Energy price hikes are two thirds of CPI’s 1% June rise

The Consumer Price Index rose 1% in June as its energy component increased sharply for a second consecutive month, the US Department of Labor’s Bureau of Labor Statistics reported July 16.

The energy index’s 6.6% increase on a seasonally adjusted basis in June accounted for about two thirds of the overall increase for all items during the month and followed a 4.4% increase in May, it said. “The index for petroleum-based energy advanced 10%, and the index for energy services rose 1.5%,” BLS said. The energy index’s 29.1% increase during 2008’s first 6 months accounted for about half of the overall total growth as energy commodity prices climbed 34.7% and energy services prices rose 20.1%, it indicated.

The latest CPI report to Congress came one day after the Federal Reserve Board said steep increases in commodity prices boosted consumer price inflation in a sluggish US economy during the first half.

A decline in the dollar’s foreign exchange value increased import prices, putting upward pressure on inflation, the Fed continued.

El Paso settles SEC reserve reporting charges

El Paso Corp. and five former employees settled federal charges of inflating reported proved oil and gas reserves in violation of federal securities antifraud laws, the US Securities and Exchange Commission said July 11.

The fiveRodney D. Erskine, a former president of El Paso’s exploration and production division; Randy L. Bartley, a former El Paso E&P senior vice-president; and Steven L. Hochstein, John D. Perry, and Bryan T. Simmons, former El Paso E&P vice-presidentsagreed to pay fines of $40,000-$75,000 without admitting or denying the allegations.

The complaint charged that during 1998-2003, El Paso and the employees inflated oil and gas reserves, overstated the Houston company’s standardized measure of future cash flows, and overstated capitalized costs related to its oil and gas production.

In 2004, El Paso restated its financial statements for 1999-2002 and for the first 9 months of 2003. It reduced its previously reported total proved reserves by 2.2 tcf of natural gas equivalent for the end of 2002; 3.3 tcfe at yearend 2002; and 3.3 tcfe at yearend 2001. It also reduced its previously reported standardized measure of future cash flows.

The restatements reduced El Paso shareholders’ equity as of Sept. 30, 2003, by $1.7 billion, according to SEC. Two subsidiaries, El Paso E&P and El Paso CGP Co. LLC, also restated previously issued financial statements to correct material overstatements of proved oil and gas reserves, standardized measures of future cash flows, and capitalized costs relating to oil and gas production activities, it said.

Bingaman urges DOI to push lessee development

Energy and Natural Resources Committee Chairman Jeff Bingaman (D-NM) and 30 other US Senate Democrats urged Interior Secretary Dirk A. Kempthorne to act immediately to encourage development of federal oil and gas leases totaling millions of acres.

“Federal lands both onshore and on the Outer Continental Shelf that are already leased, but not producing, are our biggest opportunity to provide needed oil and gas supply in the near term,” the lawmakers said in a July 15 letter to Kempthorne. “We are concerned that policies of the [US Department of the Interior] do not result in the timely production of these resources.”

The message reflected congressional Democratic sentiment that access to additional federal acreage should not be granted to oil and gas producers if they are not diligently developing tracts they already have leased. US Minerals Management Service officials and producers have said that this mandate does not recognize the time it takes to evaluate a lease once it has been granted or capital, equipment, and personnel constraints.

Bingaman and the other senators, including Majority Leader Harry M. Reid (D-Nev.), asked Kempthorne to immediately clarify that oil and gas producers holding federal leases are required to diligently develop the tracts and asked him to exercise his full authority for appropriate OCS lease term lengths and lease rates and require lessees to regularly report their progress in diligently developing the tracts.

Recent lease sales failed to generate bids for major OCS tracts that are already available, including about 300 million acres in the Gulf of Mexico, the letter added.

Kazakh sulfur must be stored indoors by 2010

Kazakhstan said Chevron-led Tengizchevroil must store its open-air sulfur stocks indoors by 2010. The company said it is working on ways of storing sulfur indoors and plans to cut stocks significantly by 2017. Last year, a court imposed a 74 billion tenge fine on Tengizchevroil but later reduced it by 50% (OGJ, Oct. 12, 2007, p. 30).

The government reportedly also reversed another earlier decision and could try to impose export duties on Tengizchevroil oil.

Tengizchevroil produces some 300,000 b/d of crude oil, which accounts for 20% of Kazakhstan’s total oil production. It plans to increase total capacity to 400,000 b/d following the first phase expansion of 90,000 b/d, while the start-up of full facilities in this year’s second half will further increase production capacity to 540,000 b/d (OGJ Feb. 4, 2008, Newsletter).

The Tengizchevroil partners include Chevron 50%, KazMunaiGas 20%, ExxonMobil Kazakhstan Ventures Inc. 25%, and LUKArco 5%.

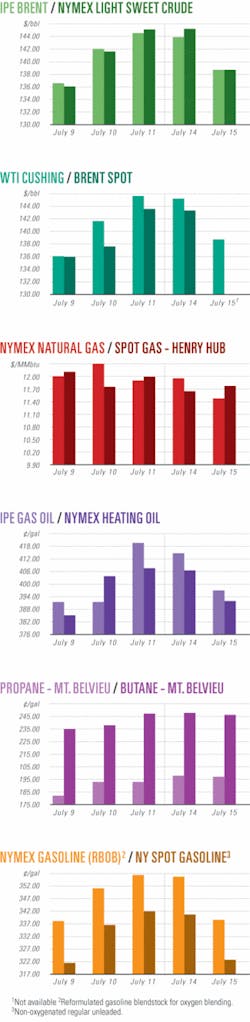

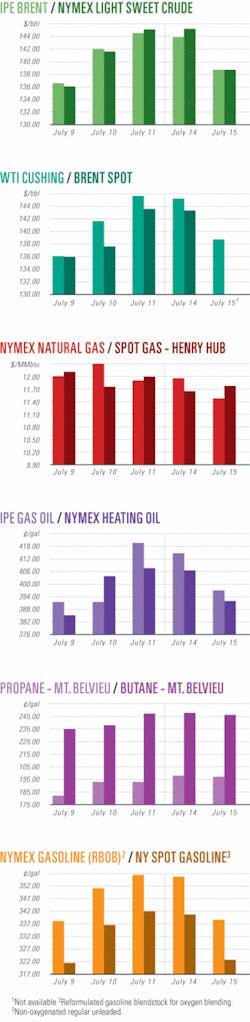

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesBrazil likely will hold two lease auctions in 2008

Brazil likely will hold two auctions for oil and gas exploration blocks in 2008, but will exclude rights to blocks in the presalt layer until passage of a new regulatory law.

“We are going to promote the resumption of the Eighth Round, and also hold another auction that will involve land areas and the fringes of the presalt area,” said Mines and Energy Minister Edison Lobao. “An auction including the presalt area will be held only after a new regulatory law has been passed.”

He said 15 exploratory drillings have been made in Brazil’s presalt area, but additional wells must be drilled to determine the area’s status.

Lobao told the state news agency that the government by early 2009 will have found a solution to the oil sector rule changes planned for exploitation in subsalt areas.

It recently was reported that Lobao plans to propose the creation of a new state-run firm that would manage oil discoveries made in recent months in the subsalt layer of the Santos basin (OGJ Online, July 7, 2008).

GeoPark tests oil from Chile’s Fell block wildcat

GeoPark Holdings Ltd. discovered an oil field in Chile’s Fell block following drilling and testing at its Aonikenk 1 exploration well.

GeoPark said a production test in the Springhill formation at 2,270 m in a 5-m perforated interval, flowed without stimulation. GeoPark, Hamilton, Bermuda, said the rates were 1,201 b/d of oil, 1.2 MMcfd of gas, and 1,465 b/d of water through a 12-mm choke and with a wellhead pressure of 896 psi.

“These are preliminary results following a 6-day production test, and further production history will be required to determine stabilized flow rates from this well and the extent of the reservoir,” GeoPark said.

It said 30° gravity oil is transported via trucks to a tank facility near the Fell Block. Engineering is under way on necessary processing and sales facilities.

GeoPark said geological and geophysical interpretations suggest opportunity for further development drilling in Aonikenk field, and that “a new drilling location has been selected to be drilled in fourth-quarter 2008.”

According to CEO James F. Park, “The Aonikenk oil discovery also opens up a new potential oil region in the northeast portion of the Fell Block, which will be further developed and explored with additional drilling this year.”

In June, GeoPark discovered two new gas fields, with wells Nika Oeste-3 and Bump Hill-1, on the Fell Block. The Nika Oeste-3 well was drilled to 3,023 m TD, and at 2,960 m, produced test flows of 133,089 cu m/day of gas, 70 b/d of condensate, and 14 b/d of water.

At a different geological structure, GeoPark’s Bump Hill-1 well was drilled to 2,979 m TD. This well produced test flow rates of 25,485 cu m/day of gas plus small quantities of condensate and water.

GeoPark said the preliminary results needed further testing to determine stabilized flow rates and the size of the reservoir.

Last December, GeoPark reported success at the San Miguel-1 exploration well on the 440,000-acre Fell Block. The well, on a structure defined in GeoPark’s 2006-07 3D seismic program, gauged 3 MMcfd of gas, 65 b/d of condensate, and 35 b/d of water from Cretaceous Springhill at 3,020 m through a 10-mm choke with 980 psi wellhead pressure (OGJ Dec. 21, 2007, p. 34).

Range boosts Marcellus shale high-grade acreage

Range Resources Corp. said it has drilled more than 100 wells in the Marcellus shale play in the Appalachian basin, including 20 horizontal wells, and has increased its high-graded acreage position to 850,000 net acres out of 1.4 million acres total.

Previously, Range had high-graded 700,000 acres of the Marcellus. The 850,000 acres includes acquisitions expected to close shortly.

John Pinkerton, Range’s chairman and chief executive, said Range continues to accelerate both its drilling and acreage acquisition efforts in the Marcellus shale. Range anticipates that Marcellus production ramp up will begin primarily in the play’s southwest region where 60% of its high-graded acreage position lies. Pipelines and processing plants are being built.

Range has three rigs operating and plans to drill 40 horizontal wells in 2008. Wells are being drilled, completed, tested, and shut in awaiting pipeline construction.

Production is expected to reach 30 MMcfd in the first quarter of 2009. The last 10 reported horizontal wells had an average peak initial rate of 4.1 MMcfd equivalent.

Range estimates gross average reserves of 3-4 bcfe/horizontal well. The Fort Worth independent revised upward its estimate of the unrisked reserve potential of its leasehold position to 22 tcf from 15 tcf.

Shell awards Oceaneering Perdido subsea works

Shell Oil Co. recently awarded a contract to Oceaneering International Inc., Houston, for fabrication and installation of subsea equipment on Shell’s ultradeepwater Perdido Regional Development project in the Gulf of Mexico.

Engineering and fabrication are under way for 29 flowline and well jumper spools, a pipeline tie-in sled, and related products. Installations are scheduled to begin later this year using Oceaneering’s dynamically positioned vessels, including the Olympic Intervention IV (OI IV).

The Perdido development is 200 miles south of Freeport, Tex., in 7,800 ft of water. Some production wells will be in water as deep as 10,000 ft.

Drilling & Production Quick TakesBP signs contract with Parker

BP Exploration Alaska Inc. (BPXA), a division of BP PLC, has signed a contract with Houston-based Parker Drilling Co. to build, deliver, and commission a new ultraextended-reach drilling rig for the Alaskan Beaufort Sea that will be able to drill wells nearly 2 miles deep and with offsets as long as 8 miles. Some planned measured depths exceed current records (OGJ, Oct. 2, 2006, p. 37).

BP will own the land-based rig and intends to use it to drill as many as six extended-reach wells into offshore Liberty field beginning in 2010. BPXA expects oil production to begin in 2011, ramping up to 40,000 b/d, with an ultimate recovery of 100 million bbl oil.

The construction and commissioning contract is the second phase of Liberty field’s development. Parker anticipates that gross margins through Phase 2 of the drilling rig project will be $14-18 million, about 1% of the overall Liberty development cost, which BPXA anticipates to be about $1.5 billion.

Parker previously completed a 2006-07 front-end engineering and design contract to design the rig (Phase 1) and was authorized to procure long lead items. One of the design requirements was the ability to drill wells out to 8.3 miles (43,824 ft). Liberty field is nearly 6 miles offshore.

BP drilled the Liberty discovery well in 1997 from the Tern gravel and ice island, about 20 miles east of Prudhoe Bay. The company will drill the development wells from an existing satellite pad at its Endicott oil field. The Liberty wells will produce directly into existing facilities.

The new rig features a state-of-the-art automated equipment package and is designed to operate in temperatures as low as -50° F.

Total, Inpex to spend $2 billion for Indonesian EOR

Total SA and its Japanese partner Inpex will invest, together, some $2 billion next year to enhance recovery in the partners’ oil and gas fields in Indonesia, both offshore and in the Mahakam River Delta. Total has already invested $11 billion in the fields.

It will use enhanced recovery technology developed elsewhere but not yet applied in Indonesia. The group produces 90,000 b/d of oil and condensates and 2.6 bcfd of gas. High oil prices henceforth make it sensible to increase expenditures, especially in the Mahakam delta, where fracturation in several layers of sand is being attempted in Tambura gas field to reach inaccessible pockets of gas.

Total, which has officially dedicated its Sisi and Nubi gas fields’ coming on stream, is eyeing participation in Indonesia’s giant offshore Natuna gas field which also requires huge investments to develop because of a strong carbon dioxide concentration.

Bualuang oil field off Thailand set to produce

Soco International PLC, a partner in Bualuang field in the Gulf of Thailand, said oil production from the field would commence this month. Salamander Energy PLC operates the field, which was discovered in 1993 on Block B8/38.

Thai Energy Ministry officials indicated that field output of as much as 10,000 b/d could be expected.

The field’s proved oil reserves were recently upgraded to 11 million bbl from 7.2 million bbl, with probable and possible reserves lifted to 20 million bbl (OGJ, June 6, 2008, Newsletter).

Rubicon Vantage, the floating production, storage, and offloading vessel, was being hooked up to the wells.

Six development wells were drilled in the field, encountering 27° oil, a better-quality reservoir than forecast.

Salamander holds a 60% interest in Block B8/38, and Soco has a 40% stake. Both companies are based in the UK.

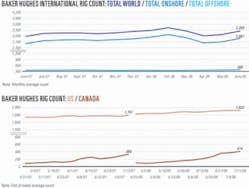

US drilling activity stabilizes

US drilling activity remained relatively for stable the week ended July 11, with 1,922 rotary rigs working, 1 more than the previous week and up from 1,791 in the same period a year ago, said Baker Hughes Inc.

Land drilling dipped by 4 rigs to 1,832 working the week of July 11. That was offset by a 4-rig increase offshore, with 67 rigs drilling in the Gulf of Mexicocurrently the only activity in US waters. Inland waters activity increased by 1 rig to 23.

Of the rigs working, the number drilling for oil dropped by 3 to 370. Units drilling for natural gas increased 5 to 1,544. The rest were unclassified. There were 386 rigs involved in directional drilling, down 1 from last week. There were 560 rigs drilling horizontally, 5 more than previously.

Processing Quick TakesPetrobras lets refineries engineering, automation

Zurich engineering firm ABB signed a $61-million frame agreement with Petroleo Brasileiro SA to supply process automation systems and related services to eight oil refineries in Brazil over 5 years. The agreement includes $29 million for engineering services.

The Swiss firm said the technology will help produce fuels with lower sulfur content, which have fewer emissions than other fuel blends.

ABB will supply its extended automation System 800xA for process automation with integrated substation automation functions, software and hardware, upgrades of existing installed ABB control systems, along with other project management and engineering services.

The technology, it said, will “help Petrobras expand production at its refineries, maximize energy efficiency, and optimize maintenance and operation costs.”

NOC, Star group to upgrade Ras Lanuf refinery

Libya’s National Oil Corp. (NOC) signed a 50:50 joint venture agreement with the Star Consortium of TransAsia Gas International and Star Petro Energy covering improvement of the existing 220,000-b/d Ras Lanuf export refinery.

Stage 1 of the refinery upgrade aims at refurbishing the existing plant to increase capacity and improve the ability to market the products.

In stage two, the companies will expand the refinery and add the latest technology for converting fuel oil into high-value products, improve efficiency, and bring overall quality in line with international standards.

Work on the upgrade, valued at $2-3 billion, will begin immediately and will take up to 5 years to complete.

The Ras Lanuf facility includes a refining plant that produces naphtha, kerosine, and light and heavy gas oil, and other units that produce ethylene and polyethylene.

Ras Lanuf and its surrounding region have seen increased industry activity in recent months, including refining ventures and new crude oil discoveries.

CSB cites likely cause of 2007 Valero refinery fire

The Feb. 16, 2007, fire at Valero Energy Corp.’s McKee Refinery in Sunray, Tex., likely was caused by water that leaked through a valve, froze, and cracked an out-of-service section of piping, reported the US Chemical Safety Board July 9. The refinery did not have an adequate program to identify and protect from freezing out-of-service or infrequently used piping, it said.

The fire occurred in the refinery’s deasphalting unit, which uses high-pressure propane as a solvent to separate gas oil from asphalt. Propane leaked from an ice-damaged piping elbow believed to have been out of service since the early 1990s when Ultramar Diamond Shamrock Corp. owned the refinery.

The piping crack released high-pressure liquid propane that ignited, causing a massive fire that injured four workers and forced Valero to evacuate and shut down the refinery for 2 months (OGJ Online, Feb. 21, 2007).

Ultramar Diamond Shamrock had not identified hazards that could arise from the dead-leg, had not removed the piping, isolated it from the process with blinds, or protected it against freezing temperatures. Nor had officials at the McKee plant applied Valero’s policies on emergency isolation valves to control its valves, CSB said.

CSB has asked the American Petroleum Institute to develop a new recommended practice to protect refinery equipment from freezing and to improve existing practices related to fireproofing, emergency isolation valves, and water deluge systems.

Transportation Quick TakesPembina completes Horizon pipeline

Pembina Pipeline Corp., Calgary, completed its $400 million Horizon pipeline, which will provide 250,000 b/d of dedicated transportation capacity to Canadian Natural Resources Ltd.’s Horizon oil sands project. Work began in November 2006.

Construction involved laying 73 km of new pipeline following twinning in 2004 of the original Alberta Oilsands pipeline (AOSPLnow called the Syncrude pipelinewhich the company acquired in late 2001. It expanded the AOSPL capacity to 389,000 b/d of dedicated synthetic crude oil transportation capacity to Syncrude Canada Ltd. The following year, Pembina completed the 136,000 b/d Cheecham lateral.

Pembina spent over $600 million to expand its service offering in the Athabasca oil sands region and now has 775,000 b/d of fully contracted synthetic crude oil transportation capacity in three distinct pipelines serving customers in this region.

Hungary, Romania to connect gas systems

Hungary and Romaniaciting supply security issueshave agreed to connect their natural gas systems. FGSZ Natural Gas Transmission Co., operator of Hungary’s gas transmission system signed a joint development agreement with Transgaz, the operator of Romania’s gas transmission system in Arad, Romania. The interconnecting pipeline will follow the Arad-Szeged route.

FGSZ will build the 47-km Hungarian section of the gasline, and Transgaz will lay the 67 km Romanian section, of which 36.7 km are already built.

Each side will finance its own section. For Hungary, the investment is 9 billion forints. The interconnection should become operational in mid-2010. For the commercial operation of the gasline, both parties intend to sign an operation agreement and a capacity allocation agreement.

Initially, gas will be transported to Romania from Hungary. At a later stage, if technical conditions are established, gas could be transported to Hungary from Romania. The proposed connection will help develop gas markets in the Eastern EU and diversify supply routes, increasing supply security for Romania and possibly Bulgaria.

Egypt starts natural gas exports to Syria

Egypt has begun sending natural gas to Syria via a pipeline that extends through Jordan as part of a larger project to export Egyptian gas to the Middle East and, eventually, Europe.

Sufian Allaw, Syria’s oil minister, said the new line would provide his country with 88.3 MMcfd of gas, eventually rising to 212 MMcfd over the next 9 years.

Egypt has agreed to supply Jordan, Lebanon, and Syria with gas for 30 years under terms of the $2.1 billion, 1,200-km Arab Gas Pipeline Project, which was signed in 2001.

The first phase of the project, linking Egypt with Jordan’s Red Sea port of Aqaba, was finished in 2003, with the pipeline passing under the Gulf of Aqaba to avoid crossing Israeli territory.

In 2005, under the second phase of construction, the pipeline was extended to the Jordanian town of Rihab, north of the capital Amman.

Egypt has been exporting nearly 99 bcf/year of gas to Jordan under a 15-year agreement.

The third phase brought the pipeline to Syria’s Deir Ali electric power station south of Damascus, according to Allaw. Further extensions are planned to Lebanon and Turkey, where the line will be connected to the planned Nabucco Pipeline for the delivery of gas to Europe.

El Paso moving forward with Ruby pipeline

El Paso Corp. unit Ruby Pipeline LLC has received more than 1.1 bcfd of binding commitments from gas shippers under 10-15 year contracts and is moving forward with the project, subject to regulatory approvals.

The 42-in. Ruby pipeline is a 670-mile interstate gas pipeline that will extend from the Opal Hub in Wyoming to a pipeline interconnect at Malin, in southern Oregon.