Drilling programs support large land rig construction

The recovery of the land drilling market is accelerating in North America due to solid natural gas prices and a growing focus on deep shale gas, leading to drilling fleet expansions. New land rigs, offshore rigs, and related equipment, such as marine drilling risers, are under construction worldwide.

US land drilling

In August, Lehman Bros. analyst James C. West said leading-edge rates for land rigs are $18,000-23,500/day in the US, up from $15,000-21,000/day earlier this year, and $14,000-20,000/day in second-half 2007. He expects contractors’ profit margins to increase in this strong drilling market.

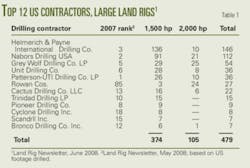

The new rush toward drilling new, deep shale gas plays will require higher-spec land rigs: 1,500-hp and higher. Table 1 shows the 12 drilling contractors that control most of the higher-spec rigs in the US land drilling fleet. As of June 2008, this includes 374 rigs of 1,500-2,000 hp and 105 rigs of 2,000 hp or more.

The top five US drillers control land fleets with 1,118 rigs, and have a combined market capitalization of nearly $27 billion (Table 2).

In 2007, many industry analysts speculated that building land rigs on spec might be result in a glut and depress day rates, particularly in light of the downturn in Canadian drilling. But Richard Mason, publisher of The Land Rig Newsletter, noted in June, “$12 gas changes things…There is no doubt that existing manufacturing can produce another 50 higher spec rigs.”

In July, LeTourneau Technologies Inc. (LTI), a subsidiary of Rowan Cos. Inc., announced two new contracts to build land drilling rigs:

- $90 million contract with Nomac Drilling Inc., a wholly owned subsidiary of Chesapeake Energy Corp., to provide major components for nine new 1,500-hp rigs. LTI will begin delivery fourth-quarter 2008 and will complete the order by mid-2009.

- $74.4 million contract with Weatherford Drilling International (BVI) Ltd. to construct four new 2,000-hp rigs. LTI will deliver the first rig in third-quarter 2008 and the other three by July 2009. LTI will assemble the land rigs at its Jebel Ali, Dubai yard, United Arab Emirates.

H&P

Some contractors build only with fixed contracts in hand. Tulsa, Okla.-based Helmerich & Payne International Drilling Co. announced that it has signed contracts for 18 new FlexRigs since May. The company has announced contracts for 50 newbuilds since October 2007, all with 3-7 year terms. By comparison, H&P announced only 77 new FlexRigs during 2005-07.

H&P has an order backlog for 32 new FlexRigs, scheduled to begin service through late 2009. It plans to deliver new FlexRigs at a rate of 3-4/month and, by late 2009, FlexRigs will represent about 80% of the company’s total US land drilling fleet. As of August, H&P had 181 land rigs in the US, 27 international land rigs, and 9 offshore platform rigs.

The leading US driller, Patterson-UTI Drilling Co. LP, has a fleet of 350 land rigs in the US and Canada (Table 2). It recently announced plans to take delivery of 20 new built-for-purpose drilling rigs in 2008-10, to work under 3-year contracts. This follows a 15-rig newbuild program that began in 2006.

Grey Wolf

Houston-based Grey Wolf Drilling Co. LP is the fifth most active driller in the US, based on footage drilled in 2007 and the size of its US land drilling fleet (120 units). An increasing number of the company’s rigs are operating under term contracts, 66 in August, up from 54 in May, according to West. Another 40 rigs are working in the daywork spot market. Grey Wolf has 120 rigs in South Texas (Fig. 1), the US Gulf Coast, Arkansas and Louisiana, and the Rocky Mountains, with two other rigs in Mexico.

In mid-July, Grey Wolf shareholders rejected a plan to merge with Midland, Tex.-based Basic Energy Services Inc., perhaps reopening consideration of an earlier set of offers from Canada’s Precision Drilling Trust.

In early August, Basic reported a $4.2 million after-tax charge related to the termination of the Grey Wolf merger. Basic provides contract drilling with nine rigs, as well as well completions, servicing, remediation, and fluids, in Texas, Louisiana, Oklahoma, New Mexico, Arkansas, Kansas, and Rocky Mountain states.

Bronco Drilling

Houston-based Allis-Chalmers Energy Inc., an oil and gas equipment company, offered to acquire Bronco Drilling Co Inc. for $437.8 million, although major stockholder Wexford Capital (about 13%), announced its plans to vote against the merger at a Bronco stockholder meeting on Aug. 14, 2008.

Bronco Drilling is based in Edmond, Okla., and provides contract land drilling and workover services with a fleet of 56 drilling rigs, 59 workover rigs (including 10 under construction), and 70 trucks, according to Bob Jarvis, head of Bronco’s investor relations. Six of the rigs are 1,500-hp and one is 2,000-hp,

Bronco operates in South Dakota’s Williston basin (Bakken shale, six rigs), Colorado’s Piceance basin, the Anadarko and Arkoma basins, and Woodford and Barnett shales of Texas, Oklahoma, and Arkansas, along with Cotton Valley in East Texas. Pemex has contracted for three Bronco rigs through the end of 2009. The rigs were to begin operating in the Chicontepec basin near Poza Rica, Mexico, by the end of August.

In Nov. 2007, Bronco Drilling announced it would acquire a 25% equity interest in Challenger Ltd., a private company organized under the laws of the Isle of Man with its principal operations in Libya, in exchange for 6 drilling rigs (five from the 2007 fleet and one newbuild) and $5 million in cash. Challenger was to purchase four rigs and ancillary equipment from Bronco for $12 million, payable in installments. As of August 2008, eight of the rigs contributed or sold to Challenger were in Libya with three of the rigs currently operating. Challenger is a regular subcontractor to state-owned National Oil Corp. of Libya.

Bronco announced second-quarter 2008 results on Aug. 4. Revenues were $69.8 million, up from $62.3 million in first-quarter 2008 and $74.7 million in second-quarter 2007. Drilling rig utilization for second-quarter 2008 was 82%, up from 69% in the previous quarter and 76% in second-quarter 2007. Net income for second-quarter 2008 was $4.3 million, down significantly from $8.1 million for the previous quarter and $8.7 million in second-quarter 2007. The steep revenue reduction in second-quarter 2008 is related to Broncos equity investment in Challenger Ltd.

Canada, Europe

Calgary-based Ensign Drilling Partnership, a subsidiary of Ensign Energy Services Inc., announced its acquisition of 12 drilling rigs and related equipment from Terracore Specialty Drilling Ltd. All the rigs were built in the last 4 years and are being operated through Ensign’s Encore Coring & Drilling division.

Ensign now operates a fleet of 197 drilling and coring rigs in Canada, the second-largest drilling fleet in the Canadian industry.

Trinidad Drilling Ltd. announced it would build seven new 1,500-hp land drilling rigs capable of drilling to 18,000 ft, based on long term, take-or-pay contracts with two North American operators. The rigs will be delivered by yearend 2009. This rig construction program is in addition to the nine new drilling rigs and six new service rigs Trinidad announced it would build earlier this year.

Trinidad will build and commission the rigs at its in-house manufacturing facility, Mastco. The rigs will be equipped with AC-driven machinery, monitored and operated by the company’s proprietary control systems. Additionally, the rigs will have built-in skidding systems which will allow them the ability to drill multiple-pad or single-pad wellsites.

Germany’s Bentec Drilling and Oilfield Systems, a subsidiary of Abbot, announced a $97 million contract to build four 250-tonne HR-4500 cluster-slider land rigs for Russian drilling contractor SSK (Siberian Service Co.). SSK has an option to order up to four more additional rigs under the contract.

This new contract follows the delivery of 12 other cluster slider rigs to KCA DEUTAG, BK Eurasia, and Gazprom. All the rigs are operating in Northern and Western Siberia.

Offshore drilling

High oil and natural gas prices keep the offshore drillers busy worldwide, and many continue to augment the fleets. Nine of the largest, US-based offshore drilling contractors have 33 rigs under construction, a combined fleet of 542 rigs, and a combined market capitalization of more than $110 billion (Table 2).

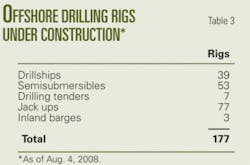

As of early August, a total of 177 offshore drilling rigs were under construction worldwide, including 39 drillships, 53 semisubmersibles, 7 drilling tenders, 77 jack ups, and 3 inland barges (Table 3).

National Oilwell Varco reported a growing backlog for land and offshore rig equipment in its second-quarter 2008 results. The company’s total backlog for rig equipment grew to $10.8 billion ($9.4 billion for offshore and $1.4 billion for land) from $9.9 billion in the previous quarter. NOV expects to deliver about $3 billion of the current backlog in remainder of 2008, $5 billion in 2009, and $3 billion in 2010 and beyond.

In August, Lehman Bros.’ West noted that the Gulf of Mexico jack up market had “improved significantly over the past quarter” and expects leading-edge day rates to move higher. West said jack ups may continue to leave the gulf due to higher contract rates elsewhere. Pemex may tender for 4-6 independent-leg cantilever (IC) jack ups, he said, releasing several mat-supported rigs, shifting its focus to IC jack ups.

Offshore construction

Additional deepwater drilling requires construction of new equipment, including these recently announced contracts:

- Drillship. $755 million contract with Daewoo Shipbuilding & Marine Engineering Co., for delivery June 2011.

- Ultradeepwater drillship. Transocean signed 20-year capital lease contract with Petrobras and Mitsui to provide 10 years of contract drilling (extendable for another 10 years), after which Transocean can purchase the ship for $1. The new drillship will cost $750 million and is under construction at Samsung Heavy Industries’ Goeje shipyard, South Korea.

- Sevan Marine ASA secured options to build six additional Sevan drilling units with China’s COSCO shipyard group. Sevan is currently building the ultradeepwater, dynamically positioned Sevan Driller at COSCO’s Nantong shipyard (Fig. 2). Sevan intends to build two other deepwater drilling units for Petrobras SA and ONGC at the same shipyard.

- Multipurpose heavy lift and pipelay vessel for Romanian drilling contractor Grup Servicii Petroliere SA, $131 million contract with Keppel Singmarine Pte Ltd., for delivery third-quarter 2011.

- Fourth deepwater marine drilling riser for Queiroz Galvão Óleo e Gás SA, $55 million contract with Aker Solutions, at new drilling riser manufacturing facility in Rio das Ostras, Brazil, for delivery third-quarter 2010. The other three risers under construction include the Olinda Star, the Gold Star, and the Lone Star, all of which incorporate the new CLIP connector technology.

- Two marine drilling risers for Daewoo Shipbuilding & Marine Engineering, $75 million contract with Aker Kvaerner Subsea to build two 7,500-ft risers for a new drillship and a semisubmersible. The risers are under construction at Aker’s new manufacturing center in Malaysia and the buoyancy modules are being manufactured by Aberdeen-based Phoenix Polymers International Ltd. The risers will be delivered in 2010.

Fleet, company changes

In late July, Transocean Inc. announced that it would sell the GSF Arctic II and GSF Arctic IV semisubmersible rigs to Northern Offshore, Ltd. for about $750 million. This is the first major sale since the merger of Transocean and Global Santa Fe last year.

As of July 21, 2008, Ocean Rig ASA was delisted from the Oslo Stock Exchange, following its purchase and privatization by Dry Ships Inc.