OGJ Newsletter

Bush urges Congress to lift bans on OCS leasing

US President George W. Bush urged Congress to lift oil and gas leasing bans on the Outer Continental Shelf as the first of four steps to increase domestic supplies in response to soaring prices.

“Experts believe that the OCS could produce about 18 billion bbl of oil. That would be enough to match America’s current oil production for almost 10 years. The problem is that Congress has restricted access to key parts of the OCS since the early 1980s,” Bush said on June 18.

“Since then, advances in technology have made it possible to conduct oil exploration in the OCS that is out of sight, protects coral reefs and habitats, and protects against oil spills. With these advances and a dramatic increase in oil prices, congressional restrictions on OCS exploration have become outdated and counter-productive,” Bush said.

Bush also asked Congress to authorize oil and gas leasing within the Arctic National Wildlife Refuge, remove a moratorium on the development of a federal oil-shale leasing program, and expedite permitting for new US refineries or expansion of existing ones. But Bush’s call to end OCS drilling bans produced the strongest responses (OGJ Online, June 17, 2008).

SEC staff advises updating reserves reporting

US Securities and Exchange Commission staff members have recommended that the commission consider updating its oil and gas reserves reporting requirements, the commission reported in a June 12 news release.

The commissioners have yet to consider and vote on the proposal. Current SEC reserves requirements were adopted more than 25 years ago. The recommended proposals would allow oil and gas companies to provide more reserves information to investors, the release said.

John White, director of the SEC’s division of corporation finance, said that there are “tremendous changes in the way reserves are measured and oil and gas companies do business” that are not yet reflected in reserves reporting rules.

Details of the staff recommendations were not provided in the news release. Late last year, SEC solicited comment on whether changes in the reporting requirements were needed and appropriate.

The commission received 80 comment letters, generally supportive of updating the requirements.

The American Petroleum Institute said June 13 it intended to review the recommendations and then will comment if needed.

Large reserves writedowns by some oil and gas companies in 2004 rekindled debate about how companies estimate reserves, what regulators worldwide require of companies, and how investors use the information.

Adjustments are a normal part of reserves reporting but disclosure policies drew close attention after Royal Dutch/Shell Group reclassified its reserves estimates five times in a little over a year (OGJ, Feb. 21, 2005, Newsletter).

Reserves estimates and reporting standards have been the subject of much industry discussion (OGJ, June 20, 2005, p. 20).

OPEC maintains world well-supplied with oil

The Organization of Petroleum Exporting Countries, in its latest monthly oil market report, reiterates its position that the world is well-supplied with oil.

The organization’s current forecast for 2008 OPEC crude demand stands at 31.8 million b/d, higher than other agencies’ forecasts but still below its current production of 32.2 million b/d.

Expected higher OPEC oil exports and the planned halt in the filling of the US Strategic Petroleum Reserve should help to increase excess supply and further build commercial inventories, the report says.

Further, the market outlook says that current production levels combined with additional crude supply of 300,000 b/d from Saudi Arabia starting this month will lead to a higher-than-normal stockbuild in the third quarter and a contra-seasonal inventory build in the fourth quarter of this year.

“This clearly demonstrates that the market is amply supplied and that claims that the recent surge in prices is due to a supply shortage are unjustified,” OPEC reported.

The reasons behind the recent oil-price surge were to be the focus of discussions at a June 22 meeting of producers, consumers, and other stakeholders in Jeddah.

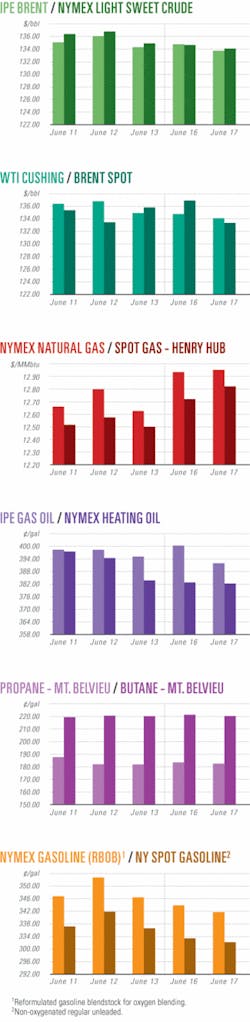

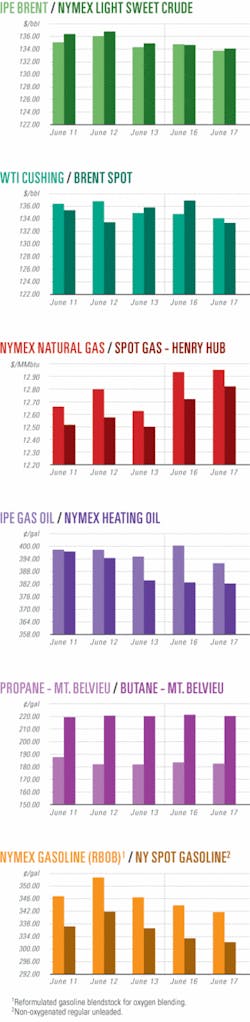

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesTrinidad and Tobago awards exploration licenses

Trinidad and Tobago has reported granting approval for a consortium comprising OCNG Mittal Energy Ltd. (OMEL) and Petroleum Co. of Trinidad & Tobago (Petrotrin) to explore and develop Block NCMA 2 in the shallow marine area off northern Trinidad.

The consortium has undertaken to drill five exploratory wells, four to a depth of 9,000 ft and one to 13,500 ft.

The consortium also will undertake the shooting of 986 sq km of full fold 3D seismic.

In addition, the Caribbean island nation has granted approval for a consortium comprising Petrotrin and Trinidad Exploration & Development Co. Ltd. (TED) to explore and develop the Southwest Peninsula Shallow and Deep Horizon blocks onshore in Trinidad’s Southern basin.

TED is a wholly owned subsidiary of Captiva Resources Inc.

ExxonMobil to step up Philippines exploration

ExxonMobil Corp. plans to undertake exploratory operations in the Sulu Sea in the Philippines and, based on the outcome of current seismic studies, could begin drilling exploratory wells in a year’s time, according to a senior official.

ExxonMobil Exploration Co. Vice-Pres. Stephen Greenlee, after meeting with the Philippine’s President Gloria Arroyo and Energy Secretary Angelo Reyes, said the US major is currently evaluating seismic data taken from the project area.

If the data are encouraging, Greenlee said, the company plans to drill exploration wells starting mid-2009 at a cost of around $100 million.

ExxonMobil E&P Philippines BV, meanwhile, said Manila has approved the company’s acquisition of a 50% operating interest in Block SC 56 in the deepwater Sandakan basin.

ExxonMobil acquired the interest from Mitra Energy, which holds the remaining 50% interest in the block. The partners completed a 2D seismic survey in 2006 and a 3D seismic program in 2007.

Tap Oil outlines Philippines program

Australian independent Tap Oil plans to begin exploration drilling in midyear on its Service Contract 41 off the southern Philippines in the Sulu Sea.

Tap acquired 750 sq km of 3D seismic over the offshore block last year, and is eyeing reserves of 50-150 million bbl of oil. Tap holds a 50% stake in the block, while Salamander has 35%, and seven Philippine firms hold the remaining 15%.

Recently, the Philippines government announced that development of the Galoc oil field in Palawan has been completed and will start operation by June 16.

It followed a March announcement by Galoc Production Co. which pronounced the Galoc-3 development well ready to connect to the field’s floating production, storage, and offloading vessel after it flow-tested at a constrained, stabilized 5,200 b/d of oil (OGJ Online, Mar. 10, 2008).

The Philippines government anticipates that Galoc will have a production rate of 20,000-30,000 b/d or about 10% of current domestic demand.

GTE completes Costayaco-4 well in Colombia

Gran Tierra Energy Inc. has completed drilling the Costayaco-4 well in Costayaco field on Colombia’s Chaza block. The well reached 8,884 ft TMD.

Gran Tierra said log interpretations from data acquired after drilling indicate about 16 ft of potential hydrocarbon pay in the Kg sand unit of the Rumiyaco formation, 14 ft in the U sandstone unit of the Villeta formation, 38 ft in the T sandstone unit of the Villeta formation, and 125 ft in the Caballos formation.

“Significant progress is being made on defining production infrastructure requirements, advancing production capacity and setting new production targets for the field,” said Dana Coffield, Gran Tierra president and chief executive officer.

In April, Gran Tierra completed the testing of its Costayaco-3 well, the third well drilled in Costayaco field, discovered in 2007.

Gran Tierra has a 50% interest and is operator on the Chaza block, with Solana Resources holding the remaining 50% interest.

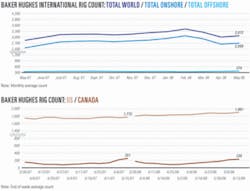

Drilling & Production Quick TakesUS drilling hits new 22-year high

The US rig count during the week ended June 13 topped 1,900 working units for the first time in more than 22 years.

Baker Hughes Inc. reported 1,901 rotary rigs drilling in the US, 15 more than the previous week and up from 1,773 during the same period a year ago. The last time the rig count surpassed that level was during the week ended Jan. 3, 1986, when 1,915 units were working.

As usual, land operations accounted for the bulk of the increase, up 15 rigs to 1,808 drilling. Offshore drilling increased by 4 rigs to 68 in the Gulf of Mexico, resulting in a net increase of 2 rigs to 68 on all offshore federal leases. Inland waters activity was down 2 rigs to 25.

Among the rigs now working, 1,504 are drilling for natural gas, 389 are drilling for crude, and 8 are unclassified. Directional drilling increased by 10 rigs to 380. Horizontal drilling declined by 1 rig to 547.

StatoilHydro extends rig contract for Troll field

StatoilHydro has extended by 2 years the contract with Odfjell Drilling to use the Deepsea Trym semisubmersible drilling rig on Troll oil and gas field in the Norwegian North Sea. The contract extension is worth $347 million.

Odfjell is operator of the rig, which is owned by Songa Offshore ASA. The rig has worked on the field since 2005 and will continue to 2011. The contract with StatoilHydro includes an option for one more year, extending the contract period until the first quarter 2012 if the option is exercised.

Troll holds 60% of the country’s total gas reserves on the Norwegian continental shelf, and in 2002 the oil production was more than 400,000 b/d. Production is expected to last another 70 years.

ERCB sees rise in Alberta CBM output

Alberta’s coalbed methane production could reach 640 bcf/year in 2017, or 16% of the province’s marketable gas output compared with 5% in 2007, the Energy Resources Conservation Board said.

CBM production may be higher than forecast if commercial output from Mannville coals is accelerated, the board said.

Alberta had more than 9,000 wells that produced CBM in 2007 with remaining established reserves estimated at 858 bcf, ERCB said.

The 9,339 wells that produced some CBM yielded a total of 240 bcf of gas in 2007, of which the ERCB estimates 77.7 bcf was CBM.

Industry drilled 2,055 CBM wells in 2007, down 24% on the year, and connected 2,259 wells, down 23%.

Alberta’s first CBM was produced in 1970, ERCB defined the first CBM pool in 1995, and commercial production began in 2002.

Rigless intervention in Vincent field completed

Marine services company TSMarine has completed the first phase of a rigless intervention operation at Woodside Energy’s Vincent field heavy-oil project off Western Australia.

The company’s Havila Harmony monohull vessel deployed, installed, and tested seven subsea trees and carried out wireline operations on each well. It is the first rigless intervention job carried out in the Asia Pacific region, the company said.

The vessel was operating in 372 m of water.

TSMarine said the successful operation was the culmination of more than 2 years of planning and engineering working in collaboration with Woodside.

Vincent field on permit WA-28-L was found in 1998 and is estimated to contain 73 million boe. It is expected to come on stream later this year.

Woodside holds a 60% interest in the prospect and Mitsui E7P Australia the remaining 40%.

Processing Quick TakesValero resolves CWA violations after 2006 oil spill

Valero Refining Texas LP has agreed to resolve alleged violations of the Clean Water Act stemming from a June 1, 2006, spill of 3,400 bbl of oil into the Corpus Christi Ship Channel, which flows from Tule Lake into Corpus Christi Bay and into the Gulf of Mexico.

Under the consent decree lodged in federal court in Corpus Christi, Valero will pay a $1.65 million civil penalty and perform a supplemental environmental project that will cost $300,000. Under the agreement, the project will require Valero to design and construct a boat ramp that will aid emergency-response efforts in the vicinity of the oil spill.

The government’s complaint, filed along with the consent decree, alleges that at least 142,800 gal of oil spilled from a containment berm on the edge of the Ship Channel at Valero’s Corpus Christi Refinery-West Plant into the channel. Valero has since removed the containment berm and the associated above-ground storage tank from the edge of the Ship Channel in order to prevent future oil discharges.

The penalty paid for the spills will be deposited in the federal Oil Spill Liability Trust Fund, which is used to pay for the federal cleanups of oil spills.

S. Dakota residents okay land rezone for refinery

Residents of Union County, SD, have approved the rezoning of farm land north of Elk Point for privately held Hyperion Resources Inc., Dallas, to build a proposed refinery (OGJ, June 25, 2007, Newsletter).

About 3,300 acres of farmland would be rezoned for the proposed $10 billion, 400,000 b/d facility.

The Union County Board of Commissioners had approved the rezone in March, but both Hyperion and opponents of the refinery project requested a voter referendum.

The vote passed by a 3,932 (58%) to 2,855 (42%) margin.

TransAsia plans refinery relocation project

TransAsia Refinery Ltd. plans to relocate a 100,000 b/d refinery from Naples, Italy, to Port Qasim, Karachi.

The company is seeking formal approval from the Environmental Protection Agency and the Sindh government to implement the project on a fast-track basis, reported the EPA.

TransAsia awarded a contract on Apr. 21 to Descon Engineering of Lahore for the engineering, construction, products and utilities pipelines design and construction, crude and export products storage-handling facilities design and construction, and utilities and off-sites construction.

The project is scheduled for completion by April 2010.

IAG lets contract for CCRL refinery expansion

International Alliance Group (IAG) has awarded a detailed design services contract to Mustang Engineering for the Consumers’ Cooperative Refineries Ltd. (CCRL) $1.9 billion refinery expansion project in Regina, Sask. (OGJ, Nov. 5, 2007, Newsletter).

IAG is the program manager for the grassroots portion of a proposed refinery expansion that would increase capacity to 130,000 b/cd from a current capacity of 100,000 b/cd.

In 2007, Mustang completed front-end engineering design for the project. Detailed design will take more than 600,000 man-hr of work to complete, according to Mustang.

Mustang’s automation and control business unit is providing detailed design, configuration, staging, and integration of the process control system for five new process units and supporting utilities.

The grassroots expansion includes an FCC complex to help the refinery process additional light synthetic crude from Canada’s oil sands. The expansion will be CCRL’s second expansion this decade and is scheduled for completion in 2012.

Jorf Lasfar refinery plan in Morocco moves ahead

Abu-Dhabi’s state-owned energy investment firm International Petroleum Investment Co. (IPIC) has approved a plan for construction of a refinery at Jorf Lasfar in Morocco, the latest of several projects announced for the port on the country’s Atlantic seaboard.

UAE state news agency WAM said work is under way to set up a company to administer the project in cooperation with Moroccan partners, which were not named. WAM gave no further details concerning the size of the plant or investment.

In July 2007, Morocco’s energy ministry announced plans for the construction of a 10-million-tonne, $3 billion refinery at Jorf Lasfar, which would become the country’s second facility. The plans called for completion of the refinery during 2015-16.

“Negotiations are under way with Spanish, UAE, Kuwaiti companies and other firms, with the view of building the second refinery,” the ministry said.

Energy and Mining Minister Mohammed Boutaleb said, “Part of the new refinery output would be destined for exports to Asian, North American, and European markets.”

The existing 136,000 b/d Samir refinery, at Mohammedia north of Casablanca, is owned by Corral Holding, a Swedish company controlled by Sheikh Mohamed Al Amoudi of Ethiopia.

Reports say Samir is working on a modernization scheme valued at more than $530 million to introduce hydrocracking technology and the latest refining processes.

Last July, Morocco’s L’Economiste newspaper also reported that Samir, Casablanca-based diversified holding company Akwa Group, and Morocco’s state-owned Office National de l’Electricite will build a 5 billion cu m LNG regasification terminal either in Tangiers or Jorf Lasfar.

L’Economiste said the gas would be piped to industrial centers at El Jadida and Kenitra for the production of electricity in combined cycle power plants and for the refining industry. It also said the LNG terminal could be connected to the Maghreb-Europe pipeline GME, linking North Africa with the Iberian peninsula.

Costs derail Petronas’s planned Sudan refinery

Malaysia’s Petronas has deferred plans for its 100,000 b/d refinery project in Sudan due to rising costs, according to a senior company official.

The Sudanese government had awarded Petronas a contract to build the refinery at Port Sudan on the Red Sea in 2005, with output from the refinery to be exported. The refinery, which would be jointly owned 50:50 by Sudan and Petronas, was due to come on stream in 2009 (OGJ, Sept. 12, 2005, Newsletter).

However the cost of the refinery has soared to $5 billion from the originally estimated $2 billion.

“We cannot justify its commercial viability because of the very high investment cost,” said Petronas Pres. and Chief Executive Officer Tan Sri Mohd Hassan Marican. “We have to put it aside for now,” he said.

Transportation Quick TakesYemen LNG secures financing, sales contracts

Yemen LNG has obtained $2.8 billion in financing for construction of its LNG liquefaction plant on the Gulf of Aden at Belhaf, including $1.1 billion from Total SA and $1.7 billion from export agencies in France and South Korea.

Altogether, eight banksBNP Paribas, Societe Generale, Calyon, ING Bank, Bank of Tokyo-Mitsubishi, SumitomoMitsui Banking Corp, Royal Bank of Scotland, and Citigroupacted as mandated lead arrangers for the $1.1 billion part of the package, and Coface of France, Kexim of South Korea, and various export agencies guaranteed the remaining $1.7 billion.

JGC, Technip, and KBR in September 2005 received a contract to build the two-train liquefaction plant, which will have a capacity of 6.7 million tonnes/year, as well as a 320-km pipeline and two 144,000-bbl storage containers. The project will receive gas from Block 18 in Marib.

Yemen LNG has signed long-term contracts to supply South Korea’s Kogas with 2 million tonnes/year, Suez with 2.55 million tonnes/year, and Total Gas & Power with 2.15 million tonnes/year.

French major Total is the project leader with a 39.62% share. Its partners in the project are US-based Hunt 17.22%, the Yemen Gas Co. 16.73%, SK Corp. 9.55%, Kogas 6%, Hyundai Corp. 5.88%, and Yemen’s General Authority for Social Security and Pensions 5%.

Sakhalin-2 loan secured; year-round flow to begin

The Japan Bank for International Cooperation (JBIC) and four private-sector banks are finalizing plans to provide a $5.3 billion loan for the Sakhalin-2 oil and natural gas development project.

Japan’s Nikkei newspaper reported that JBIC will lend about $3.7 billion, with Bank of Tokyo-Mitsubishi UFJ, Mizuho Corporate Bank, Sumitomo Mitsui Banking Corp., and BNP Paribas providing the remaining $1.6 billion.

The financial institutions were scheduled to sign a lending agreement with Russia’s OAO Gazprom as early as June 15. Gazprom partners, Royal Dutch Shell PLC, Mitsui & Co., and Mitsubishi Corp. have already committed about $15 billion to the project.

JBIC and the three major Japanese banks plan to offer financing for the project to support efforts by Japan’s public and private sectors to obtain a stable source of energy, the paper said.

The financing announcement followed reports last month that year-round production will begin from the Sakhalin-2 project this summer.

“The current plan is to start year-round production in the second half of 2008, after commissioning and testing of the pipeline has finished,” said Ivan Chernyakovsky, a spokesman for the consortium.

Oil will then be transported along the 800-km pipeline to an ice-free export terminal on Sakhalin Island’s southern tip. The project produces 80,000 b/d of oil.

Habshan-Fujairah pipeline start-up delayed 1 year

Abu Dhabi’s International Petroleum Investment Co. said its planned 1.5 million b/d Habshan-Fujairah oil pipeline will begin operating in March 2010, about a year later than originally planned.

No explanation was cited for the new start-up date for the 320-km, 48-in. pipeline, which will join state-owned Abu Dhabi National Oil Co’s Habshan fields with the Port of Fujairah. The project also includes oil storage and terminal facilities for crude exports at Fujairah.

According to analysts, the pipeline will greatly enhance Abu Dhabi’s supply security, bypassing the busy Strait of Hormuz, which generally is recognized as a strategic oil transport choke point.