Brazil plans oil law changes, oil management firm

Brazil’s Mines and Energy Minister Edison Lobao plans to propose to President Luiz Inacio Lula da Silva the creation of a new state-run firm that would manage oil discoveries made in recent months in the subsalt layer of the Santos basin.

Lobao, who is responsible for developing a new model for oil exploration, is scheduled to present a study on the matter within 60 days, according to a report in Valor Economico business newspaper.

The paper reported that Lobaoafter considering suggestions received in recent weeksis convinced that the best solution for the country is to adopt a production-sharing regime, which would require legislation changes to Brazil’s Petroleum Law.

In countries where this regime has been implemented, the paper said, state-owned companies have the role of deciding on production levels and supervising exploration in fields.

According to Lobao, the new state firm would neither drill wells nor extract oil but would hire government-owned Petroleo Brasileiro SA or other firms as service suppliers.

Australia’s Offshore Petroleum Act 2006 in effect

The Petroleum (Submerged Lands) Act 1967 (PSLA)Australia’s primary legislation for the administration of its offshore petroleum resources since the riches of Bass Strait were discovered and first produced in the 1960swas replaced July 1 with the new Offshore Petroleum Act 2006 (OPA).

Martin Ferguson, resources and energy minister, says the new act will make the legislation easier to understand and will reduce costs of compliance and administration for industry and government.

However, he said there are no changes to major policies or the current management regime.

The OPA received Royal Assent in March 2006 but could not be proclaimed until all states and territories had updated their offshore petroleum legislation. This was completed when Tasmania amended its legislation on June 16.

UK oil participants agree to share best practices

Offshore operators and contractors in the UK have agreed to share experiences and best practices on the design and development of new learning products and services under a major partnership to help address the skills shortage in the oil and gas industry.

OPITO-The Oil & Gas Academy and the Engineering Construction Industry Training Board (ECITB) will work with Oil & Gas UK and the Offshore Contractors Association.

“As well as allowing for improved quality and transferability of the skills pool leading to increased safety and overall business performance, the new alliance will also provide a combined menu of skills and training solutions for operators and contractors,” OPITO said.

ECITB Chief Executive David Edwards said, “The changing business models within the industry means that more alignment is needed to address the skills priorities. Working together will make this happen more quickly and effectively whilst ensuring duplication of effort and cost is eliminated over time.”

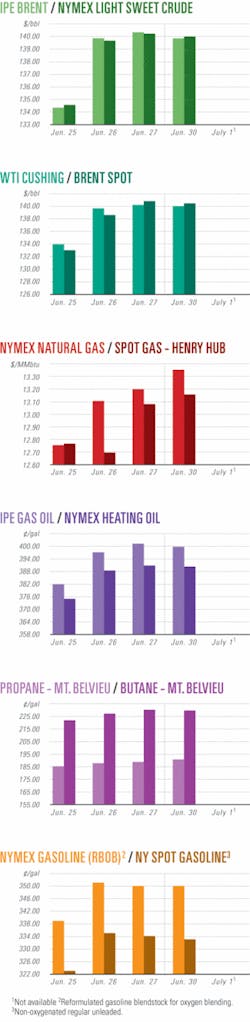

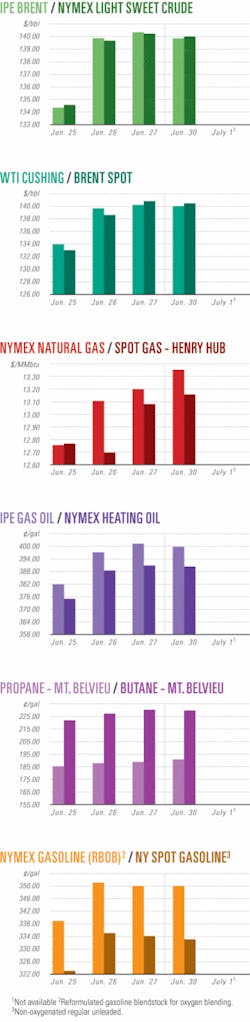

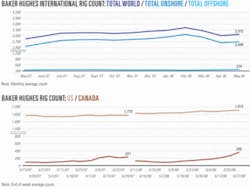

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesLukoil, ConocoPhillips start W. Siberia field

A joint venture of OAO Lukoil and ConocoPhillips has begun first-stage oil and gas production from Yuzhno Khylchuyu field in the Nenets Autonomous District of northwestern Siberia, Russia.

The first 32 development wells in the arctic field are producing oil through a 98-mile, 21-in. pipeline to the Varandey oil export terminal on Kola Bay on the Barents Sea. The field’s oil is 35.5° gravity with 0.71% sulfur, better than Russia’s 32° gravity, 1.3% Urals export blend.

Discovered in 1981, Yuzhno Khylchuyu field has more than 500 million bbl of proved oil reserves. It is considered one of the largest fields in Russia’s Timan Pechora oil and gas province and the anchor field for an overall $4 billion in developments by the joint venture.

Interests in the OOO Naryanmarneftegaz joint venture, established in 2005, are Lukoil 70% and ConocoPhillips 30%.

Besides the 32 wells, the first stage comprises a 3.8 million tonne/year oil treatment unit; an oil desulfurization unit; a 40,000 cu m tank farm; a pump station; a 17-mile, 11-in. Yareyu-Yuzhno Khylchuyu high-pressure gas pipeline; a 370 million cu m gas treatment plant; a 125-Mw power supply complex; and 178 miles of 220 kv high-voltage transmission lines.

Second-stage start-up planned for December involves 32 new wells, doubling the capacity of the oil treatment unit, and adding a compressor station and sulfur disposal and storage facilities.

Design capacity is projected at 150,000 b/d in 2009. Crude is to be loaded from floating storage at Varandey onto 70,000 dwt tankers for shipment to Europe and North America.

Tullow Oil makes Uganda oil, gas discovery

Tullow Oil PLC discovered oil and gas within the Ngege-1 exploration well on the northern part of Block 2 in Uganda’s Lake Albert Rift basin 41 km northeast of the Taitai-1 discovery well.

The find marks a new deltaic play fairway with high-quality reservoir in which Tullow found over 5 m of net oil pay of moveable 30-32º API and dry gas in 9 m of net pay spreading through separate sands. The Victoria Nile Delta play, in a new fairway along the axis of the Lake Albert Rift basin, is significant because it upgrades several other prospects to be drilled later.

Tullow will not test the well, as it wants to assess the results of its other wells after it finishes regional drilling. Ngege-1 reached a TD of 640 m and was drilled some 3 km from the crest of the structure.

Tullow said seismic interpretation indicates further significant potential updip. Logging has been successfully completed and the well suspended as a potential future producer.

NOC signs E&P deals with Oxy, OMV

Libya’s National Oil Co. has signed exploration and production agreements with Occidental Petroleum Corp. and OMV AG to upgrade their existing petroleum deals (OGJ, Feb. 7, 2005, p. 35).

NOC said the companies would train Libyans and carry out enhanced oil recovery projects.

Oxy’s contract covers fields with 2.5 billion bbl of high-quality oil reserves. Libya’s largest land holder, Oxy owns a net working interest in nine exploration blocks in Libya covering 130,000 sq km (OGJ, Jan. 23, 2006, p. 31). It will carry out major field redevelopment and exploration programs in the prolific Sirte basin, where it operates Blocks 106 and 124.

Oxy will spend $5 billion over the next 5 years to triple its gross production to 300,000 b/d.

Norway launches 20th licensing round

Norway has invited operators to bid for 79 blocks or parts of blocks under its 20th licensing round that covers the Norwegian and Barents seas. Deadline for applications is Nov. 7.

The petroleum and energy ministry said the licensing round was important to maintain production on the Norwegian Continental Shelf and that new discoveries could help with employment and industrial development on the northern coast.

However, environmental standards and fishery concerns have been tightened in some areas following public consultation.

“The government wants to await the assessments in the upcoming management plan for the Norwegian Sea before starting new petroleum activities outside the More coastline,” the ministry said, adding, “Further petroleum activities and conditions in this area will be assessed in the management plan.”

The plan will assess the environmental impact of oil and gas activities in the Norwegian and Barents seas and its future development.

BLM posts final EIS for Pinedale Anticline area

The final supplemental environmental impact statement for the Pinedale Anticline Project Area (PAPA) in Wyoming is available, the US Bureau of Land Management said on June 26.

The FSEIS is part of a US Department of the Interior analysis of a proposal by Questar Market Resources Co., Shell Exploration & Production Co., and Ultra Petroleum Inc. The three producers have proposed conducting year-round drilling and completions within the PAPA, BLM said.

BLM added that the FSEIS is not a decision document, but is designed to inform the public and interested agencies of environmental and socioeconomic impacts that could result from the project and to evaluate alternatives.

Additional information acquired from public comments and from internal reviews could result in the selection of an alternatives or group of alternatives to provide the best operating practices, impact mitigation and management practices to reduce environmental harm, BLM said.

UK’s Moth a dual oil, gas-condensate find

Although not quantified, the Moth exploration well in UK Central North Sea Block 32/21 is thought to be a large discovery, said the UK subsidiary of Oilexco Inc., Calgary.

The 23/21-6z Moth discovery well went to TD 14,616 ft and cut 605 ft of hydrocarbon-bearing sands in Middle Jurassic Pentland and 219 ft in Upper Jurassic Fulmar, Oilexco said. The company earned a 50% working interest at Moth, where its partners are BG Group, Hess Corp., and BP PLC.

A packer failure prevented flow measurement on a drillstem test of Pentland perforations at 13,276-730 ft in 439 ft of oil and gas bearing reservoir sands. Further tests are likely in a future appraisal well.

The primary target Fulmar sands at 12,982 ft are to be perforated later in July at 12,980-13,030 ft for tests in 118 ft of gas-condensate bearing reservoir sands.

Appraisal wells will likely use higher-capacity test equipment, Oilexco said. Moth is just south of Lomond gas field.

Drilling & Production Quick TakesCabinda Gulf installs Angola gas platform

Chevron Corp. subsidiary Cabinda Gulf Oil Co. Ltd. has successfully installed the Takula gas processing platform on Block 0 off Angola. Commissioning and start up is expected to happen during the third quarter.

AMEC Paragon was the engineering contractor for the project.

The platform is in 57 m of water with the capacity to process 100 MMscfd of sour gas for injection and delivery to the new onshore Cabinda gas plant. It is bridge-linked to an existing platform and is a single-train facility designed as a 5,000-tonne, single-lift modular deck.

The platform is key to Angola’s determination to reduce onshore and offshore gas-flaring. As engineering contractor to Cabinda, AMEC Paragon provided front-end engineering and design services and offered detailed engineering and procurement assistance to Samsung Heavy Industries for the platform, which was built at the Samsung Geoje shipyard in South Korea.

Callon awards contract for Entrada field

Callon Petroleum Co. has let a lump-sum installation contract to Technip, Paris, for development of Entrada oil field in the Gulf of Mexico.

Technip is to install two 6½-mile steel flowlines that will tie-back two subsea wells at a depth of 4,475 ft. In addition, the French group will be responsible for installation of pipeline terminations and inline structures, as well as steel catenary risers that will be connected to the Magnolia offshore platform in 4,675 ft of water.

Detailed engineering and project management will be performed at Technip’s operating center in Houston, while welding of the flowlines and risers will take place at Technip’s spoolbase in Mobile, Ala. Technip said offshore installation is scheduled for the third quarter using the firm’s Deep Blue deepwater pipelay vessel.

Oxy to acquire interest in Joslyn oil sands project

Occidental Petroleum Corp. signed an agreement with Enerplus Resources Fund to purchase a 15% interest in the Joslyn oil sands project in northeastern Alberta for $500 million (Can.).

Joslyn, operated by France’s Total SA, holds more than 8 billion bbl of bitumen in place. While still in the early stage of development, Joslyn currently has more than 1,800 delineation wells drilled and is being developed by steam assisted gravity drainage (in process) and surface mining. Oxy plans to spend $2 billion to develop the reserves, the company said.

Enerplus acquired a 16% interest in Joslyn in 2002 and subsequently sold a 1% interest to Laricina Energy Ltd. in early 2006 in exchange for common stock in that company. Enerplus will have invested $115 million in its 15% interest in Joslyn.

Dong Energy lets Nini East platform contract

Dong Energy let a turnkey contract to Bladt Industries AS to construct and install an unmanned satellite production platform for its Nini East oil field in the North Sea. The site lies 7 km northeast of the existing Nini platform. Bladt said its contract contains an option for future work in the area. Design has begun, and materials specification is under way. Production is scheduled to start by yearend 2009. Nini East holds an estimated 17 million bbl of oil.

Bladt Industries will work with Saipem UK to design, produce, and install both the jackets and topsides and develop a pipeline to connect Dong’s Nini and Cecilie fields to the Siri platform where oil will be treated and shipped. Total platform weight will reach about 3,500 tons. Fabrication should take 15 months, after which it will be towed, installed, and commissioned.

Total investment, including a pipeline between Nini and Nini East, is 2.1 billion kroner.

Petrobras, Mitsui sign ultradeepwater contract

Transocean Inc.’s subsidiaries reached an agreement with subsidiaries of Petrobras and Mitsui to acquire a newbuild ultradeepwater drillship under a capital lease contract.

The currently unnamed newbuild is under construction at Samsung Heavy Industries Co. Ltd. yard in Geoje, South Korea.

Costs to be incurred by Petrobras and Mitsui for the drillship’s construction are estimated at $750 million.

The rig will feature Transocean’s patented dual-activity drilling technology, allowing for parallel drilling operations in deepwater well construction.

Transocean said the rig will have a variable deckload of more than 20,000 tonnes and the capability of development and exploration drilling in greater than 10,000 ft of water, upgradeable to 12,500 ft of water. With additional equipment, it can drill to 37,500 ft total depth.

In conjunction with the 20-year capital lease contract, the companies signed a 10-year drilling contract covering worldwide operations, with an option to extend the drilling contract by 10 additional years.

Processing Quick TakesConstruction begins on Marathon Detroit refinery

Marathon Oil Corp. has begun construction of the $1.9 billion heavy oil upgrading project at its Detroit refinery following issuance of an air quality permit by the Michigan Department of Environmental Quality.

The project will include an additional 80,000 b/d of heavy oil capacity and increase the total refining capacity to 115,000 b/d from 102,000 b/d. The increased capacity will supply more than 400,000 gpd of additional transportation fuels to the marketplace. The project is expected to be completed in late 2010.

Fluor Corp. will provide integrated engineering, procurement, and construction services.

Construction on an associated 29-mile pipeline in Monroe and Wayne counties, Mich., is expected to begin in second-quarter 2009 and complete in 2010.

Aramco, Total form Jubail Refining & Petrochemical

Saudi Aramco and Total SA agreed to create the Jubail Refining and Petrochemical Co. during third-quarter 2008 to develop a world-class refinery in Jubail, Saudi Arabia.

The parties signed agreements June 22 pertaining to a 400,000 b/d refinery scheduled to start operations by yearend 2012. It will convert Arabian Heavy crude to high-quality refined products, complying with the most stringent global product specifications.

“As a full-conversion refinery, Jubail will maximize the production of diesel and jet fuels. In addition, the project will produce 700,000 tonnes/year of paraxylene, 140,000 tpy of benzene and 200,000 tpy of polymer-grade propylene,” the companies said in a joint statement.

Aramco will have an initial 62.5% stake in the company, with Total taking the remaining 37.5%. Subject to regulatory approvals, the parties plan to offer 25% of the company to the Saudi public while the two founding shareholders each intend to retain a 37.5%. Both will share marketing of the refinery’s products.

Lukoil, ERG form refinery joint venture

OAO Lukoil reported it will pay €1.3 billion to acquire a 49% stake in a new joint venture with Italian refiner ERG SPA. The JV will jointly operate ERG’s Isab refining complex at Priolo, Sicily.

ERG will have a 51% share in the JV and Lukoil may be able to increase its stake in the future under the agreement. Both parties require approval from the European Commission and other antitrust bodies.

The complex 320,000 b/d Isab refinery is on the coast and will meet growing middle distillate demand in Europe, mainly kerosine and diesel fuel.

According to their equity stake, ERG and Lukoil will source its own share of oil to refine and market the products. “The Isab refinery has the flexibility to process crudes such as Urals, and Lukoil intends to fully integrate its share of the refinery into its supply chain,” Lukoil said.

Lukoil Pres. Vagit Alekperov said the company’s refining capacity would increase by 13% and its overseas refining capacity by 60%. “The refinery’s advantageous location and an opportunity to process Russian crude make this project very attractive.”

Transportation Quick TakesFive planned LNG terminals in Italy move forward

Italy’s privately-held Anonima Petroli Italiana SPA, Rome, applied for approval from the country’s Environment Ministry for an offshore regasification terminal with an capacity of about 4 billion cu m/year.

The facility will be located in the Adriatic Sea in front of Anonima Petroli’s Falconara refinery. After converting the LNG, the company will inject the gas into Snam Rete Gas SPA’s grid. Construction will take just over 5 months.

The news coincided with reports that Gas Natural could win environmental clearance for an 8 billion cu m regasification terminal it wants to develop at Trieste in northern Italy. An official at the environment ministry confirmed that Gas Natural’s LNG facility had received positive opinions from a series of subcommittees at the ministry, and it said the project could be approved or a series of observations on the plans could be made.

In June, Iride SPA and CIR SPA’s unit Sorgenia SPA said their planned 12 billion cu m regasification terminal at Gioia Tauro, which won environmental approval in April, has been granted access to European Union funding. The Gioia Tauro terminal is due to go online in 2013.

In early May, Royal Dutch Shell and Italy’s ERG received local authorization to build their planned joint Ionio LNG import terminal in Sicily. The partners hope to begin construction of the import terminal in 2010 and to have it operational by 2013, according to ERG’s power and gas division head Raffaele Tognacca.

Later in May, following a feasibility study completed early this year on its Triton LNG project 30 km off Italy’s Marches region in the Adriatic Sea, Gaz de France signed a joint development agreement with Oslo-based Hoegh LNG for the design, construction, and operation of a floating storage and regasification unit vessel (OGJ Online, May 30, 2008).

Maryland LNG project wins CZMA appeal

US Commerce Secretary Carlos Gutierrez overturned one state’s objection to a proposed LNG project but upheld another as the US Department of Commerce issued two federal consistency appeals decisions on June 26.

The secretary ruled against Maryland’s objection to AES Sparrows Point LLC and Mid-Atlantic Express LLC’s proposal to build an LNG facility east of the Port of Baltimore on Chesapeake Bay. However he upheld an objection by Massachusetts to Weaver’s Cove Energy LLC and Mill River Pipeline LLC’s proposal to build an LNG terminal and pipeline near Fall River.

Sponsors of each project had appealed to a rule after the state had determined that the project was not consistent with its plan under the Coastal Zone Management Act. Under CZMA, federal agencies may not issue permits for a project unless the Commerce secretary overrides the state’s consistency objection on appeal.

In a decision announced by the National Oceanic and Atmospheric Administration’s Office of General Council for Ocean Services, Gutierrez overrode Maryland’s objection after determining that the national interest, which would be served by the Sparrows Point project, outweighs its limited adverse coastal effects.

The proposed terminal and associated pipeline would help meet regional energy demand by providing enough natural gas capacity to heat about 3.5 million homes daily or to generate enough electricity each day for about 7.5 million homes, the decision indicated. The impact of dredging on fish and aquatic vegetation would not be significant, Gutierrez said.

The decision means sponsors of the Sparrows Point project can continue to pursue federal permits and licenses, but will still be required to comply with all state and local permitting regulations and complete all required environmental reviews.

A timetable at the project’s web site anticipates that the Federal Energy Regulatory Commission will complete a final environmental impact statement by Aug. 15 and issue a certificate by Nov. 20.

In the Massachusetts decision, Gutierrez upheld the state’s objection because it determined that adverse coastal effects, particularly navigational concerns associated with tankers traveling up the Taunton River to deliver LNG to the terminal outweighed the project’s national interest.

LNG construction approved for the Netherlands

Dutch Economy Minister Maria van der Hoeven approved construction of the Netherlands’ first LNG import terminal in Rotterdam.

The €800 million Gate terminal, a project of Neder Nederlandse Gasunie NV and Royal Vopak, will consist of three storage tanks with a capacity of 180,000 cu m each and one jetty. The terminal will have an initial throughput capacity of 9 billion cu m (bcm)/year, which can be increased to 16 bcm/year in the near future.

A consortium comprised of Techint Group, Sener Ingenieria y Sistemas SA, Entrepose Contracting, and Vinci Construction PLC will build the terminal, which will come online in second half 2011, at a cost of €800 million. Dutch port operator Havenbedrijf Rotterdam NV will invest €60 million in basic infrastructure as the project will significantly strengthen its position as an energy port.