SPECIAL REPORT: Shell optimizes new Pinedale completions

Shell Rocky Mountain Production LLC is optimizing drilling, well design, and completions in the Pinedale field in western Wyoming’s Green River basin to increase production and reduce surface disturbance. The company is drilling more than 90 wells in the 150-sq-mile area this year.

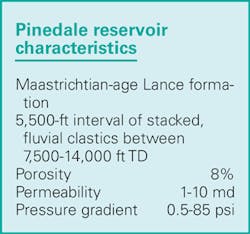

The Pinedale anticline is 35 miles long, 6 miles wide, and produces from upper Cretaceous fluvial shales, siltstones, and sandstones. The California Co. drilled the first well in 1939, but the low permeabilities of the rock and distance to the nearest pipelines precluded production.

Introducing hydraulic fracturing in the 1990s and using multistage fracs have allowed operators to develop Pinedale into the second-largest natural gas field in the US (OGJ, June 25, 2007, p. 39), based on Shell’s estimated recoverable reserves of 25 tcf.

Shell entered the field in 2001 and is the third-largest leaseholder, after Ultra Petroleum Corp. and Questar Corp. Since 2002, Shell has drilled more than 280 wells, performed more than 2,800 frac jobs, and invested more than $1.5 billion at Pinedale.

The company formed its tight gas task force, with an initial focus on Pinedale, to “find, develop, and implement technologies that would assist in unlocking natural gas resources from ultra tight reservoirs (>0.01 md) in North America.”1

Shell discovered that there is no single “silver R&D bullet” that addresses the technical challenges. Producing gas from low and ultralow permeability reservoirs requires an integrated approach that incorporates optimized drilling, completions, and reservoir performance modeling, according to Shell.

Well design

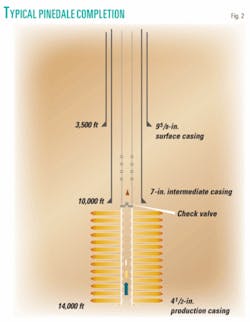

The design of Shell’s Pinedale wells has evolved. The company is drilling directional wells with slimmer profiles (95⁄8-in. surface casing, 7-in. intermediate casing, 4½-in. production casing), using underbalanced drilling techniques, PDC bits, and oil-based mud, according to Operations Manager Geoff Sell. Wells in the field were originally designed with large casing profiles (133⁄8-in. surface, 95⁄8-in. intermediate, 7-in. liner, 4½-in. production), conventional (overbalanced) well control, rock bits, and water-based mud.

The company is also drilling with casing and skidding rigs on drill pads, as part of the effort to reduce the number of surface pads in the field (OGJ, June 16. 2008, p. 19). Most of the anticline is on 10-acre well spacing but may be reduced in future (Fig. 1), says Shell.

Drilling

Drilling Superintendent Tony Harris told OGJ that Shell is using tricone bits, primarily from Hughes Christenson, to drill the 12¼-in. upper section to about 2,500 ft with clear gypsum water. Shell uses PDC bits to drill the remaining hole and usually get about 80 hr/bit. Drillers switch to oil-based mud to handle swelling shales; they see a clear gamma ray marker at about 7,500 ft, he said.

A typical well is drilled directionally, in an ‘S’ shape, to 13,500-14,000 ft MD, using a mud motor with a 1.5º bent sub. The drillers set intermediate casing above the pay, then drill about 5,000 ft vertically (Fig. 2).

Harris said the pressure at the bottom of the productive interval is usually 15-16 lb and Shell drills at 13.5-14 lb for more efficient drilling and ROP.

Sell said Shell typically drills four to six wells and completes multiple wells simultaneously in groups of two to four, alternating perforating and fracturing operations. The company uses Schlumberger and Halliburton coiled-tubing equipment to drill the plugs.

Completion design

Shell uses a commercially available completion modeling software package. Some of the company’s design issues include:

- Subsurface complexity (discontinuous, thin sands).

- Zonal isolation.

- Perforation selection.

- Proppant selection and volume.

- Flow-back time, cleanup.

- Isolation technique, staging, connectivity.

- Cross-sections, production logging tools (run on every well, sometimes multiple PLTs/well).

Mike DeWitt, Shell’s completion superintendent, told OGJ that Shell has run a number of technology trials at Pinedale, including fracing with coiled tubing and different isolation systems, such as the Excape system from BJ Services Co. and Marathon Oil Co.2 “Subsurface complexity has made it very difficult to determine if the technology trials produced measurable improvements in performance,” he said.

Completions

Shell focuses on pay zones from 14,000 ft to 7,000 ft MD, consisting of as many as 50 different sands. Pressures range 11,000-3,800 psi, and permeabilities average 0.005 md.

Each frac interval is 100-400 ft and includes two to four individual sands. The crew pumps slick water and cross-linked gel fluid at an average 35 bbl/min but can range 25-45 bbl/min.

In general, each well will has 15-22 individual frac stages, using an average 105,000 lb of proppant/stage. Shell’s completion superintendent Mike DeWitt told OGJ that about 65-70% of the proppant is 20/40 Ottowa sand, and 30-35% is a mix of intermediate-strength ceramic and economy ceramic. Sell said Shell pumps a “river frac” in the top 3,000-4,000 ft of the reservoir—20/40 sand with slick water. It uses a cross-linked polymer gel for lower intervals.

A few years ago, Shell experimented with trailing-in resin-coated sand but did not see a noticeable benefit, said Sell. Shell trucks all proppants north from Rock Springs, the closest railhead.

Shell filters produced water and reuses it for hydraulic fracturing. The company plans to increase the amount of water available for reuse.

Shell typically fracture stimulates wells about 2 weeks after getting the drilling rig off location (Fig. 3). Preparing the location includes checking the plugback TD, cement bond log, and spotting water tanks. The completion follows a set process:

- Perforate stage 1.

- Mobilize hydraulic fracturing crew.

- Frac stage 1 with no flow-back.

- Plug; perforate stage 2.

- Frac stage 2 with no flow-back.

- Plug; perf; frac; repeat up to 22 stages.

- Flow back upper zones until coiled tubing is rigged up.

- Drill out composite plugs with CT. All gas to sales; minimal flaring.

- Flow well 6-8 days to clean up.

- Hand off well to production.

Wells typically flow for 6 months to 18-24 months before liquid loading begins to require tubing installation. Shell generally installs 23⁄8-in.-diameter jointed tubing in the initial workovers. Only a handful of wells have plunger lift systems. Sell told OGJ that Shell will try running 1¼-in. diameter CT strings inside 23⁄8-in. tubing.

Operations

A typical Pinedale well completed in the Upper Cretaceous MesaVerde and Lance sands has 16-18 frac stages in 8-9 days. Sell told OGJ the company sees about 20%/year inflationary cost increases but is “leveraging our size to reduce costs.”

In 2007, Shell ran 8 rigs, drilled 80 wells, completed 75 wells, and performed 1,409 frac jobs. US onshore asset manager David Todd said that rig crews were consistently delivering “sub-30-day wells” in 2007 and that the best performance in 2008 was a well completed in 18.2 days. Todd said that sub-20-day wells were consistently possible.

This year, the company is drilling more than 90 production wells using 8 Nabors rigs. There are about 20 other rigs working in the field this year; Questar operates 11-12 and plans only 26 production wells for the year (OGJ, Mar. 3, 2008, p. 37).

After 6 years of operations at Pinedale, Shell sees significant improvement in total completion cost, cycle time, and individual frac stage cost.

Shell considers itself “the low-cost driller” at Pinedale. Todd said the company will be successful through its application of technology, economies of scale, and integration of drilling, completion, and reservoir modelling. Margins are tight, and “the low-cost emphasis is always going to be part of the formula for success here.”

References

- Bickley, John, Brake, Candace Beck, Caputi, Mike, et al., “Meeting the Pinedale Challenge,” AAPG Hedberg Conference, Understanding, Exploring and Developing Tight Gas Sands, Vail, Colo., Apr. 24-29, 2005.

- Bailey, Alan, “Shooting for more pay—Marathon Excape well technology evolves from Cook Inlet into wider application,” Petroleum News, Vol. 13, No. 20, May 18, 2008, www.petroleumnews.com.