CGES: World needs more OPEC crude

The world needs more crude oil priced at a level that makes it economic to refine, said analysts at the Centre for Global Energy Studies (CGES), London.

CGES squarely places the blame for today’s tight oil market on the Organization of Petroleum Exporting Countries. The organization continues to assert that the world is well supplied with crude and refuses to accept that production needs to rise, CGES said in its latest Monthly Oil Report.

The report refutes the assertion that the market has enough oil, pointing out that global oil inventories fell for six consecutive quarters between the fourth quarter of 2006 and the first quarter of this year.

OPEC shows no signs of being willing to increase its own production, as it continues to blame high oil prices on factors other than its own production policy, including the weak US dollar, geopolitics, and market speculators, CGES said.

While OPEC forecasts 2008 production growth outside the organization at 560,000 b/d, first-half production was down 330,000 b/d. This implies a surge in non-OPEC output of 1.45 million b/d in the second half.

CGES also said refinery runs will rise only if it becomes profitable to process the marginal barrel of supply without cracking it, since margins on straight-run processing are poor due to weak gasoline and fuel oil markets. Currently refineries are running at capacity of their upgrading units but not to capacity of their distillation units, according to the report.

“In the absence of additional supply, only a global recession, destroying enough demand to reduce the need for OPEC oil, can set prices on a downward path. It is a bleak picture and one that has OPEC’s production policy among its key features,” CGES said.

USGS: Arctic holds 90 billion bbl of undiscovered oil

The area north of the Arctic Circle contains an estimated 90 billion bbl of undiscovered, technically recoverable crude oil, reported the US Geological Survey July 23 as it released its first petroleum resource estimate of the region.

The Arctic, especially offshore, is essentially unexplored with respect to petroleum, it noted.

The region also contains an estimated 1,670 tcf of technically recoverable gas and 44 million bbl of technically recoverable natural gas liquids in 25 geologically defined areas thought to have petroleum potential, the US Department of the Interior agency said.

It said the resources represent about 22% of the world’s undiscovered, technically recoverable petroleum resources (about 13% of the oil, 30% of the gas, and 20% of the gas liquids). About 84% of the estimated resources are offshore, USGS said.

USGS said the appraisal was part of a project to assess global petroleum basins using standardized and consistent methods and controls. USGS said it worked with a number of international agencies to geologically analyze the Arctic provinces.

“Before we can make decisions about our future use of oil and gas and related decisions about protecting endangered species, native communities, and the health of our planet, we need to know what’s out there. With this assessment, we’re providing the same information to everyone in the world so that the global community can make these difficult decisions,” USGS Director Mark Myers said.

The assessment said more than half of the undiscovered oil resources are believed to be in just three provinces: Arctic Alaska, the Amerasia basin, and the East Greenland Rift basins. Gas is estimated to be three times more abundant than oil in the Arctic on an equivalency basis, with more than 70% of it occurring in the West Siberian basin, the East Barents basins, and Arctic Alaska, it indicated.

Brazil to update oil law in wake of discoveries

Brazil’s ministry of mines and energy has created a new working group that will aim to update the country’s existing oil law, according to a senior government official.

“This group is studying the legislation of several countries, especially those which have a monopoly, and we are going to make a proposal to change the current law,” said Mines and Energy Minister Edison Lobao.

The minister said every country changes the rules whenever new discoveries are made and that “Brazil can’t be different.” However, he acknowledged that there are interests intent on maintaining “the status quo.”

Lobao, who said the changes are in the interests of the Brazilian people, was apparently referring to criticism of the proposed changes voiced by Petroleo Brasileiro Chief Executive Jose Sergio Gabrielli.

Noting that 60% of Petrobras’s capital is private, while only 40% is held by the government, Lobao said Gabrielli represents a private company and, as such, is fighting for Petrobras’s interests.

Lobao also gave assurances that the recently proposed creation of a new company to manage subsalt oil reserves will not result in a breach of existing contracts.

“This is an initial idea but, in my view, all contracts will have to be maintained,” he said. “What we seek is a new formula.”

Earlier this week, it was reported that Lobao plans to propose to President Luiz Inacio Lula da Silva the creation of a new state-run firm that would manage oil discoveries made in recent months in the subsalt layer of the Santos basin (OGJ Online, June 30, 2008).

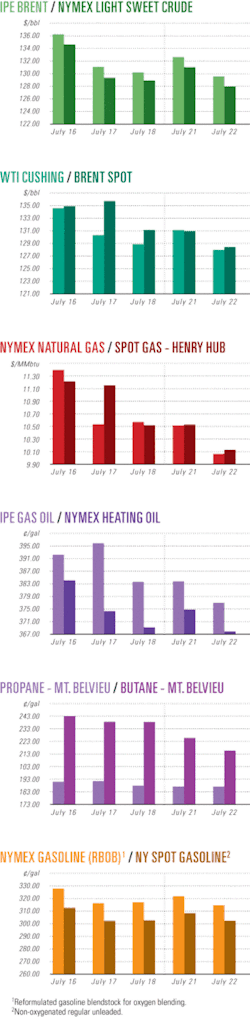

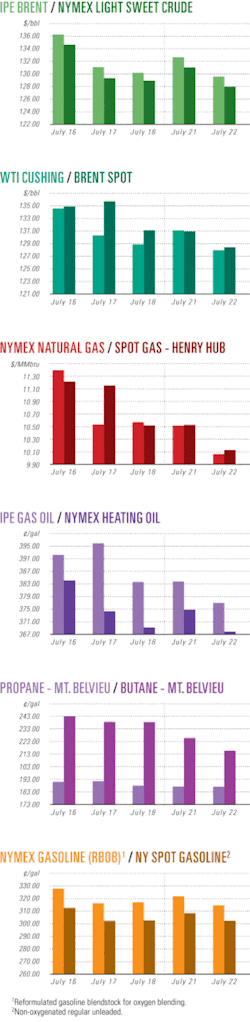

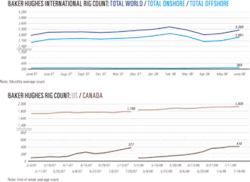

Industry Scoreboardnull

null

null

Exploration & Development – Quick TakesChina to Exxon: pull out of Vietnam exploration deal

The Chinese government has warned ExxonMobil Corp. to pull out of an exploration deal off Vietnam, describing the project as a breach of Chinese security, according to a Hong Kong newspaper.

The Sunday Morning Post, citing sources close to the firm, said Chinese diplomats in Washington, DC, have made repeated verbal protests to ExxonMobil executives in recent months, warning them that its future business interests on the mainland could be at risk.

The protests are said to involve a preliminary cooperation agreement between state oil firm Petrovietnam and ExxonMobil covering exploration in the South China Sea off Vietnam’s south and central coasts.

ExxonMobil is confident of Vietnam’s sovereign rights to the blocks it would be exploring, the paper’s sources said–those off central Vietnam start at the coastline–but it could not dismiss China’s warnings out of hand.

“If it was simply a legal question it would be easy,” one of the sources said. “Vietnam would probably prevail in international mediation. But it’s political, too. China’s concerns make the situation much more complicated for a company like Exxon.... China is a very important player in the international oil industry.”

The Chinese envoys based their protests on Beijing’s historical claim to virtually all of the South China Sea, the source said. Both countries claim the entire Paracels and Spratlys archipelagos and much of the surrounding waters.

Vietnam bases its claims on its extensive continental shelf and the exclusive economic zone. This allows it to stake out according to the United Nations’ International Law of the Sea. China’s claim is legally vaguer, independent academics say.

An ExxonMobil spokesman refused to discuss any approaches from China, saying only that the firm is evaluating a “business opportunity, and sovereignty is a matter only governments can address.”

Carl Thayer, a Vietnam-watcher at the Strategic and Defense Studies Centre of Australian National University, said Vietnam’s sovereignty was “under threat” and that Hanoi was struggling to deal with the situation.

“Chinese hard power is once again part of the equation, as far as Vietnam is concerned,” he said, adding that China may be trying to push Vietnam towards a joint exploitation deal like the one struck with Japan in the East China Sea.

Rift makes gas find in Papua New Guinea

Rift Oil PLC has discovered 48.5 m of net natural gas pay in its Puk Puk-1 wildcat in the forelands onshore Papua New Guinea.

The company reports that this result is 50% more than predicted and twice the thickness of the interval found in the Douglas-I wildcat drilled last year in the same permit, PPL235.

Puk Puk-1 was targeting an estimated predrill recoverable reserve of 226 bcf of gas.

The gas was found in the Toro, Upper Hedinia, and Lower Hedinia sands. Downhole sampling also recovered significant condensate, raising the possibility of an oil reservoir at depth in this structure, or at least potentially to be found in surrounding features.

Rift now plans to remap the Puk Puk structure and flow-test the well.

If the test is successful, the new find bodes well for the company’s two gas development options for this area. Rift has signed an agreement with Flex LNG to use a floating LNG facility in the Papuan Gulf as one alternative.

It also has signed a nonbinding memorandum of intent with Alcan Australia to potentially supply Alcan’s alumina plant at Gove in the Northern Territory of Australia with 40 bcf/year of gas for 20 years.

Key confirms Tanzanian find commercial

Key Petroleum Ltd.’s Kiliwani North-1 natural gas discovery in Tanzania has been declared a commercial development option.

Flow testing of the well confirms the earlier announcement of a flow of 40 MMcfd.

Perth-based Key adds that there was zero drawdown of bottom hole pressure during the test. This and other pressure data plus laboratory analysis satisfied Key that the well and the field are commercially viable.

The company has a 20% interest in the find.

Key says that the Nyuni block that surrounds the discovery has substantial upside potential including a number of untested leads and prospects in the vicinity.

The potential encompasses prospects in the range of up to 500 bcf of gas in place. Total undiscovered gas in the block could be more than 2 tcf.

Development plans for Kiliwani North-1 include construction of a pipeline to connect with the neighbouring Songo Songo gas field processing plant.

Key added that seismic and drilling data are still needed to assess further global growth prospects in the region.

Drilling & Production – Quick TakesTaiwan to invest in Canadian oil sands

Taiwan’s state-owned CPC Corp. on July 17 signed a memorandum of understanding with Canadian-based Indian Oilsands Corp., paving the way for a possible partnership on oil sands development in Alberta. CPC Vice-Pres. Arthur Kung and Indian Oilsands representative Ken Thomas signed the MOU in Taipei.

CPC plans to budget $792 million for a 5-year exploration program. Company officials say the project is part of an effort to diversify energy sources and stabilize domestic energy supplies in face of the continued rise in global oil prices.

Formosa Petrochemical Corp., a member of the Formosa Plastics Group, also is studying a plan to tap Canada’s oil sands and intends to send an inspection delegation to Alberta.

Pemex production rises after pipelines repaired

State-owned Petroleos Mexicanos (Pemex) said it increased production by 41,000 b/d in June to 2.84 million, a slight improvement over May but still below the company’s target of 2.9 million b/d for 2008.

Pemex said the improvements came after it repaired an offshore pipeline in the Southeast marine region. The repairs enabled an 11.5% increase in June to 535,937 b/d.

Still, June production remains 11.5% lower than the same period a year ago, when Mexico produced 3.21 million b/d.

Earlier this week, Pemex said its average daily oil production in the first 6 months of 2008 fell 9.7% from the year-ago period, producing an average of 2.86 million b/d of crude oil in the first half of this year.

Pemex said output at Cantarell, its largest source of crude oil, was 1.15 million b/d, a decline of some 457,000 b/d from the same period in 2007. In June, it said, Cantarell production fell by 25,849 b/d to 1.05 million b/d.

Apart from the decline at Cantarell, Pemex production also has been hurt by the need to shut in wells that have started to produce large amounts of water. The company is said to be struggling to establish water separation facilities to enable continued production at such wells.

While crude production remains below target, natural gas output in the first half of the year rose 13.3% to 6.723 bcfd. Gas production also rose to a record 7.02 bcfd in June, up from 6.85 billion in May and 6.19 billion in June 2007.

Pemex said it is producing more gas at Cantarell, where gas is moving into wells that formerly produced oil. Gas output at Cantarell rose 4.9% in June to 1.67 bcf.

Karachaganak oil now subject to export tax

Kazakhstan, apparently reversing an earlier ruling, has announced that the consortium developing Karachaganak gas field must pay a new oil export duty.

“Karachaganak has become a payer of the export duty,” said Deputy Finance Minister Daulet Yergozhin, referring to the consortium comprised of Eni SPA 32.5%, BG 32.5%, Chevron Corp. 20%, and Lukoil 15%.

Yergoshin also said the finance ministry soon plans to expand the list of 38 eligible companies announced in May when the government established the export duty.

The export tax, introduced on May 18, comes to $109.91/tonne of crude oil or $27.43/tonne for those who pay royalties for exported oil and gas condensate. The customs duty for heavy distillates, coke, and bitumen exports is $82.20/tonne.

At the time, the BG-Eni consortium and the Chevron-led Tengizchevroil joint venture both were excluded from the list due to their long-term contracts with the government under which they were considered exempt from any additional taxes.

The Karachaganak consortium’s operations are regulated by a production-sharing agreement signed in 1997 by the Kazakh government and the group. The consortium has the right to continue operating the fields until 2038.

However, at the end of May, Kazakh Finance Minister Bolat Zhamishev said that all subsurface resource producers might have to pay the crude export duty.

The consortium faced threats of closure when the Kazakh customs control department in Atyrau would not sign off on an oil export declaration for June. It said the ministry of energy and mineral resources had not provided notification of whether the consortium had to pay the export duty.

One official had said at the time that if the issue were not resolved, Karachaganak might have to halt exports on the Caspian Pipeline Consortium (CPC) pipeline.

At that time the consortium faced a choice, he said: either it paid the duties for June in order to keep exports flowing, or it defended its position, in which case the CPC pipeline might be closed to it.

Chevron considers Big Foot development options

Chevron USA Inc. has hired Intec Engineering for a pre-FEED (front-end engineering and design) study concerning development options for the Big Foot project in the Gulf of Mexico.

Big Foot lies in more than 5,000 ft of water on Walker Ridge Block 29, 225 miles south of New Orleans and 180 miles offshore (OGJ, Feb. 11, 2008, Newsletter).

The development study, expected to be completed in the fourth quarter, will evaluate various types of subsea systems as potential alternatives.

Intec said a key aspect involves researching subsea boosting options.

Chevron owns 60% working interest in Big Foot. Partners are StatoilHydro AS 27.5% and Shell Gulf of Mexico Inc. 12.5%.

Processing – Quick TakesPetroVietnam lets Nghi Son refinery design contract

State-owned PetroVietnam has awarded Foster Wheeler a contract to design the 200,000 b/d Nghi Son refinery and petrochemical project, effective July 18.

Under the contract, Foster Wheeler will finish the designing in 16 months from the day the contract came into force. Scheduled for completion in 2013, the refinery is expected to meet 60% of Vietnam’s domestic demand for gasoline and other products.

The Nghi Son project will import oil from Kuwait to produce high-quality products.

The award coincided with reports that Vietnamese Prime Minister Nguyen Tan Dung has asked contractors of the Dung Quat refinery project in central Quang Ngai province to speed up construction to ensure the planned February 2009 start up.

While visiting the construction site on July 19, Dung reminded lead contractor Technip and its subcontractors of the coming flood and storm season and asked them to keep a close eye on the progress of the project.

Meanwhile, Vietnam National Petroleum Corp. (Petrolimex) has recently received approval from central Khanh Hoa province to build a $4.5 billion refinery in the region.

According to Petrolimex Chief Executive Vu Ngoc Hai, the plant will have a capacity to refine 10 million tonnes/year of oil.

Petrolimex has chosen Sinopec as a partner to carry out the project, and the two sides are said to have discussed setup of a joint venture as well as stake equity to be owned by each party.

Petrolimex also is working with PB Tankers Ltd. of Singapore and the Petrolimex Insurance Joint Stock Co. (PIJSC) to build Vietnam’s first bonded warehouse for petroleum.

The depot is an investment of the Van Phong Warehouse Co. Ltd., a joint venture of Petrolimex, PIJSC, and PB Tankers.

Construction on the facility began in December 2007 in the Van Phong Economic Zone in Ninh Hoa district of central Khanh Hoa province.

Nguyen Van Que, director of Van Phong Warehouse, said the project has two phases, with the first phase costing $100 million over 18 months.

The depot will be capable of holding 500,000 cu m of petroleum in Phase 1 and a further 500,000 cu m on the completion of Phase 2. No date has been given for the completion of the second phase.

Van Que said the depot would be equipped with “the latest environmentally friendly technology and would be able to handle 150,000-dwt oil tankers.”

PetroRabigh refinery upgrades near completion

Rabigh Refining & Petrochemical (PetroRabigh), a joint venture of Saudi Aramco and Sumitomo Chemicals, plans to complete the $10 billion upgrades to its 400,000 b/d refinery and petrochemical complex in Rabigh, Saudi Arabia, in the fourth quarter.

The project will raise output of transportation fuel and make the refinery the basis of a complex producing 2.4 million tonnes/year of petrochemical solids and liquids, along with large volumes of gasoline and other products (OGJ, Mar. 13, 2006, Newsletter).

Upgrades to the facility, originally built by the joint venture partners in 2005, will add a 60,000 b/d gasoline refining unit, a 200,000 b/d vacuum distillation unit, a 92,000 b/d catalytic cracking unit, and a 26,000 b/d alkylation unit.

The refinery also will see the addition of an ethane cracker capable of producing 1.25 million tonnes/year of ethylene as well as a gas processing plant that will produce 900,000 tonnes/year of propylene.

Transportation – Quick TakesAlaska Senate to consider natural gas pipeline

The Alaska House of Representatives approved a state license for TransCanada Corp. to pursue federal certification for a 1,715-mile natural gas pipeline. The Alaska Senate has yet to consider and vote on the measure.

The state’s Senate must make its decision before Aug. 2 on Gov. Sarah Palin’s Alaska Gasline Inducement Act. The AGIA established state requirements for companies interested in building a pipeline.

If the legislature grants a license to TransCanada, that still does not guarantee pipeline construction. A license would provide up to $500 million in state startup money for TransCanada to begin the lengthy, costly process toward federal certification for a pipeline.

Under AGIA, TransCanada was one of five companies that applied and the only one that satisfied the guidelines, Palin has said previously. The Alaska House passed HB 3001 with a vote of 23 to 16.

Meanwhile, BP PLC and ConocoPhillips are working on a pipeline proposal called Denali. They announced Apr. 8 plans to build a 4 bcfd gas pipeline that would extend from the Alaska North Slope to Canada and potentially on to the US (OGJ, Apr. 14, 2008, p. 30).

BP and ConocoPhillips called the proposed Alaskan gas line the “largest private-sector construction project ever built in North America.” They plan to spend $600 million over the next 36 months on an open season, which is slated to begin before yearend 2010.

Holly, Centurion agree to W. Texas pipeline reversal

Holly Refining & Marketing Co., Dallas, has entered into a definitive agreement to ship crude oil on the Centurion pipeline, operated by a subsidiary of Occidental Petroleum Corp., to supply its Navajo Refining Co. LP refinery in New Mexico. Centurion has a 16-in. OD and is 375 miles long.

The agreement follows a 30-day open season held by Centurion starting Apr. 14 to determine interest in reversing the pipeline, which had been running from West Texas to Cushing, Okla. (OGJ Online, Apr. 25, 2008). The line to be reversed, known as the No. 1 Pipeline, is one of two 16-in. lines Centurion operates between Slaughter, Tex., and Cushing.

The No. 1 line will now deliver crude from Cushing to Slaughter, near the Texas-New Mexico border. Holly said it will build a 70-mile pipeline between Slaughter and Navajo and is considering both its physical properties and whether the line will be built by Holly Refining & Marketing or Holly Energy Partners. Holly has shipping commitments in place on TransCanada’s Keystone and Enbridge’s Spearhead pipeline to transport heavy crude from Canada to Cushing. Holly hopes to have both the reversed pipeline and the 70-mile line in service as early as fourth-quarter 2009, with a projected capacity of 60,000 b/sd.

Holly is implementing capital improvement projects on the Navajo refinery to increase its feedstock flexibility with an eye toward processing as much as 40,000 b/sd of heavier Canadian crudes. These projects are expected to be completed in fourth-quarter 2009. Holly is also expanding Navajo’s overall capacity to 100,000 b/sd from 85,000 b/sd and expects this work to be mechanically complete by first-quarter 2009.