OGJ Newsletter

Oil & Gas UK outlines UKCS production challenges

Operators on the UK Continental Shelf (UKCS) spent £4.9 billion on developing new reserves in 2007 compared with £5.5 billion spent a year ago, according to an economic report produced by trade association Oil & Gas UK.

The decline in spending is worrisome because rising exploration and production costs mean that capital is only one-third as efficient as 5 years ago, which threatens bringing on new oil and gas production.

OGUK said the industry required significant investment over and above the £21 billion planned by companies to produce 9.8 billion boe over the next 5 years. The association believes that as much as 25 billion bbl could be recovered.

OGUK Chief Executive Malcolm Webb said, “Whilst realizing this goal will require massive further investment from the industry, at $100/bbl, it is worth $1.5 trillion to the British economy and this is a prize which the country should not contemplate losing.”

The trade association has called on the government to offer tax incentives to attract investment in the mature province that produced 2.8 million boe/d in 2007. Indigenous production dropped by 4% in 2007 and is forecast to fall to 2.6-2.7 million in 2008 as several large projects reach full production. On current trends, production decline is expected to average 5% over the next 5 years.

Last year, the UK met 75% of its gas needs through domestic production and was self-sufficient in oil.

Carbon trading scheme advocated for Australia

Australia should introduce a carbon trading scheme as soon as possible, according to a draft report on climate change policy handed to the Australian government.

The commissioned report, written by economist Ross Garnaut, signals the start of efforts by the new Labor government in Canberra to cut carbon emissions. It recommends a broad emissions trading scheme across industries.

Although the 600-page report stopped short of placing any hard prices on carbon omissions (and thus not quantifying the true economic impact), it did advocate that transport fuels should be included in such a scheme. It also declared that energy costs will rise and coal-powered electricity generation would not be given any compensation for having to pay a carbon tax.

However, Garnaut said it would be in Australia’s best interest to learn as soon as possible whether there can be a low-emissions future for coal, and to support rapid deployment of commercially promising technologies. He suggested that $3 billion (Aus.)/year be spent on developing low emissions technology and that Australia should strive to become a market leader in this work.

Garnaut said he supports the phase out of mandatory emissions targets once a trading scheme is put in place. The report is one of a number of inputs likely to shape the federal government’s policy decisions in response to climate change.

Brazil to update oil law in wake of discoveries

Brazil’s ministry of mines and energy has created a new working group that will aim to update the country’s existing oil law, according to a senior government official.

“This group is studying the legislation of several countries, especially those which have a monopoly, and we are going to make a proposal to change the current law,” said Mines and Energy Minister Edison Lobao.

The minister said every country changes the rules whenever new discoveries are made and that “Brazil can’t be different.” However, he acknowledged that there are interests intent on maintaining “the status quo.”

Lobao, who said the changes are in the interests of the Brazilian people, was apparently referring to criticism of the proposed changes voiced by Petrobras Chief Executive Jose Sergio Gabrielli.

Noting that 60% of Petrobras’s capital is private, while only 40% is held by the government, Lobao said Gabrielli represents a private company and, as such, is fighting for Petrobras’s interests.

Lobao also gave assurances that the recently proposed creation of a new company to manage subsalt oil reserves will not result in a breach of existing contracts.

“This is an initial idea but, in my view, all contracts will have to be maintained,” he said. “What we seek is a new formula.”

It was reported recently that Lobao plans to propose to President Luiz Inacio Lula da Silva the creation of a new state-run firm that would manage oil discoveries made in recent months in the subsalt layer of the Santos basin (OGJ Online, June 30, 2008).

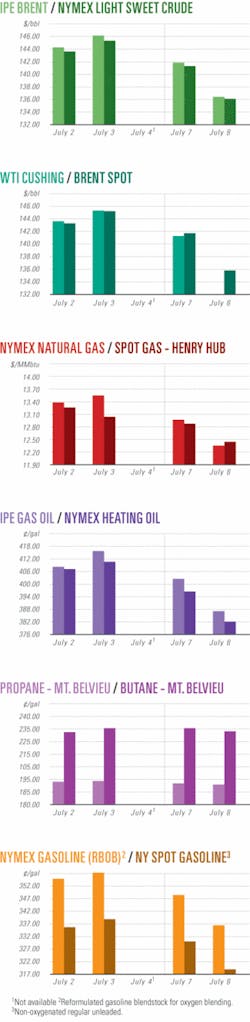

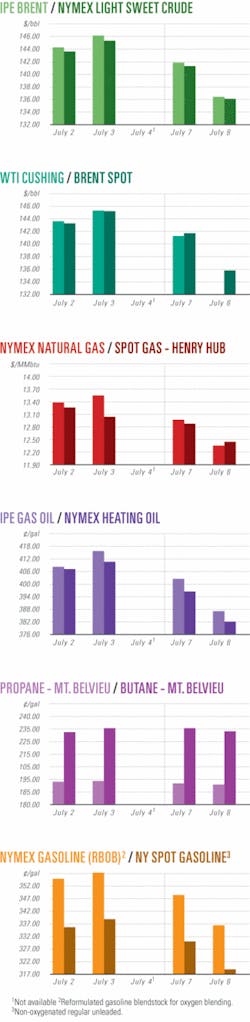

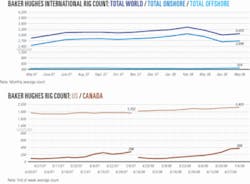

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesHusky presses work in basins off South China

Husky Energy Inc., Calgary, has signed on for its eighth block off South China and plans to begin delineating its Liwan 3-1 deepwater gas discovery later this year.

Husky signed a contract with China National Offshore Oil Corp. for the 1,777 sq km Block 63/05 in the Qiongdongnan basin 100 km southeast of Hainan Island. The block is a similar distance southwest of Block 29/26, where Husky Energy plans to start delineation drilling in the third quarter of 2008 at its Liwan 3-1 discovery.

Liwan 3-1, in 1,300 m of water in the southwestern Pearl River Mouth basin, is the deepest water well drilled off China (OGJ, Mar. 26, 2007, p. 39). The South China Sea discovery well cut 56 m of net gas pay averaging 20% porosity in two zones on a structure with 60 sq km of closure.

The Liwan discovery well was drilled on 2D seismic, and Husky has now shot 925 sq km of 3D seismic across Block 29/26 and adjacent 29/06.

Husky also shot 750 sq km of 3D seismic on Block 35/18 in the Yinggehai basin west of Hainan Island and expects to drill exploration wells in 2009-10 on Yinggehai blocks 35/18 and 50/14 and Liwan blocks 29/06 and 29/26.

Seismic starts in central BC’s Nechako basin

Industry-led, nonprofit Geoscience BC has launched a 350 line-km 2D seismic survey southwest of Prince George in British Columbia’s nonproducing Nechako basin.

The Vibroseis survey on existing forest roads is the first seismic shot in the basin since the early 1980s.

The survey area is largely contained in the Nazko First Nation’s Traditional Territory, and seismic contractor CGGVeritas is providing training and employment opportunities to Nazko citizens.

The area west of Quesnel is also in the heart of the mountain pine beetle affected area of interior British Columbia, said British Columbia Energy Minister Richard Neufeld.

“Successful oil and gas development in the Nechako basin has the potential to help offset the economic impacts of the mountain pine beetle infestation,” Neufeld said.

The Northern Development Initiative Trust Pine Beetle Recovery Account is providing $500,000 of the $2.5 million cost of the survey.

After Canadian Hunter Exploration Ltd. shot 1,300 line-km of 2D seismic in the basin 25 years ago, five wells were drilled but hydrocarbon exploration ceased shortly after. The basin’s oil and gas potential is still not well understood, said ‘Lyn Anglin, president and chief executive officer of Geoscience BC.

OGDC finds gas with Dhodak well in Pakistan

Pakistan Oil & Gas Development Corp. (OGDC) reported a natural gas discovery in its Dhodak Deep No. 1 exploration well drilled in Dera Ghazi Khan district in Punjab province under the Dhodak drilling and production license.

The well, which was spudded June 30, was drilled to a target depth of 4,150 m.

Based on open-hole logs and drilling data, the selective interval of 85 m in Chiltan limestone formation was tested. After stimulation, it produced 5.5 MMcfd of gas through a ½-in. choke. Wellhead pressure was recorded as 1,500 psi, while water production was recorded as 60 b/d.

Sterling Energy spuds Iris Marin well off Gabon

Sterling Energy PLC spudded its Iris Charlie Marin-1 exploration well (ICM-1) in the Iris Marin production-sharing contract area off Gabon.

Hercules Offshore’s Hercules 156 jack up rig began drilling July 5 in 25 m of water 12 km southwest of the Gamba field and is expected to reach its target depth later this month. The prospect is estimated to hold reserves of 20-40 million bbl in the Gamba sandstone formation.

Sterling has 32% interest in the licence following a recent farmout to Addax Petroleum. About 18% of Sterling’s costs in the well are being paid by Addax Petroleum.

Drilling & Production Quick TakesNeptune starts oil, gas production in gulf

BHP Billiton Ltd. and its partners in the Neptune oil and gas development in the deepwater Gulf of Mexico reported the start of production. Neptune, which lies 120 miles off Louisiana, is being developed using a tension-leg platform installed on Green Canyon Block 613 in 4,250 ft of water.

The TLP facility’s design capacity is 50,000 b/d of oil and 50 MMcfd of gas. The facility had recently undergone remediation to strengthen components inside the hull’s pontoons, Neptune partner Marathon Oil Corp. said.

Neptune field comprises five blocks: Atwater Valley blocks 573, 574, 575, 617, and 618. Water depths range 4,200-6,500 ft. Crude oil from Neptune is transported via the Caesar pipeline, while natural gas is exported via the Cleopatra pipeline.

SBM Atlantia Inc. installed the TLP’s 5,900-ton hull last year (OGJ, Aug. 6, 2007, Newsletter).

Field development includes six initial subsea wells tied back to the TLP. Further development wells are expected to be drilled after interpretation of new seismic data, which will be obtained in this year’s second half.

Neptune partners are operator BHP Billiton Ltd. 35%, Marathon 30%, Woodside Energy (USA) Inc. 20%, and Repsol-YPF SA unit Maxus (US) Exploration Co. 15%.

Bualuang oil field off Thailand set to produce

Soco International PLC, a partner in Bualuang field in the Gulf of Thailand, said oil production from the field would commence this month. Salamander Energy PLC operates the field, which was first discovered in 1993 on Block B8/38.

Thai Energy Ministry officials indicated that output from the field of as much as 10,000 b/d could be expected.

The field’s proved oil reserves were recently upgraded to 11 million bbl from 7.2 million bbl, with probable and possible reserves lifted to 20 million bbl (OGJ, June 6, 2008, Newsletter).

Rubicon Vantage, the floating production, storage, and offloading vessel, was being hooked up to the wells.

Six development wells were drilled in the field, encountering 27° oil, a better-quality reservoir than forecast.

Salamander holds a 60% interest in Block B8/38, and Soco has a 40% stake.

Oxy invests in CO2 source for Permian basin EOR

Occidental Petroleum Corp. with its agreement with SandRidge Energy plans to increase substantially the amount of carbon dioxide available in the Permian basin for use in enhanced oil recovery projects.

The CO2 will come from Oxy’s planned gas processing plant to be built in Pecos County, Tex.

Oxy expects the additional CO2 will allow its projects in the area to increase production by at least 50,000 bo/d in the next 5 years.

Oxy Chairman and Chief Executive Officer Ray R. Irani said the project will provide at least 3.5 tcf of CO2 for Oxy’s long-term use in EOR projects and develop about 500 million bbl of oil reserves from currently owned assets at an attractive cost.

Oxy will own and operate the new facilities and will invest about $1.1 billion in their development.

The planned gas processing plant has an expected 450 MMcfd of CO2 takeaway capacity, and Oxy expects to receive another 50 MMcfd of CO2 from existing SandRidge gas processing plants. The project also includes construction of a 160-mile pipeline from the plant, through McCamey, Tex., to the industry’s CO2 hub in Denver City, Tex.

The plant will process SandRidge’s locally produced, high CO2-content natural gas.

Oxy says it is the largest producer in the Permian basin with about a 16% net share of total regional production. It produces about 200,000 boe/d and at yearend 2007, its Permian basin properties contained proved reserves of about 1.2 billion boe.

Subject to approvals, Oxy expects the new gas plant and pipeline in 2011 to start operations and commence CO2 deliveries to its existing CO2 EOR operations.

In 2007, the Permian basin received about 1.371 bcfd of CO2 for use in EOR projects (OGJ, Apr. 21, 2008, p. 45).

StatoilHydro improves Gullfaks oil recovery factor

StatoilHydro produced an extra 60 million bbl of oil from Gullfaks field in the Norwegian North Sea as it has improved the recovery factor to more than 60%.

Reidar Helland, head of petroleum technology at StatoilHydro, said during a presentation at the World Petroleum Congress that 4D seismic surveys are a key mechanism to locating hidden barrels of oil that equate to more than a year’s production from the field.

However, StatoilHydro wants to improve the rate of recovery at Gullfaks to 70% and sustain production to 2030, which Helland described as a “challenging ambition.”

The company has drilled 17 wells on Gullfaks based on 4D seismic datawells that would not have been drilled without this technology. “Oil has been struck in all of the wells. In other words, an excellent accuracy. This experience clearly shows the importance of employing new technology,” Helland said.

Shell continues operations in Ogoniland

Shell Petroleum Development Co. (SPDC) has not been ordered to leave its operations in Ogoniland in Rivers State, although Nigerian President Umaru Yar’Adua said another operator would replace Shell by yearend.

Yar’Adua said in June that trust between the Ogoni people and Shell has badly deteriorated and a new operator would be assigned. But Mutiu Sunmonu, managing director of the Shell subsidiary, told reporters in Port Harcourt the company still holds a 30% stake in its oil wells in the area.

Sumonu said company officials learned of the president’s remarks via the media. “We are yet to get any letter or official directive on the matter as [of] today. The federal government has not formally notified us. There has not been a formal letter. We have heard and discussed it. What the president said is headline statement, [of] which details are not available,” he said.

The government set December as the new deadline to end gas-flaring in the Niger Delta, and Sunmonu said the company would have to spend $5 billion to meet this target. SPDC missed previous gas flaring deadlines because its joint venture partner, Nigeria National Petroleum Corp., failed to contribute its share of funding to set up gas gathering infrastructure. So far SPDC has spent $3 billion in “commissioning facilities to gather and process gas.”

Sunmonu said the security problem in the Delta would determine whether the firm could meet the government’s new deadline.

SPDC agreed to loan the federal government $1.3 billion to advance its stalled projects in the Niger Delta. Both parties signed only a head agreement, Sumonu said. The final agreement is still being negotiated. Total SA and ExxonMobil Corp. agreed to loan the government $6.1 billion to cover the funding gap.

Sumonu denied that SPDC laid off more than 2,000 employees due to soaring exploration and production costs and reduced output because of repeated attacks on its operations in the Niger Delta. He said a review of Shell operations is still under way.

Processing Quick TakesIRS issues regs to encourage refinery expansions

The US Internal Revenue Service has issued temporary regulations and a notice of proposed rulemaking (NOPR) to encourage expansion of existing US refineries and construction of new plants as mandated by the 2005 Energy Policy Act (EPACT).

The temporary regulations amend Section 179C of the federal income tax code, which was added when EPACT became law. They define “qualified refinery property” and are designed to assist refiners in determining costs that may be expensed under the provision, the US Department of Treasury division said on July 8.

An installation located within the US that processes liquid fuel from oil or other qualified fuel is considered a qualified refinery under the temporary regulations, which the IRS has proposed adopting as a rulemaking. Not eligible are refinery properties that are primarily topping plants, asphalt plants, lubricant facilities, crude or product terminals, or blending facilities. Nor is refinery property built solely to comply with consent decrees or projects mandated by federal, state, or local governments.

Section 179C allows refiners to deduct 50% of the cost of any qualified refinery property that goes into service between Aug. 8, 2005, and Jan. 1, 2012, according to the notice. Remaining qualified expenditures are generally recovered under Section 179B and Section 168 where applicable, it indicated. All properly capitalized costs can be included, it said.

The IRS will take comments on its proposed rulemaking through Oct. 7. It also plans to hold a public hearing Nov. 20 and will accept outlines of topics to be discussed there through Oct. 14.

StatoilHydro starts Mongstad refinery upgrade

StatoilHydro has let an engineering and procurement contract to M.W. Kellogg Ltd. to upgrade the coker unit at its 186,000 b/d Mongstad refinery near Bergen, Norway.

“The project will improve the working environment and safety of the operators on the coker unit by automating processes to improve safety, performance, and reliability,” said Kellogg parent company KBR. The value of the contract was not disclosed.

The coker unit will be closed in 2009 while the revamp is carried out along with a scheduled refinery turnaround period in April 2010, with completion scheduled for the middle of 2010. Project work will be performed at Kellogg’s main office, along with collocated StatoilHydro representatives, in Greenford, West London.

Transportation Quick TakesAlaska looks toward intrastate gas line

Alaska has formed a public-private partnership to build an intrastate gas pipeline to serve south-central and interior Alaska.

The system would begin service in 2013 with a capacity of 460 MMcfd of gasabout twice current demand. The supply would mainly come from undiscovered supplies in Cook Inlet, interior basins along the pipeline, and the North Slope foothills, officials said.

Construction would start at Cook Inlet and progress north along the Richardson Highway for about 400 miles, reaching Fairbanks and interior Alaska by 2013.

If sufficient supplies fail to materialize from the Cook Inlet and Copper River basins and exploration along the pipeline, a second phase would involve a leg to bring gas from the North Slope foothills.

If the second phase were not needed, the line could be connected to the pipeline planned to move North Slope gas to Canada and the Lower 48, officials said, when it is completed in 2018-20.

Forming the partnership were the Alaska Natural Gas Development Authority, Enstar Natural Gas Co., and the state, said Gov. Sarah Palin. She said specifics would be worked out this fall in time to be added to appropriations legislation in January 2009. Construction would start in 2011.

ExxonMobil to position Adriatic LNG terminal

ExxonMobil Corp. plans in August to move the gravity-based Adriatic LNG regasification terminal to the Adriatic Sea off Italy. Construction of the 6-million-tonne/year terminal is nearing completion, said Rex Tillerson, ExxonMobil chief executive.

It will be the world’s first offshore gravity-based regasification terminal, with capacity to supply 10% of Europe’s LNG needs.

The company has developed Q-Max technology with Qatar Petroleum that increases the LNG ship cargo capacity by 80%.

Tillerson said a global LNG market will supply increasing energy demand but he stressed that energy efficiency was crucial also because it extends the life of resources, reduces greenhouse-gas emissions and energy prices, and strengthens energy security.

ExxonMobil has invested more than $1.5 billion on energy efficiency since 2004, has budgeted $500 million on additional initiatives over the next few years, and will work with vehicle manufacturers to develop transportation technologies that can improve fuel economy and reduce emissions.

Fos oil terminal gets nod from port board

The Marseille Port Board approved construction of a seventh mooring berth for refined oil products at the Fos petroleum terminal.

The investment will amount to €22 million, in addition to the €32.7 million investment voted last November to build a sixth mooring berth alongside the quay. This will increase the receiving capacity of the Fos oil terminal to 21.5 million tons in 2011 from 6 million tons in 2006.

The latest expansion is dictated by the need to adapt the Fos terminal to the increasing storage capacity of the Fos Oil Depots (DPF) and creation of a new oil depot by OMM (Oiltanking-Mediaco), a joint venture of France’s Mediaco and Germany’s Oiltanking and subsidiary of Germany’s Marquard and Bahls, the world’s second leading terminal storage group.

The seventh mooring berth will accommodate 45,000-ton vessels 200 m long and will provide a 12 m water draught. It will be operational mid-2011.

Canadian oil pipeline capacity remains tight

Canadian oil pipeline systems need additional capacity soon to accommodate growing supply and provide greater market flexibility, according to Canada’s National Energy Board.

“Capacity constraints on oil pipelines in Canada were evident in 2007,” said NEB Vice-Chair Sheila Leggett. “While there was some spare capacity, periods of apportionment meant that some pipelines were at times not able to fully meet shipper demand.”

The high capacity utilization is driven by growing oil sands production and continued strong demand in the US. Although some capacity will be added in 2008, tight conditions will likely exist for the remainder of the year, officials said in their annual report on the 45,000 km of oil, natural gas, and product pipelines regulated by the NEB.

Most NEB-regulated gas pipelines have some excess capacity, even during the peak winter season. Throughput for most gas pipelines declined in 2007 due to declining conventional gas supplies from the Western Canada Sedimentary Basin, growing demand within western Canada, and competition from other supply basins, particularly in the western US.