systems. Many operational and environmental parameters can influence ESP performance and well productivity. To improve pump performance, several oil companies in the Middle East have comprehensive strategies for deploying smart digital oil field technology. A key component of these digital technologies is real-time remote surveillance for ensuring optimal artificial-lift performance and predicting well failures before they occur.

Digital oil field

vMonitor is conducting several digital oil field projects across the Middle East with Petroleum Development Oman (PDO), Saudi Aramco, Kuwait Oil Co. Ltd. (KOC), Qatar Petroleum Corp., and several companies in Abu Dhabi, such as Abu Dhabi Oil Co. for Onshore Oil Operations (ADCO), Zakum Development Co. (ZADCO), and Abu Dhabi Marine Operating Co. (ADMA-OPCO).

In these smart digital oil field initiatives, the common technology denominator is real-time data capture and remote surveillance.

The focus of most of these companies for now is on real-time data capture, analysis, alarms, and tools for supporting the decisions made by production and reservoir experts.

To date, these systems have limited remote-control functions. In the case of ESP systems, the remote control for now is limited to on-off and changing frequency. As the technology matures further, it is likely that these systems will incorporate more autonomous control functions.

ESPs

One goal of companies is to extend the run life of an ESP. Severe operational and environmental conditions,however, often cause an ESP to fail, which in turn interrupts production and leads to expensive workovers.

An ESP system may encounter many problematic elements, such as:

- Proper pump design and redesign.

- Corrosive environments caused by sour gases and microbiological elements.

- High associated gas production.

- Solids produced during pumping.

- Maintaining proper electric power supply.

The industry has made many advances in ESP systems in the past decade, including new materials, downhole multisensor systems to measure pressure and temperature, advanced variable-speed drives (VSDs), improved methods for design, and lately real-time surveillance and optimization technology.

Real-time surveillance, optimization

Remote ESP monitoring and optimization systems are key for ensuring long pump life and optimal production. Traditional installations require personnel to visit wellsites constantly and collect data manually, thereby making it impossible to detect and predict failures in a timely manner.

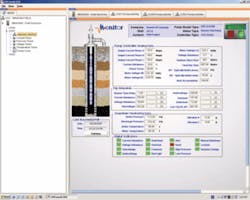

Real-time surveillance systems make pump data available instantaneously. Operators can see real-time reports, trends, and diagnostic measures. Important ESP performance measures and well lift performance become available immediately to the ESP and production experts in the office and field. They can view downhole sensor data in real time and quickly determine how pressure, temperature, and electrical current are affecting pump performance.

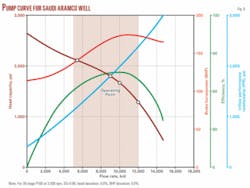

These systems allow historical data from several critical parameters such as intake and discharge pressure, motor, and intake temperature to be displayed quickly to determine the health of the system. ESP experts can analyze pump curve data that show actual pump data vs. theoretical pump model data and determine the most efficient manner for operating the pump.

Another feature of these systems is that they allow programming of intelligent alarms based on the collected historical and real-time data so that operators are warned of impending problems or failures.

This new remote surveillance and control technology has allowed easy control of the pump from operator offices hundreds, even thousands of miles away from the wellsite.

Technology rollout

Fig. 1 shows common system architecture of several real-time surveillance and optimization systems that vMonitor has deployed in Saudi Arabia, Abu Dhabi, and Kuwait. The surveillance system collects data from the ESP pump controller, the downhole gauge sensors, and the wellhead surface pressure and temperature instruments.

A remote terminal unit (RTU) connected to a communications system gathers the data (Fig. 2). The telecommunication system is wireless in most cases.

Available are various wireless communication options such as GPRS/3G (GSM phone network), broadband radio systems, and soon Wimax. In some cases, the wells are in a fiber optics network.

These systems transmit the data in real-time from the well RTUs to the control room. In some applications, the surveillance system transmits up to 80 ESP parameters.

Some of the various parameters collected by vMonitor’s vMESP software in the main control room include:

- VSD cabinet temperature.

- Frequency signal control.

- Current unbalance (%).

- Voltage unbalance (%).

- Current unbalance set point.

- Voltage unbalance set point.

- Underload shutdown threshold.

- Overload shutdown threshold.

- Efficiency of the power.

- Total run time.

- Lockout status.

- Red light status on controller.

- Current limit status.

- ESP central shutdown.

The vMESP software has several modules. The first module is a data-polling engine that collects data from the ESP controller, downhole gauges, and the surface instrumentation. Some oil companies have deployed systems that collect data from nearly 250 wells simultaneously.

The other software modules include the database or data historian. Once the software captures the well data, several software modules provide a variety of diagnostics charts, trends, and smart alarms (Figs. 3-6).

One important diagnostic tool is the pump-curve analysis module (Fig. 6) that provides the essential steps for pump optimization.

Wireless technology

Companies have applied various wireless technologies for remote surveillance systems. One such technology is broadband (Ethernet-based) radio. Most countries in Middle East allow the use of broadband radios using 2.4 Ghz frequency. In North America, the use of 900 Mhz radio is common, while in the Middle East, countries do not allow 900 Mhz radio communication because the frequency is too close to their cellular phone GSM frequency.

In the Middle East, GSM (GPRS, EDGE, and 3G) networks have extensive coverage even in very remote oil field desert areas.

In a GSM cellular network, GPRS/EGDE/3G carries data instead of voice. GPRS is the older technology and has a lower bandwidth (54 kilobits/sec).

Most Middle East countries have rolled out 3G networks that provide a data communication bandwidth up to 2 megabits/sec.

Broadband radios can have a bandwidth of up 2 megabits/sec. Broadband radios require installation of private network and infrastructure. Once companies have set up communication structure (towers and antennas), data transmitting is free, while transferring data using the GPRS/3G network incurs monthly charges from the telecom company providing the service.

Many oil companies in the Middle East are moving towards setting up their own private ultrahigh-speed communication network using the emerging Wimax technology.

Wimax is a high speed, long-range Wi-Fi system. Wimax frequencies in the Middle East range between 3 and 5.8 Ghz. Wimax has a theoretical bandwidth of up to 100 megabits/sec that will enable high-speed data, internet, voice, and video access, even in the most remote oil fields.

The author

Hatem Nasr ([email protected]) is a cofounder of vMonitor. Before founding vMonitor, he was a director of technology at Baker Hughes Inc. He also worked for 11 years at Honeywell Technology Center where he held several positions include senior principal scientist and several research and management positions. Nasr completed his PhD studies at the University of Minnesota in computer engineering and holds BS and MS degrees in systems engineering from the University of Houston.