COMMENT: Iraq takes licensing step, but E&P fiscal policy murky

The invitation extended early this month by Iraq’s Ministry of Oil to international oil companies (IOCs) to preregister by Jan. 31 for exploration and production licensing rounds has no doubt attracted much interest in the industry (OGJ Online, Jan. 3, 2008).

In its announcement, the ministry requested the applicant companies to provide a comprehensive list of information, from company bylaws to tax compliance record to HSE policy. The ministry will use the information to select those companies that will be allowed to compete for upstream projects in the country. The scope of information requested for qualification may set a new standard in the industry.

But IOCs are still mainly in the dark as to Iraq’s fiscal policy. Timing of the first licensing round is also unclear.

A festering dispute

A long-festering dispute between the federal government and the autonomous Kurdistan Regional Government (KRG) in the north concerning the oil sector has kept the federal government from enacting a petroleum law for upstream projects. The federal government, dominated by Arab leaders, wants centralized control of the oil sector. In contrast, KRG wants decentralized control. There are also differences as regards the contracting terms.

KRG has passed its own (regional) petroleum law and has signed a number of E&P contracts with foreign companiese.g., DNO, Genel Enerji/Addaxputting the central government in an awkward position.

Because of the dispute, a draft federal petroleum law approved by Iraq’s cabinet in February 2007 went nowhere.

Last November Iraqi Oil Minister Hussain Al-Shahristani criticized foreign oil companies making deals with KRG (OGJ, Dec. 3, 2007, Newsletter). According to a Jan. 10 United Press International report, the leader of the Iraqi Parliament’s Energy Committee, Abdul Hadi al-Hassani, accused Iraq’s Kurdish leadership and the national ministerial council of stalling the petroleum law, repeating the national government’s position that the KRG deals are illegal.

The oil ministry apparently decided to issue a prequalification invitation ahead of a final petroleum law because it felt the urgency to act in the face of developments in northern Iraq. Exploratory drilling in the KRG territory has uncovered some prolific finds, presaging early production. Export outlet remains a problem, however. KRG contractors are not allowed to use the Kirkuk pipeline heading north. Although some crude from new discoveries has found its way to Iran by tanker transport, major development and significant export must await rapprochement with the national government.

Contracting policy

Although details of Iraq’s petroleum law are uncertain, the general thinking of the national government on this subject can be gleaned from a presentation delivered in Dubai last September by N.K al-Bayati, director general of petroleum contracts and licensing, Ministry of Oil.

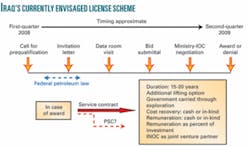

According to el-Bayati, the government’s preference is service contracts (see figure). It is noted that IOCs would favor production sharing contracts (PSCs) but that the government, given the political and economic culture, considers PSCs unsuitable for Iraq.

Evidently, the government feels that the profit oil split embodied in the PSC model would compromise state ownership of oil and gas (notwithstanding that the net “take” valuesgovernment vs. IOC sharesunder the service contract and PSC could be similar). The service contract model was used in a limited fashion in Iraq after nationalization in 1972.

A 15-20 year service contract with the option for additional lifting is foreseen, with cost recovery and remuneration in cash (“basically”) or in-kind. Remuneration would likely be a percentage of the investment. The contractor would bear the risk and carry the government through exploration, if applicable.

Iraq National Oil Co. (INOC) would have the right to form joint ventures (up to 50% interest) with contractors in development and production projects. Whether INOC would fully share the related costs, or would be partially carried by the contractor, is not clear.

No mention is made of any bid fee, of possible consequences of cost overrun, of delay or underperformance in production, cost recovery limit, payout, allowed rate of return, etc. The duration of the contract is generous compared to the Iranian buyback scheme.

The service contract approach stands in contrast with the PSC approach adopted by KRG.

All licensing rounds, whether at the federal or regional level, would be referred to a Federal Oil and Gas Council (FOGC) that would have the authority to review and approve contracts. FOGC would also set priorities on exploration blocks and fields to be tendered. Regional authorities would make proposals to the federal government and hold licensing rounds in their territories using model contracts drawn up by FOGC. (Currently the KRG territory is the only “region” in the federal structure).

INOC would play a key role in dealings with the IOCs and carry out upstream activities on its own.

Somewhat unusually, two separate committees, one for exploration blocks and the other for fields, would handle bid evaluation and negotiation.

Long-awaited round

Preceded by a preregistration invitation, a long-awaited E&P licensing round by Iraq’s oil ministry thus may be in the offing. But in the absence of a federal petroleum law, contractual terms remain sketchy. IOCs will gauge their interest in Iraqi licensing according to the fiscal terms offered. A federal petroleum law, embodying the service contract as the dominant if not the sole model, will likely be enacted within the next few months.

Indications are that the initial licensing round will include few exploration blocks and fields to test the efficiency of the new system and assess investor response.

How the legal status of KRG’s contracts will be handled in the federal law remains to be seen. It is expected that the federal law will acquiesce to these contracts but ban similar contracts in the future. IOCs deemed “errant” may be excluded from future licensing rounds.

Overriding all these developments is the certainty that no real progress in Iraq’s licensing rounds can be expected until the security situation improves.

The author

Ferruh Demirmen ([email protected]) is an independent petroleum consultant and lecturer in Houston, dealing mainly with reserves and economic issues. He retired from Royal/Dutch Shell after a long international career, mainly in production. He holds a PhD in geology from Stanford University.