OGJ Newsletter

CFTC seeks comment on NGX registration request

The US Commodity Futures Trading Commission is requesting public comments on Natural Gas Exchange Inc.’s (NGX’s) application to register as a US derivatives clearing organization. Its US office is in Houston.

The Calgary-based exchange, which has been operating since February 2004, is owned by the Toronto Stock Exchange’s parent company, TSX Group. NGX began an operating alliance earlier this year with the InterContinental Exchange in which NGX uses ICE’s front end trading technology and provides clearing services for ICE’s US physical gas products, according to information at NGX’s website.

It says it lists more than 60 physical and forward gas contracts—which can be delivered at 30 Canadian and US hubs—more than 80 financial gas swaps and options, more than 20 electricity swaps and more than 10 physical gas transport (location) swaps. NGX said an average 2,700 contracts are traded each month on its platform.

Comments should be submitted by Sept. 17 and will be posted at the commission’s website, the CFTC said.

Brazil, asked to join OPEC, declines

Iran has invited Brazil to join the Organization of Petroleum Exporting Countries, according to a Brazilian senior government official.

Brazilian oil minister Edison Lobao, in an interview with Brazil’s Folha newspaper, said OPEC members believe Brazil will in the future be one of the largest oil producers worldwide.

But Brazil’s President Luiz Inacio Lula da Silva, accompanied by Lobao Sept. 2 at the inaugural ceremony for the first oil production in presalt rocks off Espirito Santo state, demurred, saying that Brazil has been investing in its refining capacity in order to become an exporter of fuel, not crude oil.

In June, Lobao made similar claims based on the fact that Brazil was asked to attend a meeting of oil producer and consumer nations in Jeddah. “The simple fact that we were invited for an emergency meeting means, in my view, OPEC intends to invite us to join, if not now, then in the short run,” Lobao had said.

Diesel fuel sales decline at US truck stops

Diesel fuel sales have declined at US truck stops in response to higher prices, a national association of truck stop and travel plaza operators reported.

A survey of its 1,100 members also showed that gasoline purchases increased slightly, with a huge shift from premium and midgrade to regular, NATSO said. The Alexandria, Va.,-based trade association was founded in 1960 as the National Association of Truck Stop Operators.

NATSO said the survey found that the average monthly diesel sales volume fell 5.2% year-to-year to 906,700 gal in June and 4.5% to 898,109 gal in July. During that period, it noted, data compiled by Oil Price Information Service showed that truckers paid an average $1.74/gal more in June and $1.76/gal more in July than a year earlier.

The declines began after volumes began 2008 with strong growth, NATSO said. Sales were 6% higher year-to-year in January and February, 2.5% lower in March and 2% higher in April before falling sharply (5.8%) in May, it indicated.

Meanwhile, NATSO members reported that gasoline sales volumes at their truck stops grew an average 1.5% year-to-year in June and 1.8% in July. Premium gasoline sales fell 17% in June and 19% in July, while mid-grade gasoline sales declined nearly 13% in June and 16% in July, the association said.

It said OPIS data show gasoline prices were $1.03/gal higher year-to-year in June and $1.09/gal higher in July.

The US Energy Information Administration reported Aug. 25 that retail diesel fuel prices fell for a sixth consecutive week to an average $4.145/gal nationwide but remained $1.282/gal higher than their level a year earlier.

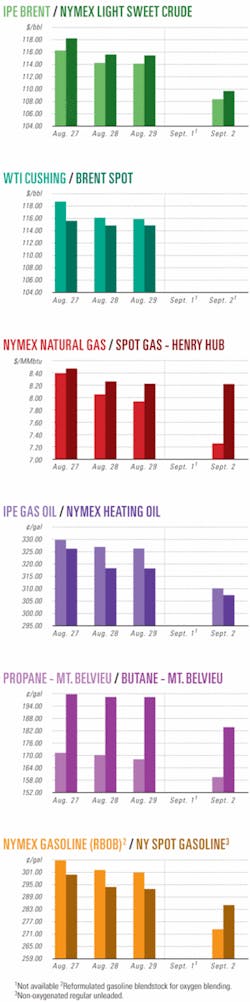

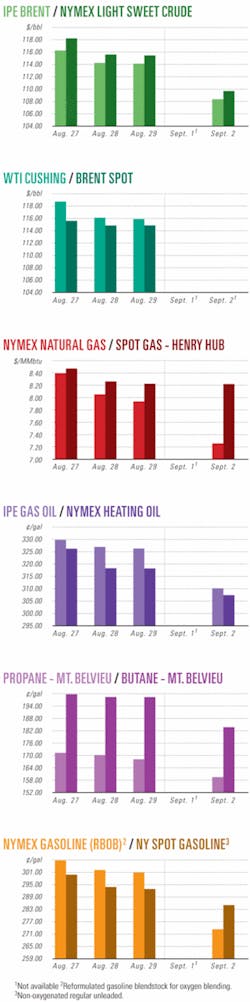

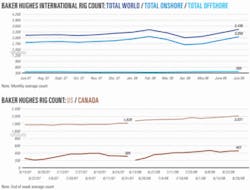

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesOMV begins Austrian gas production

To boost Austria’s energy supply, OMV AG has started natural gas production from Strasshof and Ebenthal fields in the Vienna basin.

The company’s domestic production will increase by 20%—about 40,000 boe/d—until 2010. OMG said it cost €210 million to bring the fields on stream.

Strasshof, which holds an estimated 4 billion cu m of reserves, was discovered in 2005. OMV has since drilled four additional wells and spent €175 million to construct gas processing facilities and expand the existing sour gas treatment plant at Aderklaa. At the first expansion stage, Strasshof’s maximum production will be 4,000 boe/d—20% of the company’s overall production.

Ebenthal, which has gas reserves of 1.5 billion cu m, cost €35 million to develop. OMV built gas treatment facilities and revamped the Auersthal compressor station. A 16-km pipeline will link the field to the compressor station. Ebenthal output will hit 3,000 boe/d in September, which will represent 15% of OMV’s domestic gas production.

OMV will invest €250 million in 2008 and again in 2009 to boost Austrian oil and gas production for long-term supply security by optimizing production of its mature oil fields as well as exploring for new reserves.

“Environmentally sound production technologies and low emissions are particularly important for OMV,” a company spokesperson said. “With Baumgarten becoming an increasingly important Central European gas hub, additional gas storage opportunities are being investigated.”

At the end of 2007, OMV’s Austrian reserves were 143 million boe, with natural gas reserves of 14.8 billion cu m and crude oil reserves of 56 million bbl.

Total seeks Syrian oil block PSA extension

Total SA Chief Executive Christophe de Margerie will accompany French president Nicolas Sarkozy on a recent state visit to Syria aiming to negotiate the extension of an oil block agreement.

A spokesperson for the French firm said De Margerie wants Syria to extend the existing production-sharing agreement for the Deir Ezzor area in the northwestern part of the country by 10 years to 2021 from 2011.

Discussions between the two sides began in early April over the current agreement, signed in 1988, which allows Total to produce some 30,000 b/d of oil at Deir Ezzor.

At the time, Syrian Oil Minister Sufian Al Alao said the government wanted to boost oil production levels by awarding exploration contracts to international companies.

His statement came just days after Syria signed an agreement with China National Petroleum Corp. to build a 100,000-b/d refinery in the same region as the Total concession.

“The refinery would process heavy crude oil produced in Deir Ezzor area,” the oil minister told a news conference on the sidelines of an oil and gas show in Damascus.

CNPC would own 85% of the refinery, while Syria would own the rest, he said. Syria would buy products from the refinery, he added without saying how much the refinery would cost.

Al Alao also said plans were proceeding on another refinery at Deir Ezzor having a processing capacity of 140,000 b/d. It is set to be built jointly with Kuwait’s Noor Investment Group.

Delaware basin shales strain for economics

The Mississippian Barnett shale has the potential to be a prolific gas producer in the Delaware basin, write geoscientists in the AAPG Bulletin.

One well is reported to have an estimated ultimate recovery of 9 bcf, said Travis J. Kinley of Texas Christian University and fellow authors. Drilling and stimulation costs to as deep as 18,000 ft began at more than $18 million and have been reduced to about $8 million.

Interval A at the top of the Lower Barnett typically has resistivities of 50-100 ohm-m and “is believed to be a significant zone of gas saturation within the Barnett,” they reported.

For the most part, however, shale gas plays in the basin have resisted efforts for viable economic development.

Both the Barnett and Devonian Woodford shales should be evaluated, but silica content is less than in the Fort Worth basin. Shale is brittle and will not fracture as well, and proppant embedment may be a problem, the authors wrote.

Shales can slough in horizontal wells, and the high pressures challenge frac pumping equipment.

Even so, a few wells have made initial flow rates of up to 3 MMcfd, and IP at the best well was 5 MMcfd, but decline rates are steep. Chesapeake Energy Corp. and Hallwood Energy Corp. have commercial gas sales.

Using logs from 150 wells in a study area of 500 sq miles in the northern part of the basin in West Texas and Southeast New Mexico, Kinley el al. said that areas for future exploration focus can be delineated by mapping a net resistivity greater than 50 ohm-m. No core was available, but the group studied mud logs and cuttings from five wells.

They noted that the first Delaware basin shale gas wells were drilled in southwestern Reeves County in 2002, and shale gas activity in West Texas has waxed and waned over the last 5 years.

They also noted that it took years to discover the correct combination of drilling and completion techniques to tap gas in the Barnett shale in the Fort Worth basin.

Talisman encouraged by Utica shale test

Talisman Energy Inc. announced what it calls encouraging results for its Quebec unconventional program following a Utica shale test.

The Gentilly vertical well, a reentry to a previously drilled Trenton-Black River well, flowed 800 Mcfd from one completed interval on a sustained basis on test for 18 days.

At the time of the shutin, the well was still cleaning up, and pressures and flow rates were constant.

Talisman, holding a 75% interest, operates the Gentilly well, which is on the south side of the St. Lawrence River about 100 km south of Quebec City.

John A. Manzoni, Talisman president and chief executive officer, said additional testing is planned for the well, including zones within the Basal Lorraine and Lorraine shale formation.

The Lorraine shale sits on top of the Utica and can be up to 6,500 ft thick. The Utica shale is 300-1,000 ft thick.

Early indications show both the Lorraine and Utica rocks are thick, porous, and appear brittle and over pressured, all of which are conducive to artificial fracture stimulation.

Gassco lets seabed surveys contract

Gassco AS has let a contract to Sweden’s Marine Matteknikk AB to start seabed surveys in September for potential carbon dioxide pipelines.

The company will shoot 636 km of seabed surveys over 19 days. Data will be collected to determine transport routes to be further developed during the preengineering phase in first quarter 2009.

The work underpins Gassco’s investigation to transport captured CO2 from flue gas emitted by Naturkraft’s 420-Mw gas-fired power plant at Karsto and the thermal power plant under development at Mongstad. Gassco is working with Gassnova SF and the Norwegian Petroleum Directorate to develop technical solutions.

“Suitable locations on the Norwegian Continental Shelf shall be evaluated for the sequestration of the captured CO2,” Gassco said.

Drilling & Production Quick TakesSevan orders drilling equipment for deepwater rigs

Sevan Marine ASA has let a $240 million contract to Aker Solutions to provide two drilling equipment packages and possibly a third for deepwater drilling rigs that are under construction.

“The contracts will cover delivery of complete drilling packages consisting of engineering and equipment deliveries,” Sevan said.

Aker Solutions will deliver equipment for Sevan’s first drilling rig in 2009. A spokesman from Sevan Marine told OGJ that both rigs were deepwater floaters based on the cylindrical Sevan 650 design. The rigs are capable of operating in 10,000 ft of water. “One rig will drill off Brazil and the other [off] India.”

The rig for Brazil will start operations in mid-2009 in the Santos presalt cluster basin. The other, for India’s Oil & Natural Gas Corp. Ltd., will be delivered in 2010.

Petrobras begins Jubarte presalt oil production

Brazilian President Luiz Inacio Lula da Silva, aboard platform JK P-34, has launched oil extraction from the presalt layer of Jubarte field in the Campos basin off the state of Espirito Santo.

Petrobras will use the P-34 platform, which has been producing from other undersea wells since December 2006, to produce the first presalt crude, estimated at 18,000 b/d at full capacity.

The firm also said that production from the well will provide knowledge that will help it develop the presalt reserves in Espirito Santo and in other areas off the Brazilian coast.

“This is the fundamental data that will be used to develop these new areas,” said Petrobras E&P director Guilherme Estrella, who added that Jubarte field will accelerate the learning process needed to bring online other large presalt fields such as Tupi.

Petrofac begins Don fields drilling campaign

Petrofac Energy Developments has spudded the first well on the West Don field in the UK North Sea, which is expected to start production in second-quarter 2009, along with Don Southwest field. The company is using the Transocean John Shaw semisubmersible drilling rig.

The fields, 150-km northeast of the Shetland Islands, are in 170 m of water. West Don is on Blocks 211/13b and 211/18a. Petrofac will drill seven wells on the fields over the next year, with three sequential wells on West Don prior to moving across to Don Southwest early in 2009.

Petrofac has begun laying the infield pipelines and export infrastructure for the fields’ development. Pipeline trenching is also complete. The installation of the subsea structures and diving tie-ins is scheduled to start at the end of August.

Initially oil will be exported by offshore tanker loading for 6 months and then will switch to pipeline export via a subsea line to Lundin Petroleum’s Thistle platform and the Brent pipeline system. Terms have now been agreed with Lundin Petroleum for the export service.

Don Southwest’s oil production is expected to hit 12,000 b/d at peak rate and will decline over 10 years. It will cost £200 million to bring on stream.

Petrofac will invest £200 million to drill two production wells and one water injection well in West Don, where Petrofac hopes to produce 20,000 b/d of oil at peak rate.

“The project remains on target for first oil production during the first half of 2009, delivering significant value for Petrofac and the field’s joint venture partners,” said Bill Dunnett, executive vice-president, project development, for Petrofac Energy Developments.

Petrofac Energy Developments operates both Don Southwest, with a 60% working interest, and West Don 27.7% working interest.

Processing Quick TakesChevron plans base oil plant at Pascagoula, Miss.

Chevron Corp. has applied to the Mississippi Department of Environmental Quality for an environmental permit to build a premium base oil facility at the company’s 330,000 b/d refinery in Pascagoula, Miss. The refinery produces gasoline, jet fuel, diesel, and other products.

The base oil facility is expected to produce about 25,000 b/d of premium base oil for use in manufacturing high-performance lubricants such as motor oils for consumer and commercial uses. The facility will use Chevron’s proprietary isodewaxing technology, which results in higher yields and enables use of a broader range of crude oil feedstocks.

Chevron expects to begin construction in early 2009 and to complete in 2011.

“These oils are the primary ingredients in the production of top-tier motor oils needed to improve fuel economy, lower tail-pipe emissions, and extend the period between oil changes,” said Dale Walsh, president, Chevron global lubricants.

Napesa to build Saenz Pena, Argentina, refinery

Argentina’s Chaco province, which recently announced plans to promote oil exploration, has signed a letter of intent with local firm Empresa Nacional de Petroleo SA (Napesa) for the construction of an oil refinery in Saenz Pena.

The provincial government said the refinery, to be built with a combination of public and private investment, is slated to begin operating in March or April 2009 and will produce gasoline, fuel oil, asphalt, and diesel.

Napesa has agreed to provide the materials and services to construct and start up the refinery, while the provincial government will create a fund to guarantee the supply of crude oil for the operations.

The announcement follows reports in July that the Chaco government passed Decree 1884, which authorizes the provincial Ministerio de Infraestructura, Obras, Servicios Publicos y Medio Ambiente to award permits and contracts for the exploration and production of oil and gas.

Dalian refinery receives Saudi crude

PetroChina’s recently expanded refinery in Dalian received its first cargo of Saudi Arabian crude on Aug. 26.

Saudi Aramco said the 2 million bbl cargo of Arabian Light was carried in the Olympic Legend very large crude carrier. The cargo shipped out earlier in August (OGJ Online, July 28, 2008).

In June Dalian Petrochemical Co. commissioned new units that doubled its crude capacity to 410,000 b/d.

The units commissioned include a new 200,000 b/d crude distillation unit, 74,000-b/d hydrocracker, 123,000-b/d kerosine-gas oil hydrotreater, 51,000 b/d continuous catalytic regeneration reformer, 40,000-b/d residue desulfurization unit, 200,000 cu m/hr hydrogen manufacturing unit, and a 270,000 tonne/year sulfur recovery unit.

Transportation Quick TakesColombian oil line to link Rubiales field

A contract has been awarded for construction of a 24-in., 235-km pipeline to connect Rubiales heavy oil field in east-central Colombia to the OCENSA pipeline.

Pacific Rubiales Energy Corp., Toronto, and Ecopetrol SA awarded the contract to Consorcio Rubiales-Monterrey, a joint venture of Spiecapag and Ismocol. The pipeline is to be called Oleoducto de los Llanos Orientales.

The line will extend from Rubiales field on the Rubiales and Piriri association contract areas in Meta Province to the OCENSA Monterrey station in Casanare Province. Completion is set for Sept. 30, 2009.

Capital commitments for the project so far include $320 million, including $190 million for the lump-sum fixed-price contract, the pipe, and procurement of long lead time items. Contract for the Rubiales pump station is to be awarded separately.

The local partner Ismocol de Columbia has 20 years of experience in the Colombia oil and gas industry.

Pacific Rubiales, which will own 35% of the pipeline, said the project will “leverage the future development of the very prospective Los Llanos heavy oil basin.”

WBI to expand Grasslands pipeline capacity

Williston Basin Interstate Pipeline Co., (WBI) the wholly owned natural gas transmission pipeline subsidiary of MDU Resources Group Inc., reported it will expand firm transportation capacity on its existing Grasslands Pipeline to 213 MMcfd from the current 138 MMcfd—a 54% increase. Project cost is expected to be about $28 million.

The 253-mile Grasslands pipeline extends from the Powder River basin in northeastern Wyoming to western North Dakota, where it connects with the Northern Border pipeline.

The project will include the construction of two new compressor stations; one in western North Dakota near Golva, the other in the far corner of southeastern Montana near the Wyoming border. Additional horsepower also will be added to an existing compressor station near Manning, ND. The targeted in-service date is August 2009, pending timely receipt of the necessary regulatory approvals.

Williston Basin conducted an open season on the expansion project in early July, seeking customer commitment for the additional capacity, and the resulting strong customer demand resulted in the expansion project. The Grasslands pipeline held an initial capacity of 80 MMcfd when it was placed in service in late 2003. Since installation, the pipeline has been incrementally expanded, bringing firm transportation capacity to its current total.

Woodside puts North West Shelf Train 5 online

The North West Shelf gas project’s fifth LNG train at the Woodside Petroleum-operated facilities on the Burrup Peninsula near Karratha in Western Australia has been brought on stream.

The Train 5 project, built at a cost of $2.6 billion (Aus.), includes the fifth train, a jetty extension, and a second LNG loadout berth. In addition the Burrup plant has been provided with two more power generation units, a third LPG fractionation unit, a new fuel-gas compressor, an acid gas removal unit, and a third boil-off gas compressor.

The new train has increased the gas project’s capacity by 4.4 million tonnes/year to a total output of 16.3 million tonnes/year.

Woodside operates the new infrastructure for a consortium consisting of itself, BHP Billiton, BP Developments Australia, Chevron Australia, Japan Australia (MiMi) and Shell Australia. All have a one-sixth interest.

Enterprise books Barnett shale shipping

Affiliates of Enterprise Products Partners LP have signed long-term agreements with major Barnett shale natural gas producers for about 900 MMcfd on its 1.1 bcfd-capacity Sherman Extension pipeline. Enterprise also will construct a pipeline to move gas supplies produced from Barnett shale wells in Tarrant and Denton Counties, Tex., to the Sherman Extension pipeline.

The 178-mile Sherman Extension runs from an interconnect with Enterprise’s Texas intrastate system in Erath County, Tex., to Grayson County, Tex., where it will connect to Boardwalk’s Gulf Crossing interstate pipeline. Devon had been the primary capacity holder on the Sherman Extension under previous agreements. Enterprise has the option to acquire as much as a 49% interest in Gulf Crossing (OGJ, May 12, 2008, p. 55).

Enterprise also will build a 40-mile supply lateral from the Trinity River basin north of Arlington to an interconnect with the Sherman Extension near Justin, Tex. The new pipeline will consist of 30-in. and 36-in. pipe designed to provide as much as 1 bcfd of gas takeaway capacity for producers in Tarrant and Denton counties. The line also will have a lateral for gas produced from the Newark East field in Wise County. Long-term agreements with major producers are in place to anchor these lines, which are expected to be in service in third quarter 2009.

Enterprise completed a 42-mile section of the Sherman Extension from Erath County to Parker County, Tex., in August and commenced interim transportation service on it to markets utilizing Enterprise’s Texas intrastate system.