US NATURAL GAS—Conclusion: Plans to add storage along US gulf threaten possibility of overbuild

Currently planned storage capacity increases in the Southeast US-Gulf Coast region would add nearly 30% to working-gas storage capacity and have an even greater effect on withdrawal capacity.

Thirty-one storage projects have been announced for 2008-10 in the Southeast US-Gulf Coast region; adding 304.9 bcf of working-gas capacity and 17.5 bcfd of withdrawal capacity (Table 1). The increased withdrawal capacity spreads across four states, with Louisiana receiving 29% of the increase, Texas 28%, Mississippi 27%, and Alabama 16%.

Part 1 of this article (OGJ, July 7, 2008, p. 74) examined the basis shifts already under way and expected as a result of ongoing pipeline construction in the Texas Gulf Coast. This concluding article reviews each announced storage facility, examines the possibility of overbuild, and summarizes the most likely storage development scenario for the Southeast US-Gulf Coast.

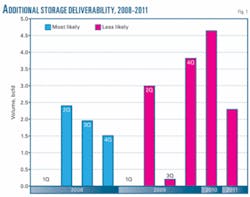

Fig. 1 shows the timing of new storage deliverability additions (new withdrawal capacity). Completion of an initial group of projects should occur during 2008. Construction of most of these facilities has been under way for months or years (shown in blue as most likely to be completed). Increases in storage development costs, various permitting problems, and a reduction of natural gas’ forward summer-winter differential will likely result in delay of some projects into 2009.

The less likely to be completed group of facilities shown in Fig. 1, currently scheduled for completion in 2009-10, will be subject to a continuation of the factors delaying some of the 2008 projects. These later projects also must overcome two key factors increasing the risk of storage development in the region:

- The development and promotion of many of them was based on service as a sink for surplus LNG expected to arrive at new and existing terminals in vast quantities during the summer season, when the global supply-demand balance would push surplus cargoes to the US. Recent developments in the LNG market suggest this LNG supply-push scenario is unlikely to develop in the near term, resulting in a decrease in LNG imports over the next 1-2 years. Absent the driver of LNG storage injections, the economics of storage development in 2009-10 may suffer.

- Financial investors and storage developers are backing many of the storage projects, rather than traditional storage players such as LDCs or utilities. These new market participants evaluate storage projects through rate-of-return, rather than as support for an underlying business. As any development problems and economic issues become recognized in the market, these financial players will likely cut their losses.

The market for facilities in the development stage may also quickly become glutted, resulting in reduced storage values and a deterioration of the environment for new storage construction.

Overbuild possibility

Completing all of these projects would lead to a nearly 30% increase in regional working-gas storage capacity.1 The buildup of so much new withdrawal capacity, however, would stand as the more important consequence.

Louisiana will host 5.1 bcfd of new, high-deliverability salt-dome storage withdrawal capacity scheduled to enter service 2008-10. Total existing withdrawal capacity of salt dome facilities in Louisiana stands at 3.2 bcfd,2 the new storage facilities therefore boosting Louisiana’s salt dome storage deliverability by almost 160%.

Other potential withdrawal capacity is also under development in the region. The two new Louisiana LNG import terminalsCheniere Energy’s Sabine Pass terminal and Sempra Energy’s Cameron terminalhave regasification and sendout capacity of 3.6 bcfd. To the extent LNG inventories are held in storage to move into the market to capture maximum prices, LNG volumes will behave like other natural gas storage.

Including the two new Louisiana LNG import terminals into the total withdrawal capacity for the state pushes the increase in incremental deliverability to 6.8 bcfd, almost double total existing deliverability out of all salt dome and depleted reservoir facilities in the state.

Various industry participants have argued whether this huge investment in storage represents overbuilding. Those rejecting the view that storage is being overbuilt base their arguments on two premises: many of these announced facilities will be delayed or cancelled, and the sporadic nature of LNG deliveries necessitates increased Southeast US-Gulf Coast storage. These points, however, do not preclude the risk of overbuilding.

Cancellation, delays

Rapidly escalating construction costs, long lead times for compressors and steel, unanticipated permitting delays, and deteriorating storage economics leave no doubt a number of the announced projects will be shelved. Most of the facilities scheduled for 2008, however, are nearing completion. Although some will be delayed, it is likely all 5.8 bcfd of withdrawal capacity in this group of 11 projects will enter service within the next 2 years. Handicapping the 22 projects (11.7 bcfd of withdrawal capacity) scheduled for completion in 2009-10 by assuming fully two-thirds of the projects will be canceled, still leaves 3.4 bcfd of additional storage.

These additions combined imply new incremental deliverability of 9.2 bcfd, not including LNG sendout from four new terminals in Texas and Louisiana. Even with a large number of cancellations, therefore, additions to regional deliverability will be large.

Sporadic LNG

LNG remains the wildcard in the storage overbuild equation. Large increases in LNG imports to existing and new Southeast US-Gulf Coast LNG terminals would support a large increase in storage capacity. Recent developments in the global LNG markets plus increases in domestic natural gas production, however, have substantially reduced the volume of LNG imports expected during the next few years.

If LNG does not arrive in quantity, the risk of overbuild increases appreciably.

Excess capacity does not define the risk of overbuild; excess deliverability does, in at least two ways. Storage gas will compete with increasing pipeline deliveries in the Southeast US-Gulf Coast region during high withdrawal periods. Constraints on outbound capacity from the region could restrict total deliverability from storage and pipeline sources, particularly for storage facilities competing with LNG terminal sendout on the Gulf Coast and storage facilities in Southeast Texas remaining somewhat constrained by pipeline capacity across the Sabine River into Louisiana.

Increased deliverability from the new salt-dome storage facilities will also increase the market’s ability to capture price peaks, effectively capping peak shaving trading opportunities critical to extrinsic storage economics (described later in this article). When prices start to spike, the crowd of new storage players will tend to sell into the increase, limiting it and dampening price volatility. A more viable source for extrinsic storage economics of Gulf Coast salt dome facilities will likely become trough trolling.3 The opposite of peak shaving, trough trolling uses multicycle storage to inject gas during periods of depressed prices and withdraw it after supply and demand return to a more normal balance.

Intrinsic, extrinsic

Twenty-six of the 31 new storage projects are high-deliverability, multiturn, salt-dome facilities being developed primarily to capture extrinsic storage economics; the trading value associated with short term price fluctuations. Many of these facilities have moved forward as a necessary means of absorbing sporadic LNG imports and were designed to trough troll when LNG oversupply would distress gulf pricing, and peak shave when winter weather, hurricanes, or similar events resulted in price spikes.

The likelihood of any of these scenarios occurring has been diminished by the combined impact of a “deliverability overbuild” and a lower probability of large increases in LNG imports. A more likely scenario over the next few years combines:

- A substantial increase in pipeline capacity into the Southeast US-Gulf Coast region.

- A steady increase in production filling that capacity.

- Continued constraints on deliverability out of the region.

- Modest LNG imports.

Lower volatility, steadily increasing supplies, and periodic constraints on outbound capacityfactors more favorable to storage developed to optimize intrinsic storage economics (the difference between seasonal market prices)would characterize this scenario. Such storage usually consists of larger, lower-cost, depleted reservoir facilities.

Intrinsic economics as measured by seasonal differences in the forward curve for natural gas have shifted during the past few months.

Fig. 2 shows the difference between the NYMEX quarterly strip for third quarter and first quarter from Nov. 1, 2007, to the present, showing three seasonal spreads:

- Third-quarter 2008 vs. first-quarter 2009 (blue).

- Third-quarter 2009 vs. first-quarter 2010 (pink).

- Third-quarter 2010 vs. third-quarter 2011 (green).

Near the end of 2007, the third-quarter 2008 vs. first-quarter 2009 spread dropped to $0.80/MMbtu from $1.10/MMbtu, a 27% decrease in the implied intrinsic value of storage for the period. At about the same time, the seasonal spread for third-quarter 2009 vs. first-quarter 2010 declined to $0.60/MMbtu from $0.90/MMbtu before recovering to near $0.80/MMbtu the week of Apr. 21, 2008. Third-quarter 2010 vs. first-quarter 2011 spread mirrored the previous years, before separating by about $0.10/MMbtu over the past few months.

The run-up in prompt-month prices in response to cold weather, declining storage inventories, and rapidly escalating crude oil prices fueled a third-quarter 2008 vs. first-quarter 2009 collapse in late December 2007. The collapse brought the seasonal spreads for the three periods discussed in the preceding paragraph into a relatively narrow range, converging at about $0.85/MMbtu. Spreads have traded within $0.10/MMbtu of this level for about 3 months, suggesting the market has accepted $0.85/MMbtu as a reasonable intrinsic value for storage capacity at this time.

The rest of this article details capacity additions to Southeast US-Gulf Coast storage facilities, grouping the projects by year, and providing the location and size of each. Each annual graphic builds on previous quarters to provide a sense of the magnitude of all projects as a group.

2008

The 11 projects scheduled for completion in 2008 (Fig. 3) will add 5.8 bcfd of new deliverability and 97.6 bcf of incremental working-gas capacity. Four of these projects are expansions and seven are new. Six of the projects are in Louisiana, two in Texas, two in Mississippi, and one in Alabama. Ten of the projects are high-deliverability salt dome storage.

Table 2 shows location, capacity, and type for each of these projects.

1. McIntosh-Bay Gas. Bay Gas expanded its McIntosh salt-dome storage cavern in Alabama to 11.4 bcf in spring 2008 and will add another 10 bcf of working-gas capacity by late 2009. Bay Gas provides interconnections to FGT and Gulf South and is adding a connection to Transco.

2. Southern Pines. SGR Holdings LLC (60%) and ArcLight Capital Partners own Southern Pines. This facility connects to Florida Gas, Destin, and Transco’s Mobile Bay lateral. The Mobile Bay connection will provide access from Southern Pines into Transco Station 85, Gulf South, and Gulfstream. Southern Pines received FERC authorization to begin service and began storage operations in early May.

3. North Lansing. North Lansing is a Kinder Morgan depleted-reservoir storage facility in Harrison County, Tex., on the NGPL system. The facility brought 824 MMcfd of working-gas capacity into service in May 2008.

4. Liberty Gas Storage. Sempra and Proliance Energy own Liberty, which connects into six pipelines: Tetco, Trunkline, Florida Gas, Transco, Cameron Interstate, and Port Arthur. Expansion plans would add 17.5 bcf. The company has purchased 150 acres of adjacent land for future expansions.

5. Pine Prairie. Plains All American Pipeline LP and Vulcan Capital own this facility, which connects to ANR, Texas Gas, FGT, Tennessee-800 leg, Tetco Transco Z3, and Columbia Gulf. The initial cavern measures 6 bcf, with expansions planned to add a second 6-bcf cavern, then expand both of caverns to 8 bcf, and finally add a third 8 bcf cavern. PAA-Vulcan purchased 240 acres of land adjacent to the project for future expansions.

6. Tres Palacios. NGS Energy Fund, based in Westport, Conn., is developing this project. Tres Palacios connects to Tennessee, HPL, Enterprise Channel, Kinder Morgan Texas, NGPL, Tetco, Gulf South, Enterprise Valero, FGT, Transco, and CrossTex. After expansions the facility will have 35.6 bcf of working-gas capacity.

7. Choctaw. PetroLogistics Natural Gas Storage LLC owns this facility. The FERC-jurisdictional storage cavern will be able to store 9 bcf of gas; 6 bcf working gas and 3 bcf base gas. Choctaw will inject 350 MMcfd and withdraw 300 MMcfd. The project is expected to enter service by September 2008, with interconnects to Sonat, Tetco, FGT, Bridgeline, and CrossTex LIG.

A contract with LNG importer BG Energy Merchants LLC for 100% of initial capacity supports the project. PetroLogistics plans to develop other caverns at the site, providing up to 16 bcf of additional working-gas capacity.

8. Bobcat. Haddington Ventures subsidiary Port Barre Investments owns Bobcat Gas Storage. The facility connects to FGT, Transco, Gulf South, ANR, Tetco, and Cypress.

9. Monroe Gas Storage. Foothills Energy Ventures and High Sierra Energy own Monroe, a depleted reservoir project in northeastern Mississippi near Amory. The facility connects to Tetco and Tennessee.

10. Egan. This project expands the existing Egan facility owned by Market Hub Partners, a Spectra company. The facility lies in Acadia Parish, La., and connects to Tetco, Tennessee, Columbia Gulf, ANR, Trunkline, Texas Gas, and FGT.

11. Arcadia. This project expands the facility owned by Martin Gas of Kilgore, Tex., which has connections with CenterPoint and Gulf South. Four new caverns are expected to enter service in 2008 with a total capacity of 1.0 bcf. Subsequent expansion will increase capacity by 7.0 bcf in 2010 and 13.8 bcf in 2012.

2009

The pace of storage development will increase in 2009, with 12 new projects planned (Fig. 4).

Table 3 identifies five of these projects as the next phase of 2008 developments. New projects in 2009 will add 8.6 bcfd of new deliverability and 150 bcf of new working-gas capacity. Two of these projects are in Louisiana, five in Texas, three in Mississippi and two in Alabama. MoBay supplies the largest single addition to storage capacity; 50 bcf owned by Falcon Gas Storage in Mobile County, Ala.

12. North Dayton. North Dayton is a Kinder Morgan expansion project connecting into Transco and Kinder Morgan Texas Pipeline.

13. Southern Pines. This project is the next phase of Project 2 (listed under 2008).

14. Tarpon Whitetail. Tarpon Gas Storage in Monroe, Miss., is a depleted reservoir with 300 MMcfd of withdrawal capacity connected to TETCO in the M1 rate zone. Planned interconnections include Tennessee’s 500 Leg, Sonat, and Mississippi Valley Gas Co. Tarpon is an affiliate of Spark Energy Holdings.

15. Tres Palacios. This project is the next phase of Project 6 (see 2008).

16. Pine Prairie. This project is the next phase of Project 5.

17. Moss Bluff. Spectra’s Market Hub Partners plans to add 6.5 bcf of working-gas capacity to this salt dome storage field by summer 2011, developing a fourth cavern at the Liberty County, Tex., site. Plans call for a portion of the additional capacity to be available in June 2009. The facility currently has 15 bcf of working-gas capacity.

18. Bobcat. This project is the next phase of Project 8.

19. Mont Belvieu. Mont Belvieu gas storage, a venture of Enterprise Products and Duncan Energy, held an open season earlier in 2008 for 10 bcf of storage east of Houston.

The project would have involved conversion of existing NGL caverns and the construction of natural gas pipeline interconnects with Enterprise Texas, Enterprise Texas Intrastate (Channel), Kinder Morgan Texas Pipeline, and Tetco. Enterprise, however, has since said it does not plan to move forward on the project because of inadequate market interest.

20. MoBay. MoBay is a large depleted reservoir facility in Mobile County, Ala., adjacent to Gulfstream Station 410. Falcon Gas Storage is developing the 50-bcf facility, which will connect to Transco’s Mobile Bay Lateral, Gulfstream, FGT Zone 3, Gulf South, Southeast Supply Header, and Destin.

21. Leaf River. NGS Energy is developing its Leaf River salt dome gas-storage project in Smith County, Miss.; providing 8 bcf working-gas capacity in its initial phase, with plans to grow to as much as 32 bcf. NGS expects the project to provide 2.5 bcfd of withdrawal capacity and 1 bcfd of injection capacity, with a proposed in-service date of July 2009.

22. McIntosh-Bay Gas. This project is the next phase of Project 1.

23. Houston Storage Hub (formerly Houston Energy Center). Enstor (Scottish Power) plans to bring the initial 7.5-bcf phase of this project online in second-quarter 2009. A 7.7-bcf expansion is planned for 2 years later. The Houston Hub has interconnects with Enstor’s Katy facility, HPL, Transco, Trunkline, NGPL, Tennessee, Tejas Gas, and Kinder Morgan Texas (MidCon).

2010

Current plans call for nine additional storage projects by 2010 (Fig. 5). Table 4 shows three of these projects as the next phase of 2008 developments. Three projects are in Texas, three in Mississippi, and three in Louisiana.

24. Escondido. Escondido Gas Storage is developing an 18 bcf storage field 55 miles southeast of San Antonio in Karnes and Live Oak counties, using the depleted Atkinson gas field. Design plans include an injection rate of 275 MMcfd and a withdrawal rate of 335 MMcfd, allowing 3-4 cycles/year. Escondido expects the project to be in service by March 2010.

25. Freeport (Stratton Ridge). Freeport LNG plans to add salt-dome gas storage at Stratton Ridge in Brazoria County, Tex., but has made no firm announcements about the project.

26. Petal. Petal Gas Storage, a subsidiary of Enterprise Products Partners, plans to expand its salt-dome storage near Petal, Miss., by April 2010, adding 5.6 bcf of working-gas capacity.

27. Starks Gas Storage. Niska’s Starks Gas storage project includes conversion of two existing salt caverns to gas-storage operations. The project would be about 25 miles west of Lake Charles, La., and would initially provide 8 bcf of working-gas capacity from one cavern, with a maximum withdrawal rate of 400 MMcfd and a maximum injection rate of 375 MMcfd. Niska would add a second cavern at a later date, bringing working-gas capacity to 18 bcf and doubling injection and withdrawal rates.

28. Palacios. This project is the third phase of Projects 6 and 15.

29. Liberty. This project is the next phase of Project 4.

30. Black Warrior Storage. Southeast Gas Storage LLC (SGS), an affiliate of El Paso-Tennessee is developing the 20-bcf Black Warrior Storage Project, in Monroe County, Miss. The proposed depleted-field gas storage would interconnect with Tennessee’s 500 Line downstream of its Columbus compressor station in Zone 1 via a new 24-in. OD pipeline. The facility would provide as much as 333 MMcfd of injection capacity and 375 MMcfd of withdrawal capacity, with a proposed in-service date of June 2010.

31. Mississippi Hub. EnergySouth is building its Mississippi Hub facility at the Bond Salt Dome structure near Jackson County, Miss. The company plans to complete it in two phases; the first of two caverns becoming operational in late 2009, the second in mid-2011. EnergySouth expects the project to have 15 bcf of working-gas capacity, 1.5 bcfd of withdrawal capability, and 750 MMcfd of injection capacity by November 2009. It plans interconnections with Sonat, Transco, and SESH.

32. Arcadia. Martin Midstream began storage services at the Arcadia storage field in 2007 and plans to boost working-gas capacity by 1 bcf by adding a fourth cavern in December 2008. Deliverability would total 200 MMcfd and injection capacity is to reach 125 MMcfd.

Phase II and Phase III expansions each consist of constructing a new cavern with 7 bcf of working-gas capacity, to be completed in August 2010 and August 2012, respectively. Phase II would provide 600 MMcfd of incremental withdrawal capacity and 170 MMcfd of additional injection capacity.

References

- Estimate of Maximum Underground Working Gas Storage Capacity in the United States: 2007 Update, Energy Information Administration, 2007.

- Bentek Market Alert: “I” of the Storm, Part One, Bentek Energy LLC, Mar. 11, 2008.

- Murrell, R., Energy South presentation to LDC Forum-Southeast, Atlanta, Apr. 14-16, 2008.