SPECIAL REPORT: ERCB update expects bitumen production doubling by 2017

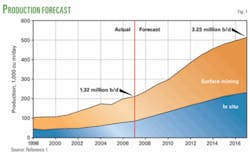

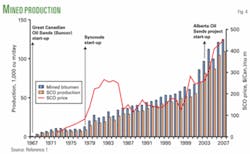

Bitumen production will more than double by 2017 to 3.23 million b/d from 1.32 million b/d in 2007, according to the latest Energy Resources Conservation Board of Alberta update on Alberta oil sands (Fig. 1).1

In its update, ERCB:

- Increased by 53% the remaining established in situ reserves under active development because of new and expanded projects in Athabasca and Cold Lake regions.

- Revised the Athabasca Wabiskaw-McMurray formation in-place resources and their northeastern areal extent.

- Added a map showing reconstructed sub-Cretaceous unconformity surface with location of the Grosmont and Nisku deposits.

- Said 2007 bitumen production increased 5% from 2006 production. This includes a 3% increase from mines and a 9% increase from in situ operations.

- Said synthetic crude oil production increased by 4%.

The Alberta Energy and Utilities Board previously published this annual update, but on Jan. 1, 2008, it divided in two bodies, with the ERCB regulating oil and gas companies and the Alberta Utilities Commission regulating utilities.

ERCB in its projections assumed that US West Texas Intermediate will average $105/bbl in 2008 and rise to $138/bbl in 2017.

The number of planned projects for the oil sands continues to increase. OGJ published a list of the projects in various stages of completion in the June 9, 2008, issue, pp. 61-64.

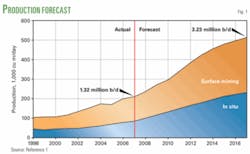

The projects in Alberta’s Athabasca, Cold Lake, and Peace River regions involve both mining and in situ processes. Athabasca with both mining and in situ projects produces the most bitumen (Fig. 2).

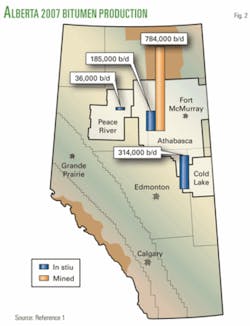

The Canadian Association of Petroleum Producers (CAPP) and the Regional Issues Working Group (RIWG) estimated in early 2007 that the industry will spend $110 (Can.) in 2007-11 and has spent $47 billion (Can.) from 1996 to 2006 on new oil sand projects.2 Discounted for various variables, the study estimated that more likely expenditures for 2007-11 would be $77 billion (Can.). Fig. 3 shows CAPP’s and RIWG’s forecast.

null

Resources

ERCB’s report contains the following assessment of bitumen resources in Alberta at yearend 2007:2

- Initial in place: 1.712 billion bbl

- Initial established: 179 billion bbl

- Cumulative production: 5.9 billion bbl

- Remaining established: 173 billion bbl

- 2007 production: 0.482 billion bbl (1.32 million b/d)

- Ultimate potential: 315 billion bbl.

In 2007, the upgrading of 286 million bbl of mined bitumen yielded 251 million bbl of synthetic crude oil (SCO), while operators mainly sold the 196 million bbl of in situ productions as nonupgraded crude, the report says. The in situ volumes also include bitumen and heavy oil produced with primary means from the same areas of the three oil sands regions.

The main deposits covered by the report are the Athabasca Wabiskaw-McMurray (AWM), Cold Lake Clearwater (CLC), and Peace River Bluesky-Gething (PRBG) covering about 54,000 sq miles.

ERCB expects to start using a 6% mass cutoff instead of a 3% mass for recoverable bitumen in future updates. Although this cutoff will reduce bitumen in place by 20% in AWM, 35% in CLC, and 50% in PRBG, ERCB expects data from additional drilling will offset these decreases.

The report says that these four deposits contain more than 64% of the total initial in-place bitumen resource and about 87% of the in-place resource found in clastics (Table 1). Of the 173 billion bbl remaining established reserves, ERCB considers 82%, or 142 billion bbl recoverable with in situ methods and the remaining 31 billion bbl recoverable with surface mining methods.

The currently active mining and in situ areas contain about 22 billion bbl out of the 173 billion bbl deemed recoverable.

Production

ERCB says bitumen production from in situ projects increased by 7.1% in 2007, compared with 2006, while production from mining projects increased by 4.3%. In 2007, the minable area produced 286 million bbl, while in situ projects produced 196 million bbl.

In situ recovery includes both primary methods and enhanced recovery, such as injection of steam, water, or other solvents into the reservoir to mobilize the bitumen.

The report notes that production in 2007 from the three current surface mining projects was:

- Syncrude Canada Ltd., 367,000 b/d.

- Suncor Energy Inc., 267,000 b/d.

- Albian Sands Energy Inc., 150,000 b/d.

At yearend 2007, the report says about two-thirds of the initial minable established reserves were under active development. Developments that ERCB considers active are the three on production and also Fort Hills, Horizon, and Jackpine.

Futures sources of production from minable resources include:

- CNRL’s Horizon project with proposed production starting third-quarter 2008.

- Shell Canada’s Jackpine mine with production expected to coincide with completion of the Muskeg Mine expansion in late 2010.

- Petro-Canada-UTS Energy-Teck Cominco’s Fort Hills project with production proposed by 2011.

- Imperial Oil-ExxonMobil’s proposed multistage Kearl mine with start-up expected in 2011.

- Total E&P Canada Ltd.’s proposed multistage Joslyn North mine with production expected in 2013.

With these projects, ERCB expects total mined bitumen production to reach 1.76 million b/d in 2017, up from 0.78 million b/d in 2007.

ERCB notes that its outlook does not include Synenco Energy-SinoCanada Petroleum’s Northern Lights mining and extraction project and UTS’s Equinox and Frontier project. If completed, production from these projects would come on stream after 2017, ERCB expects.

Fig. 3 shows mined bitumen production in Alberta, starting with production from the Great Canadian Oil Sands (Suncor) project in 1967. Also shown is the price of SCO from 1971, which the report says is generally at a premium to light crude oil.

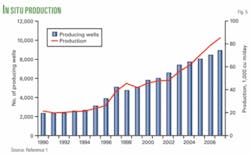

Companies have drilled most in situ producing wells in the oil sands as deviated wells from pads to minimize the drilling and production footprint. From 1985 through yearend 2007, 34,276 wells have been drilled to explore for and develop the oil sands. In 2007 of the 4,295 wells drilled in the oil sands, 1,376 were development wells and 2,919 were exploratory. About 8,900 wells were on production during 2007, with the average well producing 62 bo/d (Fig. 5).

Production from the Cold Lake region accounts for 59% of the in situ production, with another 35% produced in the Athabasca region and 7% in the Peace River region, according to the report.

ERCB expects in situ bitumen production will reach 1.46 million b/d in 2017.

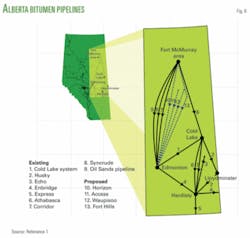

Proposed pipelines

The increase bitumen production will require additional pipelines (Fig. 6).

ERCB’s report lists the following expansion plans.

- Inter Pipeline Corridor pipeline (7 in Fig. 6) expansion project includes construction of a 42-in. diluted bitumen line, a new 20-in. products pipeline, tanks, and upgrades to existing pump stations along the existing pipeline from the Muskeg River mine to the Edmonton region. The expansion will increase diluted bitumen capacity to about 465,000 b/d by 2009 and will support further expansions beyond 2009 by adding intermediate pump stations.

- Pembina pipeline expects construction of the Horizon pipeline (10) to be completed in July 2008 and to have an initial capacity of 250,000 b/d. The project includes twinning the existing Syncrude pipeline (8), resulting in two parallel, commercially segregated lines, one dedicated to Syncrude and the other to CNRL’s new Horizon oil sands development. Also included is the construction of a new 48 km, 20-in. pipeline from the Horizon site 70 km north of Fort McMurray to the AOSPL terminal.

- Access pipeline (11) will transport diluted bitumen from the Christina Lake area to facilities in the Edmonton area. Initial pipeline capacity is 150,000 b/d, expandable to 400,000 b/d. Access has completed construction and expects start-up in 2008.

- Enbridge’s 390-km Waupisoo pipeline will move blended bitumen from the Cheecham terminal, south of Fort McMurray, to the Edmonton area. The Waupisoo Pipeline 2008 will start operating in 2008 with a 350,000-b/d initial capacity, expandable to 600,000 b/d.

- Enbridge’s preliminary plan for the Fort Hills pipeline system (13) includes a blended bitumen pipeline from the mine site north of Fort McMurray to the upgrader site in Sturgeon County. The system will have a 125,000-b/d capacity and a 70,000 b/d parallel diluent return pipeline. Enbridge may complete the pipeline by mid-2011.

By-products

Two by-products of bitumen upgrading are petroleum coke and sulfur.

Alberta has amassed large stockpiles of petroleum coke that in 2007 reached more than 50 million tons. ERCB’s report says the petroleum coke produced in the delayed-coking operation for upgrading bitumen is a potential source of energy through gasification. This energy source could reduce natural gas use in the oil sands.

Suncor has been burning sulfur-rich coke in its boilers for decades at its mine near Fort McMurray and is responsible for most of the total coke use as a site fuel. The company has also sold petroleum coke to Asian markets since 1997, mostly Japan, according to ERCB. In addition, Syncrude began using coke as a site fuel in 1995, and ERCB says the company is seeking alternative uses for its coke surplus such as using it as a reclamation material.

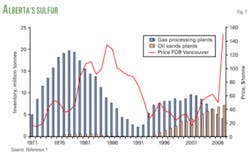

Sulfur is another by-product of oil sands. Its price has recently increased from $50/tonne in midyear 2007 to the $150-350/tonne range, according to ERCB’s report (Fig. 7). ERCB estimates that remaining sulfur reserves in Alberta decreased by 3% in 2007, with China being the major importer. ERCB notes that exports to China in 2007 decreased by 24%, compared with 2006, because of competition of exports from the Middle East.

China uses sulfur for producing sulfuric acid and producing phosphate fertilizers.

ERCB estimates that about 208 million tonnes of elemental sulfur will be recoverable from the 5 billion cu m of remaining established crude bitumen reserves in the surface minable area. The reports says the 40.5 tonnes sulfur/1,000 cu m of crude bitumen ratio reflects both current operations and expected use of high-conversion hydrogen-addition upgrading technology for the future development of surface-minable crude bitumen reserves.

References

- Albert’s Energy Reserves 2007 and Supply/Demand Outlook 2008-2017, ST98-2008, Energy Resources Conservation Board of Alberta, June 2008.

- Alberta Oil Sands Industry Update, Alberta Employment, Immigration, and Industry, December 2007.